rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Big Tech Q3 earnings, the October jobs report and US elections within 8 days

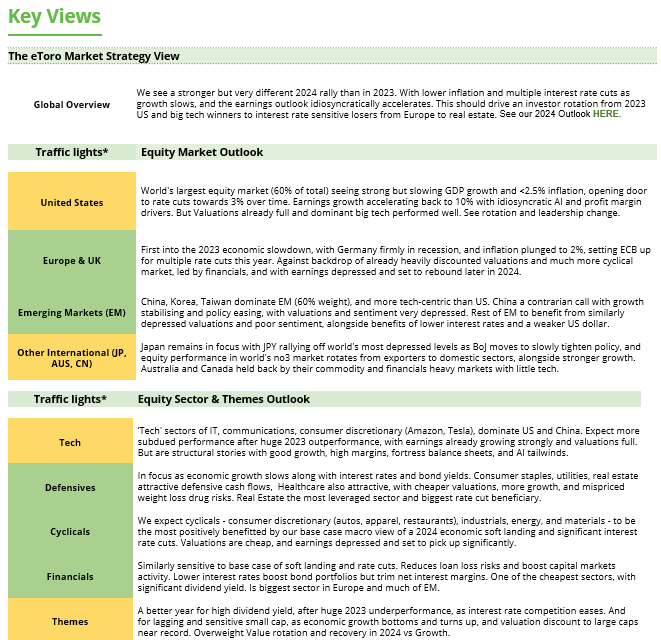

It’s a pivotal week for markets. Five of the “Magnificent 7” companies are set to report earnings, alongside fresh macroeconomic data on growth, inflation, and the October jobs report.

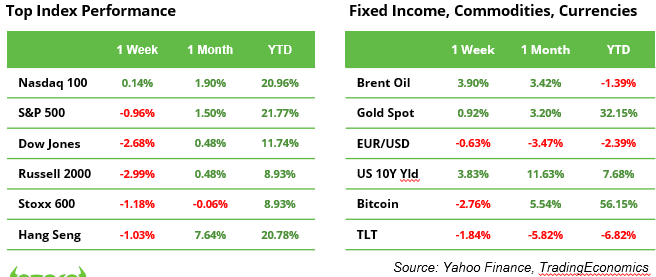

Last week’s mixed results make this week a potential “make-or-break” moment: the Nasdaq gained 0.2%, the S&P 500 declined by 1%, and the Dow Jones dropped 2.7%. The Nasdaq was bolstered by Tesla’s better-than-expected results, while the Dow Jones suffered from a bond sell-off that reshaped the Fed’s rate-cut expectations and was further impacted by disappointing earnings from GE Aerospace, 3M, Honeywell, and Boeing.

If Big Tech misses expectations and the job market shows weakness, fears of slower economic growth could resurface—just one week ahead of the U.S. presidential election on November 5.

The Big 5 that will report represent 23% of the S&P 500 Index

This week in the US earnings season, tech is in the spotlight. Five giants, Alphabet, Amazon, Apple, Meta, and Microsoft, are set to release their quarterly results from Tuesday to Thursday. Without Big Tech, the S&P 500 could struggle, with the “Magnificent 7” forecasted to post 18.1% year-over-year earnings growth compared to 3.4% for the overall S&P 500.

Since summer lows, Big Tech stocks have shown mixed performance. Meta leads with a 30% rise, doubling the S&P 500’s 14% increase, and is the only stock among the five to hit a new all-time high. Amazon and Apple also outperform the broader market, while Google and Microsoft lag. Recent sell-offs have created attractive entry points as investors maintain faith in Big Tech.

Investor focus will be on whether results meet expectations. Massive AI investments are reshaping tech, with costs, expenditures, and potential delays in both existing and new projects being top concerns. Key questions include how quickly AI can be monetized and specific issues unique to each company.

In the cloud sector, Amazon and Microsoft are in a growth race with AWS and Azure. For Apple, iPhone sales remain crucial, making up nearly half of its revenue, with Apple Intelligence launching October 28 for U.S. English users. The AI strategies of Meta AI and Google’s Gemini, Meta and Alphabet’s ad revenue, and Amazon’s e-commerce sales will provide key insights into consumer behaviour.

The next test for the bond market

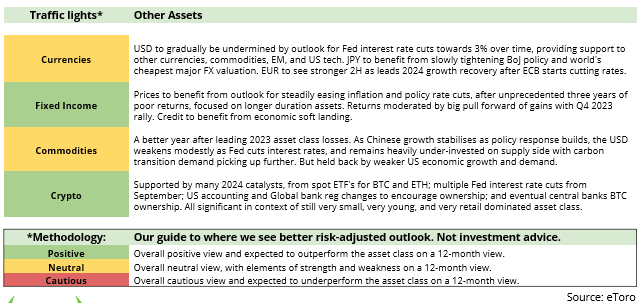

The US bond market faces a critical two-week period that will likely set its course for the rest of the year. Key events kick off with the Treasury’s announcement on upcoming debt sales and monthly payroll data, which will indicate if the economy is slowing enough to justify further Fed rate cuts. Next week, attention will shift to the November 5 presidential election and the Fed’s meeting shortly after.

Treasury prices have been hit by a sharp sell-off as economic resilience casts doubt on deeper rate cuts. If Donald Trump wins the presidency, bond yields may rise as markets anticipate inflation from potential tax cuts and tariffs. Traders are also seeking protection against yield spikes, paying high premiums on options.

Amidst market turbulence, the Fed’s preferred inflation measure and job openings data are expected to reflect easing price pressures, and U.S. payroll growth is anticipated to slow. Corporate earnings and Chinese policy decisions could further influence volatility. The Fed’s upcoming decision, coupled with the election outcome, has investors speculating heavily on yields, especially if Trump’s policies take effect and fuel the deficit.

Earnings and events

Macro-economic releases:

30 Oct. GDP Q3 for US and Eurozone

31 Oct. US PCE (Personal Consumption Expenditure), the Fed’s favourite inflation gauge

1 Nov. US NFP (Non-Farm Payrolls) and October unemployment rate (previously 4.1%)

Earnings releases:

28 Oct. Ford

29 Oct. PayPal, McDonalds, Pfizer, HSBC, BP (before US market open)

29 Oct. Alphabet, Visa, AMD, First Solar, Reddit (after US market close)

30 Oct. Eli Lilly, Caterpillar, BYD, Volkswagen, BASF, Schneider Electric, Banco Santander

30 Oct. Microsoft, Meta, Booking, Starbucks, DoorDash, Coinbase, Robinhood

31 Oct. Uber, Mastercard, Shell, BNP Paribas, Stellantis

31 Oct. Apple, Amazon, Intel, US Steel

1 Nov. Exxon Mobil, Chevron

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link