rewrite this content using a minimum of 1000 words and keep HTML tags

Hudson Pacific Properties (NYSE:HPP) screens as extremely discounted, trading at less than 30% of Net Asset Value (NAV). While it is true that discounted valuation provides a margin of safety, the magnitude of discount is a bit of an illusion.

With a consensus NAV of $7.61 and the stock trading at $2.32, HPP appears to be trading at about 30% of NAV. However, the company as a whole is really trading at 88% of that same consensus asset value. Further, an 18% decline in asset value from the most recent consensus NAV would be enough to take NAV of common shares to $0.

Let’s walk through the math:

Leverage amplifying appearance of discount

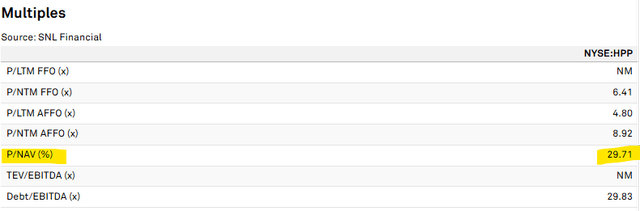

A consensus of 6 Wall Street analysts spots HPP’s NAV at $7.61

S&P Global Market Intelligence

That NAV spots HPP at a price to NAV of 29.71% (using intraday pricing on 5/5/25)

S&P Global Market Intelligence

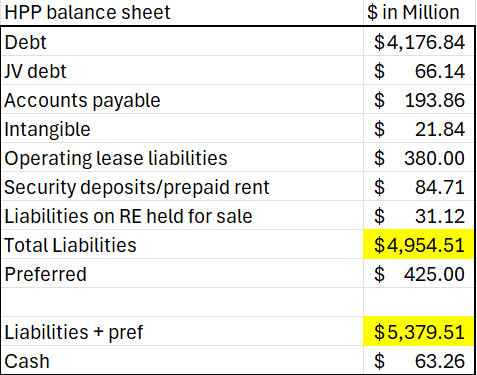

It should be noted, however, that NAV per share refers to the equity value of common shares after accounting for all securities above them in the waterfall, which in this case is debt, current liabilities, and a preferred, HPP Preferred C (HPP.PR.C).

Per the 4Q24 supplemental, liabilities plus preferred total $5.379 billion.

2MC

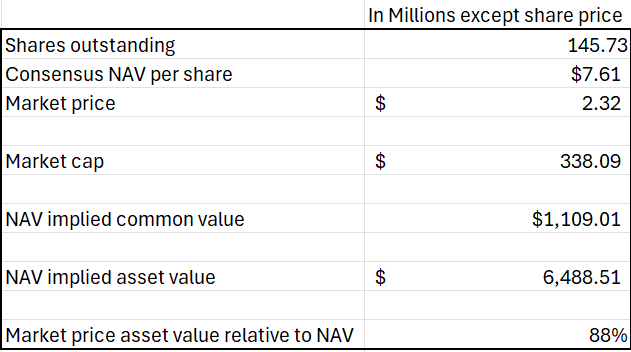

As such, the common stock is a tiny portion of the overall capital stack. At that $2.32 market price, the market capitalization of fully diluted common shares is $338 million.

2MC

The $7.61 NAV implies the common is worth $1.109B, which suggests an overall asset value of $6.488B.

So by the stock trading “cheaply” at $2.32 and 30% of NAV, an investor buying it today is indeed getting a massive discount to NAV. However, that discount is only on the common equity slice. You are essentially getting the common for $338 million instead of full price of $1.1B. That is a discount of $770.9 million.

However, it still comes with the debt and preferred. Here is how it stacks up when looking at the total capital stack.

2MC

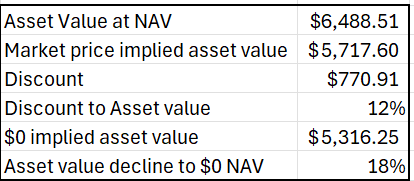

Despite trading at 30% of NAV, the company overall is trading at $5.717 billion compared to Net Asset Value of $6.488 billion.

The real discount from a total capital stack perspective is a mere 12%.

Why does this matter?

It matters because it impacts how sensitive the value of one’s investment is to changes in asset value.

On the surface, it might seem like when buying at 30% of NAV/share one could sustain 70% loss of asset value and still come out whole. But that just isn’t how it works when leverage is factored in.

So much of HPP’s capital stack is debt and preferred shares that an 18% decline in asset value from the $7.61 per share NAV would be enough to completely wipe out common shares. It would take NAV per share to $0.

That is the take-home point: A large discount to NAV does not always mean a large margin of safety.

NAV discount relative to margin of safety is related to how levered a company is, and in cases like HPP, where leverage is extremely high, the margin of safety is quite small no matter how cheap the stock looks relative to NAV.

None of this makes HPP uninvestable. It just shapes the nature of what constitutes a viable thesis.

What would make an investment in HPP perform well?

If you are in HPP because it is trading so cheaply that is probably not a good reason. Even modest continued declines in fundamentals can be a wipeout no matter how large of a discount one gets when buying the stock.

For this to work as an investment, one has to believe in the turnaround story. HPP’s office assets would have to find new sources of demand to stabilize occupancy and eventually return to growth.

It is entirely possible.

HPP has beautiful assets that — prior to the crash in office space — would have been considered trophy properties. If NOI rebounds, the value gains to investors could be enormous. If fundamentals are moving in a positive direction, the face value 30% of NAV actually works the way you hope it would. An investor would get a triple just in the stock price getting to NAV and the leverage would also work in an investor’s favor.

Leverage amplifies asset value gains as well as losses. If office broadly starts performing better, HPP’s asset value gains would be multiplied with respect to common stock. Thus, there is a bull case to be made here. It just rests firmly in a fundamental turnaround story and not in a value story.

My take

While there are some green shoots in office, I am still of the belief that office is substantially oversupplied. In my opinion, there will be more pain before the eventual upswing. At this time, I am bearish on most of the office sector.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link