rewrite this content using a minimum of 1000 words and keep HTML tags

Bitcoin has entered a prolonged phase of sideways price action, trading in a tight consolidation range just below its $112,000 all-time high. Since late May, BTC has repeatedly tested the upper boundary around $110,000 but has failed to break above it convincingly. At the same time, bears have been unable to push the price lower in a meaningful way, keeping Bitcoin locked in a stagnant pattern.

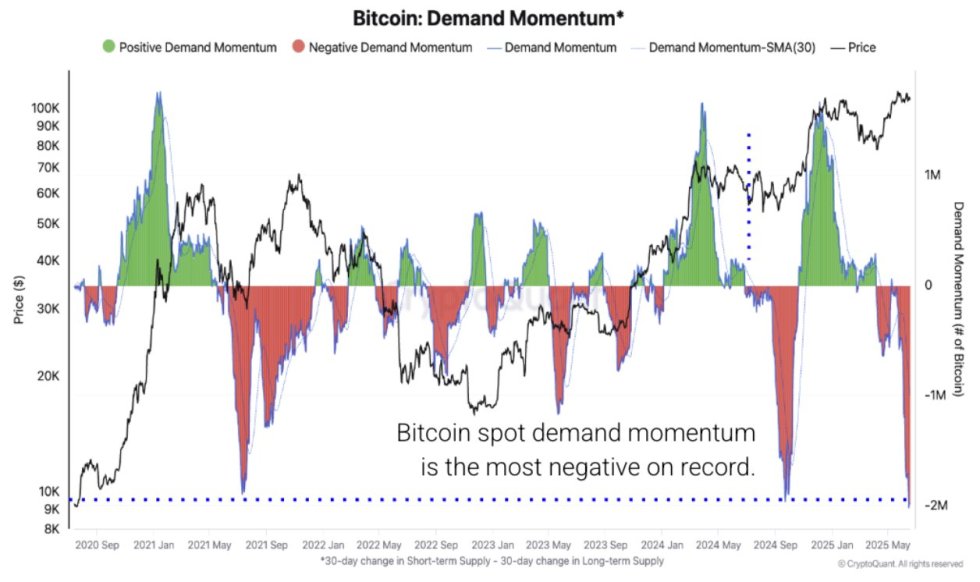

This lack of direction is frustrating both bulls and bears, with many analysts expecting a major move to unfold soon. On-chain metrics suggest that market momentum may be fading, especially among newer participants. According to data from CryptoQuant, short-term holders currently hold 4.5 million BTC, which is 800,000 fewer than they held on May 27. This signals a significant drop in speculative demand, as “new money” appears to be drying up in the current market environment.

Without fresh inflows of capital or a strong shift in sentiment, Bitcoin may continue hovering near key resistance for the time being. However, as history shows, such compressions often precede explosive volatility, making the coming days potentially pivotal for Bitcoin’s next major trend.

Volatility Grows But Bitcoin Holds Strong Above Key Support

Bitcoin continues to weather macro and geopolitical turbulence, holding firm above the critical $103,600 support despite growing volatility. As Middle East conflicts escalate and macroeconomic pressures mount—including rising US Treasury yields and persistent inflation risks—financial markets remain fragile. Yet, Bitcoin appears to thrive in this uncertain environment, consolidating with resilience near all-time highs.

Market analysts remain split on what’s next. Some suggest that Bitcoin needs clearer signals, particularly from geopolitical or economic developments, before it can break out in either direction. Others argue that BTC is simply building energy for the next leg up, and price discovery beyond $112,000 is only a matter of time.

However, recent on-chain data from CryptoQuant suggests that bullish momentum may be fading, at least temporarily. Short-term holders, often the most reactive participants in the market, have reduced their holdings to 4.5 million BTC. That’s a drop of 800,000 BTC since May 27. Even more striking is the demand momentum, which has now fallen to –2 million BTC—the worst reading on record. This suggests new money is no longer entering the market at meaningful levels, dampening the potential for an immediate rally.

Despite these metrics, Bitcoin’s ability to stay above $103,600 reflects underlying strength. As the market enters a potential inflection point, this equilibrium may soon give way to a decisive move—up or down.

BTC Price Holds Steady Within Key Range

The daily Bitcoin chart shows BTC continuing to consolidate within a well-defined range, trading between $103,600 and $109,300. Since reaching its all-time high of $112,000 in late May, price action has flattened, signaling indecision among market participants. The 50-day simple moving average (SMA) is now acting as dynamic support, aligning closely with the $104,700 region, while the $109,300 zone has repeatedly served as resistance, rejecting further upside attempts.

Volume remains relatively low, reflecting a lack of conviction from both bulls and bears. However, despite several tests of the lower boundary near $103,600, Bitcoin has not broken down, suggesting buyers are still absorbing sell pressure and defending the trend. On the upside, any daily close above $109,300 could open the door to a retest of the $112,000 level and potentially new highs.

This tight structure sets the stage for a breakout. Momentum will likely build once the price escapes this zone, especially with macroeconomic uncertainties and geopolitical tensions driving volatility. Until then, traders should monitor how BTC behaves around these boundaries, as a decisive move in either direction will likely dictate short-term market sentiment.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link