rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

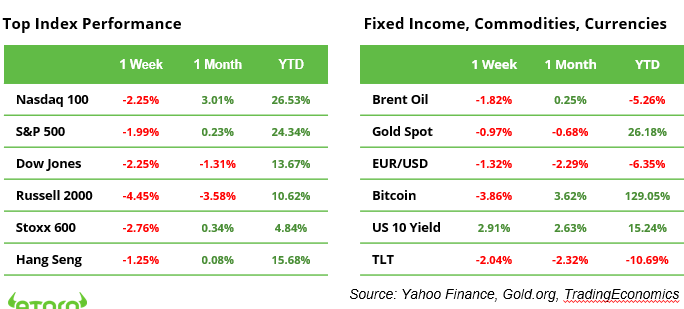

The Fed sees only two interest rate cuts in 2025

Last week saw a notable shift in equity markets as investors engaged in significant profit-taking. The Federal Reserve’s anticipated 0.25% rate cut was overshadowed by its updated quarterly dot plot, which projected higher inflation and only two additional rate cuts in 2025. This led to a rise in the US 10-year yield, which climbed from 4.40% to 4.53%.Equity markets reacted sharply to these developments, with the S&P 500, Nasdaq 100, and Dow Jones Industrial Average all declining around 2%. More rate-sensitive indices faced even steeper losses, as the European STOXX 600 dropped 2.8%, and the small-cap Russell 2000 fell 4.5%.However, sentiment turned positive on Friday, spurred by a softer-than-expected November reading of the personal consumption expenditures price index (PCE), the Fed’s preferred inflation gauge. This unexpected data provided some relief to markets, potentially setting a more constructive tone heading into the holiday season.

The coming two trading weeks will be shortened by Christmas and New Year’s celebrations, with no major economic events or data releases on the agenda. As a result, market activity may focus on year-end portfolio adjustments and positioning for 2025. The Analyst Weekly will take a brief hiatus during this period and return with its next publication on January 6, 2025. Wishing everyone a joyous holiday season and a prosperous New Year!

S&P 500 sector performance: energy lagging, but likely to take central stage in 2025

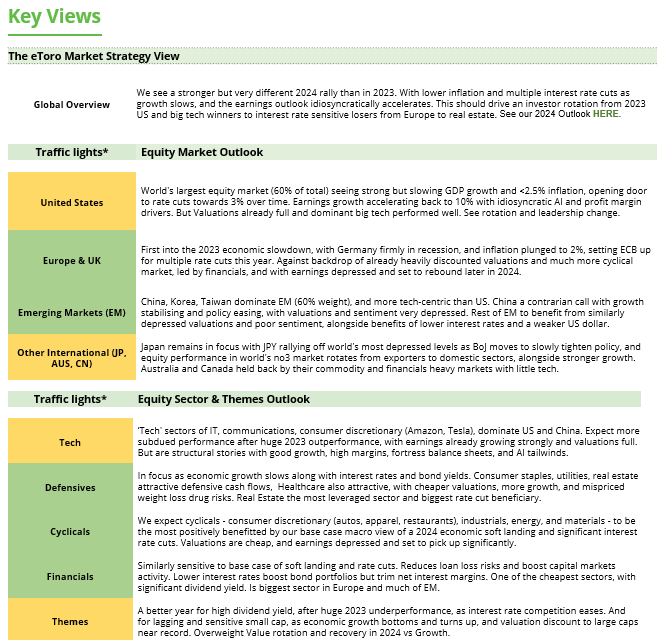

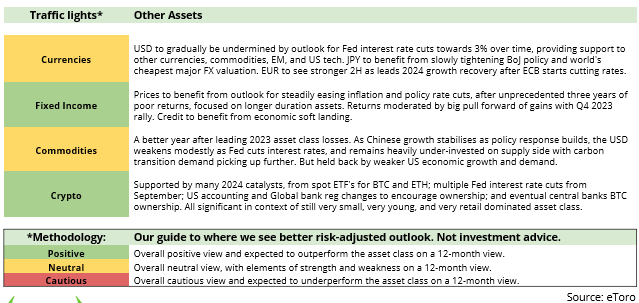

The technology sector continues to dominate the 2024 stock market rally, as evidenced by its standout performance (see chart). Overall, ten of the eleven S&P 500 sectors have delivered positive returns since the start of the year, with seven achieving impressive double-digit gains. This diverse sectoral performance highlights the pivotal role of technology in driving the market while underscoring broader economic and industry-specific dynamics influencing sectoral gains and losses in 2024.

The Energy sector stands as the sole outlier, recording negative performance year-to-date. It’s remarkable to the extent that oil prices (Brent) have dropped only 5% this year, while natural gas prices shot up with 67% in the US and 35% in Europe. The energy sector is will take central stage again in 2025 with Trump (‘drill baby drill’) as US president, moderate global economic growth prospects and cheap energy being a differentiator in regional manufacturing competitiveness.

Three commodities to watch in 2025

According to The Economist, sluggish demand in 2024 drove commodity prices lower, as the U.S. slowed and China’s economic challenges deepened. Prices for materials such as coal, cobalt, and natural gas fell to levels last seen before Russia’s invasion of Ukraine in 2022. This trend, favorable for central bankers but disappointing for traders, is expected to persist in 2025. Crude oil prices could decline further, as non-Gulf producers ramp up supply despite ongoing geopolitical tensions. Meanwhile, copper, a cornerstone of the green energy transition, remains vulnerable to short-term instability, especially due to concerns over China’s struggling property market. However, supply constraints will likely keep prices elevated for specific commodities.

Orange juice prices reached record highs in 2024 after a crippling drought in Brazil’s São Paulo region and the spread of citrus greening disease. Given that replacement trees take years to bear fruit, elevated prices are expected to continue in 2025.

Coffee markets also remain tight, with arabica prices hitting decade-highs following frost damage in Brazil. Increased demand for robusta beans, coupled with droughts in Vietnam and shipping disruptions in the Red Sea, has kept global stocks low, leading to higher prices and potentially lower-quality blends in the coming year.

Uranium stands out as demand surges due to its importance for nuclear energy. Yet, supply risks persist, with Kazakhstan cutting production and Russia hinting at export restrictions. These disruptions could drive further volatility in this critical market.

Earnings and events

No major macro or corporate events have been scheduled for the remainder of 2025.

On 1 January 2025, Poland will chair the European Union for a period of six months, taking over from Hungary. On the same day, Brazil will take over chairmanship of the BRICS organization from Russia. Looking further ahead into the new year, the annual Consumer Electronics Show (CES) will take place from 7 to 11 January 2025 in Las Vegas, providing a view on product innovation and giving investors an idea about potential AI-related retail sales.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link