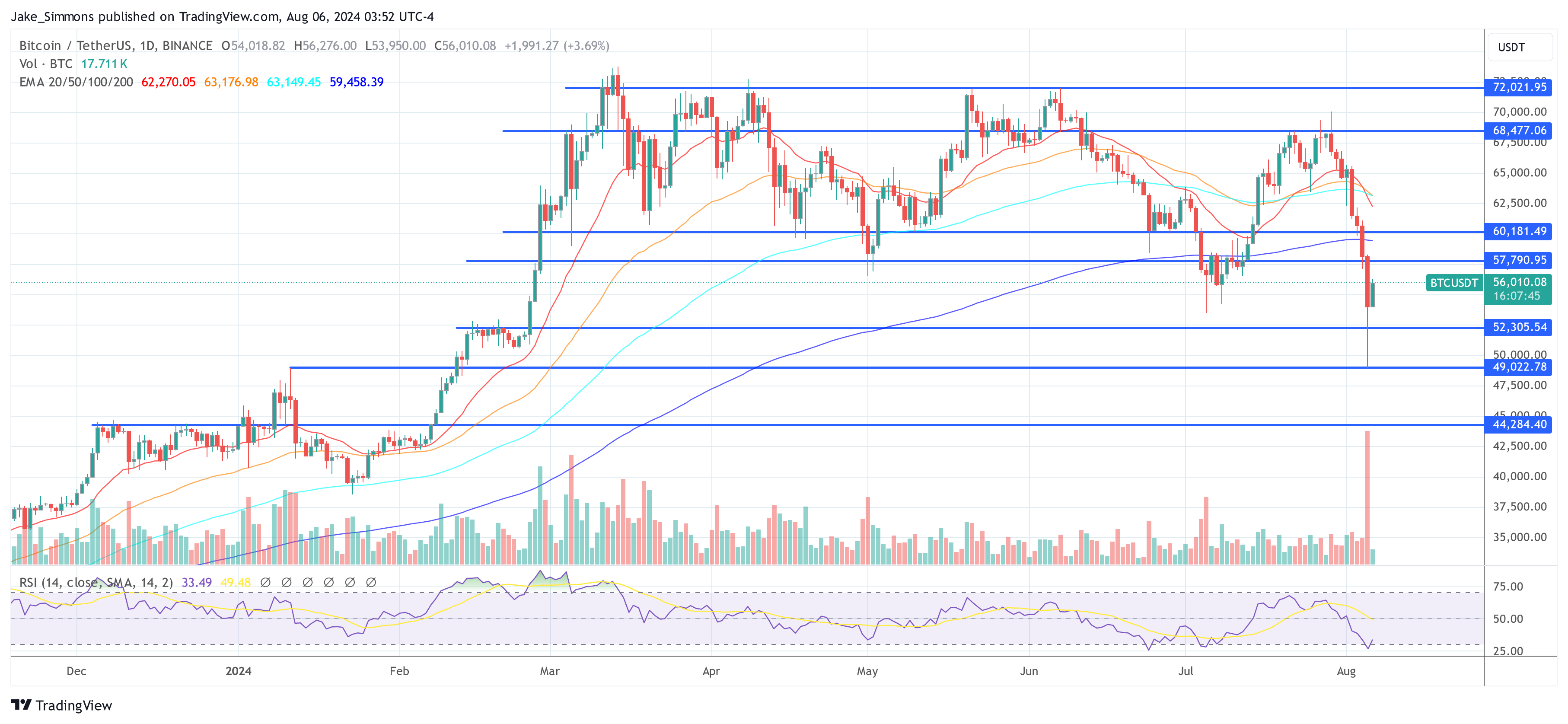

The digital currency landscape witnessed an impressive rally on Tuesday, as Bitcoin soared beyond the $56,000 threshold and Ethereum ascended past $2,500. This upturn marked a significant recovery from the “Block Monday” phenomenon, a day when Bitcoin saw a dramatic 15% drop to near $49,000, and Ethereum fell by more than 20% to a low of $2,115. The resurgence of Bitcoin and the broader crypto market paralleled a wider rally seen across global financial markets, spurred by a confluence of pivotal factors.

#1 Nikkei Rebounds, Bitcoin Follows

In an exceptional show of resilience, Japan’s benchmark stock index, the Nikkei 225, rebounded remarkably following its steepest fall since the infamous 1987 Black Monday crash. The index escalated by a remarkable 10.23%, closing at 34,675.46 points, overcoming the steep 12.4% plunge witnessed on Monday. This downturn was propelled by global market volatility and mounting recession fears in the US, in addition to complexities linked to the dissolution of the Yen ‘carry trade.’

Related Reading

Renowned crypto analyst JACKIS (@i_am_jackis), through a message broadcasted via X, shed light on the crypto market’s reaction to the overarching macroeconomic conditions, indicating that although crypto markets are currently swayed by these external factors, nothing intrinsically significant to the world of digital currencies seems to be unfolding. The analyst illustrated this point by drawing a parallel between BTC & Nikkei’s movements. He reflected that once macroeconomic conditions stabilize, a stronger rebound in the crypto domain is anticipated, though caution remained advisable in the interim.

#2 ISM Services Data Is Bullish

Another beacon of hope for the markets was the report from the US Institute for Supply Management, which indicated a bullish signal on Monday. Its non-manufacturing PMI for July surged to 51.4 from June’s 48.8, the lowest it had been since May 2020. As an essential barometer for the health of the services sector—accounting for more than two-thirds of the US economy—a PMI above 50 points indicates sector expansion. The latest data provided a sigh of relief as it suggested an uptick in service sector activities, easing worries of an impending recession to some extent.

Eric Wallerstein from Yardeni Research shared his relief and a cautiously optimistic outlook based on this data. “Woah, maybe the US economy is not crashing? ISM services employment up 5 points to 51.1. Entire PMI in expansion,” he stated via X.

Adding to the discourse, Andreas Steno Larsen from Steno Research brought attention to the tentativeness of market sentiment. “ISM Services out of the recession zone again. Not sure it is strong enough to convince Markets. We are not trading macro currently. We are trading leveraged stops,” he remarked.

Related Reading

In the same vein, Ram Ahluwalia, the CEO of Lumida Wealth, highlighted the positive deviation in the ISM Services data from the previous ISM Manufacturing data, underscoring the absence of recessionary signals. “ISM Services are *up* reversing the signal from the ISM Manufacturing data last Friday. No recession folks. This is a technical / positioning driven correction. Consider that Earnings are up 12% YOY vs Consensus of 9%. That doesn’t happen at a Recession turning point,” he elaborated.

#3 Market Anticipates Aggressive Fed Rate Cuts

The oscillations in the financial markets have concurrently brought about expectations of significant monetary easing by the US Federal Reserve. A remarkable shift in sentiment is evident through the CME FedWatch Tool, which now indicates a 73.5% probability of a 50 basis points rate cut by September, rendering a 25 basis points cut nearly a certainty. This drastic change in outlook contrasts sharply with the sentiment from just a week prior, when the likelihood of such rate adjustments was considerably lower.

Matt Hougan, the Chief Investment Officer at Bitwise, commented on the sudden shift in market dynamics, highlighting the fast-paced nature of changes within financial markets. “One week ago, the market was pricing in an 11% chance of a 50 bps rate cut in September. Today, it’s 100%. Things come at you fast,” he noted via X.

#4 Overblown Reaction

The recent market crash also sparked discussions around what some analysts perceive as an overreaction to the fears surrounding a potential US recession. Macro analyst Alex Krüger spoke on this, pointing out the cyclical nature of fear-driven market behaviors. “The world suffering from a case of mass hysteria on fears of a US recession. A display of letting price action create a narrative that feeds into price action as everything spirals down in a negative feedback loop. VIX hits 65, third largest spike in history. Then, a strong bounce comes this morning on the open while ISM data shows better than expected demand and employment growth,” Krüger highlighted.

As of the latest update, BTC was trading at $56,010, showcasing the dynamic and ever-evolving nature of the cryptocurrency market.

As we conclude this expedition through the tumultuous but ultimately resilient world of cryptocurrency, it’s worth noting the incredible tenacity and dynamic nature of digital currencies. In a realm where fortunes can swing with a tweet or a global event, the recent recovery of Bitcoin and Ethereum underscores the broader markets’ underlying strength and the growing maturity of the crypto ecosystem. For readers keen on diving deeper into the pulse of the crypto and decentralized finance worlds, DeFi Daily News is your go-to resource for trending articles and insights.

Indeed, the cryptocurrency domain continually offers a blend of high drama, substantial returns, and lessons on the intersection of technology, economy, and human psychology. Whether you’re in it for the long haul or just dabbling, keeping abreast of the latest developments is both a prudent strategy and a thrilling pastime. Is the current market upswing a harbinger of more prosperous times, or merely a temporary respite in an ongoing saga of volatility? Only time will tell, but one thing is for sure – it will be an entertaining ride.