rewrite this content using a minimum of 1200 words and keep HTML tags

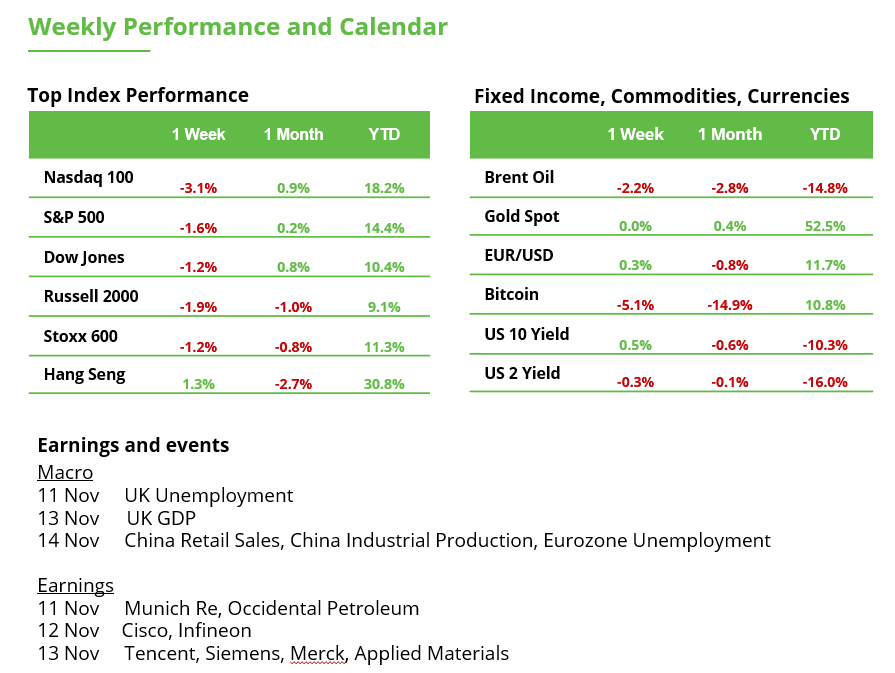

Analyst Weekly, November 11, 2025

Bitcoin: Less Noise, More Conviction

After six straight days of ETF outflows, Bitcoin just flipped the script with nearly $240M in inflows marking its sharpest rebound in weeks. It is a sign that Bitcoin’s market structure is maturing.

The old four-year boom–halving–bust cycle is fading fast. With over 93% of Bitcoin already mined, halvings now move sentiment more than supply. Institutional players like BlackRock, Fidelity, and ARK are soaking up coins while leveraged traders exit. It’s a quiet transfer of power: from speculators to allocators.

A New Phase for Bitcoin

Roughly 400,000 BTC have shifted from long-term holders to institutional investors in just the past month. Each dip is met with accumulation, not panic. Volatility is compressing, now below 30%, a level unseen since pre-ETF days, signaling that Bitcoin is behaving more like a structural asset than a speculative one. It’s starting to decouple from gold and the Nasdaq, moving to its own rhythm.

If inflows hold and leverage stays muted, Bitcoin’s evolution from cyclical trade to long-term allocation could be underway. Recoveries are faster, drawdowns smaller, conviction stronger.

Crypto: Structural Rotation Underway

Institutional flows continue to favor Bitcoin’s clarity over Ethereum or Solana but that doesn’t make the latter any less critical. We stay structurally bullish on both: Ethereum and Solana are emerging as the two main roads to the tokenized future, powering stablecoins, real-world assets, and DeFi infrastructure.

Earnings Preview: Week of November 10, 2025

Applied Materials (AMAT): Applied Materials (AMAT) will deliver its fiscal Q4 2025 earnings on Nov. 13 as the semiconductor equipment leader contends with US export curbs that have curtailed sales to China and a cautious chipmaking capex environment. Investors are focused on whether surging demand for AI server chip tools can offset softer orders from memory and logic customers. AMAT had warned of a drop in this quarter’s revenue due to Chinese chipmakers pausing new equipment purchases and if management’s guidance or comments on its backlog indicate that the industry downturn is bottoming, which would drive the stock’s reaction.

JD.com (JD): JD.com (JD) is slated to report Q3 2025 earnings on Nov. 13, and its results will show how China’s e-commerce environment is faring amid a lukewarm consumer and intense competition. Analysts expect roughly 13% YoY revenue growth but a sharp drop in profit as JD’s heavy investments in new services (like food delivery and instant retail) have squeezed margins. Investors will watch for signs that JD’s pivot to an “efficiency-first” strategy is paying off; if the company can translate solid sales growth into improved cash flow and margins, it could mark a turning point from recent cautious sentiment to renewed optimism on the stock.

Tencent Holdings (TCEHY): Tencent Holdings (TCEHY) is expected to post solid Q3 2025 growth, with forecasts for roughly 13–14% higher revenue and mid-teens earnings gains driven by a rebound in its gaming and online advertising businesses alongside improving margins. Market attention will center on whether Tencent’s heavy investments in AI and cloud (the company budgeted around RMB 100 billion in AI capex this year) are sustaining its momentum, new hit game launches and AI-enhanced ad technology have buoyed results, and how China’s macro environment or tech regulations might temper its outlook, as these factors will influence investor reaction.

Sea Limited (SEA): Sea Limited (SE) will release Q3 2025 results on Nov. 11, and the market is anticipating strong top-line growth (~40% YoY revenue surge to nearly $6 billion) driven by its Shopee e-commerce and SeaMoney fintech units. However, profitability is under the microscope, the company’s sales and marketing expenses have spiked (~30% YoY last quarter) and some analysts caution Sea is “likely to trade margins for growth” so investors will watch whether Sea can show improving margins or cost discipline even as it chases growth, which will be critical for the stock’s post-earnings reaction.

Occidental Petroleum (OXY): Occidental Petroleum is scheduled to post Q3 2025 results on Nov. 10, and Wall Street anticipates declines from a year ago (around $6.7 billion revenue, -6% YoY, and ~$0.48 EPS, -50% YoY) as last year’s oil price surge. Key focal points will be OXY’s production volumes and capital returns; the company has increased output in the Permian and aggressively cut debt (lowering interest expenses by $410 million) to bolster margins, along with any commentary on commodity price trends or shareholder payouts, which could sway the stock’s reaction.

Cisco Systems (CSCO): Cisco Systems (CSCO) will announce its earnings after the Nov. 12 close, with consensus around $14.8 billion in revenue (+~7% YoY) and $0.98 in EPS. Investors will be watching if Cisco’s core networking business can sustain robust growth, fueled by a multi-year upgrade cycle in AI infrastructure and enterprise campus refreshes and whether management’s guidance and order backlog confirm surging demand (Cisco nearly doubled its AI-related sales target last quarter), as those factors will heavily influence the stock’s post-earnings move.

Walt Disney Co. (DIS): Walt Disney (DIS) reports fiscal Q4 2025 results ahead of the Nov. 13 open, with consensus projecting about $1.02 in EPS (-10% YoY) on $22.8 billion revenue (+~1% YoY). Investors will be eyeing Disney’s streaming subscriber trends and theme park momentum versus continued weakness in its traditional TV networks, these metrics, along with any new cost-cutting or strategic updates (such as plans around ESPN or content spending), will set the tone for how the stock reacts to the earnings.

Valuations Are Stretching But So Is the Market’s Breadth

The top of the S&P 500 is still living large. The median price-to-earnings (P/E) multiple of the top five S&P 500 names sits at 30.2x, towering over the broader market’s 23x and the median stock’s 19x. Investors are still paying a steep premium for the biggest players.

What’s interesting this year, though, is that the average stock, not the megacaps, has seen the bigger valuation bump. The “S&P 493” (the rest of the index minus the Magnificent Seven) has actually experienced more multiple expansion, meaning investors are now willing to pay more for each dollar of earnings even outside Big Tech.

That’s helped lift the overall market multiple, but it’s also flashing a mild warning sign. At 19x, the median stock’s valuation is now just two turns below its 2021 peak of 21.3x, which marked the last major market top. Fundamentals remain strong, but valuation tailwinds are getting tired. Prices can’t keep rising just because investors feel good, eventually, earnings have to do the heavy lifting.

Earnings Beat Expectations, and Then Some

Corporate America is still cranking out profits. Third-quarter earnings season came in up 14% year-on-year, blowing past initial forecasts that called for mid-single-digit growth. That’s despite a backdrop of slowing job growth and a temporary government shutdown, both of which, surprisingly, barely dented earnings results. We expect a macro slowdown in Q4 is slower, as hiring cools down, yet the corporate bottom line hasn’t flinched. That has, so far, helped sustain investor confidence.

No surprise: the Magnificent Seven, Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia, continue to dominate on both profits and performance. Their earnings growth has powered much of the S&P 500’s gains for several quarters. That said, by the second half of 2026, the gap in earnings growth between the Mag 7 and the rest of the S&P 500 (the “493”) could start to compress.

That means earnings breadth may finally widen as more sectors contribute to profit growth, not just tech titans. It’s the kind of shift that tends to make bull markets more sustainable and less top-heavy.

Bitcoin Slips: Can the $100,000 Level Hold?

Bitcoin fell about 7% last week after support at $107,370 failed to hold. Sellers had already been putting pressure on the market in recent weeks. The cryptocurrency danced not only around the psychologically important $100,000 mark but also flirted with bear-market territory — at one point, the drop from the all-time high exceeded 20%.

Despite the pullback, the market showed some resilience. Bitcoin reacted to a well-known support zone, the Fair Value Gap between $96,950 and $99,730, which was already defended in June. The weekly close above the lower boundary of this zone suggests a degree of stabilization for now.

The long-term uptrend remains intact. In the short term, however, the chart would only improve if Bitcoin regains the broken support at $107,370. If the $96,950 level fails, the next major support zone could come into focus between $85,600 and $91,920.

Bitcoin, weekly chart. Source: eToro

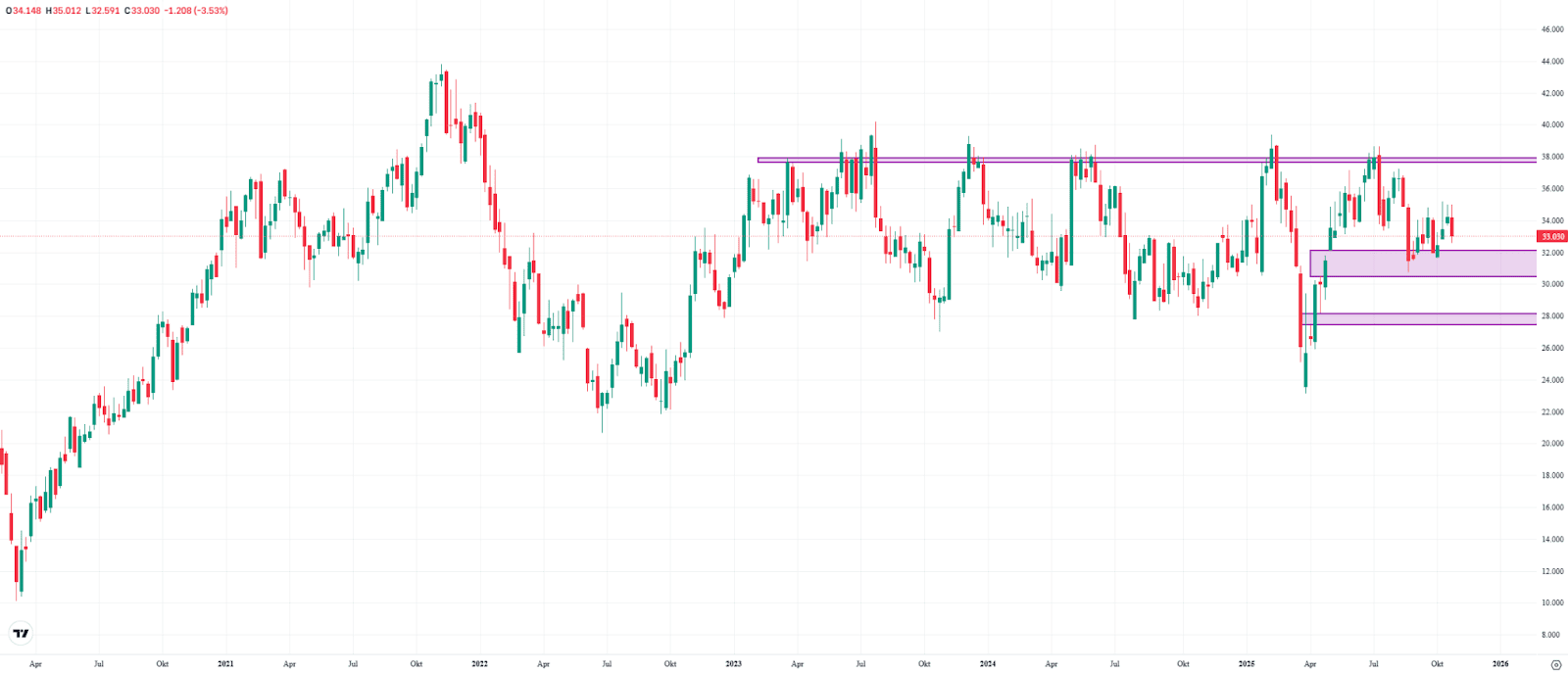

Infineon Ahead of Q3 Earnings: Recovery Stalls, Tension Rises

Infineon shares fell about 3.5% last week, currently trading around €33. This halted the three-week recovery phase for now. Since September, the stock has attempted to rebound twice from the support zone between €30.46 and €32.15, but so far it hasn’t managed to test the medium-term resistance at €38. A level that has blocked any sustained move toward record highs since March 2023.

From a technical perspective, the chance of another upward move remains as long as the lower boundary of the Fair Value Gap at €30.46 holds. However, if this support breaks, investors should be prepared for a potential decline toward the €27.44–€28.17 range. Infineon will report its Q3 results on Wednesday, which could mark a decisive “make-or-break” moment for the stock.

Infineon weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link