rewrite this content using a minimum of 1000 words and keep HTML tags

(Bloomberg) — European shares looked poised for gains at open, resuming Friday’s positive tone on Wall Street and shrugging off a weak Asian session after China’s debt swap program disappointed some investors.

Most Read from Bloomberg

The Euro Stoxx 50 futures rose 0.5%, with their US peers also edging up.

A gauge of Asian equities dropped as much as 1.3%, led by heavyweights including Tencent Holdings and Meituan. An index of Chinese companies listed in Hong Kong shed 1.7%. China’s CSI 300 benchmark fell as much as 1.4%, before erasing those losses to close with modest gains.

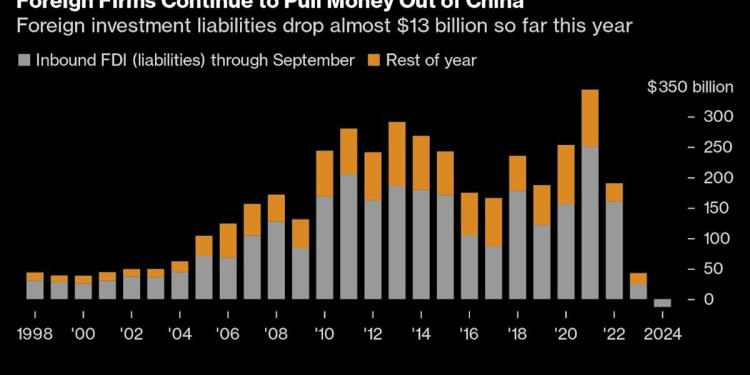

There were lingering concerns about the outlook of the world’s No. 2 economy, after Beijing unveiled a 10 trillion yuan ($1.4 trillion) program to defuse local governments’ debt risk but stopped short of unleashing new fiscal stimulus. In addition to anemic inflation, sentiment toward China is also faltering as foreign direct investment continues to slump.

Investors had hoped for more potent stimulus measures that would directly boost demand from a key Chinese legislature meeting last week, especially after Donald Trump’s presidential victory injected fresh uncertainty over tariffs. To many economists, Beijing’s stance signals an intention to preserve room to better respond to a potential trade war when Trump takes office next year.

“There will be a lot more volatility” for Chinese equities, Ecaterina Bigos, chief investment officer for Asia excluding Japan at AXA Investment Managers, told Bloomberg Television. While policy announcements on matters such as real estate have helped sentiment, “the fundamental picture has not changed yet. We haven’t seen that in earnings yet.”

UBS lowered its 2025 growth forecast for China following Trump’s election, expecting an “around 4%” expansion for 2025, and a “considerably lower” pace in 2026.

Oil turned flat after falling earlier on a soft outlook for top importer China, while iron ore declined toward $100 a ton.

Elsewhere, Taiwan Semiconductor Manufacturing Co. slipped after a Reuters’ report saying the US told the firm to halt shipments of some advanced chips often used in AI applications to Chinese customers.

Bitcoin surged past $81,000 for the first time, driven by the incoming president’s support for digital assets and the election of pro-crypto lawmakers. A bevy of smaller cryptocurrencies have also rallied.

Story Continues

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link