rewrite this content using a minimum of 1200 words and keep HTML tags

The DeFi is evolving fast – yet one problem remains stubbornly unsolved is capital inefficiency. Billions of dollars sit idle in lending pools, while lenders earn modest returns and borrowers face inflated costs. The market has matured, but the mechanics of DeFi credit still resemble its early days.

That’s where Morpho steps in. In a space crowded with copycats, Morpho stands out for one reason: it isn’t chasing yield – it’s rebuilding how on-chain lending works at its core.

What Is Morpho Crypto?

Morpho is a decentralized lending protocol built on Ethereum that redefines how capital flows in DeFi. Morpho functions as a smart optimization layer on top of existing platforms, like Aave and Compound, instead of acting as another liquidity pool.

The core idea is simple but transformative. Its ecosystem accepts connecting lenders and borrowers directly, rather than routing everything through an intermediary pool. This peer-to-peer (P2P) layer sits between users and existing lending markets.

Understand simply, Morpho helps a borrower seeking the exact liquidity a lender offers – it executes the transaction directly between them. The result: both parties receive a better interest rate. Lenders earn more than they would in the pool, while borrowers pay less. And when no match exists? Morpho automatically reverts liquidity back to the base pool (Aave or Compound).

At its core, Morpho doesn’t replace DeFi lending platforms – it makes things easy, simple, and without too many middlemen. It’s not about competition; it’s about optimization.

All transactions on Morpho are executed via audited smart contracts and on-chain verification. The protocol inherits the security guarantees of Aave and Compound, meaning users still benefit from their proven risk management systems. Morpho never takes custody of funds – it simply routes capital more intelligently. That design allows it to increase efficiency without increasing systemic risk, a rare balance in DeFi lending.

How Does It Work?

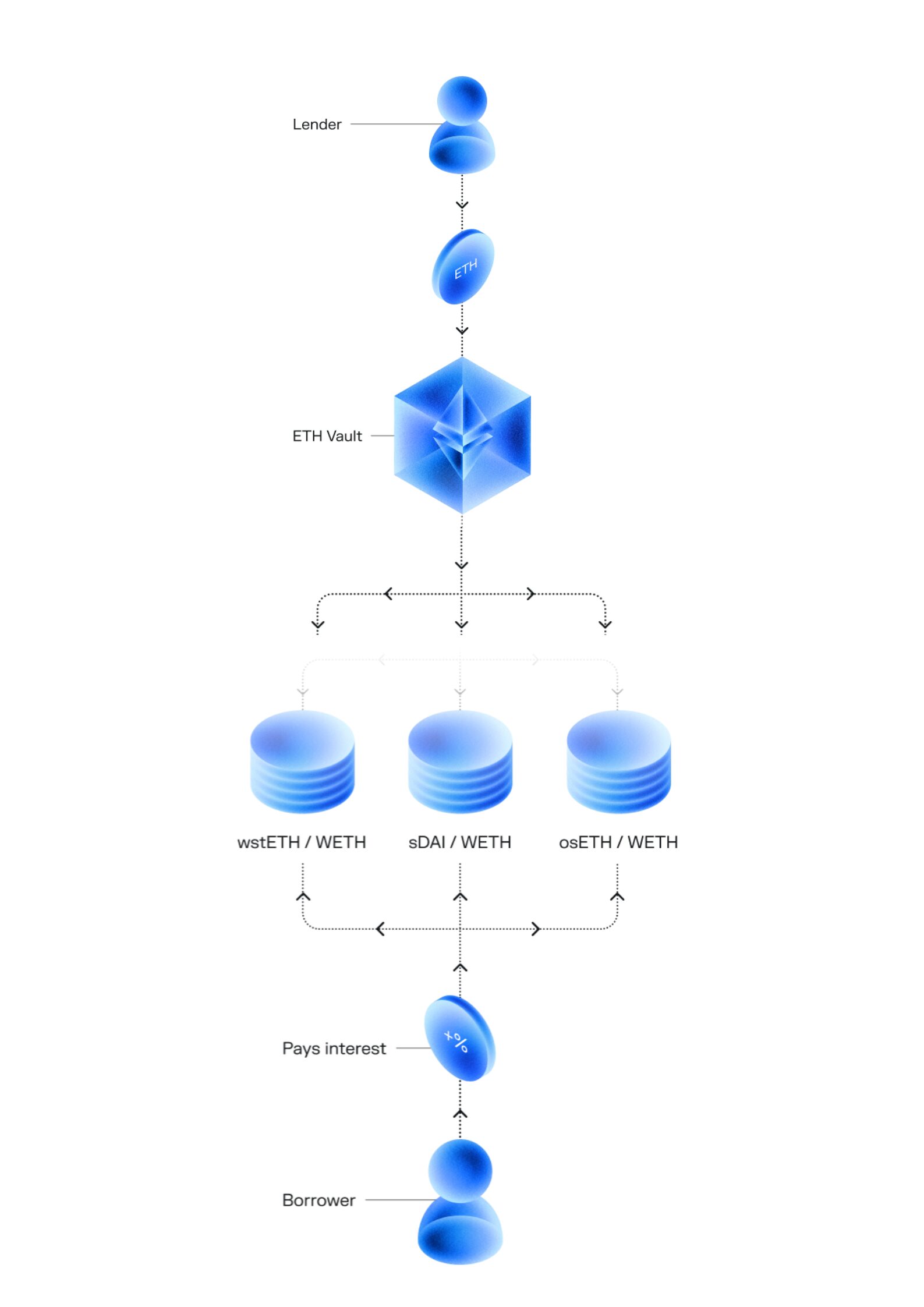

Morpho is more than a protocol – it’s a modular layer for DeFi credit, bridging the gap between liquidity providers and borrowers in a smarter, more transparent way. Through two main products – Morpho Earn and Morpho Borrow – the protocol powers a new era of capital efficiency built entirely on Morpho Blue, its permissionless lending infrastructure.

Morpho Earn – Put Your Crypto to Work

Morpho Earn Put Your Crypto to Work – Source: Morpho

Morpho Earn is the entry point for users who want to generate yield passively and securely. Instead of being based on an organization or a single lending pool, users deposit assets into Morpho Vaults-automated smart contracts that allocate funds across various Morpho Markets to optimize returns. Each vault is curated with a defined risk profile and allocation strategy, often managed by a curator (an individual, DAO, or protocol). This means users can select their exposure level – from conservative stablecoin vaults to higher-yield markets with volatile collateral.

How It Works

Deposit: The user supplies an asset (e.g., USDC or ETH) into a Morpho Vault. The protocol issues ERC-4626 vault shares representing their proportional ownership.Yield Generation: The Vault allocates funds across Morpho Markets according to its strategy. Borrowers in those markets pay interest, which accrues to the vault, increasing the share price over time.Withdraw: At any moment, users can redeem their shares to receive their initial deposit plus accrued yield (minus any performance fee).

Morpho Earn Put Your Crypto to Work – Source: WhitepaperMorpho

Many vaults also distribute extra incentives or rewards, such as governance tokens or liquidity mining bonuses – all claimable through Morpho’s Rewards API.

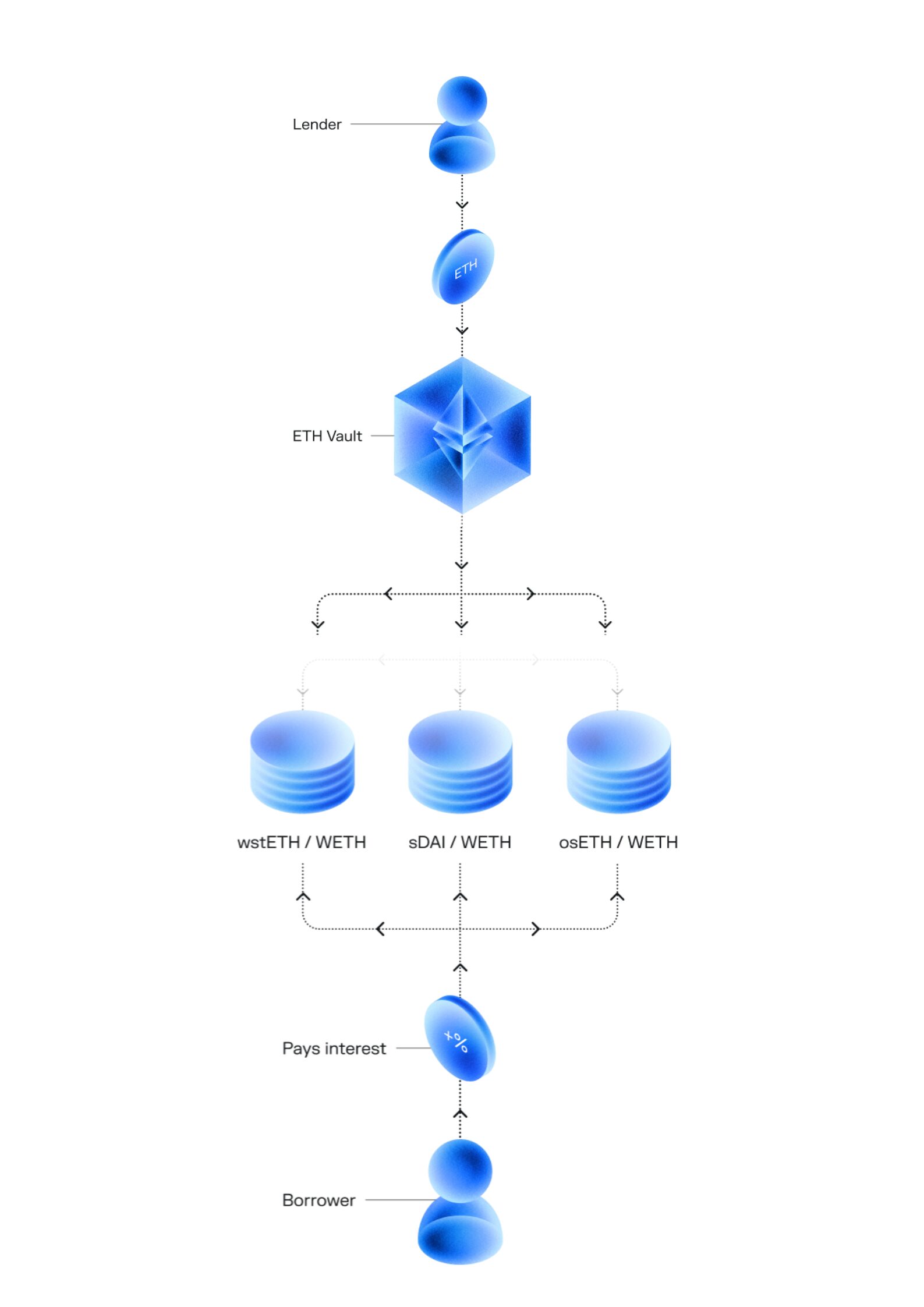

Morpho Borrow

Morpho Borrow allows users to supply collateral and borrow assets directly from isolated Morpho Markets. Each market represents a distinct lending pair – for example, wstETH/WETH or DAI/USDC and comes with its own parameters, such as collateral type, interest model, liquidation threshold, and oracle feed.

This design ensures that risks remain isolated: if one market faces a problem (like volatility in collateral), it doesn’t affect the solvency of others.

How It Works

Supply Collateral: The user locks a supported asset (e.g., wstETH) into a chosen market.Borrow: They borrow another asset (e.g., WETH) from that market. The borrowing power depends on the market’s Liquidation Loan-to-Value (LLTV) essentially, the safe borrowing ratio between collateral and loan.Repay: The borrower can repay anytime, reducing interest accrual and improving their Health Factor (safety buffer before liquidation).Withdrawal: After repayment, borrowers can withdraw part or all of the collateral. If the debt is not fully paid, you can only withdraw the collateral corresponding to the portion of the debt you paid. If they pay off the debt, they can withdraw the entire collateral.

Borrowers pay interest on outstanding debt, which is transferred to Morpho Vaults – earning profits for the lender. All positions are tracked online with real-time data on health factors, LTV, and risk levels. Morpho Borrow combines flexibility with safety – permissionless marketplace, transparent risk and better interest rates through algorithmic efficiency.

Both Earn and Borrow are designed around capital efficiency – every deposited dollar works harder, without increasing systemic risk.

Morpho Blue

Underneath Morpho’s products lies its most powerful innovation: Morpho Blue – a permissionless, modular lending layer that redefines how credit markets are built and connected on-chain. Rather than relying on a single monolithic protocol, Morpho Blue allows anyone – individuals, DAOs, or institutions to create custom lending markets with fully defined parameters, including:

Collateral and Loan assets (e.g., ETH/USDC, wBTC/DAI)Oracle feeds for price dataInterest rate models (IRM)Liquidation thresholds (LLTV)

Morpho Blue helps each market operate in isolation – meaning risk in one market never spills into another. Think of Morpho Blue as the Ethereum of lending, this is isolation blockchain which a secure base layer where any credit logic can be deployed.

How Morpho Blue Powers Earn and Borrow

Morpho Earn sits on top of Morpho Blue through Vaults, which allocate deposited liquidity to selected Markets that offer the best yield-to-risk ratio. The Vaults inherit Blue’s isolation and transparency, making each yield strategy fully auditable.Morpho Borrow operates directly within Blue’s Markets, where borrowers can open positions backed by collateral, with all parameters – from oracle data to liquidation logic — enforced by Blue’s smart contracts.

This architecture separates the protocol layer (Blue) from the product layer (Earn & Borrow), allowing developers to innovate without compromising safety or composability. Morpho Blue is more than just an upgrade – it’s a new blueprint for how decentralized credit can scale safely.

By separating the infrastructure (lending logic) from the product (Earn & Borrow), it creates a truly open, decentralized credit ecosystem – where developers, DAOs, and institutions can build credit systems as easily as developers deploy dApps on Ethereum.

Morpho Tokenomics

MORPHO token not only acts as a governance token but also as a coordination layer that enables the entire ecosystem to operate autonomously – from the DAO, the community, to developers and users.

Total Supply: 1,000,000,000 MORPHOCirculating Supply: ~338.8M MORPHO

Token Allocation – Source: Morpho

Morpho DAO: 35.4% Users & Launch Pools: 4.9% Morpho Association: 6.3% Reserve for Contributors: 5.8% Strategic Partners: 27.5% Founders: 15.2% Early Contributors: 4.9%

Why Choose Morpho?

DeFi’s greatest challenge has always been a paradox – the pursuit of efficiency without compromising security. Most protocols have chosen one side: either maximize yield at the cost of risk, or stay safe but stagnant. Morpho stands out because it does both – and does it cleanly.

By merging capital optimization with on-chain transparency, the protocol delivers what traditional finance has long struggled to achieve. This is a credit market that is efficient, composable, and trustless.

Its design solves three long-standing pain points in DeFi lending:

Inefficient Capital Use – billions of dollars sit idle in overcollateralized pools; Morpho’s P2P engine and Vault structure keep every dollar working through dynamic allocation.Centralized Risk Models – most DeFi protocols use global parameters; Morpho isolates risk at the market level, preventing systemic contagion.Rigid Infrastructure – legacy lending systems are hard to extend; Morpho Blue’s modularity makes it easy for DAOs, institutions, or dApps to deploy their own credit systems.

The result is a new layer of programmable credit, where money doesn’t just flow – it learns.

FAQ

What is Morpho?

Morpho is a decentralized lending protocol built on Ethereum that connects lenders and borrowers more efficiently through a modular architecture that is simple, transparent, and dependency-free.

How is Morpho Different from Aave or Compound?

While Aave and Compound use a pooled lending model (where all deposits share risk and interest), Morpho introduces a peer-to-peer optimization layer called Morpho Blue. It connects lenders and borrowers more directly, offering better interest rates and minimizing the inefficiencies and risks unique to each market. Essentially, it is a new infrastructure – not just another protocol.

How does Morpho Generate Profits for Users?

Profits come from interest paid by borrowers and potential incentives from partner protocols. Morpho Vaults automatically allocate capital to markets that offer the best risk-reward ratio. Over time, as vaults accumulate interest, the value of users’ holdings increases in proportion to their participation.

How to Buy MORPHO?

You can buy MORPHO directly on Uniswap (Ethereum Mainnet) or supported exchanges. Simply connect your Wallet, ensure you’re on the Ethereum network, and swap ETH or USDC for MORPHO using the official contract address from Morpho.

For better security, store your tokens in a self-custodial or hardware wallet after purchase.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link