rewrite this content using a minimum of 1200 words and keep HTML tags

With 37 different brands and four divisions, Loreal ($OR.PA) has been on my radar since I started investing. But it has never been at a discount. Today, trading at 30x PE, it is one of those high-performing companies that rarely disappoint. Is it worth investing now, or should we wait for a better opportunity?

Source: L’Oréal F2024 Annual Report.

Key Highlights

A Beauty Giant at 30x PE – L’Oréal has dominated for over a century, but is it still a buy at this valuation?

AI-Driven Edge – With 694 patents in 2024, tech innovation fuels growth. Will it sustain premium pricing?

Growth vs. Stagnation – Expansion slows, inflation bites. Is L’Oréal nearing its limits?

Business overview

In 1909, a scientist in Paris developed something never seen before: a safe-to-use hair dye, marking the beginning of L’oréal with Eugène Schueller. The iconic “Because I’m worthy” was the first advertisement of the brand in 1970, but it is still relevant today.

The beauty industry has shown resilience even in the worst crisis worldwide, and can find the reasons behind this by looking for the “lipstick effect,” a real economic theory explaining why consumers continue spending on affordable luxuries.

Source: L’Oréal.com.

Source: L’Oréal.com.

Beauty markets are growing towards the direction of not only female, but a more inclusive sector, where men, the elderly, and even kids are using beauty products, which increases the industry’s reach.

L’Oréal has been one of the companies that better understand the value of AI in their processes, as they said:

“We have optimized the work of our employees, giving them more time for higher value-added tasks, such as developing strategies through data analysis, risk management, and anticipation.” – L’Oreal investor presentation.

Their CEO, Nicolas Hieronimus, is the example of leadership we look for in company management, working in the company since 1987, started as a product manager and climbed up to become the CEO in 2021. We want in the management of our businesses commitment, beliefs in the future of the company, and especially deep knowledge in how your company works, processes, and generates revenues.

34.7% of the shares of the company are owned by the Betancourt family, and they are part of the board of directors the board, ensuring their strong personal commitment to the company’s long-term vision.

Financial analysis

When we talk about financial health, L’Oréal must be one of the companies with better historical performance I’ve seen. Average revenue growth of 6,99%, with a magnificent historical capital efficiency with a Return on Capital Employed from 17% to 25%.

The global beauty market value is about 290$ Bn, growing 4,5% annually. By 2030, estimations are that 60% of the population will consume beauty products, which could mean 750 million more people buying beauty products.

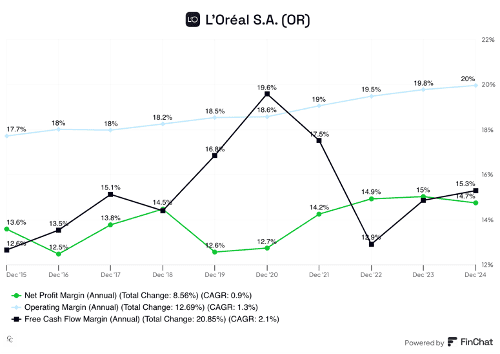

Source: Finchat.

However, as a holding company with multiple brands under its umbrella, L’Oréal’s complexity makes it difficult to assess the detailed performance of each business segment. This structure can sometimes obscure underlying issues, and I remain cautious about assuming continuous, uninterrupted growth in revenue, margins, and net income.

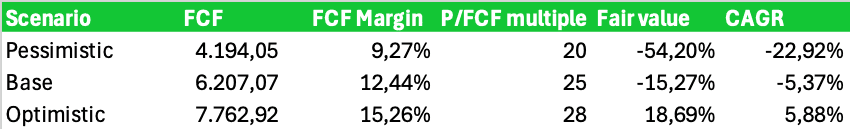

Pessimistic Scenario: We considered a 20x P/FCF multiple with possible stagnation in sales, factoring in the risks of a major crisis in the coming years that could impact expected growth. This results in a -22.92% decrease in the investment value.

Base Scenario: We raised the multiple to 25x, accounting for some growth. However, at current prices, we could still see a -5.37% decrease in investment value.

Optimistic Scenario: Only in this case would we realize gains, assuming a 28x multiple and the growth L’Oréal expects over the next three years. 28x is the multiple I assign to high-gain businesses with competitive advantages and strong growth expectations.

Because we only invest if we won’t lose money under any scenario, L’Oréal doesn’t look like an attractive investment at these prices. Our goal keeps being the same: “Don’t lose money.”

Comparative

Source: Finchat.

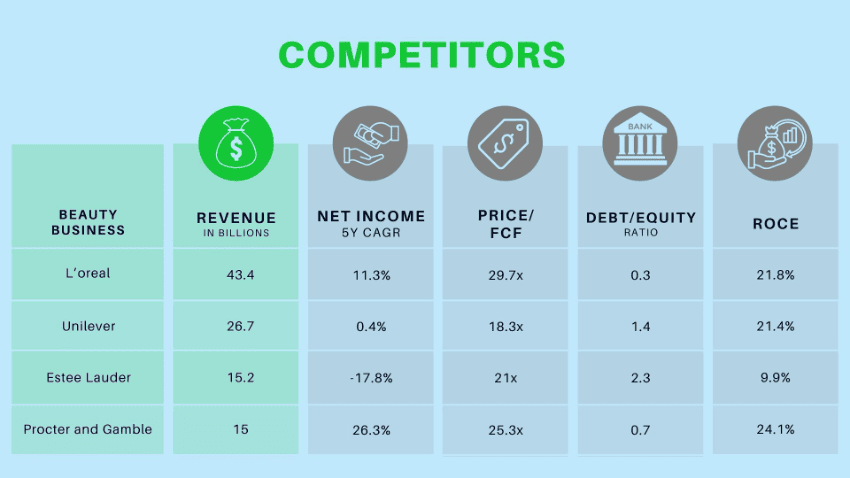

Among all beauty companies, L’Oréal is the largest in terms of market share. Compared to Unilever and P&G, its revenue is exclusively derived from the beauty segment.

One key competitive advantage is L’Oréal’s resilience in Asia. While the company reported a 3.2% decline in Q4 sales, Estée Lauder experienced a much sharper 11% decline in the same period.

L’Oréal continues to lead in innovation, filing 694 patents in 2024 and investing €1.3 billion (3% of sales) in research and innovation.

Their AI-powered virtual beauty assistant, Beauty Genius, has provided personalized diagnostics and recommendations to over 100,000 users in 2024.

BETiq improves marketing efficiency and return on investment. Currently implemented in 6 countries, it is expected to expand to 8 by 2025.

CreAItech utilizes AI-powered creativity to enhance content creation.

L’Oréal pays a 2.05% dividend, with a 6% increase in 2024, marking the highest dividend growth in 10 years. The company also completed €0.5 billion in share buybacks.

Risks

Stagnation Risk – As L’Oréal reaches global saturation, future growth may become more challenging. Expansion into Africa and Asia will require higher investments and increased operational costs.

Asian Competition – The beauty market in Asia is highly competitive, making it difficult for L’Oréal to capture additional market share.

Inflation & Currency Risks – Presence in high-inflation countries like Argentina and Turkey poses risks, though some costs are offset by the recent strength of the Euro.

Political Risks – Trump’s potential tariffs on imports could reduce L’Oréal’s margins in the crucial U.S. market.

Retailer Risks – Sales in pharmacies and drugstores have slowed due to declining foot traffic, affecting overall performance.

Expansion Risks – Moving into supplements requires significant CAPEX investment, and a lack of experience in this segment poses execution risks

Conclusion

I don’t think we will ever see L’Oréal at significantly lower valuations. However, due to its size, it will eventually reach a point where its incredible sustainable growth will slow down. We can justify paying a premium for high-quality businesses, but a valuation of 25-28x PE seems appropriate.

Growth expectations for 2025 are 4-4.5%, indicating stabilization rather than overperformance. At current valuations, I am not buying, but I will monitor for a price drop. However, for dividend-focused investors seeking a reliable blue-chip stock, L’Oréal remains an attractive choice.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link