rewrite this content using a minimum of 1200 words and keep HTML tags

Once a symbol of luxury skincare, Estée Lauder ($EL) is now facing challenges, with a decrease in sales mostly because of its Asia sales performance, with growing competition from newer brands that resonate more with younger consumers, and also new Korean marketing legislation. On Tuesday, February 4th they presented quarterly results, and now the company is trading at its lowest valuation in five years, let’s analyze their latest numbers.

Key Highlights

Trading at five year low, is it a bargain, or a value trap?

Assessing Estée Lauder’s brand and pricing power in a highly competitive skincare market.

Firing 7000 people: the company’s recovery plan.

Business Model Overview

Estée Lauder is a steward of luxury prestige brands, from skincare to haircare, fragrances, and makeup, with a wide range of target customers, and with presence in more than 150 countries. Founded in 1946 by Esther Lauder, with just a selection of creams and perfumes, it is today a company with more than 20 brands that have historically maintained strong brand and pricing power.

Their clients have been loyal for years, particularly among older consumers. In the current world, younger generations are exposed to skincare from an early age, often preferring cheaper products. Even though The Ordinary, one of their brands, offers better deals, luxury brands like Estee Lauder, LaMer, Clinique, and MAC are the real cash generator with over 1B in sales each.

One notable shift is that nine Estée Lauder brands have a presence in Amazon US today when previously they didn’t sell on Amazon at all. Some of the brands are under the “Premium beauty” category, signalling a strategic move to adapt to digital consumer behaviour. Another example is that they now have a presence in TikTok shop UK. Despite this, the company faces mounting pressures from competitors that dominate online sales and influencer partnerships, and with the new trend on Korean Beauty, Dr.Jart+ one of the Korean beauty brands of Estee Lauder, now has more competition than ever because the US market is the biggest consumer in skincare worldwide. If consumer preferences change towards Korean beauty brands, all the other brands of the company have to adapt rather quickly.

Investment Thesis

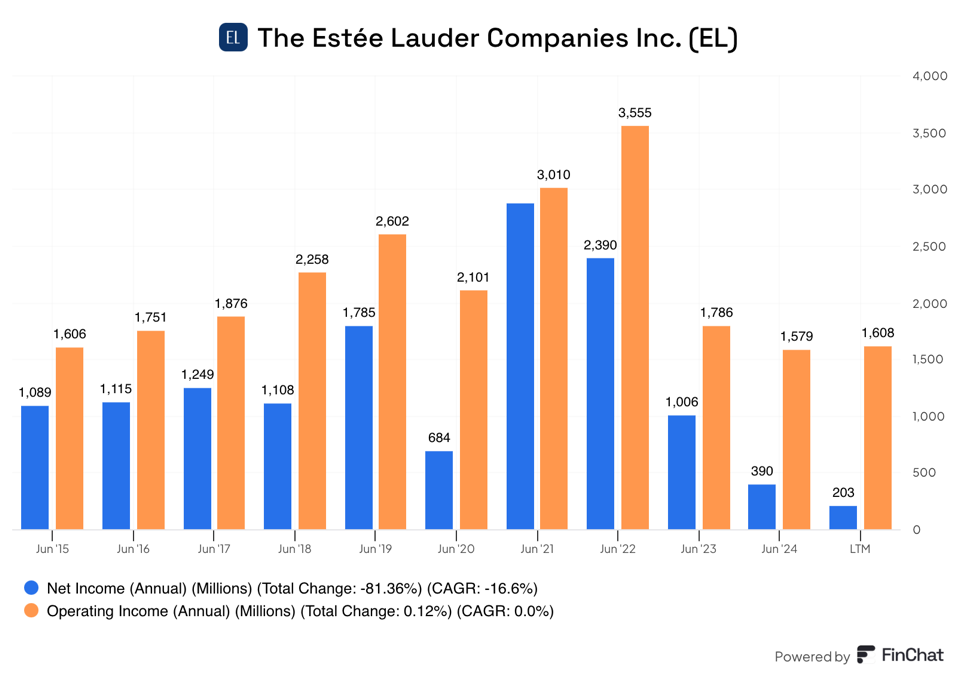

While Estée Lauder has long been a strong player in the luxury beauty industry, recent financial struggles raise concerns. The company’s latest annual report, and the recent second quarterly results, indicate a challenging retail environment, with declining sales in key markets. For example, Asia with a -11% in sales during the previous six months. Also, net sales decreased in total -6% latest quarter to $4 billion. And the guidance for the third quarter is not optimistic at all. This has hurt the operating margin, which is now the lowest of the decade.

Source: Finchat.io

To face this challenge, Estée Lauder has introduced the Profit Recovery and Growth Plan (PRGP), called “Beauty Reimagined” which aims to improve cost efficiencies and drive sustainable growth with an estimated achieving date for 2027.

Because of this turnaround attempt, the company expects another revenue reduction in the next quarter. As part of this PRGP, they expect to spend between 1.2 billion and 1.6 billion before taxes on employee-related costs (between 5.800 and 7.000 job cuts from 62.000 employees).

The big question here is, can $EL maintain the previous operating margin while maintaining or growing revenues, or are they part of the past now?

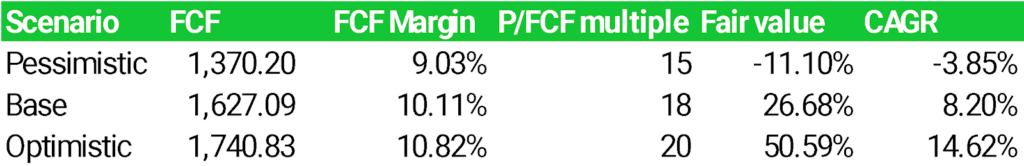

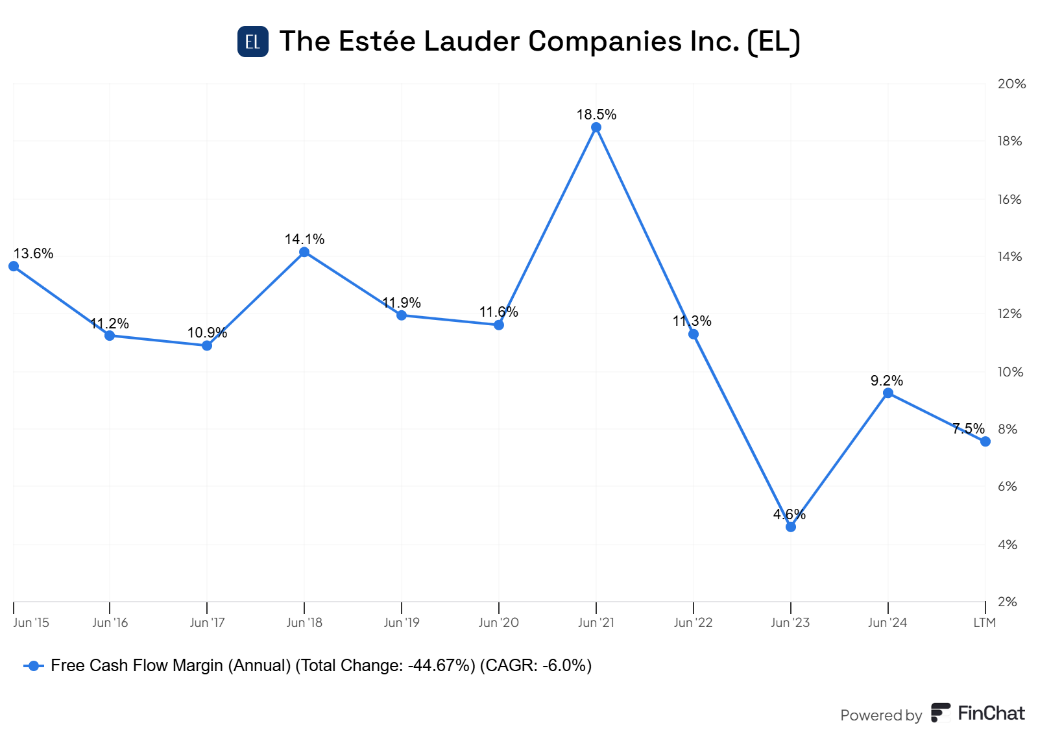

Although we know that next year is going to be challenging in terms of margins and revenue, we aim to calculate the company’s sustainable free cash flow. For that reason, we build three different scenarios. Base, pessimistic, and optimistic.

This is a company with a solid background and has luxury brands with pricing power. In the pessimistic scenario, in case the company doesn’t achieve an improvement in its net margins, the company is still overvalued. However, if they can manage to get back to their normal margins, which they are trying to achieve through their PRGP program, the company could deliver an annual return of over 14% during the coming three years.

Source: Finchat.io

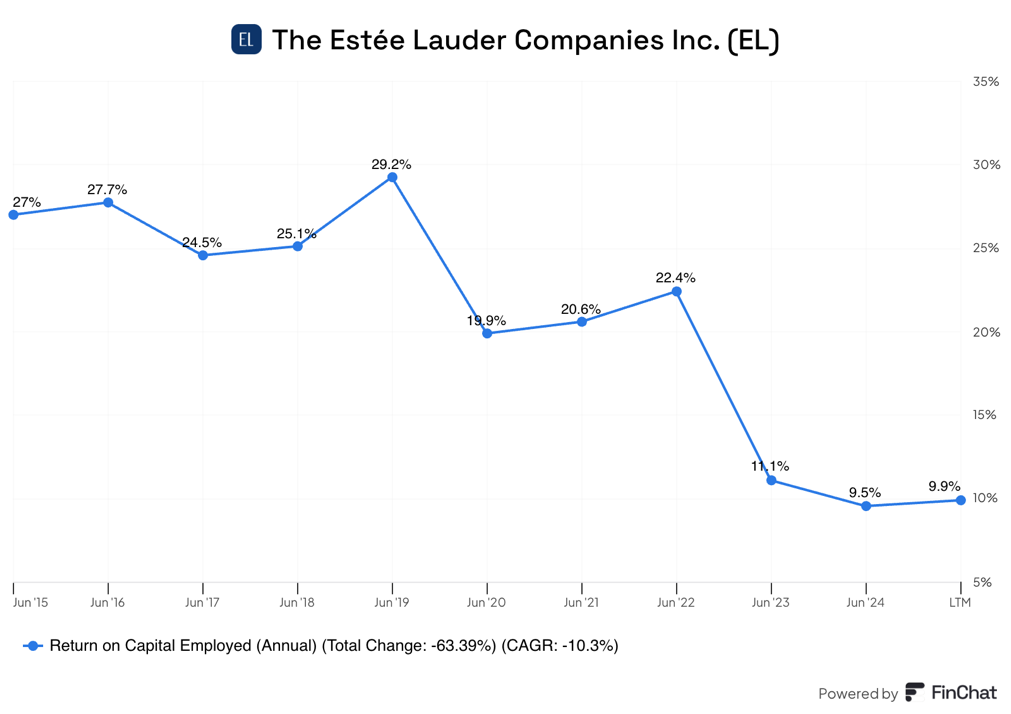

As we can notice in the graphic below, the returns on capital employed have been stable since 2015, with an average of 24,55% in eight years. This made the company trade a P/E valuation within the 30x- 40x range. So, if the company improves its margins, this will increase its current ROIC as well, and it could lead to a better margin than our optimistic valuation.

Source: Finchat.io

Risks

Declining brand power: Despite their long trajectory in the sector, new technology and discoveries in skincare and new globalized skincare trends, shifts in Korean beauty, and influencers-led brands are a true concern for the brand.

New leaders: Stéphane de la Faverie, took position in January 2025 and he has a track record of being general manager for some companies in the beauty sector. However, this is his first time being a CEO, and he’s in a really bad position to start learning. Other members of the team, like the CFO are retiring, which could be also an opportunity for new and more updated ideas to the new generation’s needs.

Execution of their PRGP: Turnarounds have proven to be difficult to implement, and as investors we have to firmly believe in the management capability to implement timely measures to change the path of the company.

Macroeconomic risk: we saw in the pandemic period of 2020, a gigantic reduction in their sales, and this is a prove that $EL is also affected by the economic environment.

Solvency risk: If the company can’t recover its margins, and revenues keep deteriorating, the debt that the company holds can become a major problem. With 6 billion in net debt, they have the risk of being unable to pay their obligations.

Regulatory challenges: They recognize one of the major impacts on the sales was the Korean guideline for e-commerce, being Korea approximately 10% of their sales. It is known that marketing strategies play with the urgency and necessities of the consumer. Here are some of the new guidelines:

The way that they advertise their prices and product size.

Restrictions in the subscription program.

Collaborations with influencers, they now have to disclose in the title or in the beginning of the recommendation that they are being paid to say that.

This makes a significant impact on marketing strategies, which need now a completely different restructuring to comply with the Korean law.

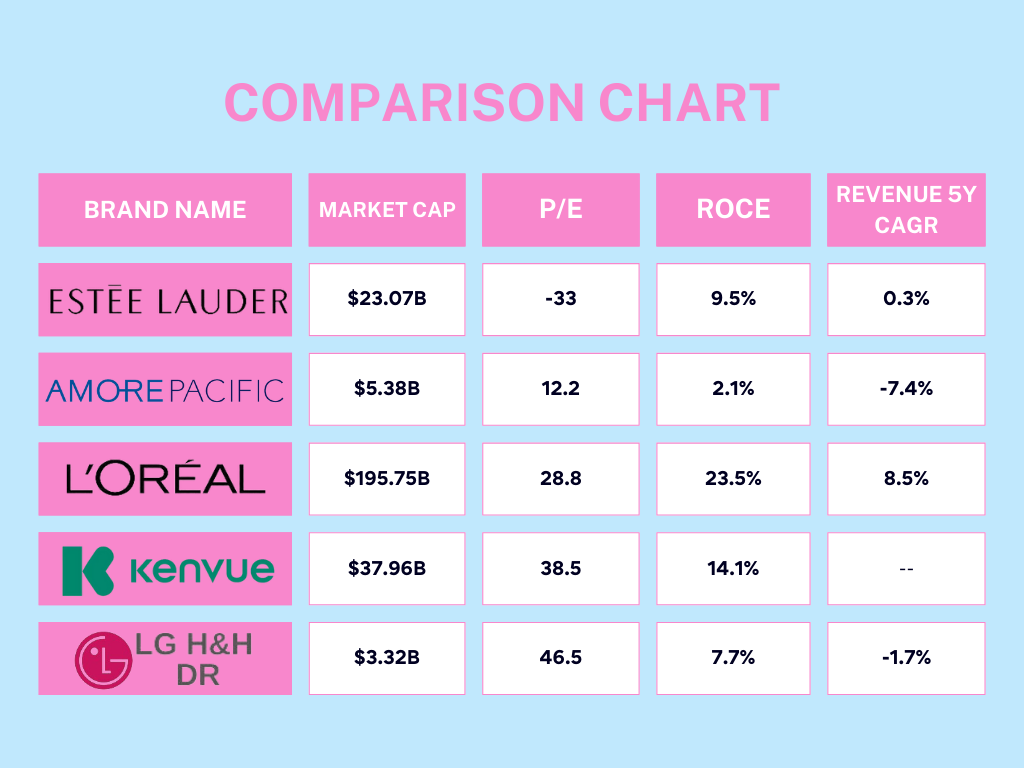

Competitors

Loreal: The biggest competitor with a market cap of 192.37 Billions.

Korean beauty brands: as LG H&H, and Amorepacific corp, Goodai.

Conclusion

The Profit Recovery and Growth Plan (PRGP) is a solid strategy to address Estée Lauder’s challenges, but with a two-year timeline for execution, is still in the early stage of execution. My position remains cautious so, I prefer to wait for the next quarter’s results to assess whether meaningful improvements in cost management and operational efficiency are taking shape. While the company possesses strong brands, management must demonstrate a clear commitment to driving a successful turnaround.

One promising development is the integration of AI into operational processes, enhancing efficiency in inventory forecasting and material planning. Early results suggest improved margins, signaling a willingness to embrace technological advancements and adapt to a new era of consumer behavior.

However, there’s a risk that Estée Lauder could become a value trap, a stock that appears cheap but continues to decline due to structural weaknesses, without a proven track record of the new management this is a possibility. While the company’s brand equity remains strong, the rise of new competitors, shifting consumer preferences, and execution risks in its recovery plan could limit long-term upside.

At current levels, I am not investing in Estée Lauder, but if the stock reaches a more attractive price that offers a prudent margin of safety, it could become a compelling opportunity. For now, my recommendation is to keep $EL on your watchlist and monitor whether management can execute its turnaround effectively. In this case, although the price can potentially go up, we would have more certainty about the company’s valuation, so the risk would diminish.

What do you think? Is Estée Lauder on the path to recovery, or is it a classic value trap?

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link