Victoria d’Este

Published: October 06, 2024 at 10:00 am Updated: October 04, 2024 at 5:11 pm

Edited and fact-checked:

October 06, 2024 at 10:00 am

In Brief

AI is revolutionizing the insurance industry, enhancing operational efficiency and providing personalized services, with over a third of customers now ready to interact with AI in high-stress scenarios.

Globally, artificial intelligence is gradually changing sectors, and the insurance industry is no exception. AI is changing the way customers engage with insurers by increasing operational efficiency and offering quicker, more individualized services. AI in insurance is becoming more and more popular among customers worldwide; it is no longer just a theoretical prospect.

More than a third of insurance customers worldwide are now prepared to interact with AI, especially in high-stress scenarios like processing claims, according to recent study. This change in customer behavior marks a new period in insurance services and marks a significant turning point for the sector.

The Current State of AI in Insurance

Due in large part to its intricate operations and legal framework, the insurance sector has historically been hesitant to adopt new technology. Yet, AI is removing these obstacles by providing solutions that can handle both operational difficulties and customer demands. These days, it’s thought that using AI technology is necessary to remain competitive.

Insurance companies are realizing that customers want flawless service and are growing more at ease with digital interactions. Thus, incorporating AI into the insurance sector is not only a progressive step, but also a required one to keep up with changing customer demands.

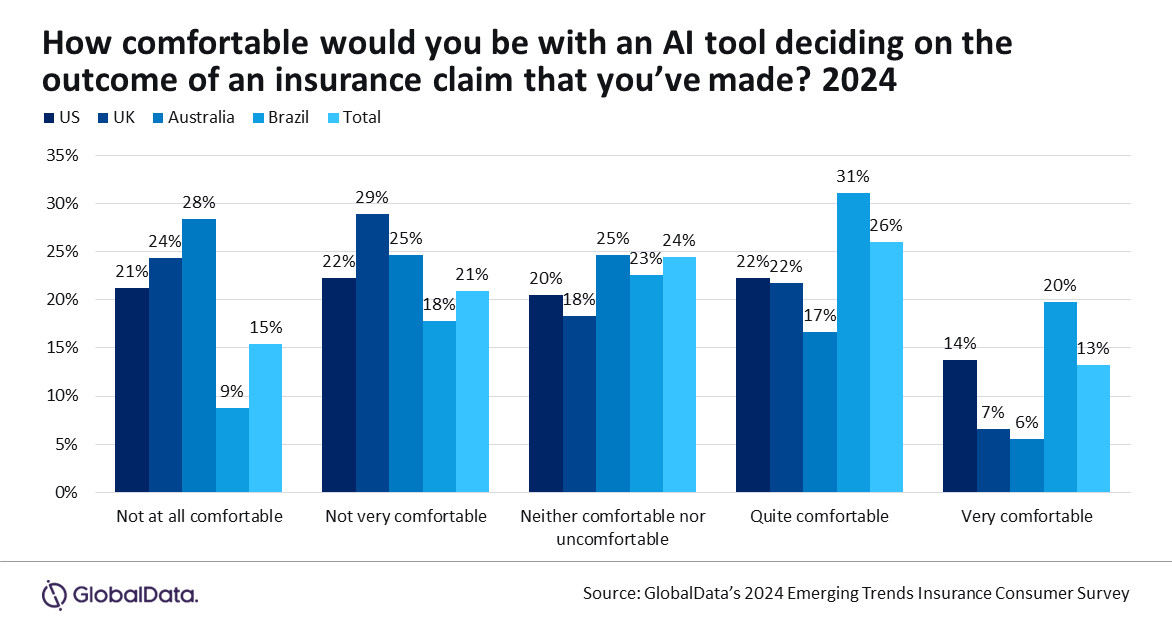

According to GlobalData’s “2024 Emerging Trends Insurance Consumer Survey,” a sizable portion of customers are amenable to interacting with their insurers via AI. The poll, which was conducted across 11 countries and received responses from more than 5,500 participants, offers insightful information on how AI is seen in the insurance industry worldwide.

Photo: GlobalData

The study shows that 39% of respondents worldwide said they would feel at ease letting AI manage the resolution of their insurance claims. This statistic is notable, considering that submitting a claim is frequently a stressful procedure for…

…For further news and trends in the tech and finance sectors, check out DeFi Daily News.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria d’Este

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.