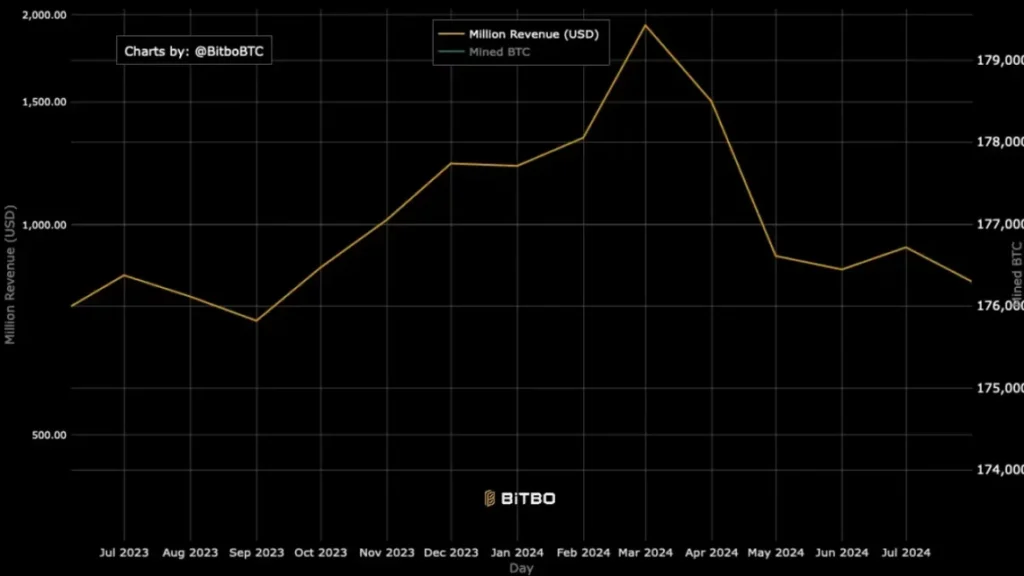

Bitcoin mining has experienced a significant decline in revenue in recent months, with miners recording their lowest revenue month since September 2023. The number of BTC mined fell in August, resulting in a decrease in miners’ revenue to $827.56 million, down more than 10.5 percent from July’s $927.35 million, but up 5 percent from August 2023. This decline in revenue is a stark contrast from the peak of $1.93 billion in March 2024, which coincided with Bitcoin’s all-time high of over $73,500 on March 13. The worst revenue month for Bitcoin miners prior to August 2023 was September 2023, when they earned $727.79 million, with Bitcoin hovering around $25,000 throughout the month.

Bitcoin mining data isn’t going well at all

The number of Bitcoins mined dropped from around 14,725 BTC in July to 13,843 BTC in August. This decline in revenue occurred as miners’ transaction volumes decreased and the difficulty of cryptocurrency mining increased, particularly after the Bitcoin halving in April, which halved rewards to 3.125 BTC. Average fees, which make up the percentage of the block reward, were 2% in August. Additionally, the 30-day average of daily confirmed transactions declined to 594,871 on August 31, after reaching a year-to-date high of approximately 631,648 on July 31.

The mining difficulty level also continued to rise, reaching an all-time high of 89.47 trillion in August, up from 86.87 trillion in July. The increasing difficulty and decreasing profitability of Bitcoin mining have led some miners to explore other avenues, such as shifting processing power to artificial intelligence, with some deals reportedly earning miners billions of dollars.

You may also like this content

Follow us on DeFi Daily News and be instantly informed about the latest developments…

Copy URL

Bitcoin mining has been facing challenges in recent months, with decreasing revenue and profitability. This downward trend is a cause for concern among miners who rely on the income from Bitcoin mining to sustain their operations. As mining difficulty continues to increase and revenues decline, miners are exploring alternative strategies to maintain profitability. The shift towards artificial intelligence processing power is just one example of how miners are adapting to the changing landscape of cryptocurrency mining.

Despite these challenges, the future of Bitcoin mining remains uncertain. The industry is resilient and has weathered previous storms, but the current economic conditions pose unique challenges that will require innovative solutions. As the market evolves and new technologies emerge, Bitcoin miners will need to stay ahead of the curve to remain competitive in this ever-changing landscape.