rewrite this content using a minimum of 1000 words and keep HTML tags

Richard Drury

Market Review

U.S. equity indices generated modest returns in the fourth quarter of 2024, and closed out the full year with double-digit returns for the second year in a row. A post-election rally pushed the large capitalization S&P 500 Index above 6,000 for the first time in early November and it reached an all-time high in early December. Small capitalization stocks as measured by the Russell 2000 Index traded above their all-time high of 2,442.74 (last reached in 2021) but failed to close above that level. Equities moved lower in December as concerns about the future direction of inflation and interest rates weighed on the outlook for stocks. Enthusiasm for all things related to Artificial Intelligence (AI) created what we believe to be a more speculative investing environment, which proved challenging for Conestoga’s investment strategies.

Returns for Conestoga’s four primary investment strategies are below:

Performance* (Total Net Returns as of 12/31/24)

4Q24

1 Year

3 Years

5 Years

10 Years

Since Inception

12/31/1998

Conestoga Small Cap

Composite (Net)

1.67%

9.59%

-1.20%

8.13%

11.76%

11.31%

Russell 2000 Growth Index

1.70%

15.15%

0.21%

6.86%

8.09%

7.06%

Since

1/31/2017

Conestoga SMid Cap

Composite (Net)

-0.68%

11.36%

-0.18%

8.70%

13.67%

Russell 2500 Growth Index

2.43%

13.90%

-0.02%

8.08%

10.48%

Since

12/31/2019

Conestoga Micro Cap

Composite (Net)

9.91%

13.52%

-6.68%

8.55%

Russell Microcap Growth

Index

11.55%

21.91%

-2.24%

5.72%

Since

3/31/2010

Conestoga Mid Cap

Composite (Net)

-4.63%

4.36%

-3.39%

6.84%

10.63%

11.30%

Russell Midcap Growth Index

8.14%

22.10%

4.04%

11.47%

11.54%

12.98%

Click to enlarge

*Periods longer than One Year are Annualized. Please see additional important disclosures in the fully compliant GIPS presentations at the end of this commentary. Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to- book ratios and higher forecasted growth values. Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values. Russell Micro Cap Growth Index measures the performance of those Russell Micro Cap companies with higher price-to-book ratios and higher forecasted growth values. Russell Mid Cap Growth Index measures the performance of those Russell Mid Cap companies with higher price-to-book ratios and higher forecasted growth values.

Click to enlarge

After two consecutive years of strong returns for equities, we believe the path to continued gains may face challenges in the year ahead. While a strong economy and expected deregulation should provide tailwinds, valuations for large capitalization stocks are well above average. Earnings growth will be needed to drive higher returns. Large caps are also very dependent on the Magnificent Seven – Alphabet, Inc. (GOOG)(GOOGL), Amazon.com, Inc. (AMZN), Apple, Inc. (AAPL), Meta Platforms, Inc. (META), Microsoft Corp. (MSFT), NVIDIA Corp. (NVDA) and Tesla, Inc. (TSLA) – which make up roughly one-third of the Index’s total weight.

We believe small cap stocks are better positioned headed into 2025, an outlook we have maintained since early 2023. Large caps outperformance of small caps over the past 14 years has caused price-earnings ratios for large caps to rise well above those of small caps. Furey Research Partners, a research boutique that provides market analysis to Conestoga, notes that a valuation gap as large as the one that existed in November 2024 has historically been followed by periods of small cap outperformance over the subsequent five years in 96% of all periods since 1968. In just over half of these cases, the outperformance was by more than 10%.

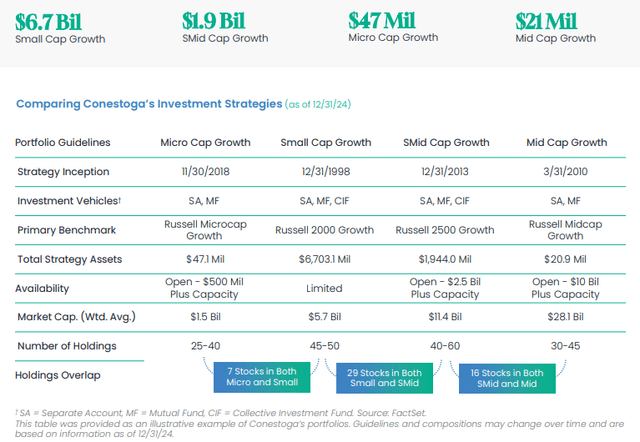

Firm Update

As of December 31, 2024, Conestoga’s total assets were $8.8 billion. Over the full year, we experienced very modest net outflows totaling $72 million from our flagship Small Cap Growth strategy, which has been in soft close since 2018. Our SMid Cap Growth strategy, which has been the primary focus of our new business development efforts since 2018, experienced net inflows of just under $300 million over the course of 2024. Our Micro Cap Growth and Mid Cap Growth strategies were stable.

Assets within our four primary investment strategies were:

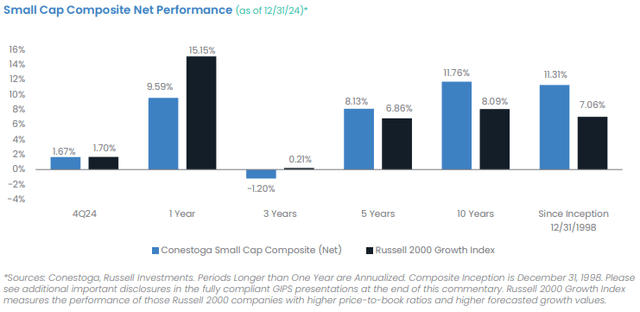

Small Cap Composite – 4Q24 Performance & Attribution

The Conestoga Small Cap Composite posted a total return of 1.67% net-of-fees in the fourth quarter of 2024, modestly underperforming the Russell 2000 Growth Index return of 1.70%. For the full year 2024, the Composite trailed the Russell 2000 Growth Index, with a return of 9.59% net-of-fees versus the benchmark’s return of 15.15%. Longer term, over the trailing five years, ten years and since inception in 1998, the Composite has outperformed its benchmark consistent with our expectations.

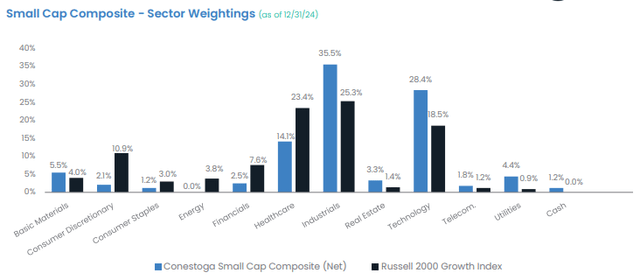

In the fourth quarter, Conestoga’s relative performance was boosted by sector allocation effects while stock selection effects detracted from relative returns. We note that our sector allocations are mostly a by-product of our bottom-up security selection process, not from any significant top-down sector outlook. Conestoga’s underweight to Health Care, particularly the biotechnology industry, boosted relative returns. An overweight to the stronger-performing Technology sector, which is primarily allocated to the software industry, also added to relative returns. Also, we note that loss-making companies significantly outperformed profitable companies in the fourth quarter, which was a headwind to our strategy.

Stock selection proved most challenging in the Industrials sector, where our positions in Exponent, Inc. (EXPO), Simpson Manufacturing Co., Inc. (SSD), and Transcat, Inc. (TRNS) each detracted from relative returns. EXPO, a consulting company that services a broad range of industries, fell on concerns that reduced industry regulation would dampen growth. Our long-term holding SSD, which manufactures and sells structural connectors, reported weaker than expected quarterly results amid continued softness in US housing starts. TRNS declined after reporting earnings that fell short of analysts’ expectations. On the positive side, our positions in Construction Partners, Inc. (ROAD) and JBT Marel Corp. (JBT) posted stronger-than-expected results in the quarter and added to relative returns in the sector.

Conestoga’s two holdings in the Consumer Discretionary sector both declined while the benchmark posted modest gains in the fourth quarter, generating negative stock selection effects in the sector. Fox Factory Holding Corp. (FOXF) continued its decline due to weakening end markets and an acquisition strategy that has not yet delivered on management’s expectations. Conestoga elected to sell FOXF during the quarter and it was removed from portfolios. SiteOne Landscape Supply, Inc. (SITE) fell after reporting earnings that missed expectations for its wholesale landscape supply services.

Stock selection was most positive in the Health Care sector. As described above, some of this was due to our lack of exposure to biotechnology stocks, which were generally weaker over the quarter. Conestoga’s sole holding classified as a biotech – Vericel Corp. (VCEL) – rose over the quarter as its revenue and earnings beat expectations. VCEL develops cellular therapies and burn care products.(Continued next page.)

Over the full year 2024, the Small Cap Composite rose 9.59% net-of-fees versus the Russell 2000 Growth Index return of 15.15%. Stock selection detracted from returns while sector allocation effects were positive. Profitable companies had a modest advantage over loss-makers in 2024, and overall, we felt there was little benefit from our emphasis on higher-quality companies.

Negative stock selection effects in the Technology sector were the primary source of Conestoga’s underperformance in 2024. Two stocks which we did not own, Super Micro Computer, Inc. (SMCI) and MicroStrategy, Inc. (MSTR), became large weights in the benchmark and detracted roughly 250 basis points from relative returns before they were rebalanced out of the Index mid-year. Our lack of exposure to the computer hardware industry, which surged over 100% in the Russell 2000 Growth Index on enthusiasm surrounding demand for Artificial Intelligence (AI)-related hardware was a key source of underperformance. Within the software industry, which we emphasize for its higher levels of profitability and recurring revenue, several of Conestoga’s positions also underperformed. PROS Holdings, Inc. (PRO), Simulations Plus, Inc. (SLP) and SPS Commerce, Inc. (SPSC) each underperformed and detracted from relative returns. PRO was sold in the third quarter of 2024. Positive stock selection from Q2 Holdings, Inc. (QTWO), a software company serving mid-sized banks and financial services companies, rose over 100% in 2024 and offset some of the negative stock selection effects.

As they did in the fourth quarter, our Consumer Discretionary sector holdings FOXF and SITE were also detractors for the full year. Both companies generally moved lower over the year, with SITE reporting weaker results in the second quarter and lowering guidance on softer residential home improvement spending. FOXF was sold in the fourth quarter of 2024 while SITE remains in client portfolios.

Positive sector allocation effects were largely driven by our lack of exposure to the Energy sector, which declined -11% in 2024 and was the weakest sector in the benchmark. An underweight to Health Care, and especially the biotechnology industry, also added to relative returns. An overweight to Technology, the strongest performing sector in the benchmark, also added to relative returns.

Small Cap Composite – 4Q24 Top 5 Leaders

Small Cap Composite – 4Q24 Bottom 5 Laggards

Construction Partners, Inc. (ROAD)

ROAD has been a leader in six of the past seven quarters, driven by robust demand in the road maintenance and infrastructure market, partially driven by the infrastructure investment made by the Federal government. More recently, ROAD made a platform acquisition in Texas that boosted revenue by $530 million at a margin of over 22%, which is nicely accretive to ROAD’s mid-teens rate. The acquisition has enabled ROAD to meet their fiscal 2027 revenue and profitability targets two years early.

Exponent, Inc. (EXPO)

After being a leader in both the second and third quarters, shares of EXPO retreated during the fourth quarter, primarily after the election. This is likely due to the belief that the regulatory environment could be relaxed. Part of the retreat was company specific as EXPO announced consultant headcount would be below expectations for the year. While guidance was reiterated, this slows expected revenue growth in 2025.

Vertex, Inc. (VERX)

VERX is the market leader in tax automation software which helps enterprises calculate and comply with various sales tax and value added tax rules. VERX’s stock has doubled in 2024 (with continued strong quarterly results) as it continued to demonstrate double-digit growth with improvements in its Earnings Before Taxes Interest Depreciation and Amortization (EBTIDA) margin. VERX had realized high returns on investments it had made in the last few years in the areas of sales/marketing and new products.

Neogen Corp. (NEOG)

NEOG reported weak 1Q 2025 results, reflecting both ongoing 3M Food Safety integration hurdles and softness across key end markets. Core revenue declined 1% amid operational challenges, though management highlighted progress in resolving shipping constraints and normalizing production. Near-term margins remain constrained by integration investments, but market share recapture efforts are gaining traction. Looking ahead, we believe an expanded product portfolio and increasing food safety regulatory tailwinds position NEOG for renewed growth and margin recovery as end markets stabilize.

Q2 Holdings, Inc. (QTWO)

Based in Austin, TX, QTWO delivered another impressive quarter of results. 3Q24 revenue results slightly exceeded estimates and EBITDA beat consensus by $3.1 million. With 80% of the business now tied to subscription revenue, QTWO continued to show significantly improved margins and also raised subscription revenue growth guidance expectations coming into the year. The company has also seen strong bookings growth on a year-to-date basis, which positions the company well to achieve its long-term growth targets.

Simpson Manufacturing Co., Inc. (SSD)

SSD reported weaker than expected Q3 results amid continued softness in US housing starts. Although Q3 sales were stable, increased costs prompted management to lower its full-year operating margin outlook, citing a slower recovery in storm-affected areas. Strategic investments are ongoing, with recent acquisitions expected to broaden the company’s offerings. Focused on cost control and these strategic investments, management aims to restore a 20% operating margin as housing demand improves. We believe, the company’s strong balance sheet and operational efficiency initiatives position it well for an eventual housing market recovery.

Workiva, Inc. (WK)

WK is a global SaaS company that provides a cloud-based platform for financial reporting, audit, risk, compliance and Environment Social Governance (ESG). WK beat and raised their full year forecast for both revenue and operating profit in each of the first three quarters of 2024. The company continued to see an improved selling environment, despite investor concerns that a Trump administration could reduce the focus on ESG, WK’s top booking solution. WK has experienced significant growth in larger accounts, with customers that spend more than $500,000 annually growing 28% in the third quarter.

Novanta, Inc. (NOVT)

NOVT designs and manufactures advanced photonic, vision, and precision motion components and subsystems, sold primarily for the healthcare market. NOVT’s normally stable financial results have been volatile in 2024 due to several events. The company’s largest customer in each of the robotic surgery, EUV technology, and DNA sequencing channels delayed orders due to short-term issues. The macroeconomic situation domestically and internationally has affected results. The company called out German government turmoil and Chinese stimulus not reinvigorating growth. Altogether, NOVT still sees 2025 organic revenue growth accelerating back to the high single digits, and potentially higher with any economic recovery in their end markets.

Altair Engineering, Inc. (ALTR)

ALTR, a leader in design and simulation software, announced on October 31st that it was being acquired by Siemens for $113 per share, representing an equity value of $10.6 billion. The price represented a 19% premium to the stock’s unaffected market price on October 21st and a 13% premium to the stock’s all-time high closing price. The deal valued ALTR at approximately 14X its 2025 revenue and 63X EBITDA.

SiteOne Landscape Supply, Inc. (SITE)

SITE is the nation’s largest distributor of supplies for residential and commercial landscape professionals. The stock struggled in the quarter for two reasons, namely the surge in interest rates has been a headwind to residential repair and remodeling projects. At the company level, persistent price deflation affecting a small segment of its products has been an overhang on revenue growth and profitability.

Click to enlarge

Source: FactSet

Small Cap Composite – 4Q24 Buys*

Small Cap Composite – 4Q24 Sells*

Crane NXT Co. (CXT)

CXT is a leading provider of trusted technology solutions to secure, detect, and authenticate its customers assets. Crane NXT’s roots go back to 1801 when Zenas Crane founded the Crane Paper Company in Dalton, MA. CXT has numerous technologies and segments that revolve around security and detection. CXT works with over 50 central banks to provide security for their currency and has been the US’s sole supplier of currency paper since 1879. CXT also secures and authenticates consumer goods, passports, and digital content. CXT provides technology and hardware solutions to authenticate payment transactions. Altogether, we believe CXT is a 5- 7% organic revenue growth company with margin expansion that yields double-digit EBTIDA growth.

Fox Factory Holding Corp. (FOXF)

A long-term holding of Conestoga’s, we sold FOXF in the quarter due to weakening end markets and a shift in the company’s acquisition strategy. FOXF has experienced a very challenging environment in its Power Vehicles and aftermarket segments which could take some time to turn around. The Company’s acquisition of a baseball bat company (Marucci Sports) was not well received by investors given it was outside of the company’s core markets.

Kadant, Inc. (KAI)

KAI is the leading global supplier of mission critical engineered parts and equipment for paper, packaging, wood, and industrial end markets. KAI’s products are often the leader in market share with significant leads over the nearest competitor. Nearly two-thirds of revenue is recurring as the company’s parts are used in harsh processing environments. The management team has had an excellent track record, delivering best-in-class value via mergers and acquisitions (M&A), strategic vision, and operational efficiencies. We believe KAI will continue to earn above-market returns over the long term.

nCino, Inc. (NCNO)

NCNO provides cloud-based software solutions to financial institutions to facilitate lending, account opening, and onboarding. NCNO’s Bank Operating System has become the market leader in commercial lending divisions within banks. NCNO has broadened their platform to include mortgage origination, consumer lending, and small business lending. NCNO operates in a serviceable addressable market of nearly $40 billion.

NCNO’s revenue is 86% recurring, grows in the mid-teens range organically, and is geographically diverse with 20% coming from international markets. NCNO targets being a “rule of 50” company and has expanded operating margins rapidly to 20%, with the goal of reaching >30%.

NCNO is headquartered in Wilmington, NC.

Click to enlarge

Conestoga added positions on six occasions and trimmed stocks on five occasions during the fourth quarter.

*Portfolio holdings shown above experienced material activity during the quarter.

Source: FactSet, Conestoga. Sectors are defined according to the ICB industry definitions

Small Cap Composite – Top Ten Equity Holdings (as of 12/31/24)

Symbol

Company Name

Sector

% of Assets

DSGX

Descartes Systems Group, Inc.

Technology

4.92%

CWST

Casella Waste Systems, Inc.

Utilities

4.43%

ROAD

Construction Partners, Inc.

Industrials

4.01%

AAON

AAON, Inc.

Industrials

3.68%

FSV

FirstService Corp.

Real Estate

3.33%

EXPO

Exponent, Inc.

Industrials

3.33%

SPSC

SPS Commerce, Inc.

Technology

3.13%

SSD

Simpson Manufacturing Co., Inc.

Industrials

3.03%

MMSI

Merit Medical Systems, Inc.

Health Care

2.89%

RBC

RBC Bearings, Inc.

Basic Materials

2.88%

Total within the Composite:

35.63%

Click to enlarge The positions represent Conestoga Capital Advisors largest equity holdings based on the aggregate dollar value of positions held in the client accounts that are included in the Small Cap Composite. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Sectors are defined according to the ICB industry definitions.

Click to enlarge

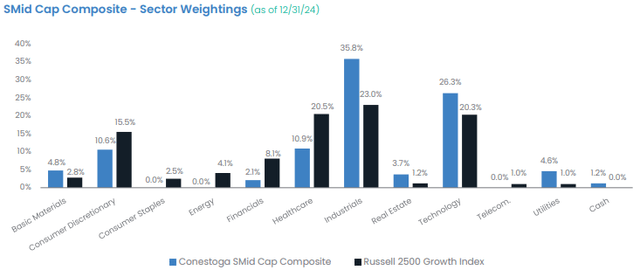

*Sources: Conestoga, Russell Investments. Composite creation date is December 31, 2013. Please see additional important disclosures in the fully compliant GIPS presentations at the end of this commentary. Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

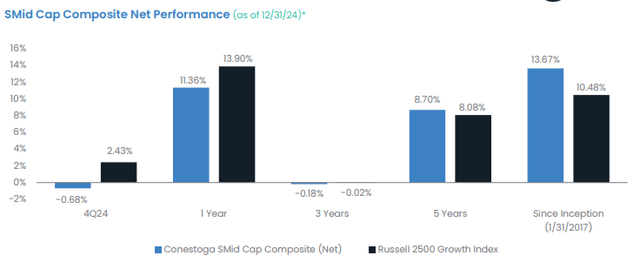

SMid Cap Composite – 4Q24 Performance & Attribution

The Conestoga SMid Cap Composite trailed the Russell 2500 Growth Index in the fourth quarter with a total return of -0.68% net-of-fees versus the benchmark return of 2.43%. Most of the underperformance occurred from October 1st through December 4th when the market rallied 12.0%. For the quarter, negative stock selection effects in the Consumer Discretionary, Industrials, and Technology sectors were the primary drivers of underperformance while positive sector allocation effects in the Health Care sector partially offset the losses. From a factor perspective, high beta stocks with the highest forward sales and earnings growth outperformed, providing a significant headwind to relative performance.

Stock selection proved most challenging in the Consumer Discretionary sector and losses were broad-based with all six portfolio holdings detracting from returns. Bright Horizons Family Solutions, Inc. (BFAM), Rollins, Inc. (ROL), and SiteOne Landscape Supply, Inc. (SITE) were the largest detractors. BFAM shares fell on disappointing quarterly earnings results and concerns about slowing organic growth in the childcare industry. ROL posted a third quarter earnings miss due to rising costs and slowing demand while SITE traded at a 52-week low because of a softer repair/remodel market and price deflation.

Stock selection was a mixed bag within Industrials with Exponent, Inc. (EXPO), Simpson Manufacturing Co., Inc. (SSD), and HEICO Corp. (HEI) leading the way lower. Quarterly earnings for EXPO were lower than expected and concerns about slowing revenue growth in key sectors like chemicals and life sciences hurt the stock. SSD experienced a decrease in profit margins caused by rising operational costs. Management also lowered forward guidance reflecting an anticipated decline in U.S. housing starts. HEI set records for revenue and operating income in the fourth quarter, but overall sales missed estimates, sending the shares lower.

On the positive side in Industrials, Axon Enterprise, Inc. (AXON) and Construction Partners, Inc. (ROAD) were the two largest contributors to portfolio returns for the quarter. AXON continued to see robust demand for its products and services, from Tasers to body cameras to the software that powers many applications within public safety operations. ROAD has been a leader in six of the past seven quarters, driven by robust demand in the road maintenance and infrastructure market.

Positive sector allocation effects in the Health Care sector provided a boost to relative results, primarily from the portfolio’s underweight to the biotechnology and pharmaceuticals industries. Our holdings in Stevanato Group (STVN) and West Pharmaceutical Services, Inc. (WST) also provided positive returns to performance.

For the full year 2024, the SMid Cap Composite underperformed its benchmark. The Composite was up 11.36% for the period but trailed the benchmark’s advance of 13.90%. Despite adding value in seven of the eleven sectors, negative stock selection in the Consumer Discretionary and Health Care sectors were too much to overcome. In addition, stocks with elevated multiples on a forward earnings basis underperformed their less expensive counterparts. Our portfolio typically trades at a slight premium relative to the index so investors’ preference for cheaper stocks hurt relative performance.

Negative stock selection effects were most pronounced in the Consumer Discretionary and Health Care sectors. Within Consumer Discretionary, the weakest performers in 2024 were those names that had benefited from Covid- era consumer spending habits. Site One Landscape Supply, Inc. (SITE), and POOL Corp. (POOL) both retreated during the year as a slowdown in the home improvement sector further contributed to lower demand and reduced sales volume for both stocks. Vail Resorts, Inc. (MTN) was also a detractor. As Epic Pass sales continued to decline, the company’s profitability was under pressure as rising costs were not offset by more revenue. We subsequently sold the stock in the fourth quarter.

Losses in the Health Care sector were broad-based with six of the seven portfolio holdings detracting from returns. EBITDA results for Repligen Corp. (RGEN) fell short of expectations as CDMOs and capital equipment sales remained weak spots in an otherwise slowly recovering bioprocessing market. Stevanato Group (STVN) reduced revenue guidance due to destocking in vials, the delay in a new order from a large customer and continued weakness in engineering services. The stock did see a rebound later in the fourth quarter. Neogen Corp. (NEOG) underperformed after cutting fiscal 2024 revenue guidance citing slower-than-expected recovery of order-fulfillment rates. The reported results reflect continued challenges to integrate the acquisition of the food safety unit of 3M Co. (MMM).

Despite the strategy’s underperformance for the year, there were several bright spots throughout the portfolio, particularly within the Industrials sector. Shares of both Construction Partners, Inc. (ROAD) and Axon Enterprise, Inc. (AXON) surged over 100% for the period and were the largest contributors to performance. Fair Isaac Corp. (FICO) and CSW Industrials, Inc. (CSWI) were other big winners.

Another boost to relative gains for the portfolio came from our lack of exposure to the Energy sector, one of only two sectors that had negative returns for the year.

SMid Cap Composite – 4Q24 Top 5 Leaders SMid Cap Composite – 4Q24 Bottom 5 Laggards

Axon Enterprise, Inc. (AXON)

AXON continued to see robust demand for its products and services, from TASERs to body cameras to the software that powers many applications within public safety operations. Shares jumped on third quarter results, which saw revenue grow 32%, EBTIDA 58%, and backlog 33% to $7.7 billion. In addition, AXON continued to expand adjusted EBITDA margins, which were above 25% in the third quarter. AXON was a leader in three of the four quarters in 2024.

Exponent, Inc. (EXPO)

After being a leader in both the second and third quarters, shares of EXPO retreated during the fourth quarter, primarily after the election. This is likely due to the belief that the regulatory environment could be relaxed. Part of the retreat was company specific as EXPO announced consultant headcount would be below expectations for the year. While guidance was reiterated, this slows expected revenue growth in 2025.

Construction Partners, Inc. (ROAD)

ROAD has been a leader in six of the past seven quarters, driven by robust demand in the road maintenance and infrastructure market, partially driven by the infrastructure investment made by the Federal government. More recently, ROAD made a platform acquisition in Texas that boosted revenue by $530 million at a margin of over 22%, which is nicely accretive to ROAD’s mid-teens rate. The acquisition has enabled ROAD to meet their fiscal 2027 revenue and profitability targets two years early.

Bright Horizons Family Solutions Corp. (BFAM)

BFAM is the largest private sector provider of employer sponsored childcare. The stock underperformed during the quarter after reporting a moderation in its full-service center utilization ramp back to pre-pandemic levels. We continue to believe it will take a few annual enrollment cycles to refill childcare centers and return to prior profitability.

Q2 Holdings, Inc. (QTWO)

Based in Austin, TX, QTWO delivered another impressive quarter of results. 3Q24 revenue results slightly exceeded estimates and EBITDA beat consensus by $3.1 million. With 80% of the business now tied to subscription revenue, QTWO continued to show significantly improved margins and also raised subscription revenue growth guidance expectations coming into the year. The company has also seen strong bookings growth on a year-to-date basis, which positions the company well to achieve its long-term growth targets.

Novanta, Inc. (NOVT)

NOVT designs and manufactures advanced photonic, vision, and precision motion components and subsystems, sold primarily for the healthcare market. NOVT’s normally stable financial results have been volatile in 2024 due to several events. The company’s largest customer in each of the robotic surgery, EUV technology, and DNA sequencing channels delayed orders due to short-term issues. The macroeconomic situation domestically and internationally has affected results. The company called out German government turmoil and Chinese stimulus not reinvigorating growth. Altogether, NOVT still sees 2025 organic revenue growth accelerating back to the high single digits, and potentially higher with any economic recovery in their end markets.

Workiva, Inc. (WK)

WK is a global SaaS company that provides a cloud-based platform for financial reporting, audit, risk, compliance and Environment Social Governance (ESG). WK beat and raised their full year forecast for both revenue and operating profit in each of the first three quarters of 2024. The company continued to see an improved selling environment, despite investor concerns that a Trump administration could reduce the focus on ESG, WK’s top booking solution. WK has experienced significant growth in larger accounts, with customers that spend more than $500,000 annually growing 28% in the third quarter.

Neogen Corp. (NEOG)

NEOG reported weak Q1 2025 results, reflecting both ongoing 3M Food Safety integration hurdles and softness across key end markets. Core revenue declined 1% amid operational changes, though management highlighted progress in resolving shipping constraints and normalizing production. Near-term margins remain constrained by integration investments, but market share recapture efforts are gaining traction. Looking ahead, we believe an expanded product portfolio and increasing food safety regulatory tailwinds position NEOG for renewed growth and margin recovery as end markets stabilize.

Descartes Systems Group, Inc. (DSGX)

DSGX is a leading provider of cloud-based logistics and supply chain solutions with over 26,000 customers worldwide. DSGX reported third quarter results which were bolstered by its customers’ navigation of the constantly evolving supply chain landscape. Wars in Ukraine and Israel, tariffs, and restrictions on goods sold to nations deemed as bad actors, all necessitates using technology to be able to dynamically and efficiently transport goods. DSGX reported 17% revenue growth and 43% EBITDA margins while converting over 83% of Adjusted EBITDA to cash from operations during the third quarter.

Teleflex, Inc. (TFX)

Based in Wayne, PA, TFX reported a mixed quarter with its quarterly results. 3Q24 revenue slightly missed estimates but profitability was slightly better than expected. The company also lowered 2024 sales guidance due to the loss of a customer that is insourcing the manufacture of a component, as well as lower interventional urology (aka UroLift) sales. Over the last several years, TFX has struggled to achieve its long-term growth aspirations. Investors have not seen the benefits of a more diversified medical products company.

Click to enlarge

Source: FactSet

SMid Cap Composite – 4Q24 Buys*

SMid Composite – 4Q24 Sells*

Procore Technologies, Inc. (PCOR)

PCOR, founded in 2002 and based in Carpinteria CA, is a market leader in cloud-based construction management software sold to general contractors, subcontractors, and building owners. PCOR competes in an underpenetrated market, has had historical double-digit growth and has recently demonstrated dramatic improvements in operating margins. PCOR has also been making improvements in its go-to-market strategy, which we believe should further accelerate growth and strengthen its customer relationships.

Vail Resorts, Inc. (MTN)

MTN is the leading ski mountain resort operator in the world. MTN’s organic earnings growth profile has slowed over the last several years after a one-time 20% reduction in pass prices during the pandemic, followed by significant wage increases to address labor shortages.

While we anticipate a modest acceleration in the coming years, we sold MTN to add to higher conviction existing portfolio holdings with better visibility into earnings growth.

Kadant, Inc. (KAI)

KAI is the leading global supplier of mission critical engineered parts and equipment for paper, packaging, wood, and industrial end markets. KAI’s products are often the leader in market share with significant leads over the nearest competitor. Nearly two-thirds of revenue is recurring as the company’s parts are used in harsh processing environments. The management team has had an excellent track record, delivering best-in-class value via mergers and acquisitions, strategic vision, and operational efficiencies. We believe KAI will continue to earn above-market returns over the long-term.

Teleflex, Inc. (TFX)

Based in Wayne, PA, TFX has experienced weaker-than- expected results due to the loss of a customer that is insourcing the manufacture of a component, as well as lower interventional urology (aka UroLift) sales. Over the last several years, TFX has struggled to achieve its long- term growth aspirations. Investors have not seen the benefits of a more diversified medical products company and Conestoga removed TFX from client portfolios.

nCino, Inc. (NCNO)

NCNO provides cloud-based software solutions to financial institutions to facilitate lending, account opening, and onboarding. NCNO’s Bank Operating System has become the market leader in commercial lending divisions within banks. NCNO has broadened their platform to include mortgage origination, consumer lending, and small business lending. NCNO operates in a serviceable addressable market of nearly $40 billion.

NCNO’s revenue is 86% recurring, grows in the mid-teens range organically, and is geographically diverse with 20% coming from international markets. NCNO targets being a “rule of 50” company and has expanded operating margins rapidly to 20%, with the goal of reaching >30%.

NCNO is headquartered in Wilmington, NC.

Cognex Corp. (CGNX)

CGNX is a leading provider of machine vision solutions used in factories and warehouses to measure, inspect and identify items to ensure accuracy. Revenue is largely dependent on customers’ capital spending, which remains challenged across most of its end markets, namely consumer electronics and logistics. One of our smaller portfolio holdings, we exited our position during the quarter to redeploy proceeds into several existing portfolio holdings.

Hillman Solutions Corp. (HLMN)

HLMN is the leading distributor of hardware, home improvement products, and robotic kiosk technologies to a broad range of retailers. Hillman leverages its 1,100 person direct sales force to manage over 114,000 SKU’s for 42,000 retail locations. While HLMN has effectively navigated supply chain disruptions and inflationary pressure, the robotics division, which is accretive to both growth and margins, has underperformed. M&A, which contributes to growth, was also delayed with the supply chain issues. HLMN has executed well, but overall, the environment has left Conestoga less positive about its future success.

Click to enlarge

Conestoga added positions on five occasions and trimmed stocks on two occasions during the fourth quarter.

*Portfolio holdings shown above experienced material activity during the quarter.

Source: FactSet, Conestoga. Sectors are defined according to the ICB industry definitions.

SMid Cap Composite – Top Ten Equity Holdings (as of 12/31/24)

Symbol

Company Name

Sector

% of Assets

CWST

Casella Waste Systems, Inc.

Utilities

4.64%

ROAD

Construction Partners, Inc.

Industrials

3.99%

FSV

FirstService Corp.

Real Estate

3.69%

DSGX

Descartes Systems Group, Inc.

Technology

3.58%

TYL

Tyler Technologies, Inc.

Technology

3.20%

AXON

Axon Enterprise, Inc.

Industrials

3.09%

ROL

Rollins, Inc.

Consumer Discretionary

2.94%

WSO

Watsco, Inc.

Industrials

2.93%

EXPO

Exponent, Inc.

Industrials

2.87%

QTWO

Q2 Holdings, Inc.

Technology

2.85%

Total within the Composite:

33.78%

Click to enlarge

The positions represent Conestoga Capital Advisors largest equity holdings based on the aggregate dollar value of positions held in the client accounts that are included in the SMid Cap Composite. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Sectors are defined according to the ICB industry definitions.

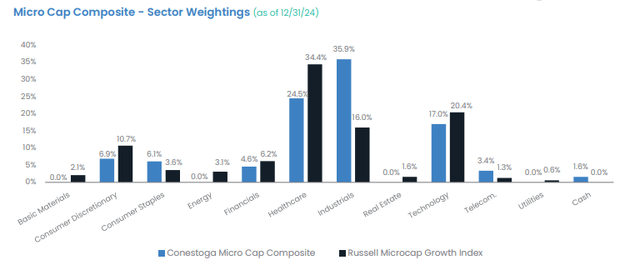

*Sources: Conestoga, Russell Investments. Composite creation date is December 31, 2019. Please see additional important disclosures in the fully compliant GIPS presentations at the end of this commentary. Russell Microcap Growth Index measures the performance of those Russell Microcap companies with higher price-to-book ratios and higher forecasted growth values.

Micro Cap Composite – 4Q24 Performance & Attribution

The Conestoga Micro Cap Composite advanced 9.91% net-of-fees in the fourth quarter but trailed the Russell Microcap Growth Index return of 11.55%. Negative stock selection was the primary driver of underperformance with holdings in the Industrials and Technology sectors detracting the most from relative results. Positive stock selection in the Health Care sector was able to offset some of the losses and positive sector allocation effects were additive to returns. Stylistic headwinds also proved difficult to overcome as the highest beta names with the highest levels of forward sales growth significantly outperformed.

Stock selection was most challenging in the Industrials sector where nine of our eleven holdings detracted value. Montrose Environmental Group, Inc. (MEG) was the largest detractor in the portfolio, trading lower due to investor concerns about potential regulatory changes stemming from the Supreme Court’s decision to overturn the “Chevron Deference”. A large portion of its revenue comes from EPA-related work, leading to fears of slowed growth and reduced enforcement actions against environmental violations.

Elsewhere in Industrials, shares of Transcat, Inc. (TRNS) fell after the company’s results fell short of expectations. The miss was the result of lower-than-expected organic growth within the Services segment, driven by a material slowdown in the Nexa unit’s cost control and optimization services business. Management laid out a series of changes that should return Nexa to growth over the course of 2025. NV5 Global, Inc. (NVEE), a leading provider of professional engineering and consulting services reported mixed results for the quarter and management lowered full-year revenue guidance. However, the company reported a record backlog heading into the fourth quarter and a robust M&A pipeline, which we believe bodes well for fiscal 2025 results. There were a couple of bright spots within Industrials, with the most notable being Construction Partners, Inc. (ROAD) which has been a leader in six of the past seven quarters, driven by robust demand in the road maintenance and infrastructure market.

In the Technology sector, Simulations Plus, Inc. (SLP) hit a 52-week low during the quarter after reporting revenue that fell short of expectations. We remain optimistic about its future growth, backed by the strategic acquisitions of Proficiency and Immunetrics that have expanded its market reach and enhanced its software offerings. On the positive side, Planet Labs PBC Class A (PL) shares have rebounded due to a reorganization that has them poised to grow on a more reasonable expense base, which has the company positioned to report their first quarter of positive EBITDA in the fourth quarter since going public.

Our high conviction position in Alpha Teknova, Inc. (TKNO) was the largest contributor in the Health Care sector for the quarter. Investors have rallied behind the company’s promising developments, propelling the stock to new heights and reflecting a robust bullish sentiment in the biotechnology sector. The company reported a significant increase in revenue primarily from the Clinical Solutions segment. Despite a challenging biopharma market, TKNO expects stability and modest growth in 2025.(Continued next page.)

For the full year 2024, the Micro Cap Composite was up 13.52% net-of-fees, but failed to keep pace with the Russell Microcap Growth Index’s gain of 21.91%. Almost all the underperformance was concentrated in the Industrials sector where stock selection proved challenging. The portfolio did benefit from positive sector allocation effects as well as positive stock selection in the Health Care and Financials sectors.

Within Industrials, SoundThinking, Inc. (SSTI), Montrose Environmental Group, Inc. (MEG), CryoPort, Inc. (CYRX), and NV5 Global, Inc. (NVEE), were the biggest detractors while our high conviction position in Construction Partners, Inc. (ROAD) was the largest contributor to relative returns during the period. SSTI had another difficult year after experiencing mixed financial results and faces several challenges, most notably the loss of significant contracts in Chicago and Puerto Rico. The losses have overshadowed growth from other products and markets, leading to a rebuilding year in 2025. However, the company has taken a proactive approach in response to these setbacks, focusing on demonstrating product value more effectively to existing and potential clients.

The Health Care sector offset some of the losses with positions in Alpha Teknova, Inc. (TKNO) and Vericel Corp. (VCEL) adding the biggest gains. Our lone position in the Financials sector, Palomar Holdings, Inc. (PLMR), was one of the portfolio’s largest contributors after shares surged more than 90% during the year.

While disappointed in the overall performance of the strategy in 2024, we remain convicted in the positioning of the portfolio moving forward due to the high-quality nature of our underlying businesses, their improving margin profiles and their attractive valuation characteristics.

Micro Cap Composite – 4Q24 Top 5 Leaders

Micro Cap Composite – 4Q24 Bottom 5 Laggards

Alpha Teknova, Inc. (TKNO)

TKNO is a leading provider of critical reagents that enable the discovery, development, and production of biopharmaceutical products such as drug therapies, novel vaccines, and molecular diagnostics. The company reported a solid quarter and called out an improving biotech funding environment and better customer order activity as reasons. Combined with improving investor sentiment, shares rallied considerably to reach 52-week highs during the quarter. As market conditions improve, we believe TKNO may be poised to capture outsized market share with the recent opening of their GMP facility.

Montrose Environmental Group, Inc. (MEG)

MEG is a pure-play environmental services company that offers end-to-end solutions for addressing environmental issues. The stock has underperformed the market since the Supreme Court’s June ruling which overturned a legal precedent (known as “Chevron Deference”). This, coupled with the administration change has introduced fears that the Environmental Protection Agency (EPA) will not be able to push new regulations and/or delay enforcement actions of existing environmental regulations.

Planet Labs PBC (PL)

PL is a market leader in Earth observation data with daily satellite scans of the entire Earth that are supported by over 200 satellites. While growth in their defense and intelligence market has been robust, this has been offset by weakness in their commercial customer base, notably in agriculture. PL shares have rebounded due to a reorganization that has commercial poised to grow on a more reasonable expense base, which has PL positioned to report their first quarter of positive EBITDA in the fourth quarter since going public. Artificial Intelligence is a key technology that is unlocking the true potential of PL and its vast data engine.

Transcat, Inc. (TRNS)

TRNS engages in the provision of calibration and laboratory instrument services. The company’s results fell short of expectations in the fourth quarter, driven by a material slowdown in its Nexa unit’s cost control and optimization services business. Management laid out a series of changes that they expect should return Nexa to growth over the course of 2025. The changes include fully integrating Nexa’s sales and marketing into the company’s process and rebranding the business as Transcat Solutions, leveraging TRNS’s strong reputation.

Olo, Inc. (OLO)

OLO is a software-as-a-service (SaaS) technology platform that enables its restaurant brand customers (over 700 total) to reach their customers across over 85,000 locations. OLO reported third quarter results ahead of expectations and raised guidance for the third time this year. Revenue for the quarter grew 24% and operating margins continued to expand. OLO continued to drive impressive cross-sell, driving up revenue per customer, which complimented their 9% growth by location.

NV5 Global, Inc. (NVEE)

NVEE is a leading provider of professional engineering and consulting services. The company reported mixed results during the quarter, with earnings ahead of consensus, adjusted EBITDA below consensus, and revenue in-line with consensus. However, management lowered full-year revenue guidance below prior expectations. Although results were slightly disappointing, the company reported a record backlog heading into the fourth quarter and a robust M&A pipeline, which we believe bodes well for fiscal 2025 results.

Universal Technical Institute, Inc. (UTI)

UTI is a leading workforce education provider of skilled trade and healthcare and education programs. UTI trains over 20,000 students annually. Shares jumped on the election results but generated most of the quarter’s return on the company’s strong fourth quarter results. Revenue grew 15% and beat expectations. EBITDA margins have also risen over the past year. Fiscal year 2025 guidance was nudged higher earlier in 2024, driven by the strong new student enrollment UTI is seeing across its markets.

Energy Recovery, Inc. (ERII)

ERII is a global leader in energy efficiency technology through its proprietary pressure exchanger technology. After being a leader in the third quarter, which was our first quarter of ownership, the stock declined in the fourth quarter. ERII reported a solid third quarter, with revenue and adjusted EBITDA ahead of expectations with positive commentary around their opportunity to enter the CO2 market. However, in mid-November, they held an investor webinar and introduced five-year financial targets below expectations, with 2025 falling notably short. The company is executing a plan to drive $5 million in cost savings and initiated a $50 million share buyback.

Construction Partners, Inc. (ROAD)

ROAD has been a leader in six of the past seven quarters, driven by robust demand in the road maintenance and infrastructure market, partially driven by the infrastructure investment made by the Federal government. More recently, ROAD made a platform acquisition in Texas that boosted revenue by $530 million at a margin of over 22%, which is nicely accretive to ROAD’s mid-teens rate. The acquisition has enabled ROAD to meet their fiscal 2027 revenue and profitability targets two years early.

Thunderbird Entertainment Group, Inc. (OTCQX:THBRF)

THBRF creates scripted, unscripted, and animated programming for the world’s leading digital streaming platforms under the Great Pacific Media and Atomic

divisions. THBRF drifted modestly lower during the quarter despite reporting a significant revenue and EBITDA beat. The company guided to stronger revenue growth for fiscal 2025, but profitability growth lagged as they have signed more lower-margin services work. Th industry has continued to rationalize and consolidate content spend, but we expect industry growth to normalize in 2025 as the boom-and-bust cycle experienced during COVID has run its course.

Click to enlarge

Source: FactSet

Micro Cap Composite – 4Q24 Buys*

Micro Cap Composite – 4Q24 Sells*

N-able, Inc. (NABL)

Founded in 2000, NABL is a leading software provider to the managed service providers (MSPs), with over 25,000 customers. MSPs are essentially outsourced IT departments that, in turn, sell these tools downstream to small- to medium-sized businesses of all kinds. NABL is a 100% recurring revenue business that provides software tools, including security, data protection, and remote monitoring, to their MSP customers. NABL has a nearly $40 billion total addressable market, with durable tailwinds as the complexity of security, cloud migrations, and data storage increase.

None.

Click to enlarge

Conestoga added positions on two occasions and trimmed positions on two occasions during the fourth quarter.

*Portfolio holdings shown above experienced material activity during the quarter.

Source: FactSet Research Systems and Conestoga. Sectors are defined according to the ICB industry definitions.

Micro Cap Composite – Top Ten Equity Holdings (as of 12/31/24)

Symbol

Company Name

Sector

% of Assets

OLO

Olo, Inc.

Technology

5.03%

PLMR

Palomar Holdings, Inc.

Financials

4.64%

UTI

Universal Technical Institute, Inc.

Consumer Discretionary

4.63%

ROAD

Construction Partners, Inc.

Industrials

4.50%

TKNO

Alpha Teknova, Inc.

Health Care

4.32%

TCYSF

TECSYS, Inc.

Technology

4.31%

PL

Planet Labs PBC

Technology

4.23%

PHR

Phreesia, Inc.

Health Care

4.14%

VCEL

Vericel Corp.

Health Care

3.80%

HLMN

Hillman Solutions Corp.

Industrials

3.64%

Total within the Composite:

43.24%

Click to enlarge

The positions represent Conestoga Capital Advisors largest equity holdings based on the aggregate dollar value of positions held in the client accounts that are included in the Micro Cap Composite. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Sectors are defined according to the ICB industry definitions.

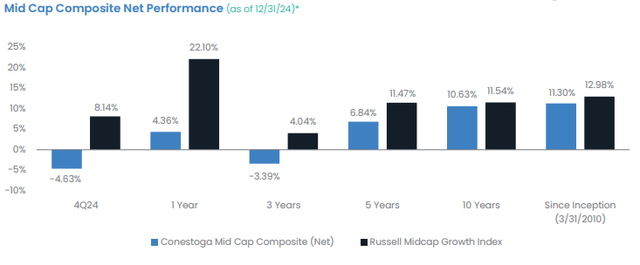

*Sources: Conestoga, Russell Investments. Composite creation date is March 31, 2010. Please see additional important disclosures in the fully compliant GIPS presentations at the end of this commentary. Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

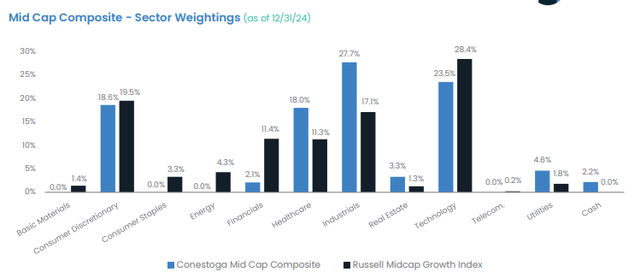

Mid Cap Composite – 4Q24 and Full Year 2024 Performance & Attribution

The Conestoga Mid Cap Composite declined -4.63% net-of-fees in the fourth quarter, trailing the Russell Mid Cap Growth Index return of 8.14%. It was a highly unusual quarter where most of the underperformance was attributed to high-flying stocks in the index that the portfolio didn’t own. The stylistic headwinds were too much to overcome as most of the benchmark names that outperformed shared similar qualities: highest beta, highest forward sales and earnings growth, and most expensive valuations on a forward earnings basis. We typically have no exposure or are significantly underweight the benchmark in these types of companies as they lack the high-quality characteristics we seek. Stock selection was most troublesome in the Technology, Industrials, Health Care, and Consumer Discretionary sectors. Our lack of exposure to the underperforming Consumer Staples and Basic Materials sectors provided a small gain to relative returns.

In the Technology sector, the portfolio lost almost 400 bps in relative performance from two benchmark names we didn’t own. Palantir Technologies, Inc. (PLTR) and AppLovin Corp. (APP) had a combined weight of almost 6% in the benchmark and were up 103% and 148% respectively during the quarter. Our holdings in Roper Technologies, Inc. (ROP) and Guidewire Software, Inc. (GWRE) also detracted from returns. One bright spot in the space came from our high conviction position in Fortinet, Inc. (FTNT). The company continues to see positive momentum in firewall services revenue and posted a big beat & raise.

Losses in the Industrials sector were broad-based with ten of eleven positions detracting from relative performance. Exponent, Inc. (EXPO) led the way lower. After being a leader in both the second and third quarter, shares of EXPO retreated during the fourth quarter, primarily after the election. This is likely due to the belief that the regulatory environment could be relaxed. Heico Corp. (HEI) was another name that saw profit-taking in the fourth quarter. The stock rose steadily throughout the year before selling off in late November. Despite the pullback, shares were still up 31% for the calendar year, besting the benchmark’s 22% return and being one of the portfolio’s top contributors for 2024.

IDEXX Laboratories, Inc. (IDXX) was the biggest laggard in the Health Care space in the fourth quarter after being a top contributor in the third quarter. Earnings for the quarter were mixed, and guidance was lowered. Shares were pressured as clinical visits across the industry remain weak, with an unprecedented 10 of 11 recent quarters seeing negative US same store vet visits. In Consumer Discretionary, Bright Horizons Family Solutions Corp. (BFAM) fell on disappointing quarterly earnings results and concerns about slowing organic growth in the childcare industry.

For the calendar year 2024, the Mid Cap Composite climbed 4.36% for the year vs. the benchmark’s rise of 22.10%. Most of the underperformance came from the highly unusual market dynamics of the fourth quarter. From the beginning of the year through September 10th, the portfolio outperformed the benchmark by almost 1%.

Unfortunately, from that date through year-end, the portfolio could not keep up with the blistering pace of the benchmark’s return. Negative stock selection in the Technology, Health Care, and Consumer Discretionary sectors were the biggest detractors from relative results while our lack of exposure to Consumer Staples, Basic Materials, Energy, and Telecommunications were most additive.

Mid Cap Composite – 4Q24 Top 5 Leaders

Mid Cap Composite – 4Q24 Bottom 5 Laggards

Fortinet, Inc. (FTNT)

FTNT is the worldwide market share leader in network security firewalls (by units). During the quarter, FTNT continued to see positive momentum in firewall services revenue and posted a big beat and raise of results and guidance. Looking ahead, the company is expecting a larger-than-normal product refresh cycle, with many customers ordering well in advance (often one year prior) of their firewall’s 2026 end-of-life schedule.

IDEXX Laboratories, Inc. (IDXX)

IDXX is the industry leader in providing instruments (and consumables) used in diagnostics, detection, and information systems for veterinary, food, and water testing applications. Earnings for the quarter were mixed, and forward guidance was lowered. Shares were pressured as clinical visits across the industry remain weak, with an unprecedented 10 of 11 recent quarters seeing negative US same store vet visits. These recent trends should normalize over time as the secular demand remains robust.

Copart, Inc. (CPRT)

CPRT is a leading provider of salvage auctions in the U.S., Canada and the UK. The company reported quarterly results that included healthy volume growth, aided by a higher total loss rate, which offset higher investment spending. We believe CPRT has an improved competitive position and expect they will have stronger earnings power on the other side of this investment period.

Bright Horizons Family Solutions Corp. (BFAM)

BFAM is the largest private sector provider of employer sponsored childcare. The stock underperformed during the quarter after reporting a moderation in its full-service center utilization ramp back to pre-pandemic levels. We continue to believe it will take a few annual enrollment cycles to refill childcare centers and return to prior profitability.

West Pharmaceutical Services, Inc. (WST)

WST, a market leader in containment and delivery solutions for the pharmaceutical industry, bounced back in the fourth quarter. The market appears more optimistic that the inventory destocking of 2024 is nearing its end, and we believe the company should be able to return to its organic growth profile of 5-8%. WST is a beneficiary of the GLP-1 product ramp across numerous pharmaceutical clients, which we expect should maintain its momentum into 2025 and beyond.

Exponent, Inc. (EXPO)

After being a leader in both the second and third quarters, shares of EXPO retreated during the fourth quarter, primarily after the election. This is likely due to the belief that the regulatory environment could be relaxed. Part of the retreat was company specific as EXPO announced consultant headcount would be below expectations for the year. While guidance was reiterated, this slows expected revenue growth in 2025.

ANSYS, Inc. (ANSS)

ANSS is a market leader in selling computer-aided engineering (CAE) software that allows engineers to simulate how product designs will behave in real world environments before they are manufactured. Despite its pending acquisition by Synopsys (SNPS), the company’s stock reacted favorably to a surprisingly healthy quarter.

HEICO Corp. (HEI.A)

HEI is a commercial and military aircraft aftermarket parts company which designs, manufactures, repairs and distributes jet engine and aircraft component replacement parts. The company reported a mixed quarter with continued strength in its flight support group and softer results from its electronic technologies group. We remain highly convicted in this cash flow compounder that is levered to aerospace aftermarket.

Verisk Analytics, Inc. (VRSK)

Based in Jersey City, NJ, VRSK’s strong competitive positioning in the insurance data and analytical industry was displayed in its 3Q results. Organic revenue growth was 6.8% (led by subscription growth of 9.1%) and EBITDA growth was 9%. The company’s EBITDA margin was 55.2%. The company’s strong growth was driven by price realization and solid renewal trends. Management also had very positive commentary around the strength of its end markets and its bookings momentum.

Rollins, Inc. (ROL)

Based in Atlanta, GA, ROL’s 3Q24 results were mixed. The company continued to show above-average revenue growth of 9.1% but profitability was less than expected. The company decided to make some additional investments which reduced EBITDA margins. The company’s incremental investment was in the sales and marketing area, particularly building out the residential and commercial salesforces as well as incremental ad spending. While those investments position the company well over the long term, they lowered EBITDA margins in the quarter.

Click to enlarge

Source: FactSet

Mid Cap Composite – 4Q24 Buys*

Mid Cap Composite – 4Q24 Sells*

Old Dominion Freight Line, Inc. (ODFL)

Based in Thomasville, NC, Old Dominion is one of the country’s largest less-than-truckload (LTL) carriers, an industry which has high barriers to entry. The company generated industry leading profit margins because of the durable competitive advantages it has created over decades including a balanced network and superior service. The freight industry is coming off a two plus year volume recession and we anticipate ODFL will resume its historical cadence of share gains in the next freight upcycle.

Teleflex, Inc. (TFX)

Based in Wayne, PA, TFX reported a mixed quarter with its 3Q24 results. 3Q24 revenue slightly missed estimates but profitability was slightly better than expected. The company also lowered 2024 sales guidance. The main reason for the lowered sales guidance was the loss of an OEM customer who is bringing the manufacture of a component in- house and lower interventional urology (aka UroLift) which continues to have growth challenges. Over the last several years, TFX has struggled to achieve its long-term growth aspirations. Investors have not seen the benefits of a diversified medical products company.

Paylocity Holding Corp. (PCTY)

Based in Schaumburg, IL, Paylocity is a leading cloud HCM software provider serving 40,000+ small and mid-sized businesses. We initiated a position in Q4, attracted by its business model featuring consistent double-digit recurring revenue growth and retention rates in the mid-90s. The strategic Airbase acquisition expands spend management capabilities, while AI-enhanced workflows drive platform differentiation. With consistent margin expansion and a large, growing $20B+ addressable market, plus Conestoga’s firsthand experience (Conestoga uses PCTY for our own payroll processing), we see compelling long-term potential.

Click to enlarge

Conestoga added to positions on six occasions and had two trims during the fourth quarter.

*Portfolio holdings shown above experienced material activity during the quarter.

Source: FactSet, Conestoga. Sectors are defined according to the ICB industry definitions

The positions represent Conestoga Capital Advisors largest equity holdings based on the aggregate dollar value of positions held in the client accounts that are included in the Mid Cap Composite. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Sectors are defined according to the ICB industry definitions.

Source: FactSet, Conestoga. Sectors are defined according to the ICB industry definitions.

Mid Cap Composite – Top Ten Equity Holdings (as of 12/31/24)

Symbol

Company Name

Sector

% of Assets

CPRT

Copart, Inc.

Consumer Discretionary

4.96%

HEI.A

HEICO Corp.

Industrials

4.92%

VRSK

Verisk Analytics, Inc.

Industrials

4.91%

ROL

Rollins, Inc.

Consumer Discretionary

4.87%

TYL

Tyler Technologies, Inc.

Technology

4.74%

WCN

Waste Connections, Inc.

Utilities

4.63%

IT

Gartner, Inc.

Technology

4.13%

FTNT

Fortinet, Inc.

Technology

4.11%

ROP

Roper Technologies, Inc.

Technology

3.63%

WST

West Pharmaceutical Services, Inc.

Health Care

3.45%

Total within the Composite:

44.35%

Click to enlarge

The positions represent Conestoga Capital Advisors largest equity holdings based on the aggregate dollar value of positions held in the client accounts that are included in the Mid Cap Composite. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned. Sectors are defined according to the ICB industry definitions.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link