jxfzsy

Dear Partners,

While individual returns may differ based on their inception dates, consolidated performance of all accounts for the period ending September 30, 2024 is as follows:

Q3 2024

YTD 2024

2023

2022

ITD*

White Falcon (net of fees)

6.0%

8.5%

36.0%

-9.26%

32.0%

S&P 500 TR (CAD)

4.5%

24.1%

23.2%

-12.6%

41.6%

MSCI All Country TR (CAD)

4.9%

20.3%

18.5%

-11.9%

30.6%

S&P TSX TR

10.6%

17.3%

11.8%

-5.8%

25.3%

*Inception date is Nov 8, 2021

Click to enlarge

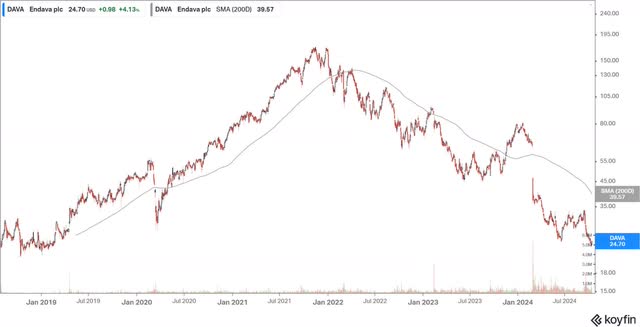

We had a good quarter, driven by precious metal royalty companies. From our experience, to truly outperform, an active portfolio generally needs a few standout winners. While many of our holdings have performed well this year, we haven’t had any major outliers like we did last year. On the other hand, several positions—Endava (DAVA), EPAM, Perrigo (PRGO), and Rentokil (RTO) —seem to be in various stages of forming a bottom and should have substantial upside from these levels. In addition, we currently hold several high-quality businesses that could be attractive acquisition targets, but M&A activity is largely on hold due to the current political climate and upcoming elections.

White Falcon’s mission remains to compound capital on a risk adjusted basis over the long term. We believe that even small advantages when compounded over time can lead to big differences in outcomes. We have continually emphasized that our performance will always look very different when compared to the popular indices as our portfolio looks very different when compared to the popular indices. These differences are especially enhanced over shorter periods of time. There are numerous reasons – sentiment, narratives, flows, factor rotations, among others – that affect the price of a stock over the very short term. However, in the long term, fundamentals rule. We believe we own good quality businesses at reasonable valuations and have full confidence in the portfolio.

“Bull-markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” – John Templeton

Although markets have been strong recently, we don’t see them as significantly overvalued at this point. It is encouraging to observe a broadening of the market, where stocks outside the biggest technology companies are starting to perform well. This is usually a positive sign and points to the health of the overall market. This rally appears to be driven by a mix of economic resilience and improving corporate earnings. As always, it is important to remember that markets will have their ups and downs. Macroeconomic factors such as inflation, interest rates, and geopolitical uncertainties can quickly change market sentiment.

Another key driver of this rally, in our view, is the devaluation of currency. The market’s rise is as much about the declining value of money as it is about economic growth and earnings. Equities, as real assets, can serve as a hedge against inflation and help preserve purchasing power.

However, if we measure the market using gold instead of the US or Canadian dollar, we see that, in gold terms, the markets are actually down this year. As you know, gold has served as money for millennia, and this year it has been one of the top-performing assets – up 31.4% YTD.

“Gold is money, everything else is credit” JP Morgan (1912)

As partners know, since the beginning of the mandate, we have had an allocation to gold in the form of precious metals royalty companies. Our rationale was that your capital is irreplaceable, and the portfolio needed a hedge to protect against macroeconomic uncertainties. Gold’s performance is especially noteworthy given that real interest rates – Fed fund rates adjusted for inflation – have been positive and relatively high. Despite the fact that investors can earn real returns by holding US dollars, many are still opting to buy gold, which not only provides no yield but also incurs storage and protection costs.

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Milton Friedman

We believe this rise in gold price is primarily driven by two factors, (a) persisting debt and deficits in the West, and (b) geopolitical tensions.

The U.S. is facing its highest levels of debt and deficits in history. Both major political parties, in their own ways, share a common desire to continue spending. Notably, in 2024, interest payments on U.S. debt surpassed defense spending for the first time. To be clear, the likelihood of a U.S. debt default is minimal, as the government issues its own currency. However, history tells us that increased government borrowing raises borrowing costs, crowds out private investment, reduces supply, and drives up prices, ultimately slowing growth. In the worst case, this could trigger a debt spiral, with borrowing and interest rates pushing each other higher. Gold may be snuffing out such a scenario.

This situation is further intensified by two hot wars and an active cold war. These conflicts not only demand ongoing spending but also polarize the world into competing blocs. Countries that once felt secure holding their reserves in U.S. dollars may now seek to diversify, with gold being a natural alternative.

Our understanding of financial history indicates that gold has been a benchmark of value since the beginning of money. Then, every so often, when a bubble bursts, gold serves as a standard against which currencies are devalued to manage debt.

Our gold and silver royalty companies have done well but remain inexpensive when compared to the new and current market price of gold and silver. We own these instead of an allocation to physical gold in the form of a gold ETF as these businesses can re-invest their earnings and compound capital. Unlike mining companies, they are high quality businesses that own royalties on a portfolio of mines, offering diversification and, importantly, option value. We discussed this opportunity in our Globe & Mail article on Franco-Nevada (FNV) earlier this year.

The top 5 holdings in the White Falcon portfolio are precious metals royalty basket, Endava, Amazon.com (AMZN), EPAM, and Converge (OTCQX:CTSDF).

We sold half of our position in NU Holdings (NU), which has been one of our highest IRR positions. We initiated a position in NU in the fall of 2022 at $4 per share and it is now trading at $14 per share. As has been communicated by us many times, good business and good managements tend to surprise to the upside. There is an option value in good quality businesses that mediocre businesses at cheap valuation just do not provide! That has been the case with NU where the actual business performance far exceeded our expectations. While we still believe NU has the potential to do well, the current risk-reward profile suggests that trimming our position might be a prudent move.

“The only way to make sense out of change is to plunge into it, move with it, and join the dance.” – Alan Watts

As we’ve discussed before, market structures have undergone significant changes over the past 10-15 years. Passive funds now account for nearly 50% of the market, and since these funds don’t consider valuations, they effectively follow a momentum strategy. So it is not surprising to observe that – either the market really likes a stock or really hates a stock – there is seldom an

in-between outcome. This dynamic is further amplified by hedge funds and other short-term investors who focus on near-term results. Our advantage lies in identifying opportunities overlooked by both of these market participants. In this environment, we truly believe that stock picking with a deep understanding of the fundamentals and a long-term perspective, is a competitive advantage.

“Whether we are buying stocks or socks, I like to buy quality merchandise when it is marked down” – Warren Buffett

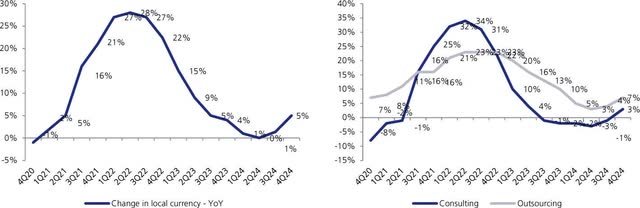

IT services companies – Endava and EPAM – have been the main detractors for our portfolio this year. Admittedly, we have been early. However, we have checked and rechecked our work and believe these businesses are nearing their bottom. In the appendix to this letter, we outline our investment thesis for Endava and explain why we think it deserves to be our top position in the portfolio. We believe Endava (and EPAM) present a compelling opportunity due to their (1) solid position in the growing IT services sector, particularly in digital transformation and AI implementation, (2) overall business quality and founder-led management teams, and (3) cheap valuation where we believe they are trading for a trough multiple of trough earnings. Despite recent revenue challenges, these businesses have maintained positive free cash flow. In fact, EPAM has been on the offensive and used its cash reserves to make four acquisitions in the last 12 months taking advantage of the weak IT spending environment. With improving IT spending and a strong management team Endava and EPAM are well-positioned for recovery and long-term growth.

We look forward to the upcoming earnings season as an opportunity to assess the performance of our portfolio companies and to gauge any developments that could impact their long-term value. Our focus remains on carefully managing risks to protect and grow your capital over time.

In closing, as we continue to grow and build long-term value for our partners, we would greatly appreciate any referrals of friends, family, or colleagues who may benefit from our approach to investing. Thank you for your continued partnership and support. Please feel free to get in touch with me at any time for any questions or feedback you may have.

With gratitude,

Balkar Sivia, CFA,

Founder and Portfolio Manager, White Falcon Capital Management Ltd.

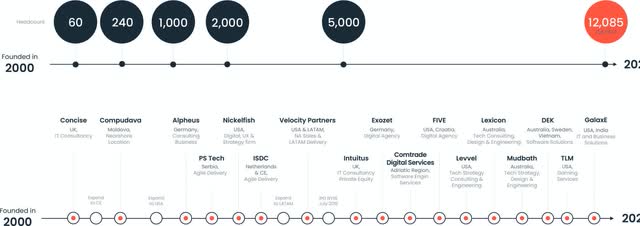

Endava PLC

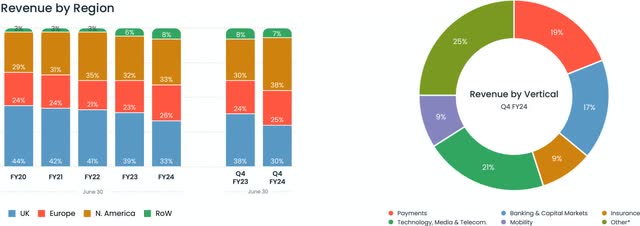

Endava plc (DAVA) is a London, UK based IT solutions company with $1.5 bn market capitalization and 12,085 employees who are hired on an outsourced basis as project developers and designers for digital transformation, AI implementation, and data modernization projects across verticals including payments, financial services, healthcare and media, among others. Between 2016 and 2023, DAVA achieved an average annual revenue growth of over 30%. However, for FY24, Endava’s revenues declined by 6.8%. This was primarily due to reduced IT spending, longer planning cycles (especially for AI projects), and a challenging macroeconomic environment. However, despite the downturn in spending, Endava has remained free cash flow positive and is currently trading at a trough multiple of trough earnings. White Falcon is long and believes that Endava is a good quality business operating in a secularly growing industry with substantial upside from these levels.

History and business mix:

6

Source: Endava Presentations Industry

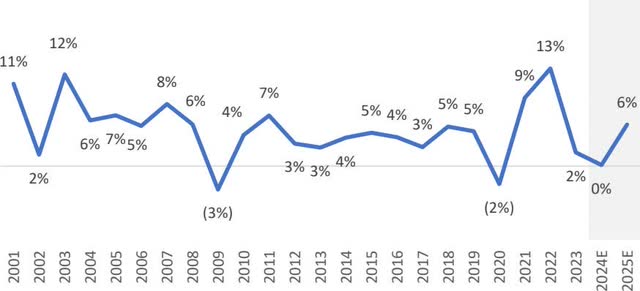

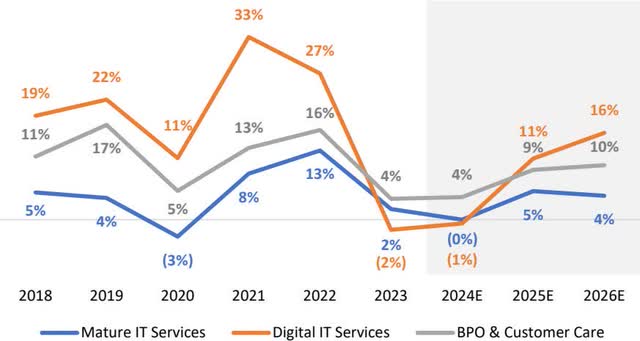

The IT services industry is a toll on global IT spending which itself is a function of global revenues – both of which have been trending up and to the right. Further, many businesses, unable to manage complex technological needs internally, increasingly rely on outsourcing. The industry has grown at mid-single digits for the last 20 years. While seemingly homogenous at first glance, the industry is filled with nuances that distinguish potential value traps from long-term compounders. IT spending, projected to reach $5 trillion in 2024, drives this sector, with software and IT services being the fastest-growing segments.

In the 1990s, companies outsourced basic functions such as infrastructure management and application development, often to Indian providers offering lower labor costs. Over time, Indian firms moved up the value chain, taking on more specialized tasks like software development and maintenance, while Western companies shifted focus to higher-margin services such as consulting and digital transformation. By the 2010s, digital transformation became the driving force behind IT services, leading to the emergence of new players like EPAM, Endava and Globant (GLOB), which specialized in end-to-end digital projects. Importantly, they offered near-shore capabilities vs. offshore capabilities so that complex projects could be delivered in a quality fashion. The rise in AI, cloud computing, and cybersecurity needs, has led corporations to allocate larger portions of their budgets to IT. In this evolving landscape, IT service providers are no longer seen merely as cost-cutting partners. Instead, they are recognized as key enablers of digital transformation, helping businesses navigate the complexities of modern technology.

The industry is very competitive with hundreds of firms competing for client business. The competitive landscape is shaped by several factors, including scale, cost, quality, relationships, expertise, and regional advantages. Indian IT firms continue to benefit from lower labor costs, but companies based in Eastern Europe or Latin America, such as Endava, offer superior quality, which can ultimately reduce overall project costs despite higher wages. These businesses have distinguished themselves by focusing exclusively on digital services, in contrast to legacy providers like Accenture and Infosys, which manage a dual portfolio of shrinking legacy businesses and growing digital operations. The downside of the business model is its cyclicality, as digital providers rely on discretionary projects, while legacy players benefit from more stable, annuity-like revenues due to their deep integration into client workflows. In addition to competing with each other, companies in the IT services industry also face competition from in-house IT departments. Interestingly, as technology gets more complex, the trend shows that the proportion of work being outsourced is steadily increasing every year.

Industry Growth:

IT Digitalgrowth:

Accenture is growing again:

Headcount growth: