tadamichi

In this article, we catch up on the latest quarterly results of the Golub Capital BDC (NASDAQ:GBDC). The company delivered a strong quarterly result with a 4.8% total NAV return. It trades at an 11.3% total dividend yield and a 3 discount to book. Its net income yield is 12.5% – in line with the sector median but, arguably, overstated due to the one-off incentive fee waiver.

We have maintained a Hold rating on the stock – our previous review is linked here. The valuation of the stock has improved since then, which makes it marginally more attractive.

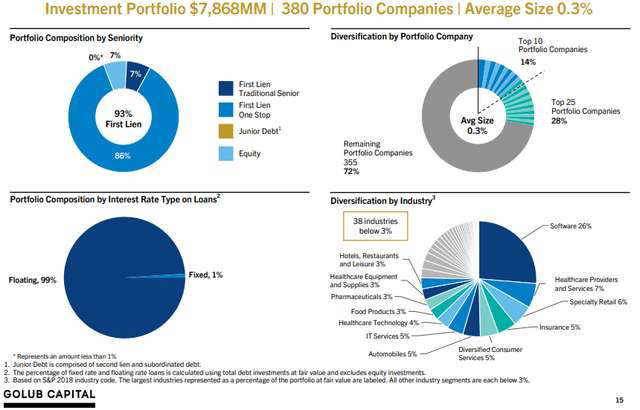

The company’s loan portfolio targets primarily floating-rate first-lien loans and is very well diversified with 380 positions – more than double the sector average. Top sectors include software and healthcare.

GBDC

Quarter Update

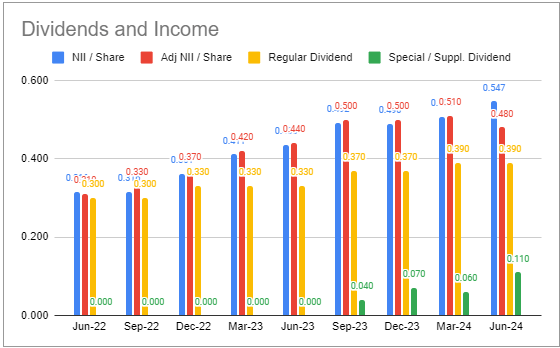

Adjusted net investment income came in at $0.48 – a 6% drop from the previous quarter, primarily from the drop in leverage. As we also highlight below, there was a one-off $0.07 boost to income as the company made a one-off incentive fee waiver due to two challenged investments. Absent the waiver, NII would have come in nearly 20% lower from the previous quarter.

Systematic Income BDC Tool

The company’s dividend structure is fairly complicated. It consists of a $0.39 base dividend, a supplemental of $0.05 as well as a merger-related special dividend of $0.05 (two remaining special dividends will be paid 13-Sep and 13-Dec).

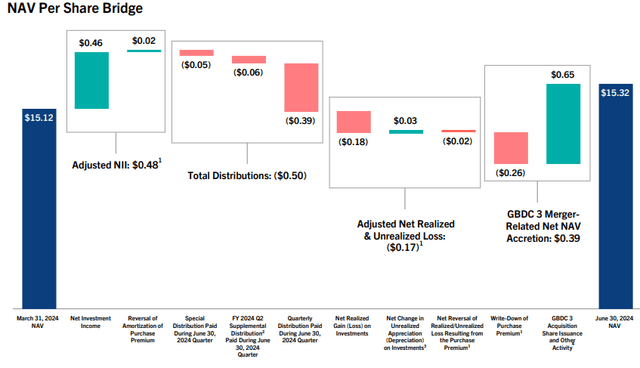

The NAV rose by 1.3%, however, 2.6% of that was due to merger-related accretion. In light of a couple of challenged investments (Pluralsight and Imperial Optical) GBDC also made a one-time discretionary incentive fee waiver which had a +$0.07 impact on net investment income. Altogether, these factors add up to a 3% positive uplift on the NAV. Absent these one-off factors, GBDC would have underperformed the median BDC in our coverage for the quarter.

GBDC

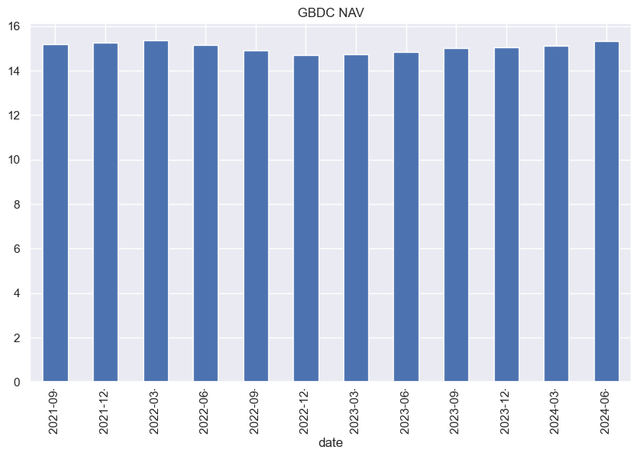

The NAV has risen for the sixth quarter in a row and has been stable over the last couple of years.

Systematic Income

Income Dynamics

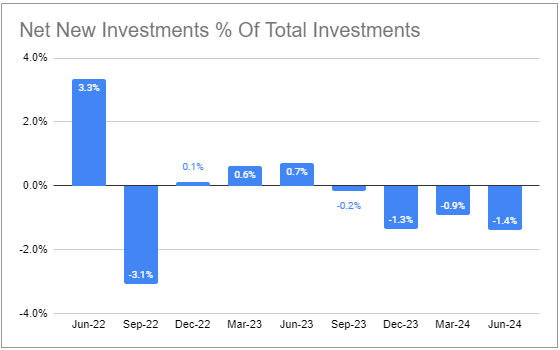

Net new investments were down on the quarter.

Systematic Income BDC Tool

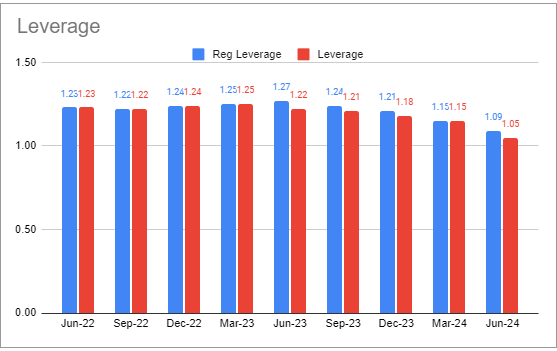

Leverage continued to fall – now standing below the sector average level.

Systematic Income BDC Tool

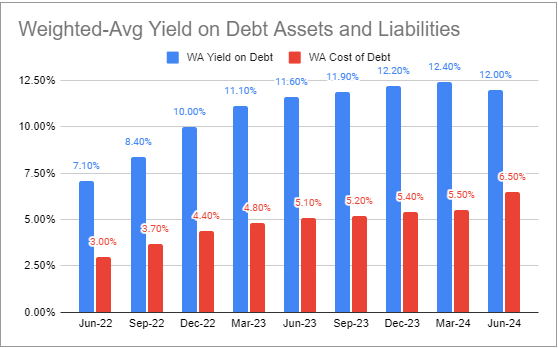

The weighted-average portfolio yield has been falling while interest expense has been rising, squeezing the yield spread. This is pretty much what we are seeing across the rest of the sector, particularly on the interest expense side.

Systematic Income BDC Tool

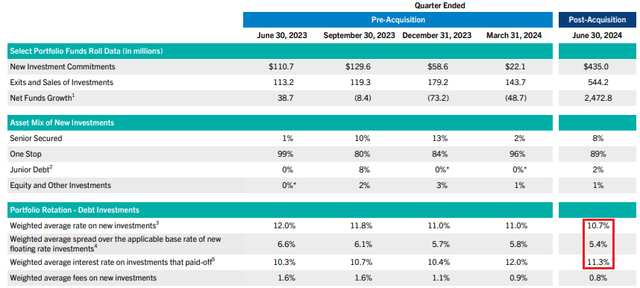

Part of the reason for the drop in portfolio yield was the fact that new investments are coming into the portfolio at a lower yield than repaid investments.

GBDC

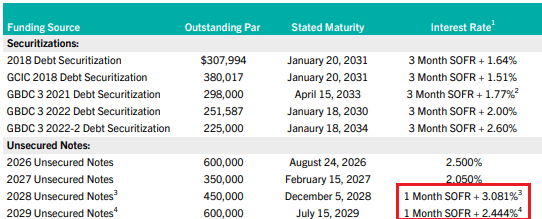

On the interest expense side, bonds that were issued in the post-COVID low interest rate period are coming due. For instance, in April, the company redeemed its 3.375% bond. Its most recently issued 2029 bond carries a swapped rate of SOFR + 2.444% or a coupon of around 7.74% at today’s SOFR. Its fixed coupon was 6% at issuance.

GBDC has been swapping its recently issued bonds – a trend we are seeing across the rest of the sector as well. The swaps have raised today’s level of interest expense due to the inverted yield curve, but the swapped bond interest expense will move lower alongside short-term rates. The swaps will only decrease the lifetime interest expense on the bonds if short-term rates fall more than what is currently priced in by the market. With the swaps, BDCs are either taking the view that short-term rates will fall more than expected, or they are willing to trade away today’s higher level of interest expense for tomorrow’s more stable net investment income (as floating-rate liabilities better match floating-rate assets).

GBDC

The merger with GBDC made permanent the incentive fee reduction to 15%, which is at the lower end of the BDC sector (incentive fees tend to range from 15-20%). All four components of the company’s fee structure are best in class – the management fee, incentive fees, the hurdle rate for the incentive fee and the total return lookback period. This, along with its occasional shareholder-friendly fee waivers, allows the company to generate a competitive level of net investment income while holding lower-yielding assets at a lower level of leverage. For example, the company’s weighted-average portfolio yield is 12% vs the 12.4% median and its leverage is 1.05x – slightly below the median level, however its trailing-twelve month NAV yield is 13.3% vs. the 12.7% median in our coverage.

Portfolio Quality

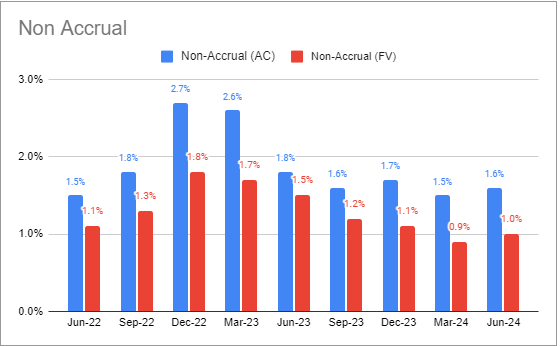

Non-accruals rose to 1% but remain below the median level of 1.4% in our coverage.

Systematic Income BDC Tool

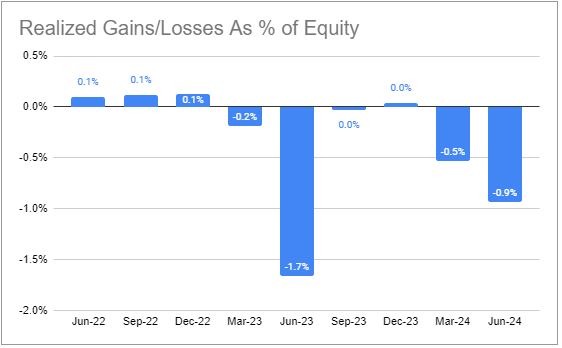

There was a sizable net realized loss. The cumulative net loss of 3% over the last 5 quarters bears watching.

Systematic Income BDC Tool

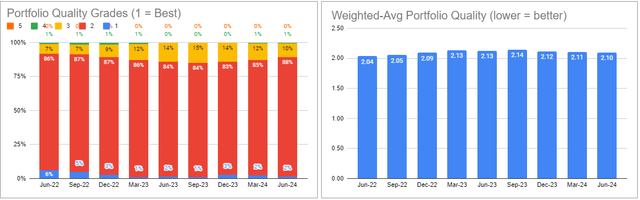

Portfolio quality as gauged by internal ratings improved slightly.

Systematic Income BDC Tool

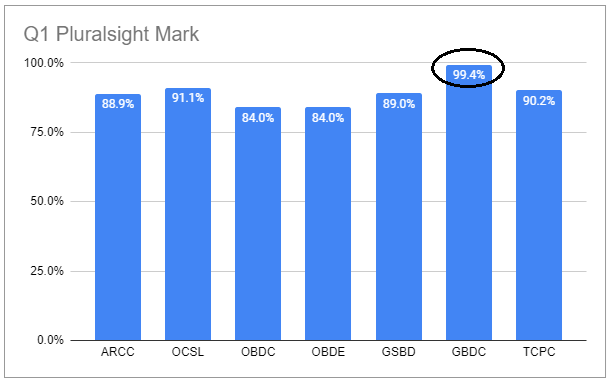

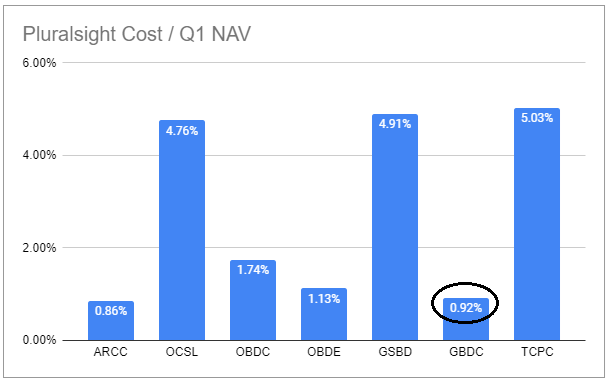

Pluralsight was one of the company’s challenged positions in the quarter. More interestingly, the size of the loan grew in Q2 by about 30%. It’s possible GBDC took over someone else’s position. GBDC had the most aggressive mark for the Pluralsight loan in Q1 – a level, which, frankly, puts its marking methodology in question and something to keep an eye on.

Systematic Income BDC Tool

Where GBDC gets points is in having a small allocation to the Pluralsight loan.

Systematic Income BDC Tool

Valuation And Return Profile

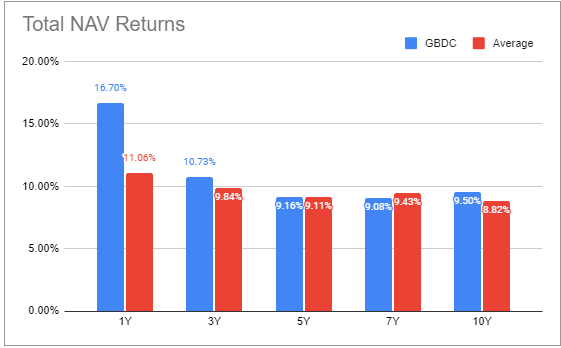

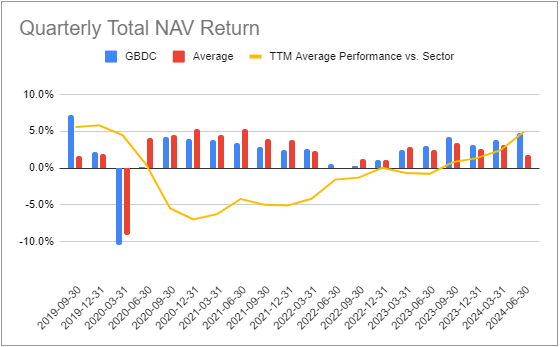

Overall, the company has been performing very well, particularly over the last 1-2 years.

Systematic Income BDC Tool

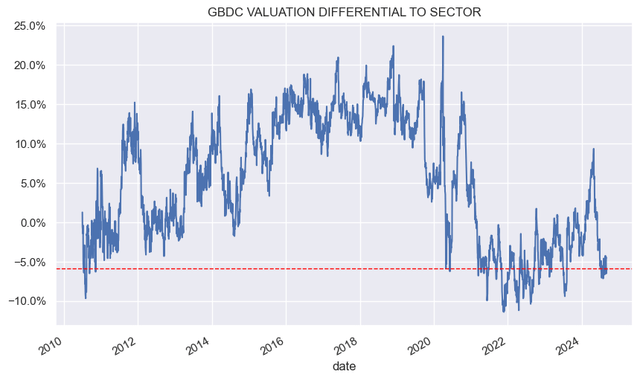

The underperforming streak came to an end around mid-2022.

Systematic Income BDC Tool

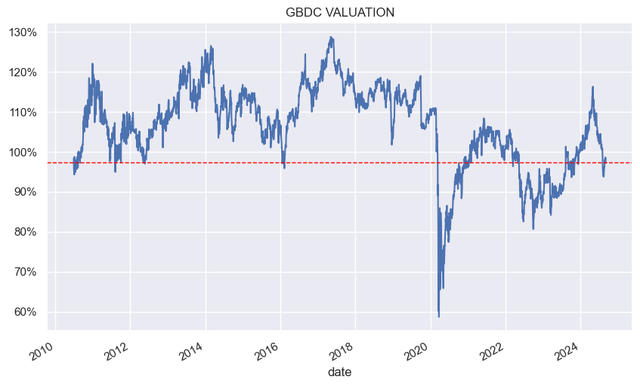

The company’s valuation has moved to a lower plateau after COVID. This may have been due to the rights offering which had bad return optics with the large NAV drop given the uplift from the exercise of the rights is not included in the NAV.

Systematic Income

The stock continues to trade at a discount to the average valuation in our coverage, though in line with the median BDC.

Systematic Income

Stance and Takeaways

Source link