tadamichi

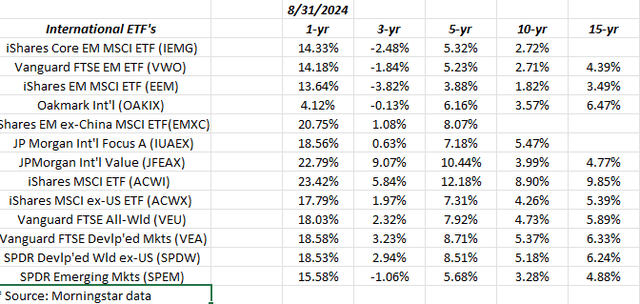

It’s a crude summary using an Excel spreadsheet, but this blog has been tracking the annual returns of the international funds and ETFs as the asset class looked more and more grim the last few years

That being said, international looks to be starting to stir.

As was noted in the Top 10 client holdings over the weekend, current longs are the Oakmark International Fund (OAKIX), which is being reduced, the Emerging Markets ex-China ETF (EMXC), the Vanguard FTSE Developed Markets ETF (VEA), and the JPMorgan Developed Int’l Value (JFEAX), of which a position is being built as of the last few weeks.

What caught my eye as the spreadsheet was updated was the 1-year returns on the pure international vehicles (i.e. no US holdings of any size) are starting to put up some healthy returns as are the non-China emerging markets (like the EMXC).

Comparing the EMXC return to both VEO and EEM, both of which are Vanguard international ETFs that mirror the China weight in the international benchmark, which is somewhere around 33%, and you’ll see that the emerging markets outside China are generating nice returns.

Watch how the US dollar responds to fed funds rate reductions. A weakening of the dollar will help the international equity and bond asset classes, bonds even more so since the dollar represents a bigger portion of the international fixed income return.

I’m sure it’s tiring listening to historical periods like the rotation into international after the growth stock and tech stocks popped in March 2000, but that’s exactly what happened. International was dead money for the 5 years from 1995-1999, as were commodities, and anything that wasn’t US, growth and tech, and then those asset classes came roaring back with a vengeance.

History may not mirror itself exactly, but investors should see a period where international outperforms, even US markets.

Look at the 10-year returns of the pure international mutual funds and ETFs (ACWI has a US component): don’t they seem pretty paltry relative to the SPY’s 10-year annual return of +12.88% and the QQQ’s +17.88%?

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve loss of principal, even for short periods of time.

Thanks for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

After analyzing the data on international funds and ETFs, it is clear that there is a shift in the market towards these assets. With improving returns and potential for growth, investors may want to consider diversifying their portfolios to include more international exposure. The recent performance of pure international vehicles without US holdings has been encouraging, showing healthy returns in comparison to other international benchmarks.

The importance of monitoring currency fluctuations, especially in response to fed funds rate changes, cannot be overstated. A weakening US dollar can have a positive impact on international equities and bonds, making them more attractive investment options. Looking at historical trends, there have been periods where international markets have outperformed US markets, signaling the potential for future growth in this asset class.

While past performance is not indicative of future results, it is essential for investors to consider the long-term outlook when making investment decisions. Diversification is key to managing risk and maximizing returns in a dynamic market environment. By staying informed and analyzing market trends, investors can position themselves for success in the ever-changing investment landscape.

For more news and updates on the latest trends in the world of finance, be sure to check out DeFi Daily News for insightful articles and analysis.

In conclusion, the international investment landscape is showing signs of potential growth and opportunity. By diversifying portfolios and staying informed about market trends, investors can navigate the global market with confidence and adaptability. Remember, the key to successful investing is to always stay ahead of the curve and be prepared for whatever the market may bring.