In a world where digital currencies are rapidly gaining traction, XRP has recently been the center of attention, trading at $0.55. This comes after weeks of speculation and excitement, where investors harbored high hopes for a significant price increase. Nonetheless, the cryptocurrency market is notorious for its volatility, dominated by fear and uncertainty. This climate has led Bitcoin, along with most altcoins, including XRP, to trade at lower levels, thus tarnishing investor confidence broadly.

Related Reading

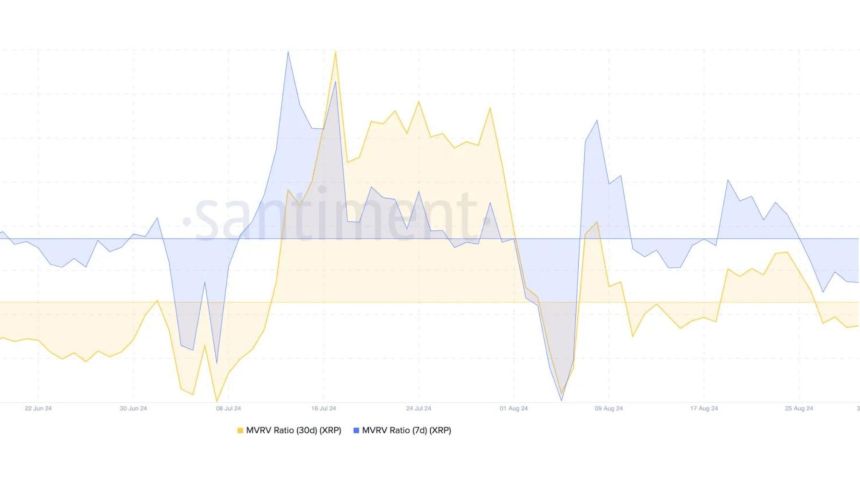

An analysis of pivotal data from Santiment indicates a shift in the perspective of XRP holders. The enhancement of optimism that previously fueled confidence among investors seems to be diminishing. A growing number are now confronted with unrealized losses, marking a significant change in sentiment. This change points to the escalating apprehensions concerning the future of XRP, especially when viewed in the light of overall market adversities.

XRP Holders Facing Unrealized Losses

Compared to its counterparts among altcoins, XRP has shown relative resilience. However, having dropped 13% from its high on August 24 of $0.631, it has nonetheless plunged investors into considerable distress—mirroring the wider market’s uncertainty.

Santiment’s detailed data analysis highlights that the 30-day and 7-day Market Value to Realized Value (MVRV) ratios for XRP have dipped into the negative. A negative MVRV ratio suggests under-valuation, implying that, on average, selling all coins at the current price would result in a loss for most traders.

This significant shift in MVRV ratios indicates most XRP holders are now at risk of realizing negative returns on their investments. This reflects a broader climate of investor caution, amplified by ongoing market volatility. Despite XRP performing relatively better than many altcoins, the negative MVRV ratios highlight increasing investor concern.

Related Reading

The decline in MVRV ratios acts as a critical barometer of market sentiment, implying the waning optimism around XRP. Investors show growing apprehension towards further potential declines, which could steepen losses. Although XRP has maintained resilience, the prevailing market conditions and negative MVRV ratios suggest exercising caution. The forthcoming days will undoubtedly be pivotal for XRP holders as they confront this tumultuous market landscape, deliberating over the risks and benefits of retaining or liquidating their stakes.

$0.55 Key Support Must Hold For Consolidation

XRP is presently trading at $0.559, marginally above a critical support threshold—the daily 200 moving average (MA) which stands at $0.5509. This juncture is vital for sustaining bullish momentum and has served as robust support, echoing the hopes of investors looking forward to a price recovery.

Should the price sustain above this MA, it could herald a continuation of the upward trajectory, offering solace to the bulls. Conversely, a breach below this pivotal indicator might provoke a further downturn, driving prices towards lower demand zones.

Related Reading

The subsequent significant support level to monitor lies around $0.48, a crucial juncture for the bulls to uphold. Maintaining a position above the 200 MA is imperative for preserving a positive outlook, whereas a decline beneath could signify mounting selling pressure. As XRP treads through this critical phase, market participants are vigilantly observing these thresholds to discern the market’s forthcoming trajectory.

Featured image from Dall-E, chart from TradingView

As we pivot to the conclusion of this in-depth analysis of XRP’s current market standing, it’s clear that the landscape of digital currency is forever evolving. The forthcoming period holds the key to whether XRP will weather the storm or capitulate under the pressure of the relentless market forces. While the world of finance is mired in unpredictability, one thing remains certain: the digital currency ecosystem continues to provide a roller coaster of challenges and opportunities for the savvy investor.

For those seeking to stay abreast of the ever-changing world of decentralized finance and cryptocurrencies, make sure to follow DeFi Daily News for more trending news articles like this.