The digital currency sphere is always a whirlwind of activity, with prices fluctuating in response to myriad factors including market sentiment, technological developments, and significant moves by whale investors. One such cryptocurrency, Solana (SOL), is currently at the center of attention due to predictions of a potential decline in its value to the $80 mark. This speculation has been sparked by a recent analysis on August 31, 2024, from the on-chain analytic firm Lookonchain, which shared via a post on X (formerly known as Twitter) about a substantial transaction involving 139,532 SOL, valued at approximately $19.5 million, being transferred to Binance at a significant loss.

Impact of Solana Whale’s 140K SOL Move

Details from the X post revealed that the whale wallet, identified by its address “FkVrB,” had unstaked and subsequently shifted 139,532 SOL to Binance. This transaction took place two days before Lookonchain’s disclosure. It was deduced that “FkVrB” acquired this substantial amount of SOL when its price hovered around the $180 mark back in July 2024, presumably in the optimistic anticipation of the United States approving a Solana Exchange Traded Fund (ETF).

Since that pivotal moment, the price of SOL has failed to revisit the $180 threshold, adopting a bearish stance in the market instead. This shift in market sentiment reflects the volatile and uncertain nature of cryptocurrency investments, where significant investments can either lead to substantial gains or losses, depending on market movements and investor decisions.

Analysts Weigh In: The Future of Solana’s Price

Expert technical analysis suggests that Solana’s value is currently perched at a critical support level of $127. Further indicating a downtrend, SOL is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe. This technical metric is often used by investors to gauge the market’s direction over a medium-term horizon.

Historically, whenever SOL’s price touches the support level of $127, it often triggers a significant rally, shooting the prices up. In this context, there’s speculation that Solana might experience a 40% surge, potentially reaching the $180 level once again. However, should SOL fail to maintain its stance above the $120 support level, closing a daily candle below it, predictions suggest it’s likely to fall towards the $80 support level, potentially marking a significant drop in its market value.

A Closer Look: SOL’s Bearish On-chain Metrics

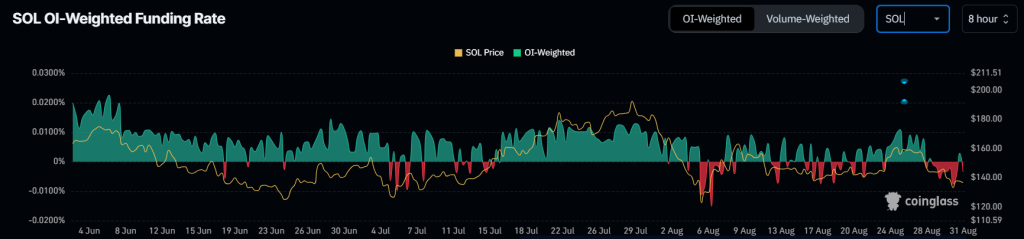

The current speculative atmosphere is further intensified by the bearish signals emanating from SOL’s on-chain metrics. Today’s SOL OI-weighted funding rate is indicative of a dominant bearish sentiment among traders, potentially signifying a downward price trend in the near term. This situation is particularly notable when considering the broader context of cryptocurrency trading, where funding rates and other on-chain metrics can offer valuable insights into market sentiment and future price movements.

Moreover, the data from CoinGlass sheds light on the precarious positions of traders, with major liquidation levels lurking near the $133.3 and $139 markers. This situation indicates a level of over-leverage among traders at these points, highlighting the highly speculative and volatile nature of cryptocurrency investments, where significant fluctuations can lead to substantial liquidations.

The Current Landscape: Solana’s Market Performance

As the discussion unfolds, SOL is being traded around the $135 mark, experiencing a slight increase over the last 24 hours. This modest uptick contrasts with a 2% decline in open interest during the same timeframe, pointing towards a decreasing trading interest amid the ongoing market downturn. This observation could infer a cautious approach by traders, possibly awaiting clearer signals before making further investments.

In the grand theatre of cryptocurrency markets, Solana’s recent narrative encapsulates the high drama and suspense that investors and spectators have come to expect. From the highs and lows of whale movements to the analytical endeavors aimed at predicting future price actions, the story of Solana is a testament to the dynamic and unpredictable nature of digital assets. Whether SOL will indeed plummet to the $80 mark or chart a different course remains an unfolding chapter in the saga of cryptocurrencies. For those keen on staying updated with the pulse of the decentralized finance (DeFi) world and cryptocurrencies, maintaining a close watch on platforms like DeFi Daily News will provide not just insights but perhaps a front-row seat to the thrilling ride that is cryptocurrency investment. As the future of Solana dangles on the precipice of market sentiment and on-chain metrics, the community watches with bated breath, ready for the next twist in the tale.

Source link

:max_bytes(150000):strip_icc()/Health-GettyImages-1450980806-fba78847365a48d8885925ecef03ab51.jpg?w=120&resize=120,86&ssl=1)