rewrite this content using a minimum of 1000 words and keep HTML tags

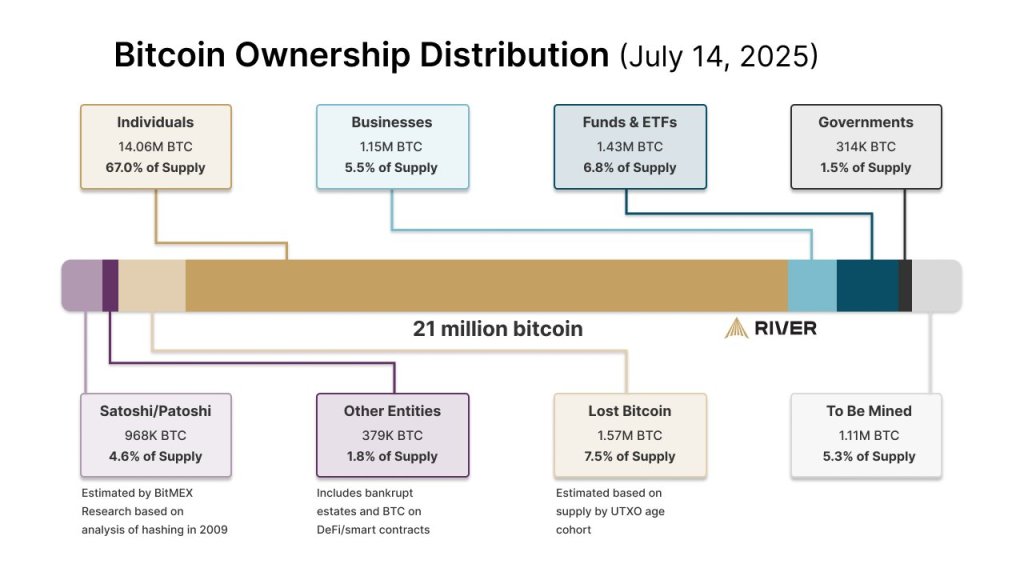

Financial services firm River has published a “Bitcoin Ownership Distribution” snapshot dated July 14, 2025, illustrating how the 21 million bitcoin supply is allocated across distinct holder classes. River accompanied the graphic with the statement: “The people had 15 years to front-run Wall Street on Bitcoin. Now big business is starting to catch on, but they’ll have to pay up to get their share.” Analyst TFTC added: “67% of Bitcoin is still owned by individuals. Wall Street, governments, and corporations? Just 13.8%.”

Who Really Owns Bitcoin?

According to River’s visualization, individual holders remain the dominant base, controlling 14.06 million BTC, or 67.0% of total supply. Institutional and state-linked ownership is far smaller in aggregate: businesses hold 1.15 million BTC (5.5%), funds and exchange-traded funds control 1.43 million BTC (6.8%), and governments account for 314,000 BTC (1.5%), for a combined 13.8% across those “Wall Street, governments, and corporations” categories.

The chart disaggregates several additional buckets. A “Satoshi/Patoshi” tranche of 968,000 BTC—4.6% of supply—is attributed to early mining activity (“estimated by BitMEX Research based on analysis of hashing in 2009”). “Other Entities” comprise 379,000 BTC (1.8%), a classification that includes bankrupt estates and BTC locked in DeFi/smart contracts. River also identifies 1.57 million BTC (7.5%) as “Lost Bitcoin,” an estimate based on UTXO age cohorts, and 1.11 million BTC (5.3%) “To Be Mined,” representing the unissued portion of Bitcoin’s fixed cap.

Each percentage in the image sums to a complete distribution across current holders, lost coins, and the remaining unmined issuance. By separating lost supply, unmined coins and the early Satoshi/Patoshi cluster from active market participants, the data emphasize the scarcity available for new institutional accumulation and underpin River’s framing that “big business” must “pay up” to acquire meaningful exposure.

Recent market structure reinforces that message. Corporate and fund participation has accelerated in 2025, with new “Bitcoin treasury” vehicles, US spot exchange-traded products and specialist firms emerging to intermediate balance-sheet allocations.

Government participation, although a small slice in River’s methodology (314,000 BTC), is led by the United States and other jurisdictions holding or managing seized or strategically acquired coins. Independent trackers such as Bitbo/Arkham list the largest national holdings as the United States (about 198,000 BTC), China (roughly 194,000 BTC), the United Kingdom (around 61,000 BTC), Ukraine (about 46,000 BTC) and Bhutan (just over 11,000 BTC).

Differences between River’s aggregate government figure and higher third-party tallies reflect divergent classification methods—some datasets include broader seized balances or additional addresses not counted in River’s narrower “governments” bucket. River thinks that the Chinese government only holds 15,000 BTC that was recovered from the Plustoken scam in 2019.

At press time, BTC traded at $116,451.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link