rewrite this content using a minimum of 1200 words and keep HTML tags

The relentless rally in Treasury yields and the US dollar is giving stock investors pause. Merck has a fundamental and technical development.

Friday’s TLDR

Rising yields are worth watching

So is a rising dollar

Breaking down Merck stock

The Bottom Line + Daily Breakdown

We rode through 2024 with a few mild corrections in the stock market, but ended with impressive gains. Bitcoin had its ups and downs too, but capped the year with a massive rally, topping $100,000 for the first time.

With so much momentum going into December, why then have risk assets like stocks and crypto been wavering lately?

Earlier this week, I mentioned the rising US dollar and rising Treasury yields, which are acting as headwinds for stocks.

Now, it’s worth pointing out that these correlations do not necessarily (or always) move in lockstep. Stocks can rally while yields and/or the dollar are moving higher. In fact, risk assets have moved higher since both yields and the dollar bottomed in September. But when the dollar and yields are rising — particularly when they are rising in a somewhat relentless manner and doing so together — it can weigh on risk assets.

The Dollar

A rising dollar squeezes the profits for multinational companies. Think of US companies that do business in other countries. The sales they generate in local currencies (like euro) are now worth less when they convert them to dollars. This weighs on earnings, which is a major factor in whether stocks go up or down.

The US Dollar can be followed here on eToro. Notice how it’s up almost 10% from the lows in September — that’s a big move for the dollar.

There are positives to a higher dollar, too. Traveling abroad is cheaper, while import prices are also lower. On the flip side though, traveling to the United States becomes more expensive for foreign tourists. There are a lot of moving parts with currencies.

Treasury Yields

When we look at rising yields, Treasuries are competing with stocks and are often considered “risk free” from a principal standpoint. When the yield of these so-called “risk-free” assets increases, it makes them more attractive vs. other assets, like stocks.

Right now, the steady move higher in yields is creating some pause for stock investors.

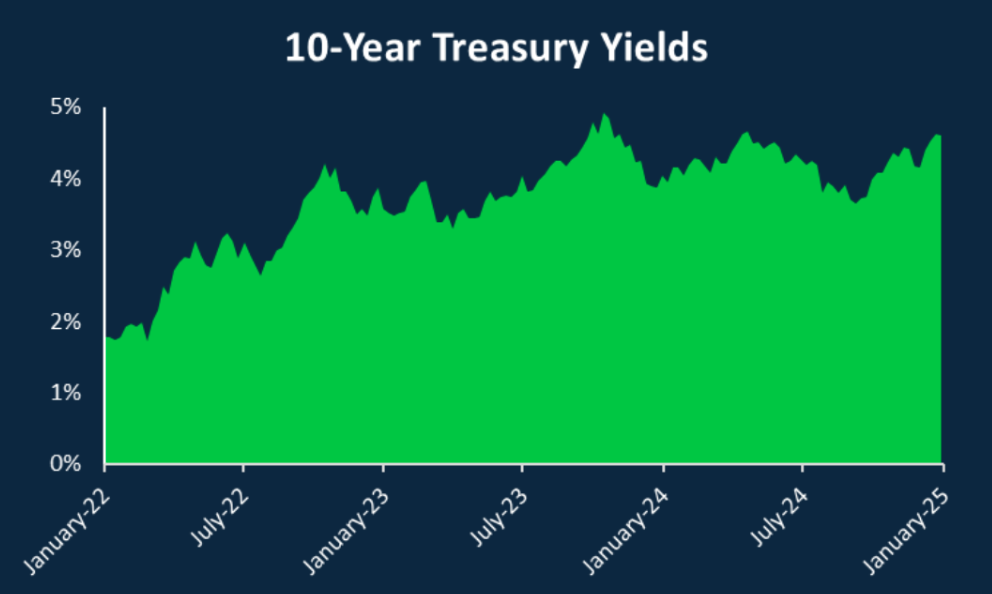

Yields began rising in mid-September — ironically right around when the Fed first cut rates — and at this week’s high, the 10-year Treasury yield was up a whopping 30.9% from the September lows when it was trading around 3.6%.

After clearing the 4.5% mark, there’s a growing worry that the 10-year will shoot back up to 5% like it did in October 2023. Yields topped around that mark — and that’s also when stocks bottomed amid an ~11% pullback in the S&P 500.

That’s not a prediction for the current situation, but just adds some context to the current environment.

The Bottom Line

Investors have to remember that risk-assets don’t go up in a straight line. Deep down, investors know this, but this reality can get lost in the shuffle once our emotions get involved and we start to see some red ink in our portfolios.

If the dollar and yields continue to rise, it increases the odds that these become larger headwinds and put more pressure on risk assets. On the flip side, yields and the dollar are not the end-all, be-all for stocks, and should they move lower, it could benefit stocks and crypto.

Want to receive these insights straight to your inbox?

Sign up here

The setup — Merck

Merck is a name that’s become interesting when we combine the fundamentals and technicals together.

Specifically, the stock is breaking out over downtrend resistance on the daily chart and is near an area on the weekly chart that’s generally been support. On the fundamental side, the stock is trading near a historical trough when we look at the price-to-earnings and price-to-free-cash-flow valuations. Lastly, analysts expect Merck to generate earnings and free cash flow growth in excess of 20% in 2025.

(I wrote a deep-dive on Merck earlier this week, for those interested).

Above is the daily chart, highlighting the recent breakout in MRK shares. If the stock is able to keep this breakout intact, more bullish momentum could be on the way.

However, active investors who want to keep a tight risk profile can consider using a stop-loss below the recent low near $94 in an attempt to contain their losses. Remember, stocks can always gap down below your expected stop-loss.

Options

For some investors, options could be one alternative to speculate on MRK. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and MRK rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link