rewrite this content using a minimum of 1000 words and keep HTML tags

FORM jumped more than +30% in the past day as leverage poured in, with traders calling the move a short squeeze.

The rally began late Sunday and carried into Monday. Prices on major exchanges swung from around $0.91 to as high as $1.47 before settling in the mid-$1.30s at press time.

(Source: Coingecko)

Why Did FORM Crypto Surge Over 40% in 24 Hours?

Binance and Bybit each recorded hundreds of millions of dollars in 24-hour volume.

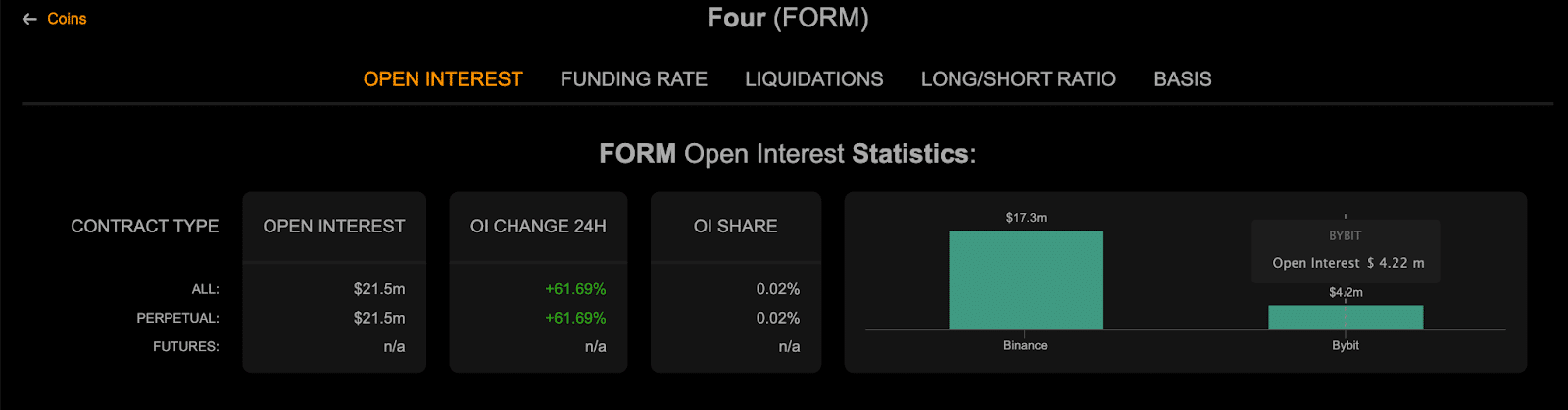

Derivatives data from Coinalyze showed that funding turned positive and that open interest had nearly doubled to $26M, a sign that traders had piled into long positions.

Funding rates hovered near +0.01% per eight hours, adding weight to the view that aggressive longs fueled the rally.

(Source: Coinalyze)

The token is the native asset of Four, a BNB Chain project that combines GameFi, an Initial Game Offering (IGO) launchpad, and meme-token tools. Formerly BinaryX (BNX), the project rebranded to Four earlier this year, with Binance handling the BNX→FORM swap in March.

FORM’s sharp swing followed a fresh all-time low near $0.91, highlighting how thin liquidity can drive large moves.

A post on Binance Square described Monday’s rally as “+44% from lows” and flagged key short-term levels for bulls to hold.

The move fits the squeeze pattern, where shorts are forced to exit as the price increases, adding to the momentum.

The rebound also reflects FORM’s volatile history since its token swap. With liquidity still patchy, the token remains prone to sharp two-way moves, leaving open whether Monday’s surge marks the start of a trend or just another squeeze.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

FORM Price Prediction: Is FORM Setting Up for a Strong Pump After Weeks of Decline?

FORM, the token behind a wave of fresh market speculation, shows signs of a possible breakout after forming what some traders call a “short squeeze” setup.

The signal came from Tryrex, a widely followed crypto analyst, who flipped from bearish to bullish once price action confirmed his reversal plan.

🟩🟩 FORM LONG TRADE 🟩🟩$FORM had this confirmation candle for a potential short squeeze. Typical textbook short squeeze pattern.

That means price is potentially getting ready for a very strong pump that will liquidate all late shorts.

We were short on this one, reached… pic.twitter.com/cWaMXdTLBy

— Tryrex (@Tryrexcrypto) September 28, 2025

In his update, Tryrex highlighted FORM’s recovery from late-September lows near $1.00 and a move back above $1.14, which he marked as a new long entry.

His trade outline sets a stop-loss at $1.0383 and a profit target near $2.29, with room to adjust if the market rallies quicker than expected.

“Price is potentially getting ready for a very strong pump that will liquidate all late shorts,” he wrote, pointing to a confirmation candle that matches common squeeze structures.

His 8-hour chart shows a steep September drop, now followed by the first meaningful bounce.

(Source: X)

A green profit zone and red risk box frame the trade, underscoring a risk-reward setup tilted toward buyers.

Market signals back the thesis. FORM rebounded more than +5% in a single session, with liquidations clearing overleveraged shorts. The plan uses 10x leverage, magnifying both risk and reward.

Traders now watch whether FORM can hold above $1.14 and push toward $2.29, or if resistance cuts the move short.

The next sessions may decide if this rally is the start of a squeeze breakout or just another false start.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link