rewrite this content using a minimum of 1000 words and keep HTML tags

Georgia-based Atlanticus is a financial technology company that helps banks offer lines of credit to mostly subprime consumers. The company is not a lender itself, but it services a relatively small portfolio of credit cards, plus a financing option for medical expenses. Those products include the following:

Many of these cards are poor options even for those with less-than-ideal credit, so we’ve included a superior alternative for each one.

Aspire credit card

The Aspire credit card is issued by The Bank of Missouri. You don’t need excellent credit, or a security deposit, to get it, but you’ll pay dearly for that accessibility.

First, the Aspire card has an annual fee of up to $175 in the first year, then up to $49 after that. On top of the annual fee, you’ll be charged a monthly account maintenance fee ranging from $5 to $15 per month.

If you want to add an authorized user to the account, that’ll cost you $19. (Plenty of credit cards don’t have monthly fees or authorized user fees.)

This card requires a security deposit, but you can choose the amount. Unlike the Aspire card, though, it doesn’t charge outrageous fees or interest.

Fortiva credit card

As of April 2025, the Fortiva card has the same annual, monthly and authorized user fees as the Aspire — up to $175 for the first year, $49 annually after that, and up to $15 per month for account maintenance.

It, too, is issued by The Bank of Missouri.

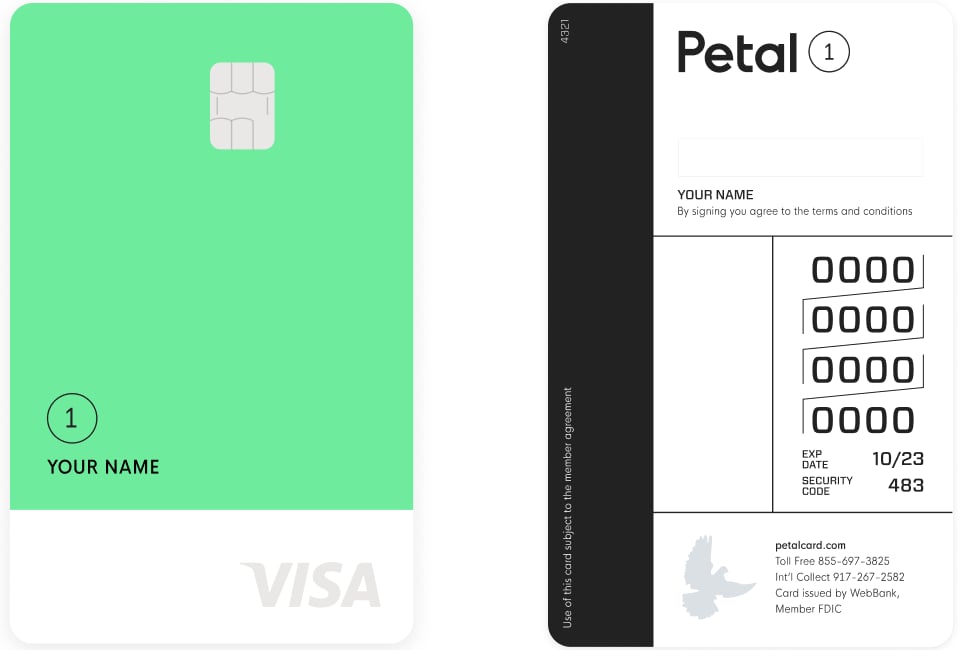

The Petal 1 card doesn’t charge an annual fee, foreign transaction fee or penalty APR if you submit a late payment.

The card also earns up to 10% cash back at select merchants.

🤓Nerdy Tip

There are cash-back versions of the Aspire and Fortiva cards for applicants who qualify. While these cards earn rewards, they also have pricey fees and high APRs, which can easily cancel out the value of those rewards.

Imagine® Visa® Credit Card

Not all is what it seems when it comes to the Imagine® Visa® Credit Card. Issued by WebBank, it doesn’t require a security deposit, but it has an annual fee, which it describes this way: As low as $99. That’s not the whole story, however, because fee amounts differ depending on the credit limit you qualify for.

The annual fee could be that low — but it could also run as high as $175 in the first year, then up to $49 thereafter. There’s also a $15 monthly fee that kicks in after the first year. And while the card doesn’t have a penalty APR, its normal interest rate is plenty high: The ongoing APR is 36.00% Fixed APR.

The card does earn up to 3% cash back in specific bonus categories. However, you’ll have to wait a full year to get those rewards, which are redeemed automatically as a statement credit.

In short, the benefits don’t do much to justify the card’s expensive fees.

For starters, the annual fee for this card is $0. No “monthly fees” either. There is a security deposit requirement, but don’t let it scare you away. Some applicants can qualify for a $200 credit limit with just a $49 or $99 deposit, depending on various factors. Capital One also lets you pay the deposit in $20 installments within 35 days of account opening. When you close the account in good standing, you’ll get the full security deposit back.

Cardholders may also receive a credit limit increase after six months of responsible use.

Curae line of credit

Not quite a credit card, Curae is more akin to a personal loan for medical expenses. Credit limits range from $2,000 to $10,000, while payment terms run from 24 to 60 months. Interest rates can be as low as 0%; however, depending on creditworthiness, rates can also be as high as 29.99% (as of this writing). There are no monthly or annual fees associated with Curae.

If you qualify for a high credit limit and 0% interest rate, then Curae could certainly be a viable option for financing medical debt. But if you receive less-than-favorable terms, you may want to explore alternatives.

Upgrade accepts credit scores as low as 580. A lower score will likely get you a higher interest rate, but Upgrade offers multiple opportunities to lower your rate. The maximum loan amount is $50,000 — much more than Curae’s top limit — which may be necessary for more expensive medical treatments.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link

:max_bytes(150000):strip_icc()/Health-GettyImages-1342542279-393944dceb304a049f93d6976e7bf192.jpg?w=120&resize=120,86&ssl=1)