Understanding the pulse of the Bitcoin market requires a multifaceted approach, and one of the most compelling perspectives comes from examining the activities and sentiments of Bitcoin miners. The actions and earnings of these critical network participants offer invaluable insights into the potential direction of Bitcoin’s price. In this deep dive, we’ll navigate through the recent trends influencing Bitcoin mining, how miners are adapting to the evolving market conditions, and what the tea leaves of various key indicators might be telling us about the future positioning of Bitcoin miners in the weeks and months ahead.

Miners play a pivotal role in the Bitcoin ecosystem, not just in transaction validation and network security, but also as forecasters of market health and direction. Our journey starts with understanding how miner earnings, especially in the current climate, paint a picture of the underlying market sentiment.

A Look into Miner Earnings

The financial well-being of Bitcoin miners is often a mirror reflecting broader market dynamics. Analyzing miners’ earnings through historical comparisons offers a window into their current sentiment. The Puell Multiple, which juxtaposes current miner earnings against the annual average of the preceding year, works as an excellent tool in this regard.

With the latest data placing the Puell Multiple around 0.8, it reveals that miners are making 80% of what they used to earn on average the previous year. This is a significant step up from moments in the recent past when the multiple dipped to 0.53, suggesting miners were pocketing barely over half of their last year’s average income.

This early year plummet undoubtedly strapped many miners for cash. Yet, the recent recovery of the Puell Multiple suggests a brighter horizon may be looming for these Bitcoin stewards.

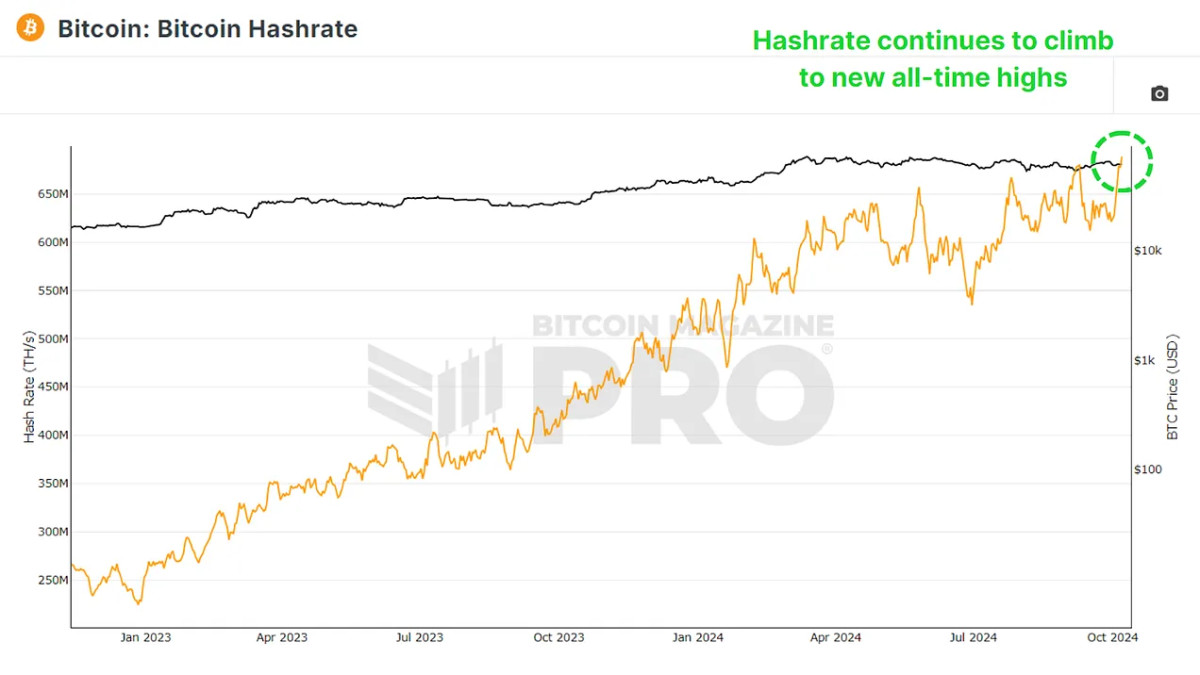

Network Health: Hashrate and Growth Dynamics

Despite the dip in earnings, Bitcoin’s mining landscape doesn’t show signs of a significant exodus. On the contrary, the network’s hashrate—a measure of the total computational effort pouring into Bitcoin mining—has been on an upward trajectory. This increased hashrate points towards either an influx of new miners or existing players beefing up their operations, both being bullish signs for network security and competitive block reward mining.

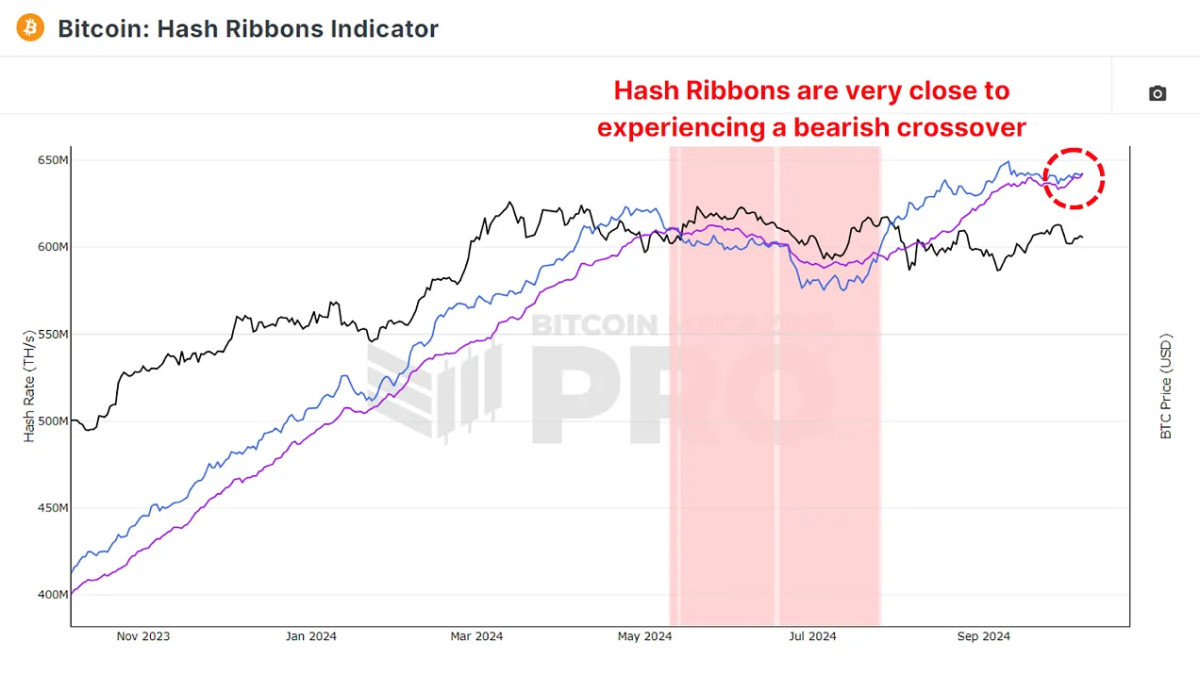

However, a cautious examination of the Hash Ribbons Indicator, which analyzes the 30-day and 60-day moving average of Bitcoin’s hashrate, hints at potential turbulence. The narrowing gap between these averages might soon signal a bearish phase—a historical precursor to miner capitulation, where financial struggles force miners to halt operations.

Yet, without a confirmed bearish crossover, the immediate outlook remains cautiously optimistic. It’s worth noting that historically, such capitulation phases are often followed by a market accumulation phase, setting the stage for subsequent price rallies.

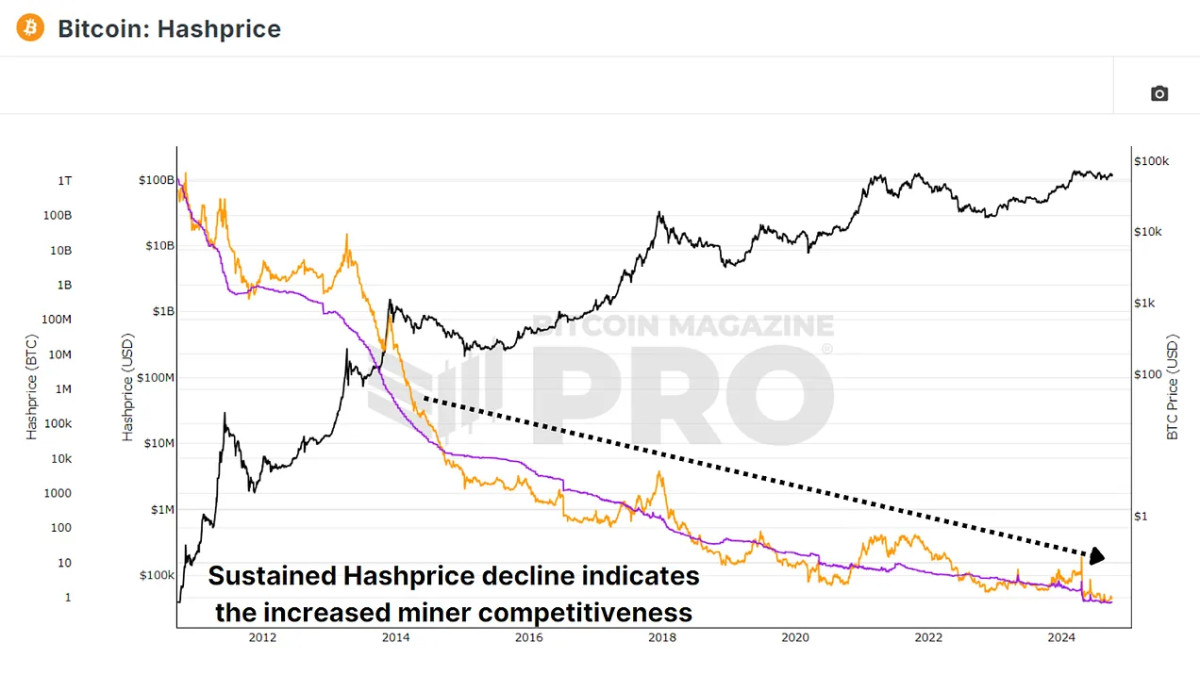

The Mining Revenue Puzzle: Hashprice Insights

While much discussion revolves around Bitcoin’s price in relation to miner earnings, another critical metric to consider is the Hashprice. This measure reflects the earnings in BTC or USD that miners receive for each terahash of computational power contributed to the network. Currently standing at around 0.73 BTC per terahash, or approximately $45,000, miner revenue has seen a decline following the recent Bitcoin halving, which slashed block rewards by half.

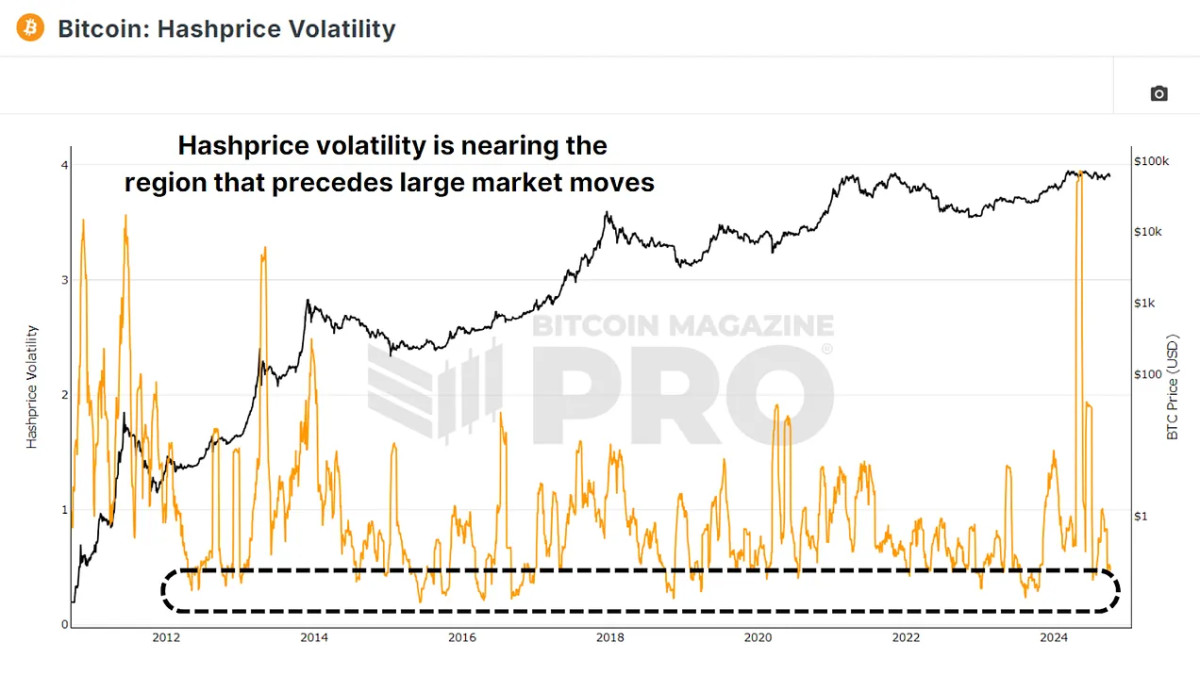

Despite reduced profitability, the uptick in hashrate suggests a strong belief among miners in the long-term value appreciation of Bitcoin. Another intriguing pointer to future market movements is Hashprice Volatility. Historically, low volatility periods in miner earnings typically precede significant Bitcoin price trends; and current data indicates a downswing in volatility, hinting at a possibly looming, volatile market phase.

Concluding Thoughts

In summary, Bitcoin mining data paints a nuanced picture of the blockchain’s economic environment. Despite the dreary shadow cast by post-halving earnings reductions, miners exhibit resilience, underpinned by a belief in a prosperous Bitcoin future. With the hashrate soaring and miner optimism still intact despite diminishing immediate returns, the stage seems set for an exciting narrative in the Bitcoin saga. Falling Hashprice volatility might just be the calm before a significant price movement storm, with all signs pointing towards an intriguing, bullish horizon.

Bitcoin miners, the unsung architects of the blockchain, remain confidently tethered to their rigs, anticipating bright days ahead for BTC. Their collective actions and sentiments, reflected through these analytical lenses, suggest not just survival, but a thriving anticipation for the next chapter in Bitcoin’s journey.

For those hungry for more in-depth analyses and trending news in the world of decentralized finance and Bitcoin, DeFi Daily News stands ready to serve a banquet of cutting-edge insights and updates.