rewrite this content using a minimum of 1000 words and keep HTML tags

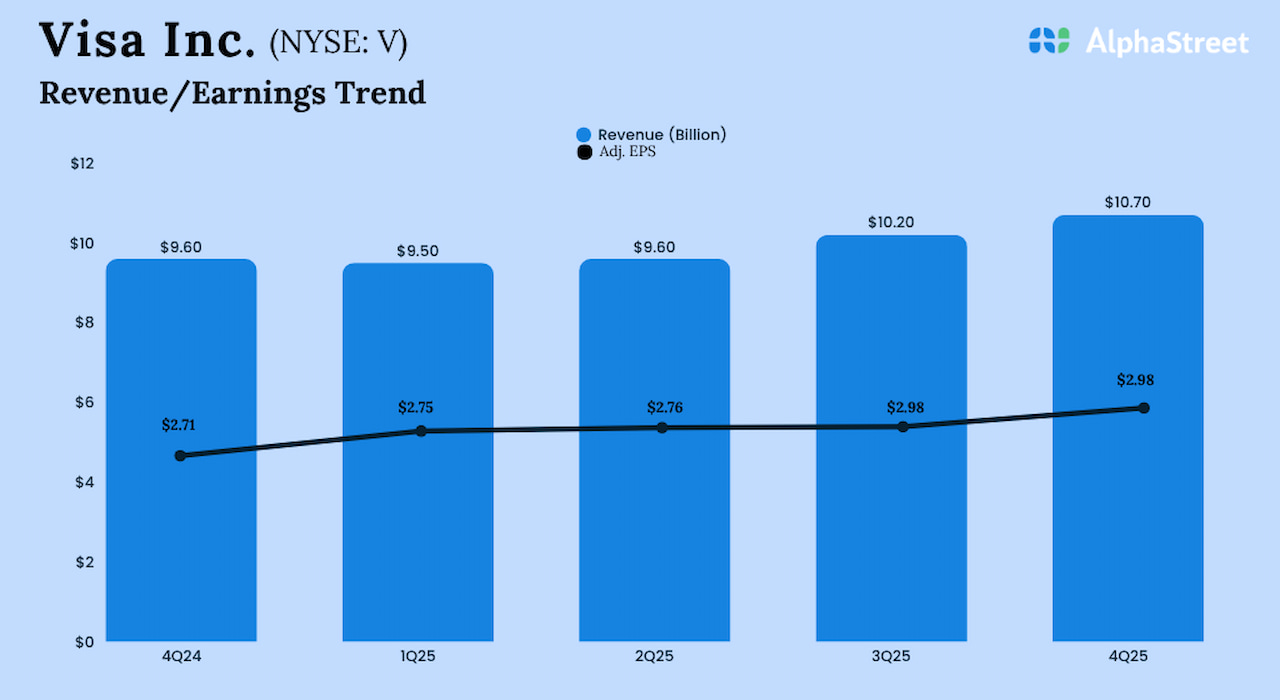

Visa, Inc. (NYSE: V) on Tuesday reported an increase in revenues for the fourth quarter of fiscal 2025, which translated into a 10% growth in adjusted earnings.

Fourth-quarter revenue grew 12% annually to $10.7 billion, aided by an increase in payment volume amid continued healthy consumer spending. The top-line beat analysts’ estimates.

As a result, adjusted earnings rose to $2.98 per share in Q4 from $2.71 per share last year, exceeding expectations. On a reported basis, net income was $5.1 billion or $2.62 per share, vs. $5.3 billion or $2.65 per share reported in Q4 2024.

“We continued to invest in our Visa as a Service stack to serve as a hyperscaler across the payments ecosystem. As technologies like AI-driven commerce, real-time money movement, tokenization, and stablecoins converge to reshape commerce, our focus on innovation and product development positions Visa to lead this transformation,” said Ryan McInerney, Chief Executive Officer, Visa.

During the quarter, the company repurchased around 14 million shares of its common stock at an average cost of $349.77 per share for $4.9 billion.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link