rewrite this content using a minimum of 1200 words and keep HTML tags

Almost current Automated Market Makers (AMMs) still operate on a static model: liquidity is locked within a fixed price range and cannot be adjusted when market conditions change. This leads to many consequences such as inefficient capital allocation, lower profits and the need for constant manual rebalancing by liquidity providers (LPs). Meteora was created to solve this fundamental problem.

In the following sections, we’ll explore how Meteora’s Dynamic Liquidity Market Maker (DLMM) and its suite of liquidity tools are redefining the DeFi experience on Solana and why this innovation could reshape how liquidity truly works across the entire ecosystem.

What is Meoteora?

What Is Meteora? – Source; Meteora

Meteora is a dynamic liquidity ecosystem designed to redefine how capital operates within decentralized finance. It is built on the Solana blockchain, which is famous for its fast and extremely low transaction speeds.

Instead of functioning as a single purpose DEX or AMM, Meteora delivers multiple technological layers that allow liquidity to self-adjust, optimize automatically, and connect seamlessly across different DeFi protocols on Solana.

Simply put, Meteora is like a “liquidity engine” that operates behind decentralized exchanges (DEXs) and DeFi applications. If DEXs are the “front end” where users transact, Meteora is the underlying layer that makes everything smoother, more efficient, and less expensive.

Unlike platforms that focus on a single product (such as Uniswap’s AMM model), Meteora positions itself as a “Liquidity Engine”, a foundational infrastructure layer that any DEX, aggregator, or DeFi application on Solana can integrate to access real-time dynamic liquidity.

Learn more: Meteora Announces MET Token Generation Event

Meteora’s mission includes:

Becoming the shared liquidity infrastructure for the Solana ecosystem.Connecting LPs and protocols, ensuring that capital is efficiently utilized across the network.Building a flexible liquidity marketplace, where liquidity doesn’t sit idle but “moves intelligently” responding to market prices, trading volume, and volatility in real time.

Meteora Product Suite

The Meteora ecosystem is built as a comprehensive liquidity technology stack designed for developers, DeFi protocols, and professional liquidity providers (LPs) on Solana.

Instead of offering a single AMM, Meteora delivers a multi-layered program suite ranging from core liquidity pools to auxiliary tools, vault strategies, and rapid deployment platforms allowing anyone to build, test, and launch DeFi applications on Solana with minimal friction.

Meteora is not just another AMM; it is a multi-layered liquidity suite, consisting of:

Core Layer: DLMM, DAMM v1/v2, DBCExtended Layer: Vaults, Lock, Zap, Fee SharingDeveloper Layer: Quick Launch, Invent, Metsumi, Actions, Scaffolds

And among them DLMM (Dynamic Liquidity Market Maker), Dynamic Vaults (Automated Liquidity Strategies), Liquidity Aggregator (Liquidity Aggregator), Yield Strategy & Partner Integration are the main products and strategies of Meteora.

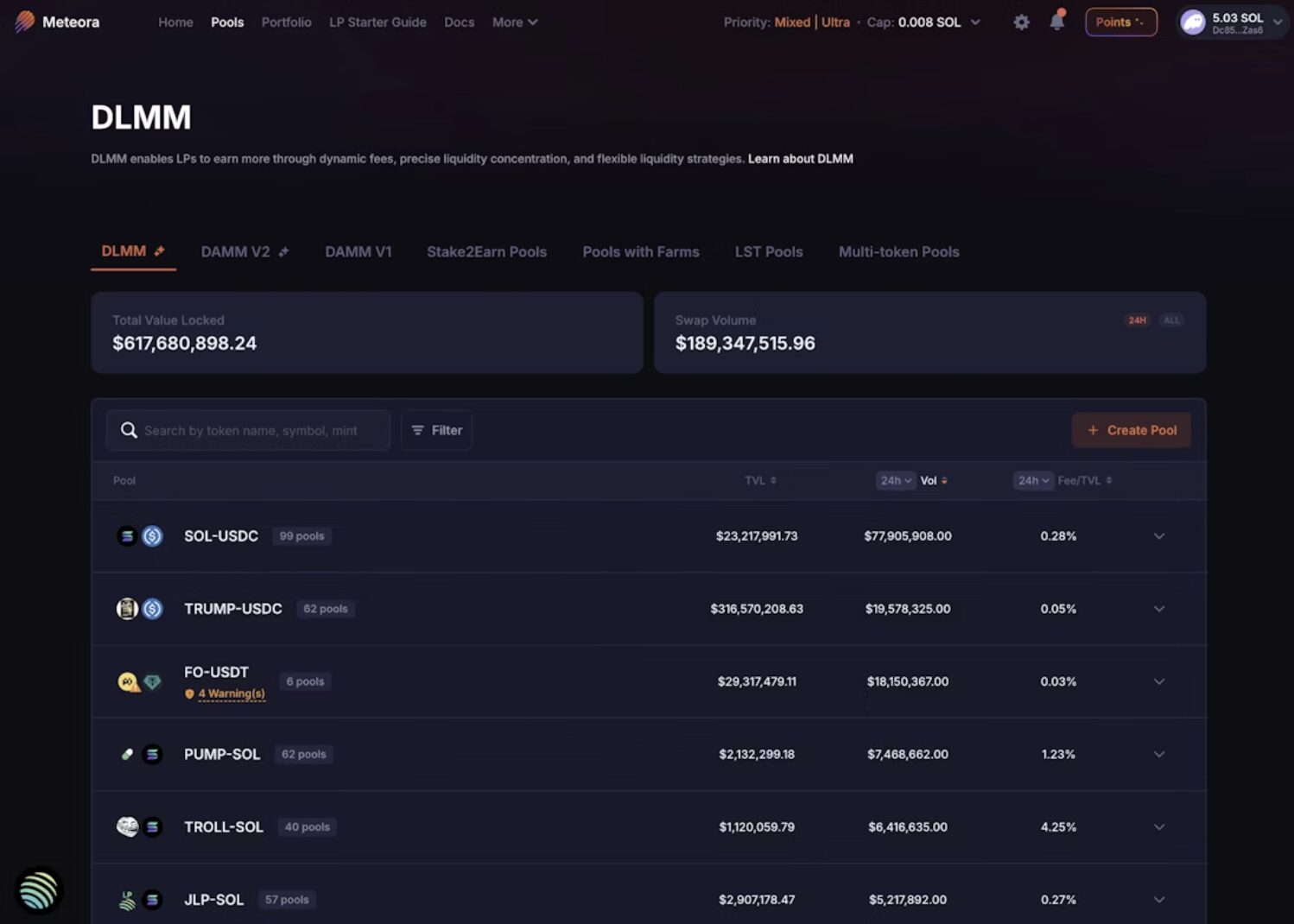

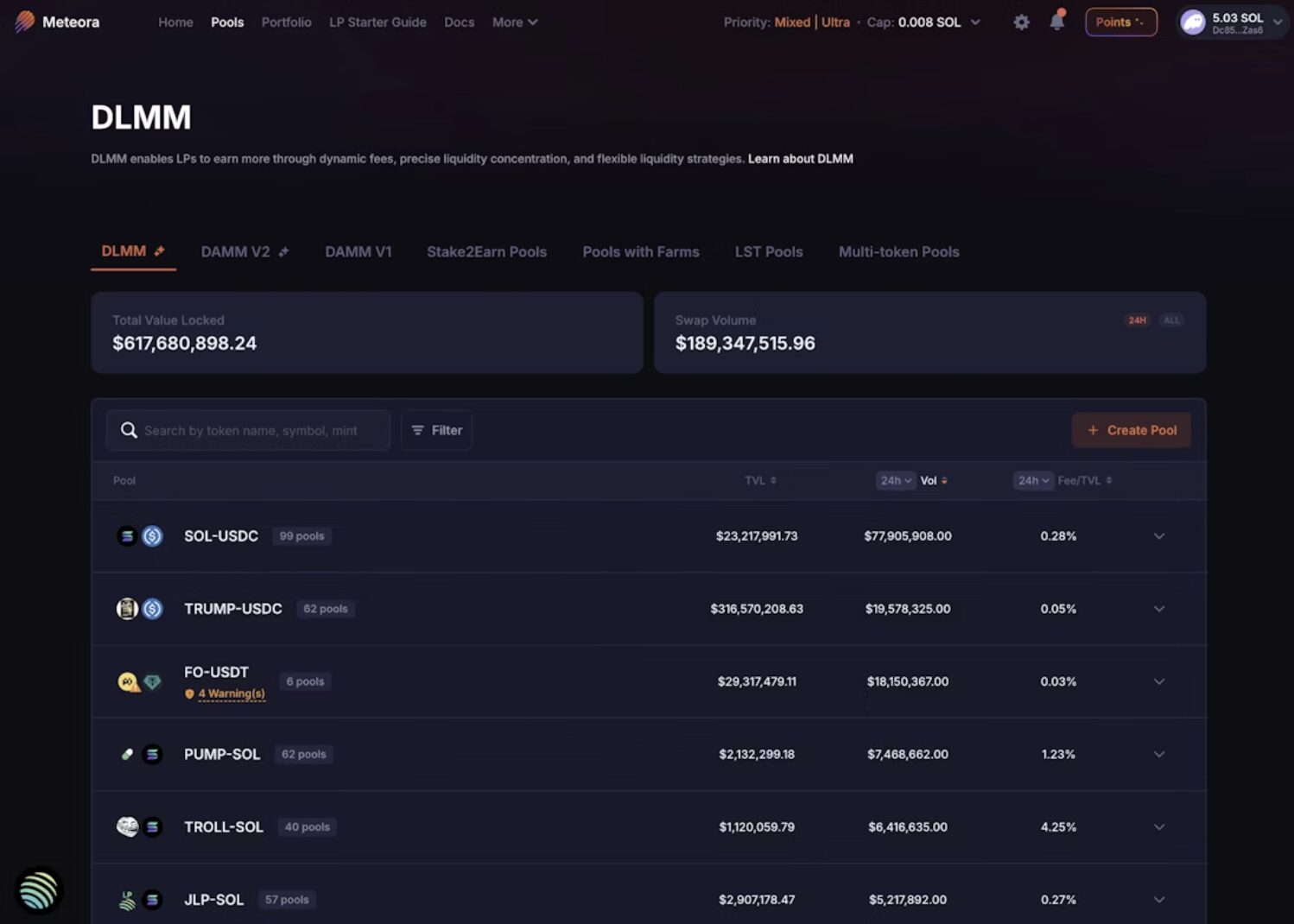

DLMM (Dynamic Liquidity Market Maker)

The flagship and most recognized product of Meteora, DLMM is a next generation AMM that enables liquidity ranges to move dynamically along with market prices. Liquidity providers (LPs) can set range migration rules, define speed, and trigger thresholds, allowing their liquidity to continuously stay within active trading zones.

DLMM is the “account engine” at the heart of Meteora. It works like a messaging version of Uniswap, but instead of “standing still” in a fixed price range, DLMM allows accounts to move automatically according to price fluctuations.

DLMM (Dynamic Liquidity Market Maker) – Source: Meteora

High Capital Efficiency: Concentrates liquidity around active trading ranges, resulting in significantly better fee toTVL ratios compared to static AMMs.Dynamic Fees: Trading fees automatically adjust with volatility to offset impermanent loss and increase LP rewards.Flexible Configuration: LPs can choose between strategies such as follow fast, band step, or follow slow based on market volatility.Smooth Trading Experience: Traders enjoy ultra low slippage, and DLMM integrates easily with routers and aggregators.

DLMM is the core product currently live, representing the first major step for Meteora in proving that the concept of dynamic liquidity is both practical and scalable.

DLMM (Dynamic Liquidity Market Maker) – Source: Meteora

Dynamic Vaults (Automated Liquidity Strategies)

Dynamic Vaults act as a liquidity optimization layer allowing users to deposit assets into vaults where the system automatically manages and rebalances liquidity across pairs, pools, and price ranges.

In simple terms, Dynamic Vaults are similar to “automatic liquidity investment funds”. You just need to deposit tokens into the Vault, and the system will automatically choose the best place to invest the liquidity just like a professional “capital management bot”.

Dynamic Vaults (Automated Liquidity Strategies) – Source: Meteora

Benefits:

Fully Automated: Users don’t need technical LP knowledge; the vault automatically adjusts based on market conditions.Fee Optimization: The system monitors on chain data and trading volume to allocate liquidity to the highest APR zones.Strategy Diversity: Vaults can follow multiple strategies such as stable farming, volatility yield, or risk-adjusted returns.

By automating complex LP management, Dynamic Vaults democratize liquidity provision, making yield generation from liquidity accessible to all users not just professionals.

Liquidity Aggregator

Instead of having isolated pools operating independently, Meteora’s Liquidity Aggregator unifies liquidity from multiple sources including DLMM pools, Dynamic Vaults, and partner DEXs.

Imagine that on Solana there are hundreds of different liquidity pools, each with their own little bit of liquidity. Meteora’s Liquidity Aggregator acts as a “pipe that connects all the pools together”.

If you are a trader, to make a large trade, you have to find the right pool with deep enough liquidity which is time consuming and prone to slippage. It aggregates liquidity from multiple places DLMMs, Vaults, or even other DEXs into a unified liquidity layer.

Advantages:

Enhanced Market Depth: Combines liquidity sources to improve execution quality.Reduced Fragmentation: Minimizes liquidity dispersion across pools and platforms.Unified Liquidity Layer: Creates a seamless, composable liquidity foundation for the Solana DeFi ecosystem.

In essence, the Aggregator acts as a liquidity router at the infrastructure level, allowing other DEXs to tap into Meteora’s dynamic liquidity without rebuilding AMM models from scratch.

Yield Strategies & Partner Integrations

Beyond its core products, Meteora expands into yield strategy design and partner integrations to enhance capital productivity across ecosystems.

This is an extension of Meteora, it’s making liquidity not only exist, but also generate smart profits. Meteora partners with many other DeFi protocols to create strategies that generate profits from the flow of capital in the system.

Collaborations with lending, perpetual, and yield aggregation protocols to enable two way liquidity connections.Implementation of RWA (Real World Asset) and stablecoin yield strategies to utilize idle LP capital effectively.Provision of SDKs and APIs for developers to seamlessly integrate Meteora’s dynamic liquidity infrastructure into their own applications.

Through these integrations, Meteora transforms liquidity from a passive pool into an active, programmable resource, powering a new wave of composable DeFi infrastructure on Solana.

With this Product Suite, Meteora is evolving into Solana’s “Liquidity Operating System” the foundational infrastructure that empowers every DeFi application to build, operate, and scale intelligent, adaptive liquidity.

How Meteora Works

At its core, Meteora operates as a modular liquidity ecosystem each component (DLMM, Vaults, Aggregator) can function independently, but when combined, they form a unified and adaptive liquidity network across Solana.

System Architecture

Liquidity Providers (LPs) supply capital either through DLMM pools or Dynamic Vaults.The Liquidity Aggregator consolidates all liquidity sources into a unified market depth view.Routers and DEXs tap into this aggregated liquidity to achieve optimal trade execution.Smart Contracts continuously adjust fees, rebalance liquidity, and distribute rewards based on real-time on-chain data.

This architecture allows Meteora to operate as a living liquidity network, capable of reacting to market conditions in real time.

Intelligent Data Model

Meteora employs a dynamic range and adaptive fee model, both driven by a data based optimization mechanism:

Volatility Index: Measures real-time volatility of trading pairs.Liquidity Concentration Ratio: Tracks how tightly liquidity is clustered around the active price.Fee Optimization Curves: Algorithmically adjust trading fees based on volume and market dynamics.

When these parameters shift, the system automatically restructures liquidity, ensuring that capital allocation remains efficient and aligned with market movements. In essence, Meteora behaves like a self adjusting marketplace, constantly learning and adapting to volatility.

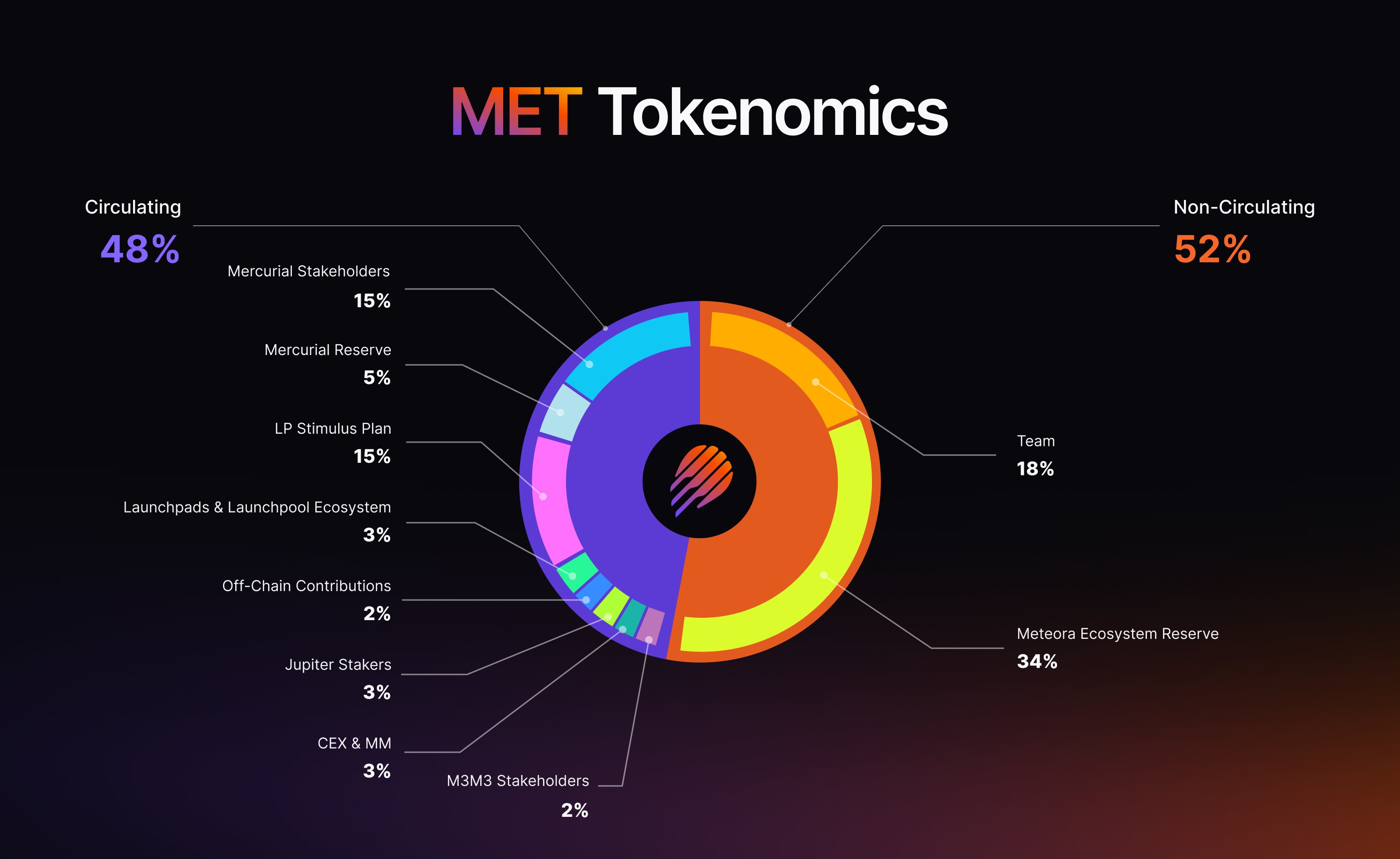

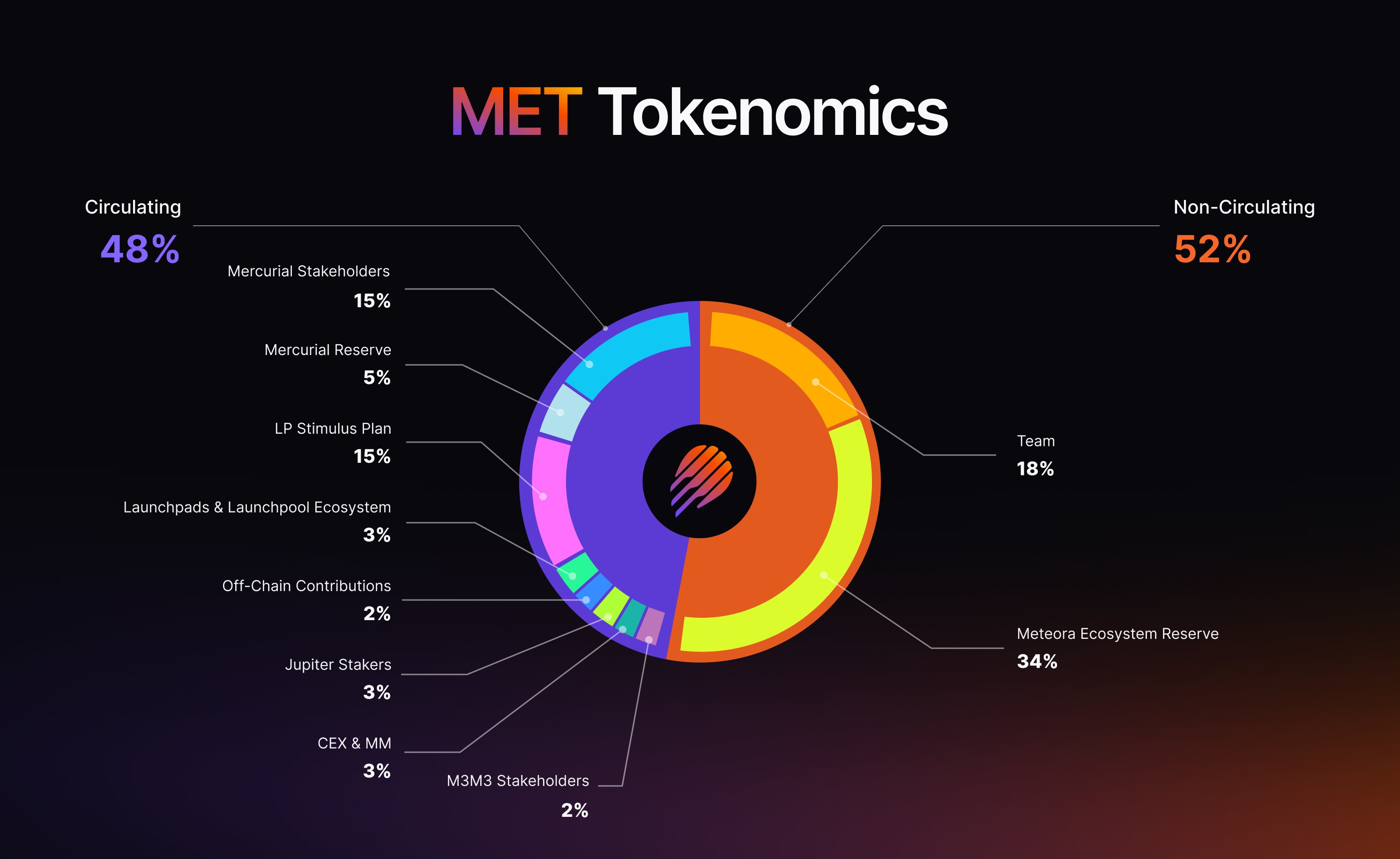

Tokenomics

Token: $METTotal Supply (tentative): 1,000,000,000 METCirculating supply: 479.999.782 MET

Tokenomic – Source: Meteora

Allocation:

Team: 18.00%Meteora Reserve: 34.00%M3M3 Plan: 2.00%Off-Chain Contributions: 2.00%Jupiter Stakers: 3.00%Launchpads & Launchpool Ecosystem: 3.00%TGE Reserve: 3.00%Mercurial Reserve: 5.00%LP Stimulus Plan: 15.00%Mercurial Stakeholders: 15.00%

Meteora’s goal isn’t merely to issue a tradable token, but to design a sustainable incentive economy, one where token value is directly linked to liquidity flow and protocol revenue across the ecosystem.

How To Buy MET

Search for MET

Once your account is funded, go to the exchange’s Market or Trade section and search for “Meteora” or “MET”. Select a supported trading pair such as MET/USDT or MET/USDC.

Choose the Amount to Purchase

Enter the amount of MET you wish to buy. You can choose between:

Market Order – buys instantly at the current market price.Limit Order – allows you to set your preferred entry price.

Confirm the Purchase

Double-check your order details, including the amount, price, and total cost. Once everything looks correct, click “Buy MET” to complete your transaction.

Wait for Order Completion

Your purchase will be processed and MET tokens will appear in your exchange wallet within a few minutes, depending on network conditions and exchange processing times.

FAQ

Is Meteora a DEX? Not exactly. Meteora is more than a DEX. It’s a dynamic liquidity infrastructure ecosystem, providing the foundation that other DEXs and protocols can integrate into.

Is DLMM the entire Meteora ecosystem? No. DLMM is just one product within the Meteora suite it demonstrates the concept of liquidity that moves with price, but Meteora includes multiple layers of products and developer tools beyond that.

Meteora is Built in Which Blockchain?

MET serves as the native governance and utility token of the Meteora ecosystem, which is built entirely on the Solana blockchain. All of Meteora’s core products including DLMM, Dynamic Vaults, Liquidity Aggregator, and Quick Launch operate on Solana’s high-speed, low-cost, and parallel processing infrastructure.

Solana’s high throughput, low fees, and parallelized account model make it ideal for Meteora’s architecture, which requires frequent updates and thousands of micro adjustments per second to manage liquidity efficiently.

How can LPs participate?LPs can provide liquidity directly to DLMM pools or deposit assets into Dynamic Vaults, where the system automatically optimizes yield and capital allocation.

How does Meteora create value for traders? Traders benefit from deeper liquidity, lower slippage, and minimal fees. DEXs that integrate Meteora can deliver a CEX-like trading experience fast, efficient, and transparent.

Will Meteora expand cross-chain? Currently, Meteora focuses on perfecting its core liquidity engine on Solana. However, its modular architecture is designed for eventual multi chain deployment in the future.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link