rewrite this content using a minimum of 1000 words and keep HTML tags

When it comes to using cryptocurrencies, transaction fees play a crucial role in determining how fast and cost-effective your transfers are. Bitcoin and Ethereum, the two largest blockchain networks, both charge fees, but the way these costs are structured, why they fluctuate, and how they impact users are vastly different.

Bitcoin’s fees are largely influenced by network congestion and block space demand, while Ethereum introduces a more complex fee structure with gas fees, which vary based on computational effort and network activity. But why do Bitcoin and Ethereum fees differ so much? What drives these costs, and how can users optimize their spending?

In this article, we’ll break down the transaction costs on both networks, explore the key factors that influence fees, and provide practical tips to help you minimize expenses when sending BTC or ETH.

How Fees Work on Bitcoin and Ethereum

Bitcoin and Ethereum networks have distinct mechanisms influencing transaction fees, shaped by their unique architectures and operational dynamics.

On Bitcoin

Bitcoin’s transaction fees are primarily influenced by block size limits and the state of the mempool. Each Bitcoin block has a maximum size of 1 megabyte and this restricts the number of transactions it can store. This limitation means that during periods of high transaction volume, not all transactions can be processed immediately.

The mempool serves as a holding area for unconfirmed transactions. When the number of transactions exceeds the block capacity, the mempool becomes congested, leading to delays and increased fees. Users often offer higher fees to prioritize their transactions, incentivizing miners to include them in the next block.

A third factor comes into play in times of congestion: miners prioritize transactions with higher fees. Users can choose to pay more to expedite their transactions or wait longer during peak periods to benefit from lower fees.

On Ethereum

Ethereum’s fee system is centered around gas fees. Every operation on the Ethereum network requires a certain amount of computational effort, measured in “gas.” Users pay fees based on the gas required for their transactions and this price fluctuates based on network demand. Ethereum can process about 30 transactions per second.

The Ethereum Improvement Protocol (EIP) 1559, implemented in August 2021 restructured the blockchain’s fee model by introducing a base fee that adjusts according to network congestion. This base fee is burned, permanently removing it from circulation. The changes also allows users to add a priority fee (tip) to incentivize miners to process their transactions faster.

High demand for Ethereum’s resources, especially during popular dApp launches or token sales, can lead to increased base fees. The dynamic adjustment mechanism of EIP-1559 aims to stabilize fees by expanding block sizes during peak times, but users may still experience higher costs during significant network activity.

Other Factors That Influence Transaction Costs

Beyond network congestion, several other factors influence transaction fees on Bitcoin and Ethereum. One important one is transaction complexity as we see in the case of smart contracts with Ethereum and Layer 2 solutions for both Ethereum and bitcoin.

Impact of Smart Contracts on Ethereum Fees

Unlike Bitcoin’s straightforward transactions, Ethereum supports smart contracts—self-executing code facilitating complex operations. Executing smart contracts consumes more gas, limiting the number of transactions a block can handle and contributing to congestion. Popular dApps and DeFi platforms often cause gas price spikes due to sudden network activity surges.

The Impact of Layer 2 Scaling Solutions

Layer 2 (L2) scaling solutions reduce transaction complexity on the mainnet and thus they are able to enhance blockchain scalability and reduce fees. They essentially process transactions off-chain or bundle them before submission to the main chain, which reduces the amount of computation that needs to be done to validate them.

Ethereum’s transaction fees have dropped significantly due to rollups, a type of Layer 2 scaling implementation. Platforms like Optimism, Base, and Scroll have reduced average transaction fees by more than 24% compared to the Ethereum mainnet while also significantly improving the transaction speed.

Ethereum’s Optimistic Rollups enable a potential throughput of over 5,200 TPS, while Zero-Knowledge (ZK) Rollups reach speeds of up to 2,000 transactions per second (TPS).

RELATED: Scaling the Ethereum Blockchain: A Comprehensive Guide on Layer 2 Solutions

The same can be said for Bitcoin even though it doesn’t really have a large ecosystem of Layer 2 networks. Bitcoin Lightning has been very effective, transaction fees on the network are 90% lower than the main network.

Which Network Is More Cost-Effective for Users?

The choice between Bitcoin and Ethereum depends on the specific use case and the user’s priorities regarding cost, functionality, and network activity. Users interested in DeFi, NFTs, or other decentralized applications may prefer Ethereum despite its higher fees due to its extensive ecosystem and functionalities.

However, in a very broader way, we can make general cost comparisons to help you have an idea of how to use both Bitcoin and Ethereum networks for your transactions.

For Small Transactions, Ethereum is preferable

Ethereum’s gas fees vary based on computational complexity. Simple token transfers typically cost less than Bitcoin transactions during network congestion.

Bitcoin’s fees depend on transaction size and network demand. When traffic is high, small transactions can become expensive.

For Large Transactions: Bitcoin is preferable

Bitcoin transactions generally have fixed base fees, making larger transfers relatively cheaper when congestion is low.

Ethereum’s gas fees for large transfers are lower than fees for smart contract interactions but can still rise significantly during peak activity.

Ultimately, the decision between Bitcoin and Ethereum depends on the user’s specific transaction needs, cost sensitivity, and network preferences.

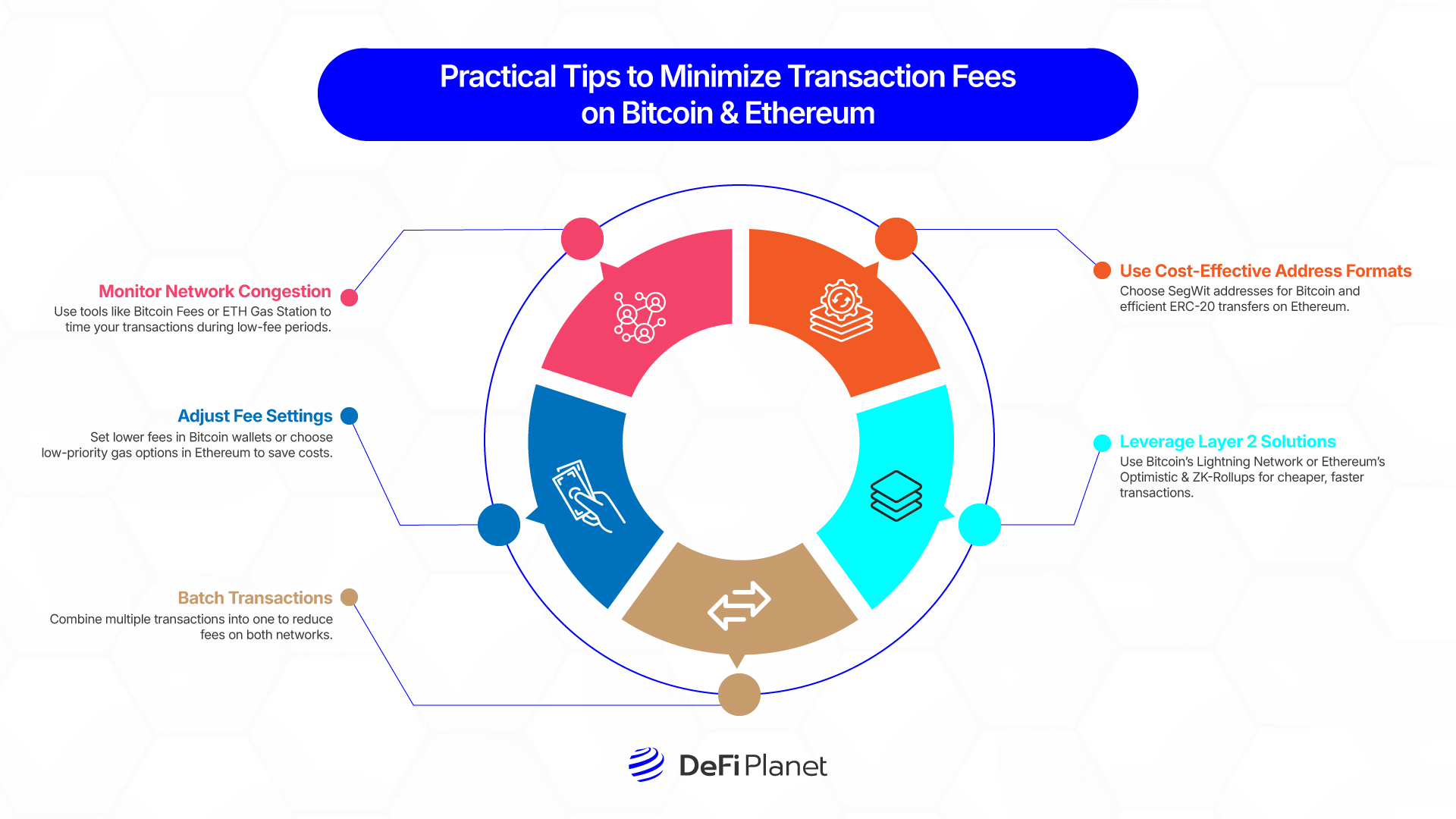

Practical Tips to Minimize Transaction Fees on Bitcoin and Ethereum

Transaction fees can add up quickly, but with smart strategies, you can reduce costs on both Bitcoin and Ethereum. Here’s how:

Monitor Network Congestion and Time Your Transactions

Use tools like Bitcoin Fees to track network congestion. Fees rise during peak usage, so sending transactions during off-peak hours can help you save money.

On Ethereum, gas fees also spike during high network activity, such as NFT drops, DeFi launches, or token sales. Use tools like ETH Gas Station or Gas Now to identify low-fee periods before transacting.

Adjust Fee Settings for Cost Efficiency

Many Bitcoin wallets allow users to manually set fees. If your transaction isn’t urgent, you can opt for a lower fee, though this may delay confirmation during congestion.

On Ethereum, if speed isn’t critical, set a lower gas price or select the “low-priority” option in your wallet. While your transaction may take longer, it will cost significantly less.

Ethereum wallets automatically estimate gas limits, but reviewing and adjusting them can prevent overpayment. Be cautious—setting a limit too low could cause the transaction to fail, leading to wasted gas fees.

Batch Transactions to Save on Fees

Instead of sending multiple transactions separately, batch them into a single transaction. This reduces the total amount of block space used and lowers fees per transaction. This tip also applies to Ethereum.

If interacting with multiple dApps, try bundling multiple smart contract interactions into a single transaction to reduce gas fees. Some platforms offer gas-saving mechanisms for batch processing.

Use Cost-Effective Address and Transaction Formats

On bitcoin, transactions sent via SegWit addresses (starting with “3” or “bc1”) tend to be cheaper as they use less block space. If your wallet supports SegWit, always opt for it.

While Ethereum does not have a direct equivalent to SegWit, choosing ERC-20 over ERC-721 (NFT) transactions when possible can help lower fees, as NFTs require more computational power.

Leverage Layer 2 Solutions for Cheaper Transactions

Bitcoin’s Lightning Network and Ethereum’s Layer 2 scaling solutions like Optimistic Rollups (Optimism, Base) and ZK-Rollups (Arbitrum, Scroll, StarkNet) allow for faster and cheaper transactions. So if you are dealing with frequent, small-value transactions, these solutions are your best bet.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link

:max_bytes(150000):strip_icc()/Health-Melatonin-Overdose-symptoms-no-text-98b6caa341d74bcf90386fa77f928643.jpg?w=120&resize=120,86&ssl=1)