rewrite this content using a minimum of 1200 words and keep HTML tags

The blockchain landscape is perpetually in pursuit of the “holy grail” – a platform that seamlessly blends scalability, security, and decentralization. Monad, a highly anticipated Layer 1 blockchain, aims to redefine this paradigm by offering a high-performance, fully EVM-compatible environment. While its mainnet is still on the horizon for late 2025, following a public testnet launch in February 2025, the project has garnered significant attention due to its audacious technical claims and substantial institutional backing. For investors, understanding the proposed metrics and what to look for post-launch is key to evaluating Monad’s long-term potential. But what do the numbers actually say about Monad—and how do they translate into real-world value?

High Performance, Low Latency

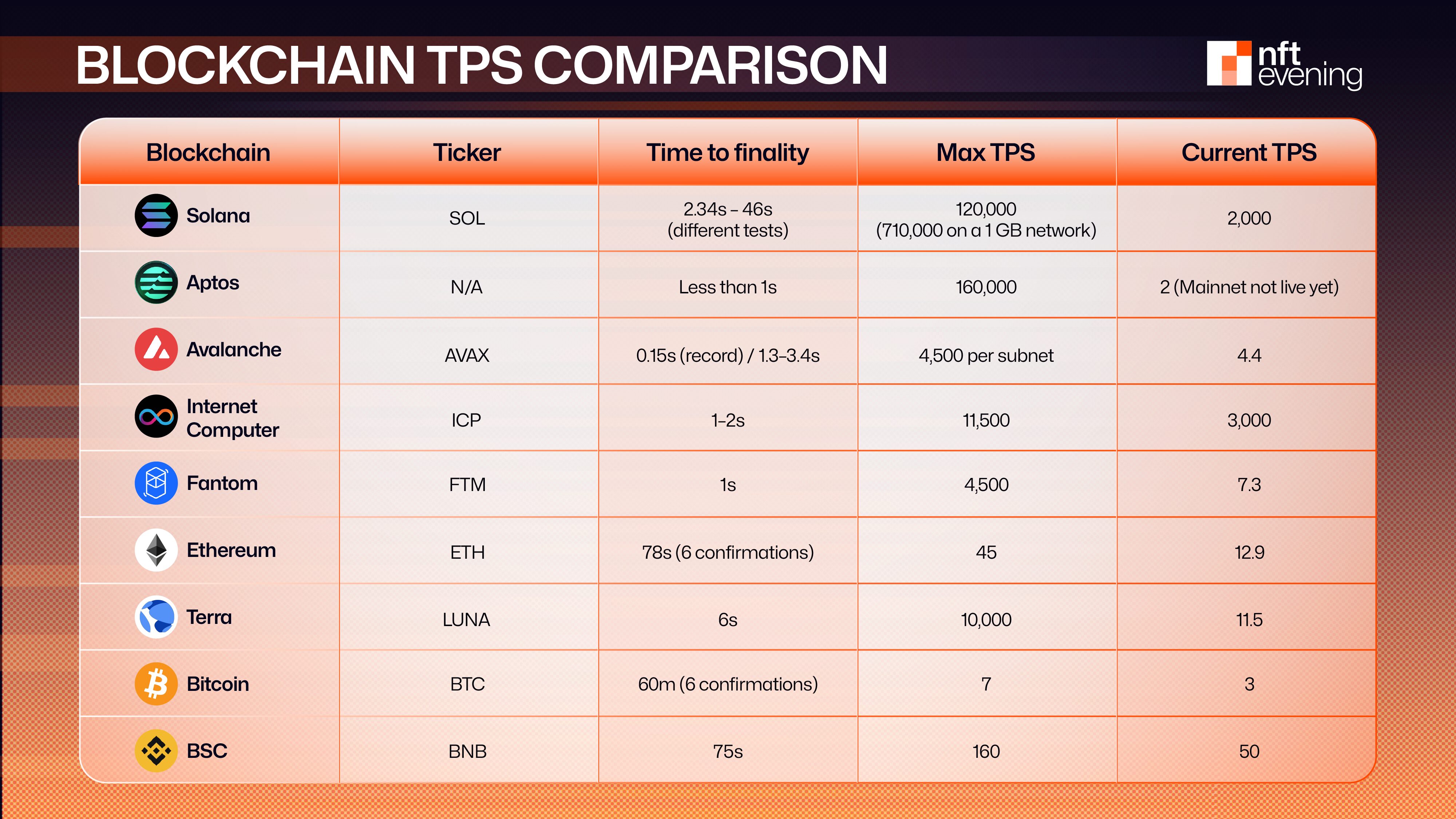

At the protocol level, Monad is engineered for speed. During the devnet phase, Monad announced that it successfully tested 10,000 TPS. The core technology is based on MonadBFT (a type of consensus method) and optimistic parallel execution. Another metric that is collected is the block times average 0.5 seconds, and finality is reached in about 1 second—significantly faster than Ethereum’s multi-block confirmation and even faster than many other high-performance Layer 1s like Solana or Aptos.

Monad Devnet is live.

10,000 real TPS achieved on the EVM. pic.twitter.com/1bnfsi6bqU

— Monad ⨀ (@monad) March 14, 2024

An increase in TPS—along with sustained finality and low gas fees—would validate Monad’s engineering claims and could result in higher developer migration from Layer 2s or alternative L1s. These performance signals are not merely technical milestones. They directly impact user retention, dApp UX, and overall network valuation from the investor’s perspective.

To have a look at other blockchains, the devnet test consequence of Monad shows some positive signals.

From developers’ perspectives, these types of technology open up the ability to build applications that simply aren’t feasible on slower chains. Analyzing these numbers in live conditions, especially during high-demand spikes, will demonstrate whether Monad can handle intensive applications such as real-time DeFi, high-frequency games, or machine-to-machine microtransactions without compromising composability.

For more: Is Monad a Good Investment in 2025?

Gas Costs: Usability Meets Capital Efficiency

Ethereum’s average transaction fees often hover above $3.85 and can spike over $20 during peak congestion—pricing out users and straining dApp scalability. Monad tackles this issue head-on with its low-overhead, parallelized execution model. Early benchmarks suggest average gas costs between $0.004–$0.007 per transaction, rivalling Solana and undercutting leading Layer 2s like Base ($0.015) and Arbitrum ($0.05).

For high-volume protocols—think DeFi trading platforms or real-time games—this fee compression is crucial. A dApp processing 100,000 transactions daily might save nearly $299,400 by choosing Monad over Ethereum. Importantly, Monad wants to keep these savings without using centralised sequencers, which helps support long-term goals of decentralisation.

If sustained at scale, Monad’s cost structure could reset expectations across EVM-compatible chains, inviting developers previously deterred by high fees. With affordability baked into Layer 1, Monad could become the new baseline for composable, high-frequency dApps.

For more: Monad Deep Dive: Into the Fully Compatible EVM Blockchain

Wallet Activity: Who’s Using the Network?

In Monad’s early development phase, available devnet and testnet metrics suggest promising momentum, though most figures remain internally reported or community-tracked. According to data from Mitosis University, Monad’s devnet saw over 242,000 unique wallet addresses and processed more than 2.7 million transactions, with block finality at 0.5 seconds and peak throughput exceeding 3,000 TPS. While these numbers reflect testnet performance, they lay the groundwork for what mainnet could achieve.

This dashboard will become particularly useful in coming weeks. You might want to bookmark the tweet so you don’t forget about it pic.twitter.com/9T2IPmj3eC

— Daniel Amah (@danny_4reel) February 21, 2025

Community dashboards such as Flipside Crypto have begun tracking real wallet interactions, though comprehensive on-chain analytics are still limited. For instance, one Flipside dashboard reports over 770,000 transactions across various contracts, with growing daily active users, but doesn’t yet verify deeper metrics like wallet retention or token distribution.

At this stage, claims such as 15,000–18,000 daily actives, a DAA-to-wallet ratio of 8.5%, or 78% of MON supply held by top 1% of wallets remain unverified by third-party analytics. Investors should consider these figures as early indicators rather than confirmed facts and closely monitor platforms like Dune or Artemis once Monad mainnet data becomes widely indexed.

Capital Flow and TVL: Is Real Liquidity Arriving?

Total Value Locked (TVL) is more than just a headline metric—it shows whether capital genuinely trusts and uses a network. According to NFT Evening, PancakeSwap on Monad has already amassed $250 million in TVL, making it the largest decentralized exchange within the ecosystem. Meanwhile, integrations with LayerZero support seamless cross-chain connectivity across 50–60 networks, enhancing asset inflows into the platform.

However, the dominance of PancakeSwap in the TVL mix raises concerns about capital concentration. When one or two protocols hold the majority of liquidity, the ecosystem becomes vulnerable—especially if incentive structures change. Encouragingly, observers report rising engagement from niche DeFi tools, staking platforms, and derivatives protocols, indicating that diversification is underway. A wider distribution of TVL would reduce systemic risk and increase ecosystem resilience—essential for supporting long-term investor confidence.

For more: Monad Ecosystem Map: Best Projects Review

Validator Distribution and Decentralization Health

As of mid-2025, Monad Testnet runs with over 57 active validators, with more expected at mainnet. While the validator count is still in its early phase, Monad’s technical architecture—especially MonadDB, which allows state access via SSDs—lowers hardware requirements. By using these sources, Monad enables a wider pool of participants to run full nodes without requiring high-end, enterprise-grade machines, promoting decentralization without sacrificing performance.

Additionally, Monad appears to have relatively low hardware requirements compared to chains like Solana, enabling wider validator participation from a global base. These signals are particularly attractive to investors focused on long-term protocol resilience, as they imply less reliance on centralized infrastructure and more community-governed scalability. Future reports on slashing behaviour and validator churn will add depth to this narrative.

Ecosystem and Testnet Traction

Metrics reported by Bitget confirm over 1.5 million unique addresses, 32.4 million transactions, 564,000 deployed smart contracts, an average block time around 0.5 seconds, 98.3% transaction success rate, and average fees of 0.01 MON.

In parallel, the ecosystem’s project pipeline is expanding rapidly. Monad has attracted over 100 independent dApps, including key integrations with LayerZero, Pyth, Chainlink, Band Protocol, Backpack Wallet, and FoxWallet, according to Coinbureau. On-chain activity is further underscored by The integration news highlights cross-chain messaging and oracle partnerships that establish a foundation for the growth of DeFi.

Kuru is excited to announce our $11.6m Series A round led by @paradigm

This funding will help us scale our team and bring our vision of a fully on-chain orderbook to life on Monad. pic.twitter.com/oNC1T9Mnht

— Kuru (@KuruExchange) July 7, 2025

Although data on fundraising for Kuru and aPriori is less concrete—Kuru’s $2 M seed raise and aPriori’s $10 M round are attributed to aggregate reporting—these investments signal investor confidence in Monad-based protocols.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link