As the 2024 U.S. presidential election shapes up for a rematch between former President Donald Trump and current President Joe Biden, the cryptocurrency industry is proving to be a significant factor in the fate of both contestants.

Trump, who hasn’t always been wasn’t a fan, is now positioning himself as a champion of crypto innovation. His campaign is the first major presidential campaign to accept cryptocurrency donations. And then, we have Biden, who, since he took office in 2021, has adopted a measured approach to crypto, which hasn’t been popular among digital currency users and companies. Despite calling for research and tweeting about “tax loopholes that help wealthy crypto investors,” Biden has said little else on the issue.

We can’t definitively say that the fate of the crypto industry depends on the elections, just as we can’t say that the influence of the sector would decide the elections. However, it is certain that the sector would have some influence on the elections, and the future of crypto in the U.S. would be greatly influenced by whoever wins.

But we have a unique situation. Both contestants have done this before. We can compare how crypto fared during their previous administrations to gain insights into what might come if either of them is in control again. This is what this article does.

Crypto Under Trump (2017 – 2021): Booming Market, Few Rules

Market Performance: Booming Growth

When Trump took office, Bitcoin was valued at around $1,000. By the end of 2020, it had surged to about $29,000, growing about 150% annually during that period. Ethereum also saw remarkable growth, reaching the $100 mark in 2017 and hitting about $750 by the end of 2020, with an annual growth rate of around 135%. The overall cryptocurrency market value skyrocketed from about $17.7 billion in early 2017 to nearly $757 billion by the end of 2020.

Adoption and Innovation: Rapid Expansion

Interest and awareness in digital currencies grew significantly during Trump’s time, but public opinion was mixed. In 2017, a small number of people had Bitcoin or Ethereum, but by 2021, 16% say they personally have invested in, traded or otherwise used one.

While some people were excited about how crypto could change finance and technology, others were worried about the market’s ups and downs. For example, Bitcoin’s wild price swings made some people cautious about its future.

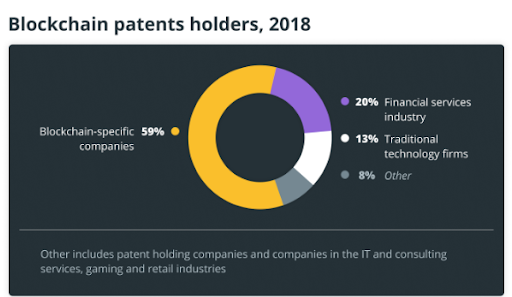

The Trump era also saw a boom in blockchain innovation, with a notable increase in blockchain patent filings led by companies like IBM and Mastercard. These patents included new ideas for payment systems and secure digital identities, making transactions safer and more efficient. The job market in blockchain and cryptocurrencies also experienced substantial growth, with companies like Coinbase and Gemini hiring more experts in blockchain technology, security analysis, and regulatory compliance.

Institutional Adoption: Early Movers

Institutional adoption of cryptocurrencies also began to take off during Trump’s presidency. Companies like MicroStrategy made significant Bitcoin purchases, amassing over $1 billion worth by the end of Trump’s term. Square (now Block, Inc.) also entered the market with a $50 million Bitcoin purchase in October 2020.

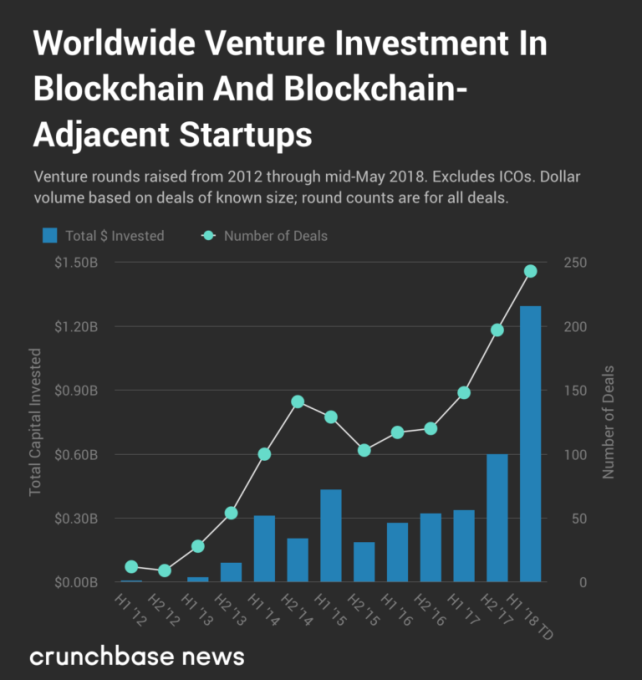

Venture capital investment in crypto startups saw wild swings during this period. In 2017, around $1.3 billion was pumped into these startups, but this amount skyrocketed to about $7.8 billion in 2018 due to a surge in Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) as crypto projects started raising funds. However, by 2020, this dropped to roughly $2.2 billion due to uncertain regulations and market instability.

Regulatory Approach: Hands-Off

From 2017 to 2021, the cryptocurrency industry enjoyed relatively friendly treatment under the Trump administration despite his overt criticism. Instead of imposing strict rules, the government watched the industry. This hands-off approach allowed the industry to flourish with minimal interference.

Regulators like the SEC and CFTC were careful in their approach to cryptocurrencies during Trump’s time. The SEC set rules for Initial Coin Offerings (ICOs) and cracked down on scams. One notable case was against PlexCoin, where people were scammed out of $15 million. Lawsuits were common and addressed issues like crypto fraud and regulatory compliance. Some cases ended with companies paying fines, while others helped establish new rules for handling cryptocurrencies. For instance, in 2019, the IRS provided guidance on reporting income from virtual currencies, while SEC Chairman Jay Clayton emphasized investor protection without stifling innovation.

Interestingly, various government agencies began exploring blockchain technology applications during Trump’s presidency. The Department of Homeland Security investigated using blockchain to secure data from cameras and sensors, while the Food and Drug Administration looked into its potential for tracking medicines.

International Influence: Emerging Leader

During Trump’s presidency, the United States emerged as a significant player in the global cryptocurrency scene. By 2019, the U.S. was handling about 22% of all Bitcoin trading worldwide. States like Wyoming passed laws welcoming blockchain companies, establishing the country as a hub for blockchain innovation. The U.S. also engaged in international efforts to create global standards for cryptocurrencies, focusing on preventing criminal activities and protecting investors.

Crypto Under Biden (2021 – 2024): More Rules, Volatile Market

Market Performance: Volatility and Stabilization

Under Biden’s administration, the crypto market has been characterized by increased volatility and signs of maturation. Bitcoin’s price experienced significant fluctuations, reaching nearly $65,000 in April 2021 before experiencing a series of corrections. By mid-2024, Bitcoin’s price had climbed to $62,892. Ethereum followed a similar pattern, reaching nearly $4,800 in late 2021 before settling around $3,352 by mid-2024. The total value of the cryptocurrency market hit an all-time high of around $2.15 trillion in 2021 but has since stabilized at about $2.22 trillion by mid-2024, reflecting both market corrections and increased regulatory scrutiny.

Adoption and Innovation: Mainstream Integration

Cryptocurrency adoption continued to grow under Biden’s administration. A recent report claims that about 20% of Americans own some form of cryptocurrency by mid-2024. This increase occurred despite market volatility and new regulations, driven by increased institutional backing and improvements in blockchain technology.

The demand for blockchain and cryptocurrency-related jobs remained strong, with companies seeking professionals skilled in blockchain development, smart contract creation, and digital asset management. Firms like Ripple and Circle expanded their workforce, particularly in areas of blockchain engineering and regulatory compliance.