rewrite this content using a minimum of 1000 words and keep HTML tags

In the ongoing quest to onboard the next billion users into crypto, one class of assets has quietly but powerfully taken center stage: stablecoins —crypto assets pegged to fiat currencies like the U.S. dollar which are gradually laying the groundwork for mainstream adoption in crypto.

They’re not flashy. They don’t promise 100x returns, but they work. And as it looks, that might be crypto’s best bet at going mainstream. For those still asking, what is the meaning of crypto adoption? It’s this: the point where everyday users engage with digital assets for real-world utility, not speculation. Stablecoins are helping that become a reality.

The Rise of Stablecoins

The rise of stablecoins marks one of the most transformative shifts in the crypto ecosystem; subtle, powerful, and widely underappreciated. What started as a niche experiment to create a digital dollar has become a cornerstone of modern crypto finance. As of Q4 2025, stablecoins are no longer fringe assets; they have become integral to the infrastructure of digital finance.

The evolution of stablecoins has been quiet but consistent. In 2014, Tether launched as a practical tool for traders. By 2019, it had surpassed Bitcoin in daily trading volume, signalling a shift in its role from utility to necessity. USDC, co-developed by Circle and Coinbase, added a layer of regulatory compliance that attracted institutional users. In 2023, PayPal launched its own stablecoin, PYUSD. By May 2025, Stripe introduced Stablecoin Financial Accounts, allowing businesses in over 100 countries to transact in stablecoins directly, solidifying their place in global fintech.

So why use stablecoins instead of fiat? The answer lies in speed, cost, and accessibility. Again, stablecoins are used not for speculative gains, but because they actually work. They have become vital for use cases such as remittances, payroll, cross-border trade, DeFi protocols, and centralized exchanges. They’re not just being bought; they’re being integrated into daily financial life. This is what true crypto adoption looks like.

Ultimately, the rise of stablecoins is a story of quiet disruption. They’ve redefined how the world uses money without the fanfare of hype-driven tokens. Not just what it looks like, but what it can do. And the journey has only just begun.

Cross-Border Payments and Remittances: Stablecoins vs the Status Quo

Cross-border payments have long been one of the most frustrating, slow, and costly aspects of the global financial system. Sending money across borders often involves a maze of intermediaries, sometimes up to five institutions, each layering on fees and delays. According to the World Bank, the global average cost of sending $200 stood at 6.4% by Q4 2023—more than double the G20 target of 3%.

But now, stablecoins are changing the game. These digital dollar alternatives are rapidly rewriting the rules of international money movement. Unlike traditional remittance channels, stablecoin transfers settle within seconds or minutes, not days. Fees are slashed from 6–7% to just cents or less—thanks to blockchain efficiency. In fact, Chainalysis reports that sending a $200 remittance from Sub-Saharan Africa using stablecoins can be up to 60% cheaper than using fiat-based services.

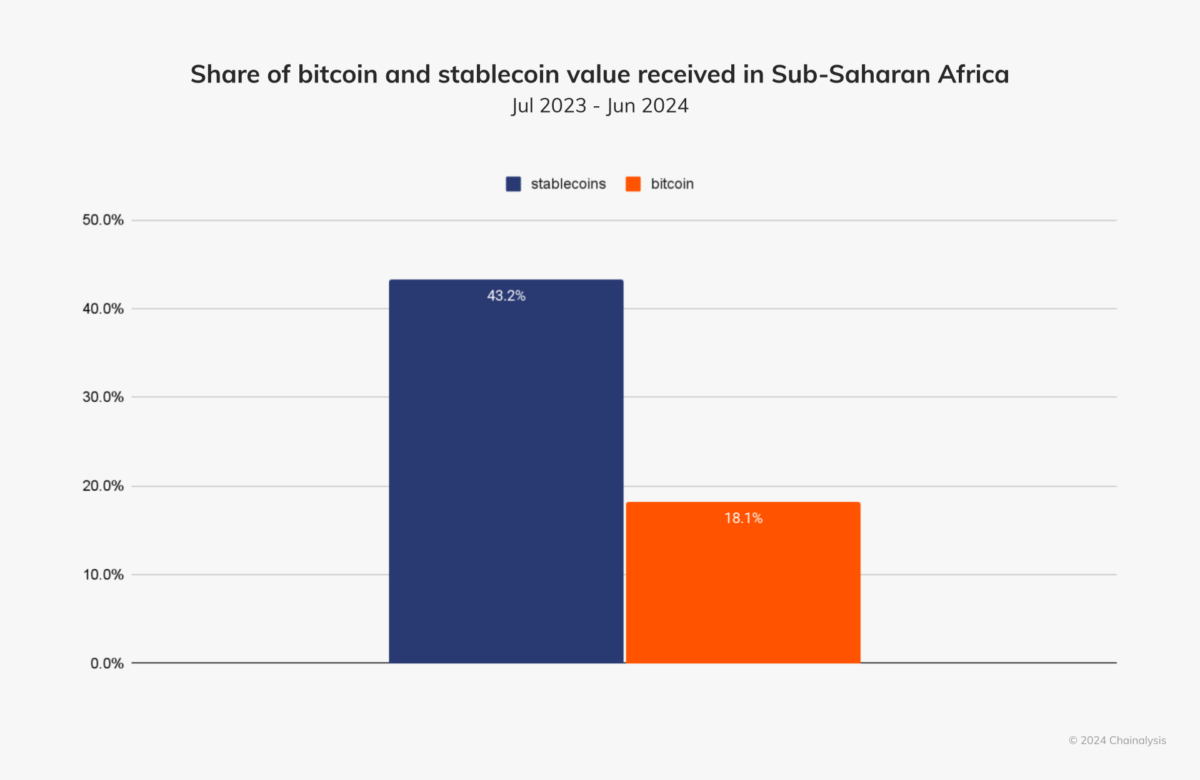

This isn’t just a trend; it’s a clear sign that stablecoins can foster cryptocurrency adoption. In regions like Central & Southern Asia and Oceania, stablecoins are powering cross-border trade and personal remittances, offering a workaround to legacy banking hurdles. In Sub-Saharan Africa, where local currencies are often unstable and U.S. dollar access is limited, dollar-pegged stablecoins like USDT and USDC are providing people with a reliable way to store value, transact globally, and support businesses. Remarkably, stablecoins account for approximately 43% of the region’s total crypto transaction volume.

Platforms such as Binance P2P, Chipper Cash, and Sendwyre have further empowered users to bypass banks entirely, enabling faster, cheaper, and less bureaucratic fund transfers. Unlike volatile cryptocurrencies like Bitcoin, stablecoins hold their peg to the dollar, allowing users to send and receive exact amounts without the risk of price swings.

By eliminating currency conversion issues, slashing fees, removing middlemen, and enabling instant, borderless settlement, stablecoins are not just improving the outdated remittance system—they’re redefining the global movement of money. This is the key to mainstream adoption in crypto.

Related: Is Mass Adoption of Cryptocurrency Achievable, or Will It Remain a Niche Technology?

Stablecoins in Emerging Markets: A Hedge Against Inflation

Across many emerging markets, where hyperinflation, unstable banking systems, and tight currency controls erode public trust in traditional finance, stablecoins are no longer a convenience; they’ve become a lifeline. Acting as digital safe havens, dollar-pegged stablecoins like USDT and USDC offer residents a stable store of value, a means of participating in global commerce, and an escape from the volatility of their local currencies.

Argentina offers a striking example. With inflation rates spiralling and the national currency rapidly losing value, stablecoins have become a cornerstone of financial survival. For many Argentinians, especially small-scale vendors and freelancers, converting daily earnings into stablecoins via platforms like Binance has become a routine practice. In “crypto Buenos Aires,” as the capital is now sometimes called, stablecoins are functioning as unofficial savings accounts. They grant people access to dollar liquidity, shielding their income from constant devaluation and offering a rare sense of financial stability.

A similar pattern is unfolding in Turkey. From April 2023 to March 2024, stablecoin purchases, including USDT and USDC, amounted to 4.3% of the country’s GDP. The sharp depreciation of the Turkish lira and surging inflation have driven everyday citizens to seek shelter in digital dollars. With traditional banks failing to offer the security or reliability once expected of them, stablecoins are stepping in as trusted alternatives.

What is the greatest benefit of stablecoins? In regions like these, it’s financial preservation and access to global markets.

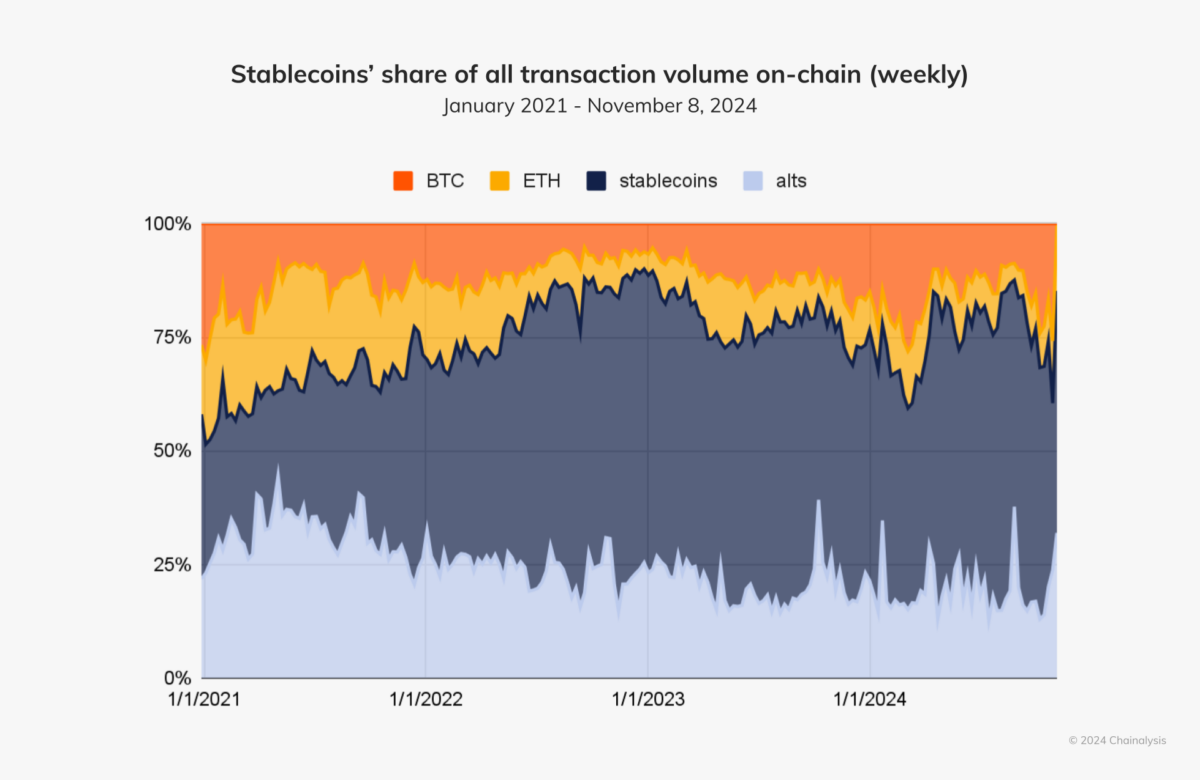

The scale of this shift is backed by hard data. According to Chainalysis, stablecoins have overtaken all other crypto assets in on-chain usage, accounting for over half and, in some cases, up to 75% of all transaction volume in emerging markets from 2021 to 2024.

This growing dominance is more than a trend; it’s a powerful answer to the question, can stablecoins foster cryptocurrency adoption? The data says yes.

Stablecoins Under the Microscope: Balancing Innovation with Regulation

While stablecoins have gained popularity for their speed, accessibility, and borderless functionality, they have also emerged as one of the most pressing concerns for regulators around the world. Their growing influence in the global financial system has sparked intense scrutiny driven by fears of systemic risk, lack of transparency, and potential misuse.

One of the biggest red flags is the sheer scale of some stablecoins and the threat they pose to both the crypto economy and traditional finance. Tether (USDT) and USD Coin (USDC), for instance, boast massive market capitalizations. If public trust in their reserve backing were to erode, it could trigger widespread liquidity crises, shaking investor confidence and sending ripples through global markets. The collapse of TerraUSD (UST) is a stark reminder of how fragile the ecosystem can be.

Transparency, or the lack thereof, is another critical concern. Many stablecoin issuers are criticized for providing delayed or incomplete disclosures about their reserves. Without regular, verifiable audits, it becomes nearly impossible for users to confirm whether these digital assets are truly backed 1:1. This opacity increases the risk of sudden depegging events and undermines market stability concerns that continue to fuel regulatory calls for clearer frameworks and stricter oversight.

Beyond financial risks, stablecoins also raise alarms around financial crime. While beneficial for efficiency and user privacy, their fast transaction speeds and partial anonymity also make them attractive to bad actors. Institutions like the Financial Action Task Force (FATF) have warned that, without proper oversight, stablecoins could become conduits for money laundering, terrorist financing, and other illicit activities.

In response to these growing concerns, legislative action is gaining momentum, especially in the United States. In June this year, President Donald Trump urged the House of Representatives to expedite the passage of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, following its approval in the Senate. This legislation aims to set clearer rules around stablecoin issuance, reserve management, and compliance.

Yet, despite these pressures, stablecoins continue to thrive based on one simple truth: they solve real problems. And that might be the key to mainstream adoption in crypto.

Are Stablecoins the Gateway to Crypto’s Mass Adoption?

What’s the difference between crypto and stablecoins? In short: volatility and usability. While crypto tokens like Bitcoin promise long-term growth, stablecoins offer day-to-day utility. This is why stablecoins are fast emerging as crypto’s stealthy gateway to crypto adoption—an entry point that feels familiar, yet opens the door to an entirely new financial system.

It often begins with a practical need, like sending money home. Someone uses USDT and is amazed by how cheap and fast it is compared to traditional remittance services. That positive experience sparks curiosity. Soon, they’re swapping stablecoins for ETH or BTC, experimenting with DeFi platforms, or even staking and borrowing against their holdings. The transition from casual use to deeper crypto adoption is smooth and almost subconscious.

This subtle progression is crypto’s Trojan horse effect in motion—stablecoins, disguised as simple digital dollars, quietly onboard users into the broader crypto economy. Today, apps like Robinhood and Revolut let users interact with USDC without ever touching a private key. Tech giants like Visa and Mastercard are integrating stablecoins into backend operations, bypassing legacy systems like SWIFT. Governments across Latin America are experimenting with stablecoins for payroll and subsidies, introducing millions to blockchain without calling it crypto.

Stablecoins aren’t just a tool; they’re a bridge. In emerging markets, they’re lifelines amid inflation. In global finance, they’re the infrastructure for a new banking era. For skeptics, they’re the lowest-risk, highest-impact way to enter the space.

Ultimately, mass adoption may not come from hype or speculation, but from stability—and stablecoins are leading the way.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link