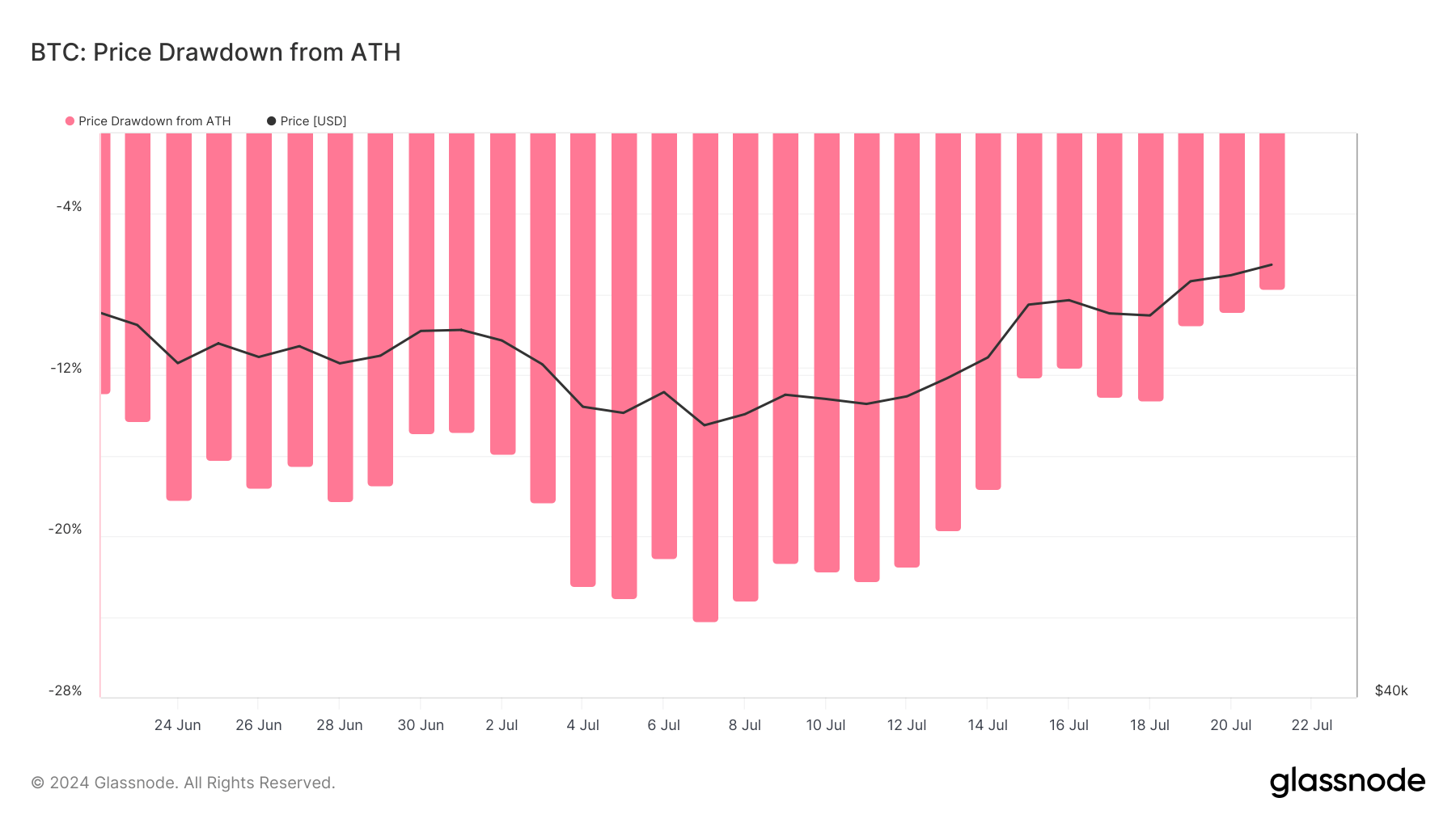

Over the recent weekend, the cryptocurrency behemoth Bitcoin saw its value ascend beyond the $68,000 mark, a move that closely followed President Joe Biden’s announcement of withdrawing from the presidential race set for November 2024. This event underscored the pronounced sensitivity of the global cryptocurrency market to political developments within the United States, highlighting the intricate relationship between politics and the digital asset world.

The ripple effect of this announcement on the Bitcoin price brings to the forefront the intriguing dynamic between the US’s political sphere and its proportional influence over global cryptocurrency trading volumes and market behavior. This intersection of US politics and economic sentiment globally is a testament to the country’s unparalleled status in the realm of financial markets, including the burgeoning sector of cryptocurrencies.

Further analysis into the distribution of trading volumes sheds light on an interesting phenomenon: despite the immense influence that US political and economic news has on global crypto markets, the country’s own share in the worldwide crypto exchange trading volume is relatively modest. According to data from Kaiko, trading volumes on US-based exchanges account for a mere 11.79% of global trades, contrasting sharply with the dominating 88.12% held by global exchanges.

This stark disparity underscores a pivotal narrative: the majority of crypto trading activities through centralized exchanges unfolds outside the United States. This trend can be attributed to various factors, among which the regulatory framework in the US stands out as a predominant influence. The United States, in its cautious approach towards cryptocurrencies, has established a challenging environment for investors through stringent oversight and enforcement actions spearheaded by the Securities and Exchange Commission (SEC). The regulatory complexity, characterized by state-specific compliance requirements, has inadvertently stifled retail investment activities on US soil, deterring a significant chunk of potential market participants.

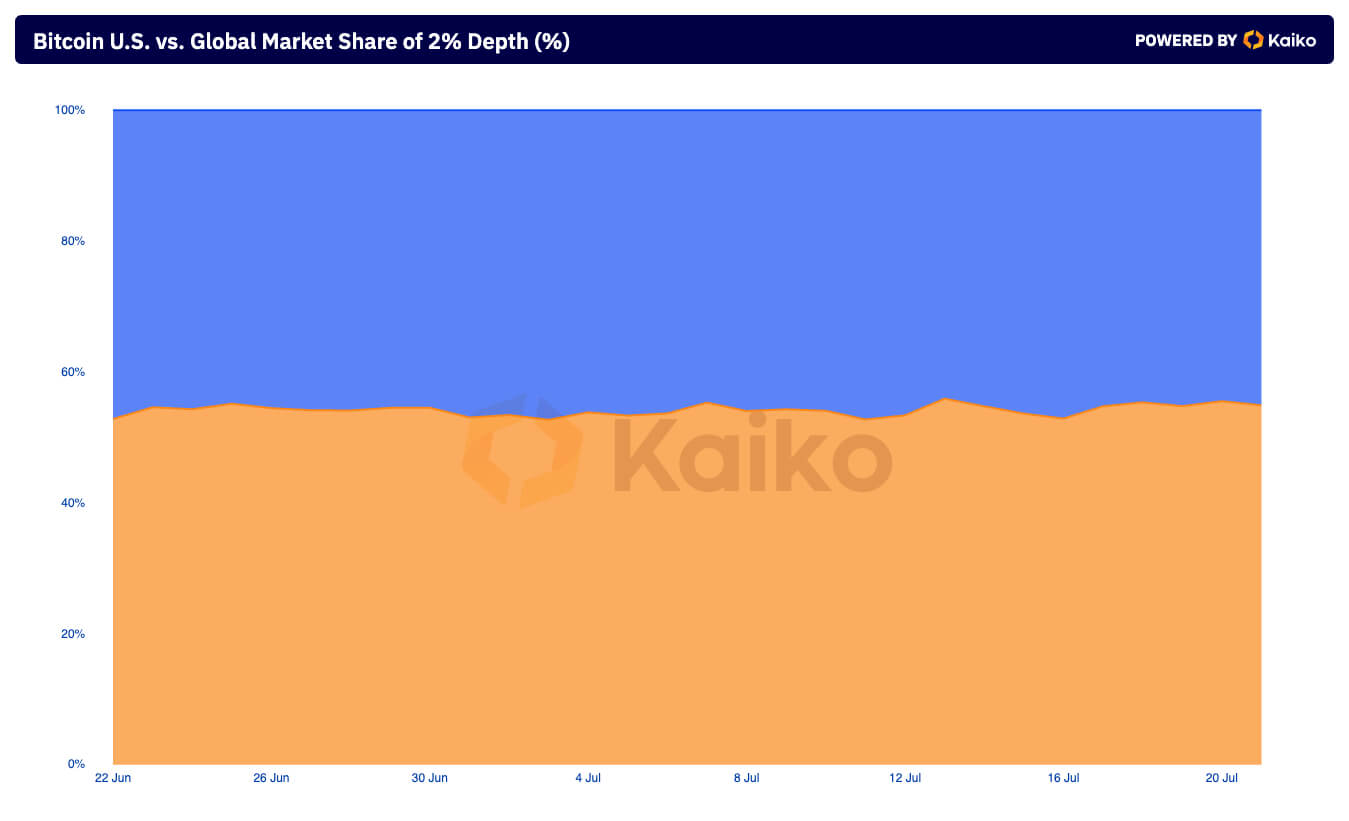

Nevertheless, it’s pivotal to acknowledge that despite its lower trading volume share, the US remarkably accounts for nearly half of the market’s liquidity. According to Kaiko, US exchanges contribute to an impressive 45.09% of the global market depth at the 2% level, showcasing the depth of the financial US market’s ability to absorb sizeable orders without substantial impacts on price volatility, an instrumental attribute for the facilitation and accommodation of institutional investments.

Market depth is a critical indicator of a market’s robustness, demonstrating its capacity to handle substantial transaction volumes without precipitating drastic price alterations. The presence of a deep market, characterized by substantial order books within the 2% price range, reveals a market’s resilience to large-scale buy or sell orders, thereby diminishing price volatility. This trait is particularly advantageous for institutional investors who engage in significant trading activities.

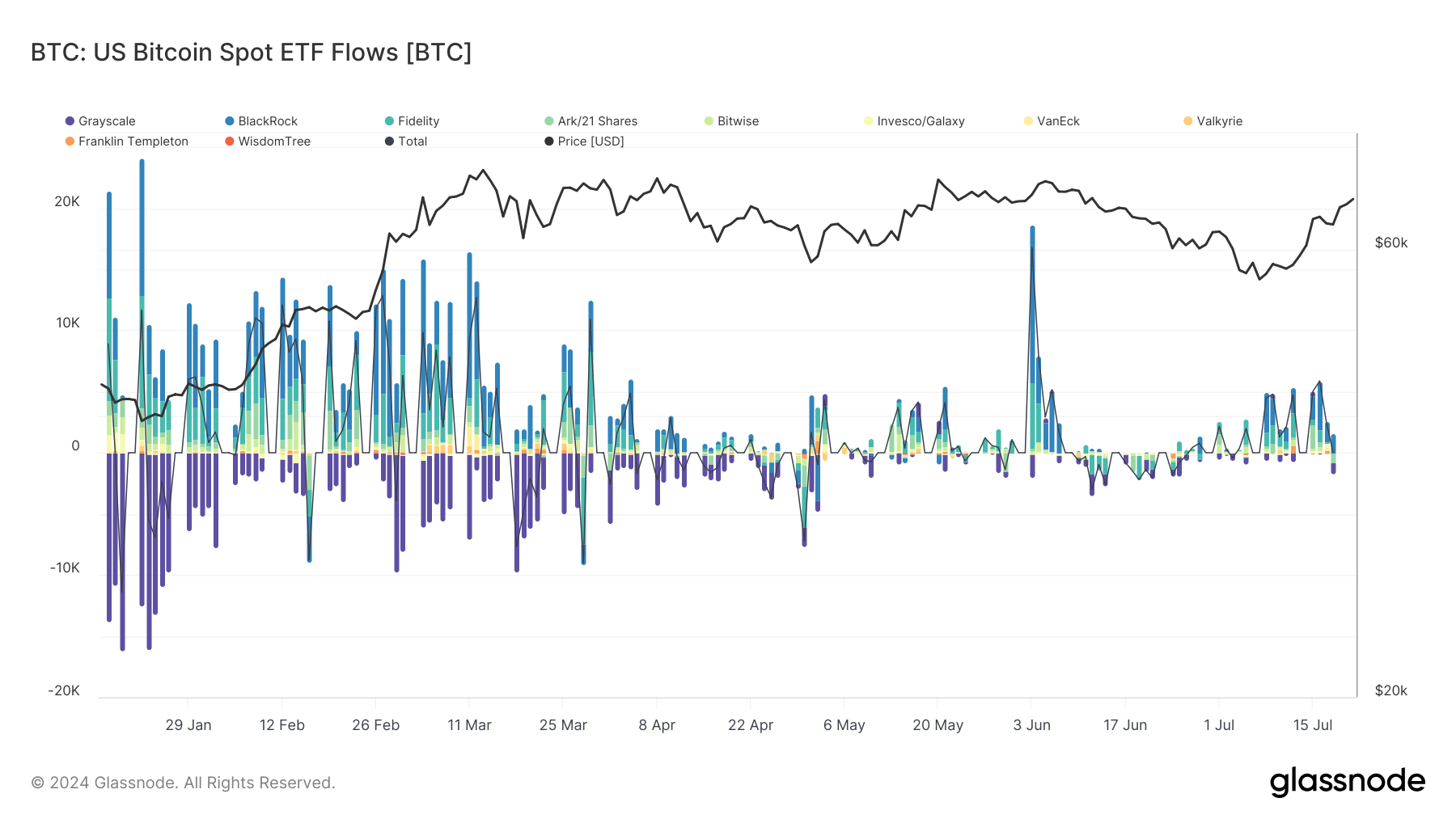

The surge in liquidity within the US market can be primarily attributed to the increasing participation of institutional investors. This demographic’s interest has substantially escalated following the introduction of spot Bitcoin Exchange-Traded Funds (ETFs) within the year. Spot Bitcoin ETFs have engendered heightened liquidity and bolstered the depth of order books on the exchanges where these financial products are transacted or monitored. The mechanics involved in the creation and redemption of these ETF shares entail large-scale operations in the underlying Bitcoin market, further emphasizing the symbiotic relationship between these investment vehicles and the broader market dynamics.

This expansive market framework is the underlying reason why news emanating from the United States can catalyze such significant shifts in Bitcoin’s valuation, propelling it to within 8% of its all-time high (ATH), notwithstanding the nation’s modest volume share. The US market’s profound liquidity serves as a standard-bearing influence, firmly anchoring its position within the global financial ecosystem.

In summation, the story of the US’s pivotal role in the global cryptocurrency market unfolds through its distinctive influence, derived not from its trading volume but from its deep market liquidity. This paradigm aptly demonstrates the intricate dance between regulatory frameworks, institutional participation, and broader market dynamics shaping the crypto landscape.

As we marvel at the dynamism and resilience of the crypto market in response to significant US political and economic developments, it’s evident that the ecosystem functions as a global entity, deeply interconnected and reflective of broader societal trends. For more comprehensive insights and trends within the decentralized finance arena, consider visiting DeFi Daily News to stay informed on the latest developments.

The intrigue surrounding the impact of US political shifts on the crypto market only serves to spotlight further the burgeoning relationship between traditional financial mechanisms and the emerging digital economy. As the narrative unfolds, the continuous harmonization and discordance between these two spheres promise a fascinating journey ahead, teeming with opportunities for innovation, investment, and introspection. In this ever-evolving saga, the confluence of factors that drive market sentiment and value discovery in the crypto universe continues to captivate and entertain, echoing the broader complexities of an increasingly digitized global economy.