rewrite this content using a minimum of 1200 words and keep HTML tags

$BGEO.L is a retail and commercial bank from Georgia. The group comprehends two different entities, mainly: Georgian Financial Services (GFS), through Bank of Georgia (AFS); and Armenian Financial Services, through Ameriabank.

Key Highlights:

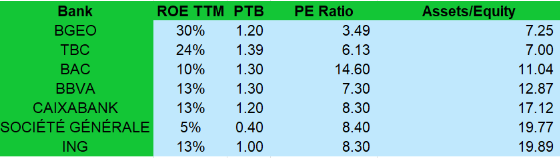

The group has a Return on Equity of over 30%, way above most peers.

The stock is currently priced at below 4 times earnings, making it a hidden gem

AFS was recently acquired at a ridiculous price

The business:

The business of the company is mainly centered in Georgia and Armenia. The Bank of Georgia currently has a market share by total loans of over 37%, operating in a duopolistic situation with TBC. This part of the business has a ROE of over 36%, while growing its loan book by over 23% per year.

Ameriabank was recently incorporated into the group. It has a ROE of over 20% and it’s currently growing its loan book by 6% on a constant currency. The management of the company sees a big opportunity in Armenia, so they’ll focus on growth in the region. The current market share of Ameriabank is 19.6%.

Source: Company’s Q3 2024 earnings release

Ameriabank’s acquisition was made at the end of 2024 for 0.65 times book value (Price-to-book, or PTB ratio), or 2.6 times earnings. That means that in three years of profits, the company will get back the price it paid, which is an insane price for a leading bank.

Valuation:

The company is currently trading at a PE ratio of 3.49 times. That’s about half of its main competitor in the region, TBC, despite having grown revenues over 35% during the past 3 years, compared with 20.9% growth for TBC. Also, the ROE of the company is among the highest of any peer, including big well-known banks.

Source: Finchat

This ROE does not come as a consequence of more leverage. On the contrary, the company is amongst the lowest leveraged banks in the world, with an assets-to-equity ratio of seven times. Basically, BGEO obtains more than twice the profitability of ING with almost one-third of the leverage.

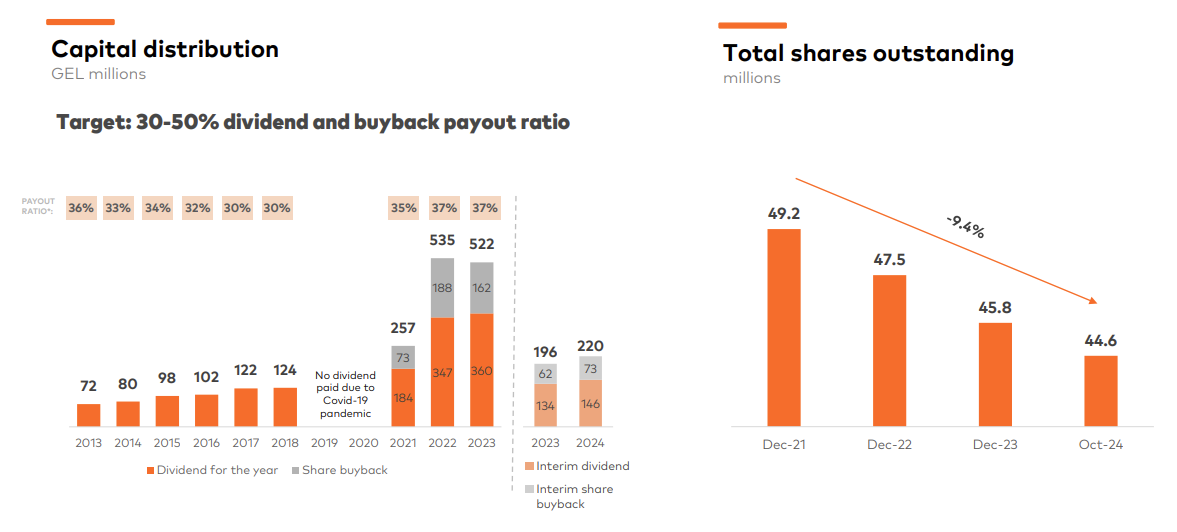

Regarding its dividend policy, the company is committed to paying out 30% to 50% of the net income in dividends and buybacks. Currently, the company is paying a dividend of 4%. But that’s not all: it has also managed to reduce the amount of shares outstanding by 9.4% in 3 years.

Source: Company’s Q3 2024 earnings release

In my opinion, the company should trade at a PE multiple of 6 times, in line with its peer TBC. This would mean an immediate upside of 73%. But more interestingly, the company expects to increase its annual loan book growth by 15%. If we translate this to EPS growth, which is below the historical average, we would have a two-year upside of 129%, or an Annual Rate of Return of over 50%, disregarding the effect of dividends and buybacks.

Risks:

Geopolitical situation: Georgia has had in the past issues with Russia, and they still have a dispute for two regions. This could be potentially dangerous for the company.

Political instability: Georgia has recently gone through elections, and there have been many protests about them. It could lead potentially to a worse environment to do business and could affect directly the economy.

Currency risk: The company does business mainly in GEL (Georgian Lari), AMD (Armenian Dram), and USD (US Dollar). However, the company trades in the UK. If the local currencies depreciate, that could affect earnings in GBP. Also, some loans are in USD, which could affect delinquency rates if the USD becomes stronger.

Mitigating currency risk:

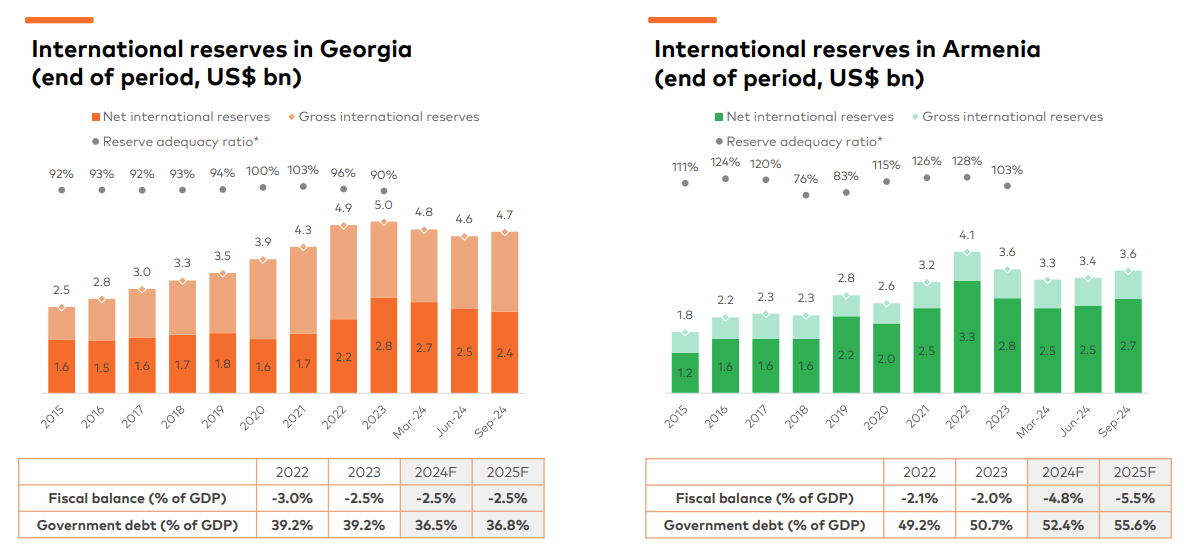

Both currencies, AMD and GEL have been good performers during 2024 compared to the USD. Currently, both countries have inflation of near 0.5%, while having interest rates of 8% and 6.75% for Georgia and Armenia, respectively. Also, international reserves in both countries remain high, supporting strong currencies.

Source: Company’s Q3 2024 earnings release

Also, although Georgia may sound like an exotic country, it actually ranks the 53rd least corrupt nation, out of 180, for Trading Economics. As a reference, Italy is the 52nd of the rank, Spain currently obtains the 46th position, the US is the 28th, and Mexico is the 140th.

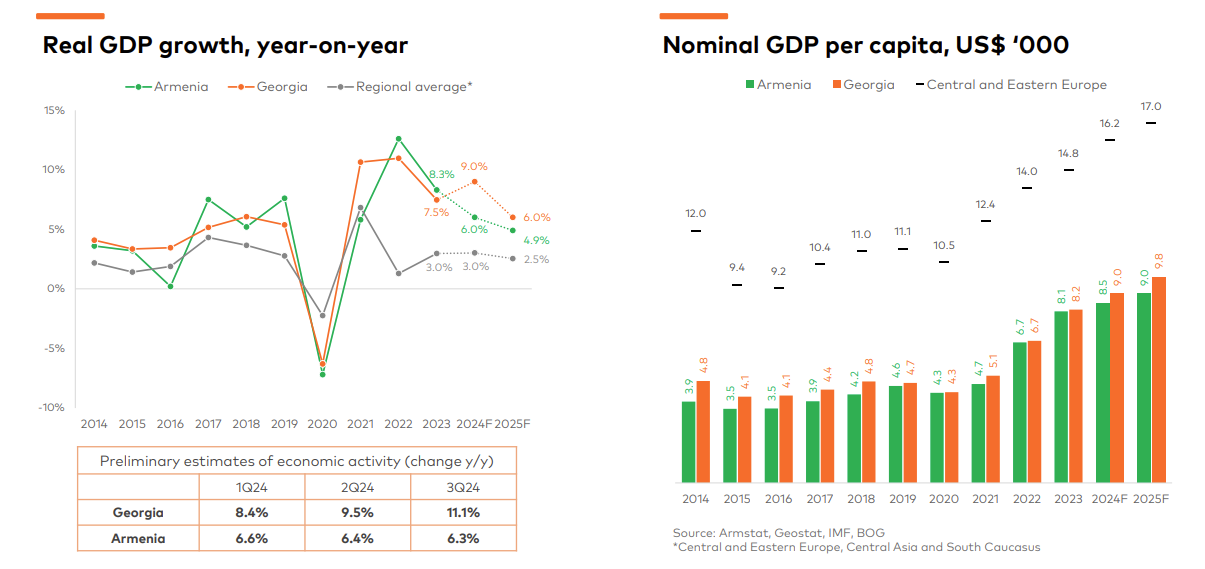

The GDP of both countries, Georgia and Armenia, has been growing rapidly, although it is still significantly lower on a per capita basis than Central and Eastern European countries, which shows that both economies still have plenty of room to grow.

Source: Company’s Q3 2024 earnings release

Conclusion:

Although the geopolitical risk might be scary, $BGEO.L is a solid business, with impressive returns on equity, growth, profitability, and capital management. Even if we need to wait for the earnings releases for the market to realize the growth potential that the company offers, we are still sitting at, at least, a 7.5% shareholder yield (dividends plus buybacks). If the company paid out 50% of the net income, the shareholder yield would be about 12.5% as of today’s earnings.

With the above being the bear case, the company has also traded in the past at over 9 times earnings. For the bull case, considering 9 times earnings for a better than the average business is reasonable, even if it’s placed in an emerging market. This would give us an instant upside of 160% from the current price.

All in all, buying such a great business for less than 4 times earnings looks like a no-brainer to me. All the reasonable scenarios offer great upside, and that’s why I’m buying $BGEO.L for my portfolio.

Catalysts:

Improvement of the political tension in Georgia

Earnings releases that prove the company’s profitable growth, both in Georgia and Armenia

Would you invest in this bank? Or do you think that the risk outweigh the potential benefits?

I own a position in $BGEO.L at the time of writing.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link