rewrite this content using a minimum of 1200 words and keep HTML tags

MicroStrategy ($MSTR): The Corporate Bitcoin Treasury Pioneer

MicroStrategy, once primarily an enterprise analytics software firm, has radically reinvented itself as the world’s leading publicly-traded corporate Bitcoin treasury. Under the vision of its executive chairman and co-founder, Michael Saylor, the company has deployed a straightforward yet powerful strategy: to acquire and hold Bitcoin as its primary treasury reserve asset.

This bold corporate maneuver has created a new niche in the financial world, offering traditional equity investors a familiar vehicle for gaining exposure to Bitcoin’s price movements. However, this strategy is a high-stakes endeavor, tying the company’s fate directly to the volatile cryptocurrency market. The recent sharp decline in Bitcoin’s price from its October 2025 peak has placed MicroStrategy’s model under a severe stress test, revealing both its inherent vulnerabilities and the steadfast conviction of its leadership.

Bitcoin/USD price chart illustrating the recent drop

Source: ProRealTime.com

The Mechanics of a Bitcoin Treasury Company

A Bitcoin treasury company allocates the majority of its corporate reserves to Bitcoin. The core philosophy is to treat Bitcoin not as a speculative asset, but as a long-term store of value a hedge against inflation and a diversifier away from traditional fiat currencies.

MicroStrategy’s execution of this model involves several key mechanisms:

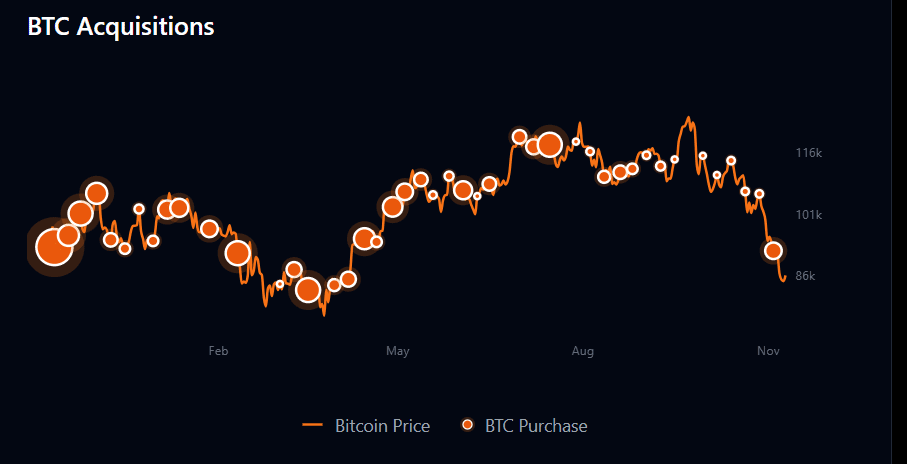

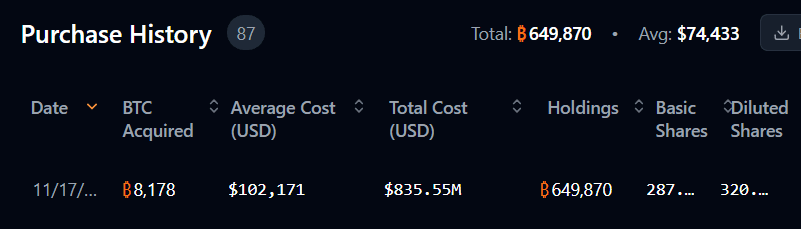

Capital Raising and Acquisition: The company funds its Bitcoin purchases by raising capital through equity sales and issuing convertible debt. This cash is then deployed to accumulate Bitcoin. For example, in November 2025 alone, the company acquired over $1.5 billion worth of Bitcoin.

The Strategic Flywheel: At its peak, MicroStrategy employed a self-reinforcing cycle. It would issue shares, use the proceeds to buy Bitcoin, and then leverage the subsequent rally in Bitcoin’s price to justify further equity issuance and accumulation. This once allowed its market value to trade at a significant premium to the underlying value of its Bitcoin holdings.

Holding and Accounting: The company’s Bitcoin is recorded on its balance sheet. Under applicable accounting rules, the value of these holdings is adjusted each quarter. A rising Bitcoin price leads to unrealized gains, while a fall triggers unrealized losses, creating significant earnings volatility.

As of mid-November 2025, MicroStrategy holds a staggering 649,870 BTC, acquired at an average price of $74,433 per Bitcoin. Despite the recent downturn, this position still shows an unrealized profit of approximately $6.1 billion, highlighting the initial success of its aggressive accumulation.

Source: https://saylortracker.com/?tab=home

Source: https://saylortracker.com/?tab=home

Significant Risks Exposed by a Falling Bitcoin Price

The recent market correction has laid bare the acute risks embedded in MicroStrategy’s model.

1. Stock Price Correlation and Liquidity PressureMicroStrategy’s stock (MSTR) is highly correlated with Bitcoin. As Bitcoin fell from its all-time high of over $126,000 in October 2025 to around $91,600 in November, MSTR’s stock price plummeted by nearly 60% from its July highs. The company’s primary asset is Bitcoin, making its stock a direct proxy.

MSTR stock price chart illustrating the recent drop

Source: ProRealTime.com

2. Dilution and Eroding PremiumTo continue buying Bitcoin during the downturn, MicroStrategy has repeatedly issued new shares, leading to significant shareholder dilution. Its common stock count ballooned from 160 million to over 286 million shares in just one year. Furthermore, the premium investors were once willing to pay for MSTR’s strategic execution has largely evaporated. Its market net asset value (mNAV) has slipped to just below 1 (0.97), meaning the stock trades only marginally lower than the value of the Bitcoin it holds . This indicates fading investor conviction in the company’s strategic premium.

Source: https://saylortracker.com/?tab=home

3. A Pure, Unhedged BetUnlike some other entities, MicroStrategy does not use hedging strategies (like options) to protect against downside volatility. Its treasury relies “primarily on the movement of the Bitcoin price,” making it a pure, unhedged bet. Without complementary revenue streams or yield-generating strategies, the company is fully exposed to market swings.

4. Regulatory and Index Exclusion RisksThere is growing scrutiny of companies holding vast digital assets. Major index provider MSCI is considering excluding Bitcoin-heavy firms like MicroStrategy from its flagship equity indexes, potentially categorizing them as “investment funds.” JPMorgan warns this could trigger up to $2.8 billion in forced selling from passive funds, creating massive downward pressure on the stock.

The Deconstructed Risk Framework

Primary Risk: Bitcoin Volatility: MSTR’s fate is inextricably linked to Bitcoin’s price, with declines often magnified due to leverage.

Solvency Risk: The Debt Spiral: The convertible debt used to fund purchases creates danger. A severe price drop could trigger margin calls, potentially forcing the company to sell Bitcoin at a loss and creating a catastrophic feedback loop.

Competition from Spot Bitcoin ETFs: The advent of low-cost, liquid, and debt-free Spot Bitcoin ETFs (e.g., from BlackRock, Fidelity) challenges MSTR’s value proposition. Investors can now gain pure Bitcoin exposure without MSTR’s corporate and leverage risks.

Regulatory and Accounting Uncertainty: Hostile regulations or changes in accounting standards to enforce “mark-to-market” reporting could cripple the treasury’s value or introduce extreme earnings volatility.

Corporate Execution Risks: The strategy represents an extreme concentration in one asset, is highly dependent on Michael Saylor’s leadership, and risks neglecting the core software business that generates operational cash flow.

Potential Opportunities and the Bull Case

Despite the clear risks, the model presents compelling opportunities for its proponents.

Leveraged Bitcoin Exposure: For believers in Bitcoin’s long-term rise, MSTR offers a way to gain leveraged exposure through a traditional stock, as each share represents a claim on a growing, debt-funded pool of Bitcoin.

The “Digital Gold” Conviction: Saylor and MicroStrategy are making a long-term bet on Bitcoin as “digital gold.” From this perspective, short-term crashes are buying opportunities, not strategy failures, as evidenced by the company’s continued purchases during the downturn.

Compelling Valuation Metrics: The recent crash has driven MicroStrategy’s price-to-earnings (P/E) ratio down to a seemingly low 8.67. Value investors may see this as a buying opportunity, assuming the core software business retains value and the Bitcoin thesis eventually prevails.

The Road Ahead

The future of MicroStrategy ($MSTR) hinges on Bitcoin’s price recovery. Until then, the stock will likely remain under pressure. The company must also navigate the potential fallout from possible exclusion from major stock indexes, which would shrink its investor base.

The recent turmoil has sparked a debate about the sustainability of “passive” Bitcoin hoarding versus more active, yield-generating strategies. MicroStrategy’s unwavering, unhedged approach is the ultimate test of a single thesis: that Bitcoin’s long-term value appreciation will eclipse all short-term volatility and risks.

Disclaimer: This article is based on information available as of November 2025. The situation surrounding MicroStrategy and cryptocurrency markets is highly dynamic and subject to rapid change.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link