rewrite this content using a minimum of 1200 words and keep HTML tags

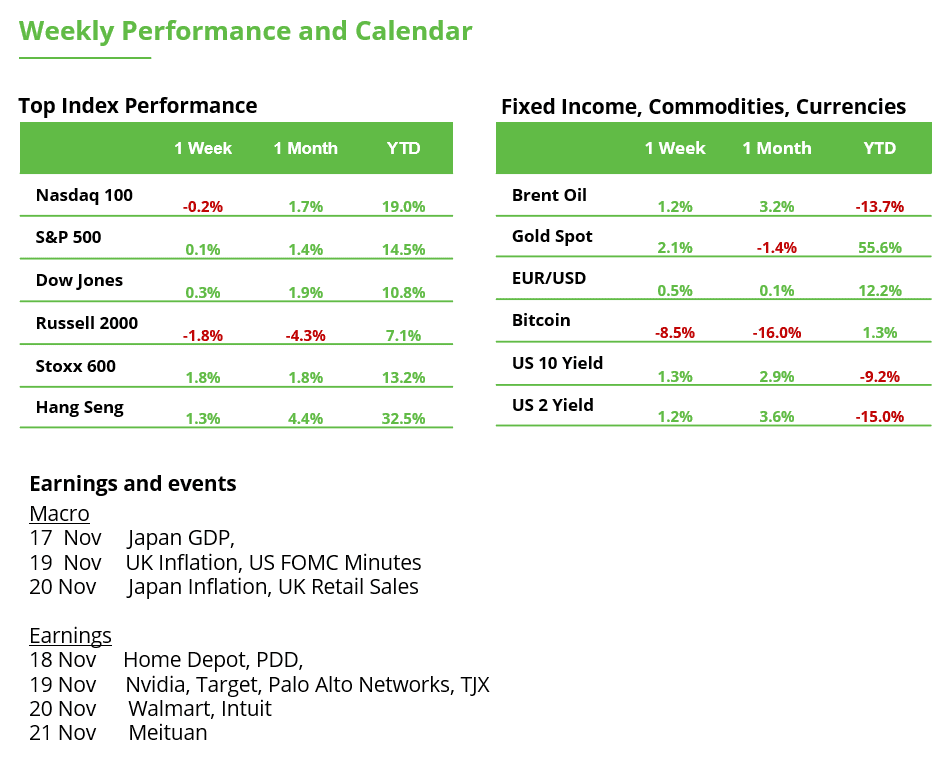

Analyst Weekly, November 17, 2025

Bitcoin’s Pullback Tests Market Conviction

Bitcoin’s break below $100K isn’t a trend killer, yet. The recent pullback in bitcoin and the broader crypto market reflects a process of technical readjustment within a more uncertain macroeconomic context, rather than a structural change in trend.

What’s driving the dip?

After a long run-up, profit-taking and rising global risk aversion triggered a selloff. BTC has now slipped under a key support, its prior high that’s held for nearly two years, suggesting traders are reevaluating their risk tolerance.

What do technicals say?

With BTC now below its two-year support and major moving averages (50 and 200 day), oversold signals may not guarantee an immediate rebound, suggesting this phase could extend before a durable floor emerges

Still, the fundamentals hold up.

Despite the deterioration in sentiment, on-chain fundamentals remain solid, with more than 70% of issued BTC still in profit and addresses holding over 1,000 BTC increasing their positions by more than 45,000 BTC in the past week, a clear signal of institutional accumulation. This behavior points to a market in consolidation rather than a structural reversal.

The takeaway:

Risk discipline remains key. A sustained drop below the $89K–$90K range would signal a breakdown in support and a potential shift toward a more extended bearish phase. But if $95K holds, this correction could evolve into a buy-the-dip opportunity for long-term investors.

The Fog, the Fed, and the Fear Gauge

The US economy is in a holding pattern and the Fed’s keeping one foot on the brake. The odds of a December rate cut have fallen to about 53%, down sharply from near-certainty before the last FOMC meeting. The Fed’s caution underscores the fragile balance between preventing a policy overshoot and waiting too long to ease.

Vol’s Parallel Shift: From Calm to Caution

What’s Happening: Volatility woke up. As the VIX broke through 22 last week, there wasn’t just a front-end spike (the usual fear reaction). The entire VIX curve shifted in parallel, with all maturities pricing in higher volatility. That means traders aren’t just nervous about the short term; they’re baking in more uncertainty across the board.

What’s Driving It:

Vol-control funds reduced equity exposures.

Nvidia earnings (Nov 19) have traders on edge.

Liquidity remains thin, amplifying intraday spikes in implied volatility.

Why It Matters: A parallel shift higher in the VIX curve happens when macro uncertainty (like the Fed’s foggy path) meets market catalysts (like mega-cap earnings).

UK Budget Jitters: Why Credibility Now Matters More Than Ever

Markets reacted sharply today following reports that the UK government may reverse plans to raise income tax. The volatility reflects a deeper concern: fiscal credibility is critical, not only for stabilising public finances, but also for tackling the cost-of-living crisis.

Freezing income tax thresholds alone won’t be enough. Without a clear and balanced approach to raising revenue, the UK risks repeated tax shifts that could undermine confidence and economic resilience. Crucially, fiscal decisions must support and not conflict with the Bank of England’s efforts to bring inflation down. Last year’s budget likely added to inflationary pressures, delaying the path to lower interest rates.

A credible budget that helps ease inflation would reduce household bills, lower borrowing costs, and support long-term market stability. That includes targeted tax measures and smarter public spending, particularly as health and welfare costs continue to grow. Equally important is maintaining consistency around pensions and savings rules to support long-term investor confidence.

Looking ahead, proposals to repurpose ISAs to channel more investment into UK equities could help drive sustainable growth, without raising taxes.

For retail investors, today’s developments reinforce the importance of diversification. If fiscal discipline holds, gilts and interest-sensitive assets may benefit. Inflation hedges like index-linked bonds or gold could play a smaller role as disinflation takes hold.

Earnings on Wednesday: Nvidia Remains the Pace-Setter of the Global AI Story

The U.S. earnings season is drawing to a close, but one final highlight is adding excitement. On Wednesday after the market close, Nvidia will report its results. For many investors, the stock has long been more than just another tech name. It’s seen as a barometer of the global AI story, and a key factor for the continuation of the year-end rally.

After two years of AI euphoria, Nvidia now appears to have reached a stage where growth is stabilizing at a high level, but no longer expanding exponentially. Wall Street expects third-quarter revenue to rise by 56.6% to $54.9 billion, while analysts forecast earnings per share to increase by 54.6% to $1.25.

The Nvidia stock has come under pressure several times in recent trading sessions. However, the two key support zones (so-called Fair Value Gaps) have held: between $183 and $188, and $178 and $180. From a technical perspective, this suggests a potential test of the record high at $212. Should these supports fail — for example, due to disappointing Q4 results or a weak outlook — the stock could retreat toward the September low near $164.

Nvidia, weekly chart. Source: eToro

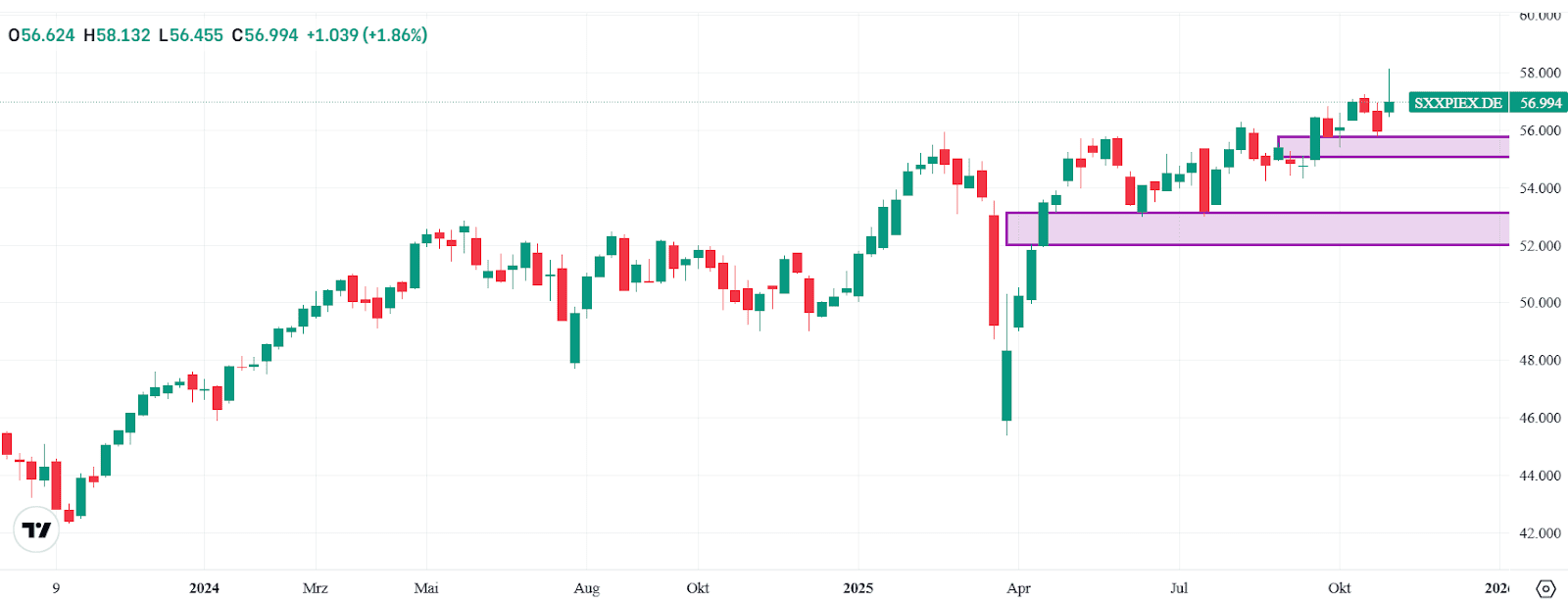

European Stock Market: False Breakout, but Rally Chances Remain Intact

The STOXX Europe 600 (iShares) rose 1.8% last week to around 57 points. However, the false breakout, visible through the long upper shadow, caused some short-term disappointment. From a technical perspective, the chances for a year-end rally still look good. A continuation of the trend, meaning a second breakout attempt, remains the more likely scenario.

If negative sentiment persists, the support zone (Fair Value Gap) between 55.10 and 55.80 points could come into focus. A break below that range would cloud the short-term technical picture, but it wouldn’t jeopardize the long-term uptrend. The next support area would then be found between 52 and 53 points.

STOXX Europe 600, weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link