rewrite this content using a minimum of 1200 words and keep HTML tags

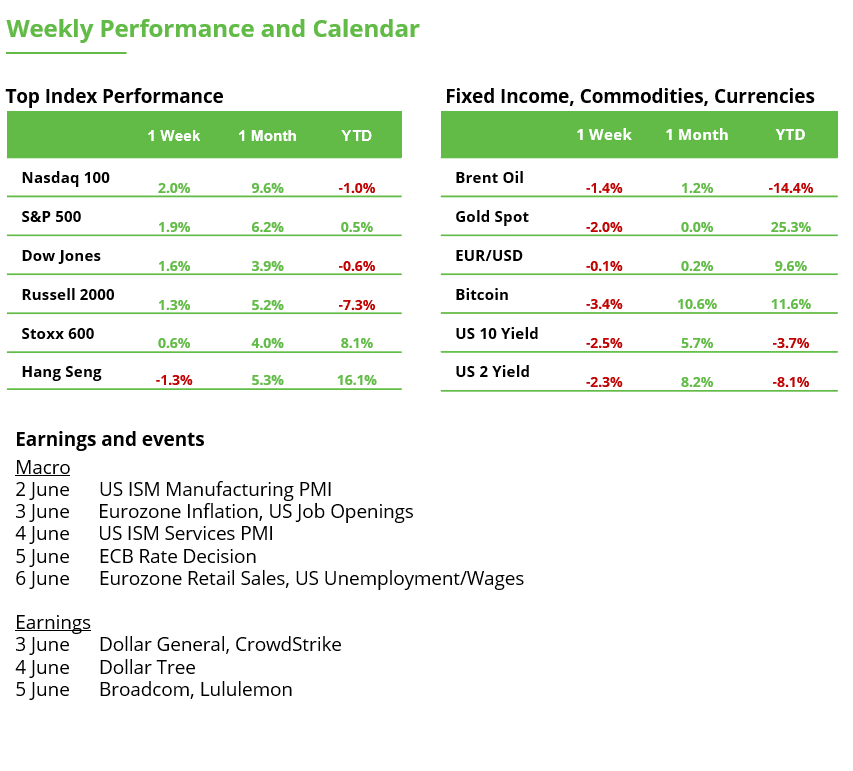

Analyst Weekly, June 2, 2025

From Internet to Intelligence: Mary Meeker’s AI Playbook for the Next Decade

Mary Meeker, long dubbed the “Queen of the Internet,” has returned to long-form with the AI Trends Report 2025, her first major deep-dive since pausing the Internet Trends Report in 2019.

Over two decades, she consistently identified key inflections: the explosion of internet users (1996), online ads overtaking print (2000), and mobile’s eventual dominance (2008). At Kleiner Perkins and later BOND Capital, she backed many of tech’s iconic names- Facebook, Spotify, Twitter, Square, Snap.

AI is shaping up to be one of the most capital-intensive and transformational tech shifts since the internet. The report highlights that Big Tech has already spent over $200B on AI infrastructure in 2024 alone, with NVIDIA emerging as the standout winner, now accounting for 25% of global data center CapEx.

Crucially, while training AI models remains costly (often $100M+), the cost to use them (called inference) has dropped ~99.7% in two years. That’s fueling a surge in developer and enterprise adoption. Microsoft’s AI revenue hit $13B; OpenAI crossed $3.7B; Anthropic and others are seeing similar growth.

Investment Takeaway:

This setup has opened up investment opportunities across three fronts: (1) infrastructure providers (NVIDIA, Oracle, CoreWeave), (2) enterprise software embedding AI into workflows (Microsoft, Salesforce, Adobe), and (3) specialized AI-first verticals in healthcare, law, and industrials (e.g., Abridge, Harvey, Anduril). Meanwhile, China’s open-source LLMs are rapidly narrowing the performance gap, raising geopolitical and competitive considerations.

The report underscores a historic platform shift, likened to mobile or cloud, with the “interface layer” moving from apps to agents. The next decade of productivity (and returns) may come from whoever owns that layer. Investors should position across both enablers (infrastructure, chips, models) and integrators (software, automation).

Earnings Watch: Lower Bar, Higher Surprise Potential

Wall Street is dialing back full-year S&P 500 profit forecasts- now expecting 7% EPS growth in 2025. That’s down slightly, but still strong vs. the 2.3% average before past recessions. Q1 earnings already showed resilience: profits jumped 13%, with sales up 5%. Most of the cuts are focused on Q2, where tariff-driven cost increases and demand headwinds are expected to hit hardest.

But here’s the twist: lower expectations could set the stage for upside surprises. If companies manage supply chain shifts, or hold pricing power, Q2 could beat the (now-lowered) bar- especially for industrials and consumer discretionary.

Volatility Watch: Fragile Calm

Right now, markets seem to be on solid footing. Internal momentum looks healthy, with more than half of S&P 500 stocks just hit new 20-day highs, a signal that has historically pointed to strong 6-month returns. Industrials are leading the way, and even the key Discretionary vs. Staples ratio, a gauge of risk appetite, has turned higher after a brief dip.

That said, there are several developments on the radar that could stir volatility in the coming weeks:

Liquidity squeeze: Treasury cash balances (TGA) begin draining on June 15.

Fiscal stress: Net interest costs now make up 18% of US tax revenue.

Tariff cliff: The current pause on reciprocal tariffs expires July 9 and we may not have court clarity by then (see below). The legal appeals process is moving slowly, making it harder for the US to finalize new trade deals in time.

Tariff Drama: Court Says No, Appeals Say Hold Up

A US court ruled US tariffs are illegal and gave a 10-day rollback deadline – but plot twist: an appeals court hit pause. So for now, tariffs stay. The legal fight could stretch into summer, maybe even to the Supreme Court.

Why it matters: The current truce on reciprocal tariffs ends July 9, and we might not have legal clarity by then. That’s making it harder for the US to ink new trade deals, giving other countries a reason to play hardball.

Big picture: Legal uncertainty = market volatility. If global partners think the US is losing grip on enforcement, they could retaliate and markets don’t love uncertainty. Keep an eye on volatility as this unfolds.

Now Everyone’s Playing Hardball: The EU’s stalling on concessions, possibly using US legal uncertainty as leverage. Trump tossed out a 50% tariff threat last week, but Brussels didn’t flinch. Next move? The G7 Summit (mid-June) will be key to watch for progress, especially with Japan.

Meanwhile, China’s dragging its feet on a May 12 tariff deal to restart rare-earth exports (yep, we had flagged it). The US hit back with tighter export controls.

The vibe: If the US looks uncertain, others will take advantage. It’s shaping up to be a tense summer for trade.

Gold’s Rise Reflects Structural Shifts in Reserve Management

The yellow metal remains elevated near record highs. Gold is hovering around $3,300/oz after a 26% surge this year, underpinned by its safe-haven appeal. We think that gold’s ascent past $3,300 is not the product of speculative excess but the result of a sustained shift in how global institutions manage reserve assets. Central banks have been the dominant buyers over the past two years, signaling a structural rather than cyclical revaluation.

This trend accelerated after 2022, when geopolitical events highlighted the risks of overconcentration in a single reserve asset class. In response, a growing number of countries, particularly in Asia and the Middle East, began diversifying away from sovereign debt holdings, notably US Treasuries. With no credible alternative reserve currency, many have increased allocations to gold- a neutral, liquid, and historically recognized store of value.

Investor positioning, by contrast, has remained conservative. Gold currently accounts for roughly 1% of global investment portfolios. That figure is far below historical levels: during the Bretton Woods era, gold and related assets made up 50–60% of institutional holdings. While a return to those levels is neither likely nor desirable in a modern financial system, even a modest reallocation to 3–5% would imply significant incremental demand.

The recent uptick in ETF inflows and fund exposure suggests that private investors are beginning to follow central banks into the trade.

Silver, meanwhile, has lagged gold but may present asymmetric upside. While central banks do not hold silver, its dual role as a monetary metal and a critical industrial input, particularly in solar, batteries, and semiconductors, makes it increasingly relevant in a global economy transitioning toward electrification.

For investors, a balanced approach remains prudent: 75–80% exposure to physical gold or gold ETFs for stability, and 20–25% to high-quality miners for upside potential. The latter remain deeply discounted relative to bullion but carry materially higher volatility.

Investor Takeaway: We see a compelling case for increasing long-term exposure to gold. Recent price action has created a more attractive entry point and further opportunities may emerge. Over the long-term, we believe gold remains a strategic asset: a core holding amid accelerating de-globalization, and a transition asset during a period marked by policy uncertainty and central bank balance sheet shifts.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link