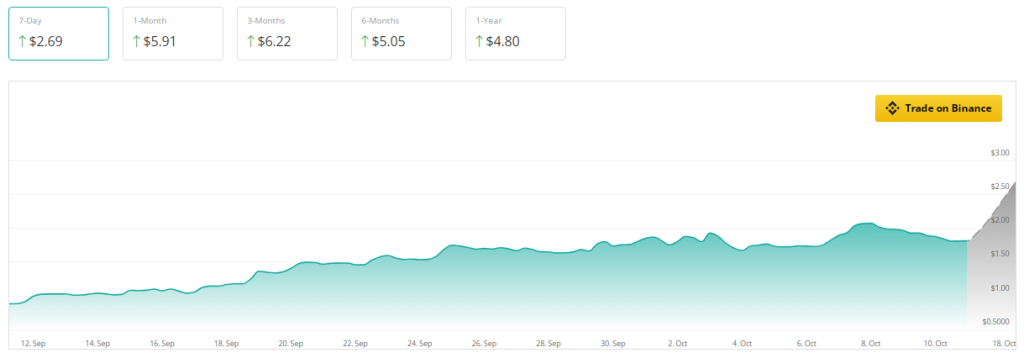

Throughout the last month, the cryptocurrency Sui [SUI] has witnessed a remarkable surge in its journey within the digital market sphere, tripling its market capitalization, a feat that has caught the eye of investors and crypto enthusiasts alike. This impressive growth spurt saw the token’s value escalate by over 100%, elevating its market capitalization to soar beyond the $5 billion mark. However, as the adage goes in the volatile world of cryptocurrencies, what ascends must, even if just momentarily, descend.

Source: Coingecko

Related Reading

Following weeks of a bullish momentum, signs are beginning to surface suggesting that SUI’s rapid ascent is hitting a pause. The trading arena is abuzz with speculations, as market participants keenly anticipate the next chapter for this digital asset that was until recently, the toast of the crypto town. Forecasting platforms such as CoinCheckup are pointing towards a curious anomaly; SUI is purportedly trading at a level 220% below what was anticipated for the upcoming month, hinting at a potential undervaluation scenario.

Price Slips And Declining Market Activity

The value of SUI witnessed a slight downturn, priced at $1.84 at the moment, showcasing a decline of 5% in a mere 24-hour timeframe. CoinMarketCap reports further accentuate this downward trend, with trading volumes experiencing a contraction of 4%. This notable dip in market activity subtly indicates a dwindling interest, at least temporarily, towards the coin.

The technical analysis doesn’t paint a rosy picture either. The Chaikin Money Flow (CMF) indicator, a metric assessing the inflow and outflow of money for a given asset, has also showcased a declining trend over the past week. A negative downturn in the CMF points towards escalating selling pressure, overshadowing buying interest, a scenario not particularly favorable for price stability.

SUI: Slowing Momentum But Potential Bounce

The sell-off phase commenced as the Relative Strength Index (RSI) for SUI descended beneath a critical threshold, hinting at a potential momentum slowdown. Nevertheless, there exists a silver lining; a resurgence in the RSI could signal a lucrative buying opportunity for those convinced of SUI’s long-term prospects.

Should the bearish trend persist, analysts conjure that SUI could test the support level at $1.70, a development not necessarily fraught with negativity. Robust support zones often attract investors discerning value at depressed prices, potentially laying the groundwork for a price rebound. To emerge from its current slump, SUI is challenged with breaching the resistance mark set at $2, a significant psychological and technical milestone.

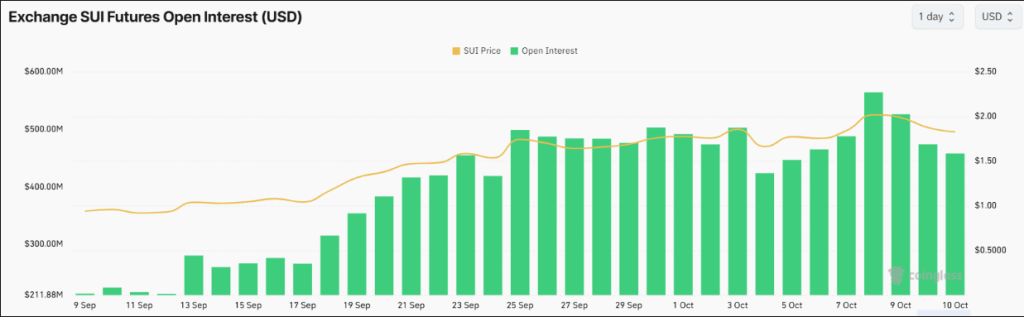

Cooling Interest

In recent times, SUI, amidst its explosive surge, has begun to witness a cooling in investor interest. This is evidenced by a 10% diminution in open interest, plummeting from an all-time zenith of $560 million to $450 million within 24 hours. This decrease suggests an inclination among traders to liquidate positions as the fervor subsides, contributing to the prevailing selling pressure enveloping the coin.

Nonetheless, this decline in open interest could be perceived as a gateway to opportunity by some market participants. A price dip invariably rekindles buyer interest, especially for those persuaded by the notion that SUI is currently undervalued.

Related Reading

Amidst the current fluctuations, SUI is still viewed with optimism for the future. Projections over the next three to twelve months anticipate potential price escalations of 240% and 160% respectively. This outlook underpins the sentiment that SUI harbors substantial promise for the long haul, despite encountering intermittent turbulence along its path.

Featured image from ThoughtCo, chart from TradingView

In a landscape that’s as dynamic and unpredictable as the cryptocurrency market, narratives such as SUI’s serve as compelling reminders of both the opportunities and risks inherent. As we sail through the choppy waters of digital finance, ensuring our compasses are well-calibrated towards reliable sources of insight becomes essential. For those hungering for more such intriguing narratives and expert analyses, turning towards DeFi Daily News might just quench that thirst.

In conclusion, embarking on the crypto voyage with a mix of cautious optimism and informed strategy seems to be the prudent approach. As for SUI, its journey eloquently encapsulates the rollercoaster ride that is cryptocurrency investing. Whether it’s soaring to new heights or navigating through turbulent zones, one thing is for certain – it makes for an entertaining saga to follow.