rewrite this content using a minimum of 1200 words and keep HTML tags

Let’s be honest, we all love music. Our tastes may differ, but for Spotify, that doesn’t matter. It’s the undisputed leader in music streaming, with 675 million users and counting. But, Spotify is no longer just about music, it’s an audio empire, expanding into podcasts with amazing shows such as Digest and Invest by eToro (you need to check it out).

Now, after years of losses, Spotify is finally making serious money, with rapid subscriber growth, rising margins, and a renewed focus on profitability. Shares hit a record high at the start of this year, topping out at USD$648, but recent market volatility has seen shares fall 21%. Yet, Spotify’s fundamentals haven’t changed. So, should it have a spot in your portfolio, or has the music stopped? Let’s find out.

Spotify reinvented music streaming and is now expanding into podcasts, audiobooks, and AI-powered playlists, turning it into a full-scale audio empire with rising profits and a growing user base.

It’s not alone in the space though. Competition remains high from cashed-up tech giants such as Apple, Amazon and YouTube.

Spotify has 27 buy ratings, 11 holds, and 2 sells, with an average price target of USD$659.88 signalling a potential upside of 23% from its last closing price.

The Basics

If you cast your mind back to the early 2000s, the music industry was in flux. Physical discs were rapidly declining, and the rise of digital music players alongside the iPod that launched in 2001 was changing the game. But at the same time, music piracy was booming. Platforms like Napster and LimeWire were costing the music industry billions in illegal downloads. Then, in 2006, 23-year-old Swedish entrepreneur Daniel Ek had a revolutionary idea: make music so accessible and affordable that stealing it would feel like more trouble than it was worth. And with that, Spotify was born.

Today, Spotify allows users to stream for free with ads or subscribe to Spotify Premium for an ad-free experience. With more than 675 million monthly active users, the platform offers almost every song in the world, along with millions of podcasts and audiobooks. It also provides content creators with tools and analytics to grow their audience. Over the years, Spotify has evolved from a music streaming service into a comprehensive audio ecosystem, with 263 million paying subscribers generating most of its revenue.

Spotify’s model is brilliantly straightforward:

Free tier: Listen with occasional ads. A gateway for users to the premium tier.

Premium tier: Pay a monthly fee for no ads, better quality, and offline listening.

Spotify pays around half of its revenue back to artists and labels, but cultural phenomena like Spotify Wrapped have turned it into more than just a music app—it’s a daily companion for hundreds of millions of people worldwide. After years of prioritising user growth over profits, Spotify is now focusing on its bottom line. Recent price hikes, cost-cutting measures, and expansion into higher-margin offerings like podcasts and audiobooks are part of a strategy to boost profitability—and it’s working.

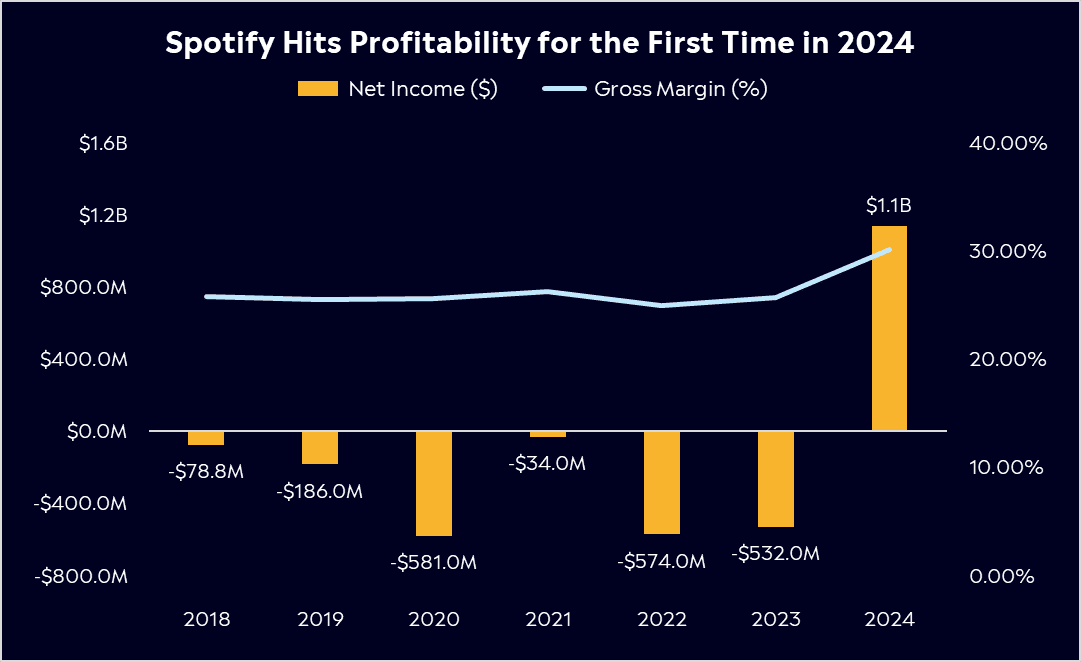

After going public in 2018, Spotify enjoyed the tech rally of 2020, with a lockdown-driven boom that saw monthly active users grow 27%. However, that quickly faded and shares went into reverse in early 2021 amid rising interest rates, a broader tech sell-off, persistent operating losses and slowing subscriber growth. But as the business went from strength to strength and turned profitable for the first time ever in 2024, shares have now rallied more than 550% since the start of 2023.

Fun Fact: The most-streamed song of all time is “Blinding Lights” by The Weeknd, with over 4.7 billion streams and counting. Australian singer-songwriter, Tones and I has the 13th most-streamed song with “Dance Monkey” racking up 3.2 billion streams.

*Past performance is not an indication of future results.

Competitor Diagnosis

Spotify remains the undisputed king in music streaming, commanding approximately 31% of the global market share. But the competition is fierce and growing across multiple fronts.

Apple Music is Spotify’s most formidable competitor with roughly 15% market share. Its advantages include deep hardware integration across iPhones and AirPods, higher-quality audio options, and the financial muscle to expand. Apple dominates in podcasts, boasting the largest podcast directory, an area Spotify is actively growing. The Apple One bundle, which packages Apple Music with other services like TV+, Arcade, and iCloud storage, creates a compelling value proposition that Spotify can’t directly match. With Apple’s vast ecosystem and financial strength, it remains a major threat.

Amazon Music benefits from Prime bundling, offering millions of songs at no extra cost for subscribers. Its integration with Alexa and Echo devices makes it the default choice for many smart home users. However, it lacks Spotify’s powerful discovery algorithms and social engagement features. Amazon’s audiobook service, Audible is Spotify’s biggest competitor in that category especially with its Kindle product.

YouTube Music holds a unique edge through its seamless integration with YouTube’s vast video library, claiming around 12% of the streaming market. Many casual listeners already use YouTube for music, and its ad-supported tier directly competes with Spotify’s free plan. As video and short-form content grows in popularity, YouTube Music’s position strengthens, particularly among younger demographics who discover music through video content. Its growing podcast base further encroaches on Spotify’s expansion plans.

Other streaming players, like TIDAL, Deezer, and Pandora, have carved out niche audiences, but none have matched Spotify’s scale. Meanwhile, Tencent Music dominates in China, where Spotify doesn’t operate, but Spotify owns a stake in Tencent through a share swap. Despite the competition, Spotify’s ability to innovate, through AI-powered playlists, exclusive content, and social-driven features like Spotify Wrapped, means challengers are finding it hard to gain market share. Podcasts, audiobooks, and new integrations ensure it remains the go-to platform for audio content across devices.

Financial Health Check

After years of losses, Spotify turned the corner in 2024, posting a positive net income for the first time ever of €1.1 billion. Free cash flow surged to €2.3 billion, nearly four times 2023’s level and a dramatic improvement from just €21 million in 2022. This turnaround was driven by strong user growth, improving gross margins, and disciplined cost-cutting.

In its latest results full-year results reported in February, Spotify reported:

675 million monthly active users (+12% YoY)

263 million premium subscribers (+11% YoY)

€15.6 billion in total revenue (+18% YoY)

Record gross margin of 30.1%, with expectations for this to keep rising despite video-podcast investments.

Spotify’s freemium model remains a key driver of its scale. The ad-supported tier attracts new users and serves as a pipeline for premium subscribers, reinforcing its global expansion strategy, a key advantage over video-streaming competitors whose costs rise sharply with content expansion. The company has improved margins rapidly through price increases, expanding advertising revenue, and cost-cutting measures, pushing its profitability outlook higher. Spotify is also finding more ways to monetise its platform, with new pricing tiers for ‘superfans’ that aim to boost revenue per user through exclusive content and early access to concert tickets (a struggle we all know) to help drive engagement. With new premium subscriber additions surpassing expectations at 27 million for the year and churn staying low, Spotify’s financial strength is improving. The company is well-positioned to extend its profitability streak in the years ahead with price hikes. Its strategy to own podcast content and new video podcasts will be a key growth driver.

* Past performance is not an indication of future results.

Buy, Hold or Sell?

Spotify remains an attractive long-term growth story, with strong fundamentals and expanding profitability. However, much of its success depends on executing price increases without deterring users. With music streaming penetration still low in many markets, especially compared to video streaming, there’s substantial room for expansion.

After years of keeping subscription prices largely unchanged, Spotify has begun raising them while still gaining users, and that will need to continue. But on the flip side, competition from Apple, Amazon, and YouTube is there, and price hikes could drive churn. With high expectations baked into its valuation, any slowdown could hit shares hard. Spotify is currently trading at 44x forward earnings, with shares trading near all-time highs despite the recent sell-off. According to Bloomberg’s Analyst Recommendations, Spotify has 27 buy ratings, 11 holds, and 2 sells, with an average price target of USD$659.88 signalling a potential upside of 23% from its last closing price. With a strong runway of growth in many markets and improving financials—higher margins, ad revenue, and cost control—supporting long-term profitability, Spotify is the name to watch in the music industry.

*Data Accurate as of 11/03/2025

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link