Within the dynamic realm of cryptocurrency, a notable crypto analyst has captured the attention of investors and enthusiasts alike with a bold prediction regarding an Ethereum (ETH) contender that is seemingly on the verge of a monumental rally. This particular digital asset, according to Jamie Coutts, the lead crypto analyst at Real Vision, could very well be on its way to charting new territories against its formidable peer, Bitcoin (BTC).

Coutts has closely analyzed the market trends and has identified a promising bullish pattern for Solana (SOL) when juxtaposed with Bitcoin. This observation is grounded in the behavior of the simple moving average (SMA) crossover on the daily chart, a traditional yet powerful indicator of potential market movements.

“The strength displayed by Solana in its consolidation phase against Bitcoin is truly remarkable. It seems we are perched at the precipice of a breakout,” Coutts remarked, underscoring the potential of Solana to outperform in the cryptocurrency market.

Coutts shared insights through a chart that illustrates the SOL/BTC pair embarking on what appears to be an uptrend, indicated by the short-term SMA rising above the longer-term SMA—a historical precursor to substantial rallies in the market. At the time of these observations, SOL/BTC was trading at 0.002663 BTC (approximately $172), although it registered a slight decline of over 1.7% in the past 24 hours.

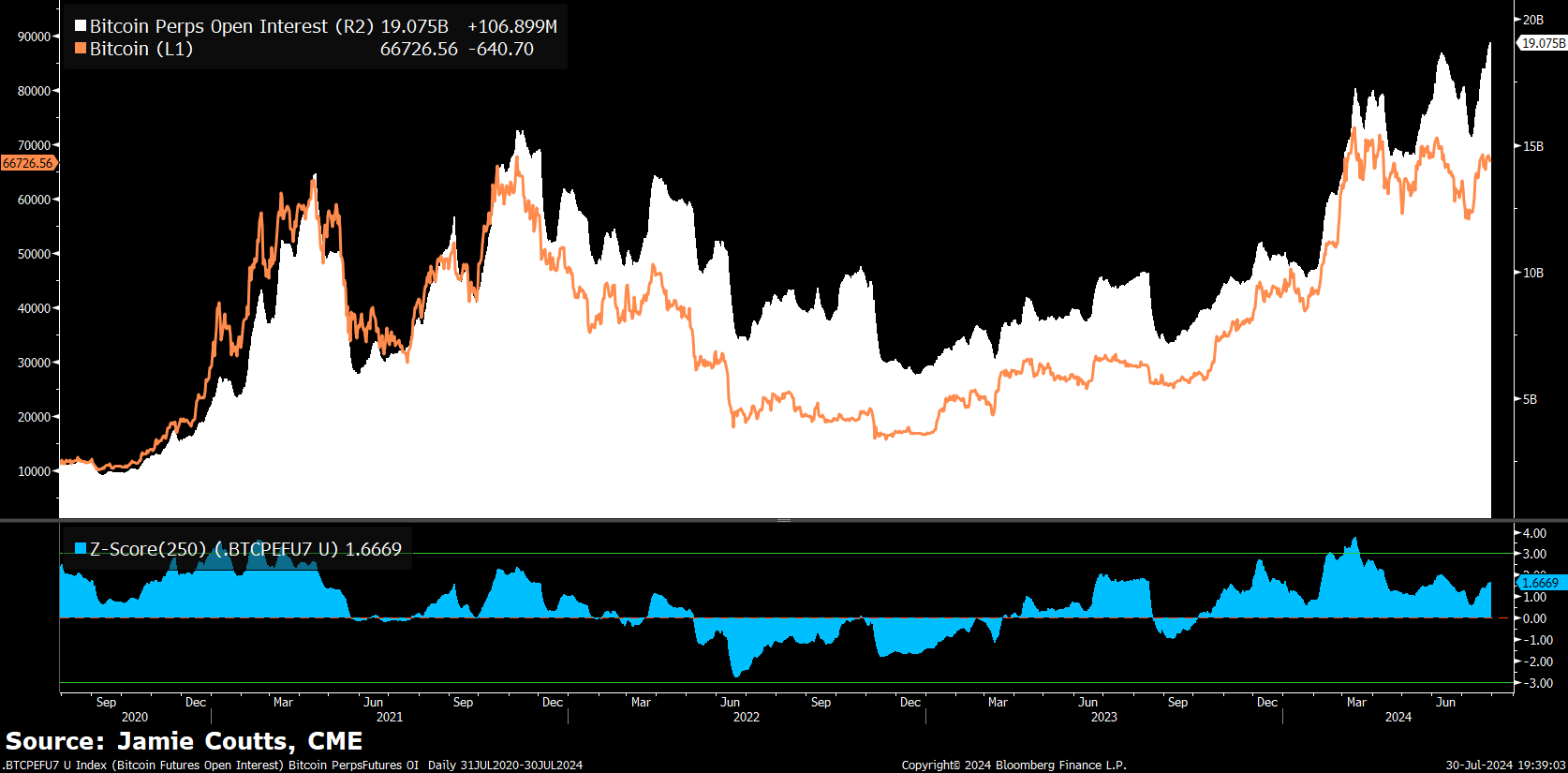

Shifting focus, Coutts also delved into the overarching landscape surrounding Bitcoin, citing key metrics that imply a positive movement on the horizon. One such metric is the open interest, which denotes the total number of outstanding derivatives contracts that have yet to be settled. “With open interest reaching new all-time highs and funding showcasing a positive/neutral stance, Bitcoin is bracing for a breakout. The current positioning appears much more balanced than in previous instances,” he explains.

Interestingly, Bitcoin’s hash rate—a critical metric for the network’s health and operational security—is also exhibiting bullish signs, specifically through the crossing of the 30-day SMA over the 90-day SMA. “The recovery of the Bitcoin hash rate is a robust signal of network health. Historical data reveals a 67% win record, profit factor of 2.18, Sharpe ratio of 1.88, and Sortino ratio of 2.64, when analyzing the impact of these SMA crosses on the market,” Coutts elucidated.

At the moment, Bitcoin is priced at $64,722, witnessing a downtrend of over 2% in the last day. However, the insights provided by Coutts offer a glimpse into the potential shift in market dynamics, suggesting an optimistic outlook for the leading cryptocurrency.

For those who thirst for the latest in the cryptocurrency arena, one must not miss a beat. Stay updated and get email alerts sent directly to your inbox. Explore the movements in the crypto markets, follow the trendsetters on platforms such as X, Facebook, and Telegram, and dive into the Daily Hodl Mix for an eclectic blend of news and insights.

DeFi Daily News is your go-to source for more trending news articles like this. Whether you’re a seasoned trader or new to the crypto world, staying informed is key to navigating the volatile landscapes of digital currencies and assets.

In conclusion, the cryptosphere remains a sea of opportunities and challenges, with analysts like Jamie Coutts providing the compass by which we can navigate these turbulent waters. As Solana prepares to take its potential leap against Bitcoin, and with Bitcoin itself showing signs of an impending bull run, the market awaits with bated breath. Yet, in this digital age of rapid information and even faster transactions, one thing remains clear: knowledge is power, and staying informed is your best strategy in the quest for crypto dominance.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency, or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney