In the fast-paced world of cryptocurrency and blockchain, Solana (SOL) has recently made waves by setting a new record: the platform now boasts over 75 million monthly active addresses. This milestone is not just a number but a testament to the burgeoning popularity of Solana, particularly within the realms of decentralized applications (dApps), DeFi, and NFT sectors. The network’s burgeoning activity underscores its appeal to developers and users alike, highlighting its capabilities in handling vast transaction volumes efficiently and affordably.

Related Reading

This surge in activity propels Solana even further ahead in the race among blockchains, cementing its status as one of the most scalable and efficient networks to date. However, despite such positive momentum, SOL’s journey is not devoid of challenges. The market has witnessed significant volatility, exemplified by events on September 18 when Solana saw $121,000 in short liquidations and nearly $3.20 million in long liquidations. A substantial portion of these long positions were liquidated on Binance, indicating that traders are treading cautiously, wary of potential near-term price fluctuations of Solana.

Source: Artemis

Price Forecast Shows Potential

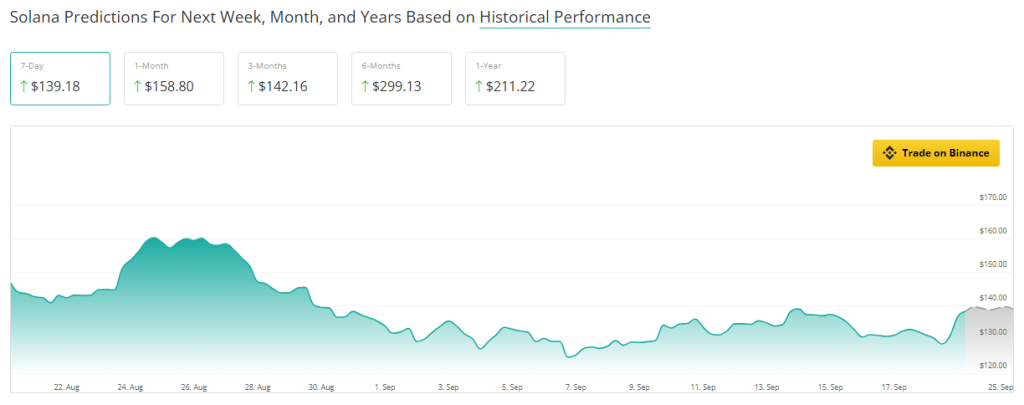

Despite the concerns over short-term volatility, the price forecast for Solana hints at a promising horizon. At present, SOL is trading at a 14.59% deficit from its estimated value for the forthcoming month. This discrepancy suggests a bearish pressure in the near term. Nonetheless, the prognosis improves with predictions of a 2.59% price increase over the ensuing three months and forecasts indicating even sturdier growth in the longer term.

In a six-month outlook, Solana’s valuation might escalate by 115%, with a projected increment of 52% over the next year. This trajectory suggests that while immediate prospects may seem dim, Solana stands as a significant investment opportunity for the long haul. At the moment, SOL’s trading price is $141.21, marking a 10.1% and 4.1% increase in its daily and weekly charts, respectively, as per data from Coingecko.

Surge In User Activity

One of the critical drivers behind Solana’s potential is its burgeoning user base. Active addresses on the network have seen exponential growth since mid-2023, reaching 75.2 million to date. This uptick signifies Solana’s scalability – its aptitude to process a high volume of transactions while maintaining low fees – attracting more developers and users to the platform and thus, bolstering the growth of its ecosystem.

This expansion in user engagement is not a mere fleeting trend. The forthcoming introduction of new features and updates is likely to further propel adoption, especially in the DeFi and NFT arenas where scalability plays a crucial role. The anticipation surrounding these developments adds to the network’s allure, suggesting a bright future ahead.

Related Reading

A Network For The Future?

The significant growth in active addresses, coupled with an optimistic price outlook, places Solana on solid ground for the future. Despite potential near-term market jitters, the long-term perspective appears promising. Investors inclined towards long-term holdings might find the current price level an attractive entry point, poised for the projected upswing.

The dynamism of the cryptocurrency market is unmistakable, with Solana showcasing a compelling mix of innovation, functionality, and prospective growth. It’s a narrative of resilience amidst volatility, a beacon for developers, investors, and users enticed by the prospects of decentralized technology.

For those entranced by the constant evolution of the DeFi space and eager to stay abreast of the latest developments, trends, and insights, a visit to DeFi Daily News will keep you informed. As the storyline of Solana and similar platforms unfold, the blend of technology, finance, and creativity continues to intrigue and inspire, paving the way for a future where decentralization reigns supreme.

Featured image from Protos, chart from TradingView