rewrite this content using a minimum of 1000 words and keep HTML tags

SharpLink Gaming, a Nasdaq-listed company, is in the spotlight as one of the first public firms to build a treasury strategy centered around Ethereum (ETH). On July 29, 2025, SharpLink disclosed that its Ethereum holdings reached an impressive 438,190 ETH. In addition, the company raised $279.2 million in net proceeds through an at-the-market (ATM) offering during the week of July 21-25, reinforcing its aggressive accumulation strategy.

SharpLink’s move is seen by many analysts as a potential turning point for Ethereum’s institutional adoption. While Bitcoin has long dominated corporate treasury strategies, SharpLink’s pivot toward Ethereum signals a new narrative: using ETH as a strategic reserve asset. This approach is being closely watched by investors and public companies exploring blockchain integration and decentralized finance (DeFi) infrastructure.

Market commentators believe that SharpLink’s initiative could set a precedent for more companies to adopt Ethereum as a core part of their treasury strategies, aligning with the broader shift toward tokenized financial systems. As Ethereum’s role in real-world asset (RWA) tokenization and on-chain settlement expands, SharpLink’s accumulation could mark the beginning of a new institutional wave positioning ETH as a treasury asset for the future.

SharpLink Gaming Deepens Ethereum Bet

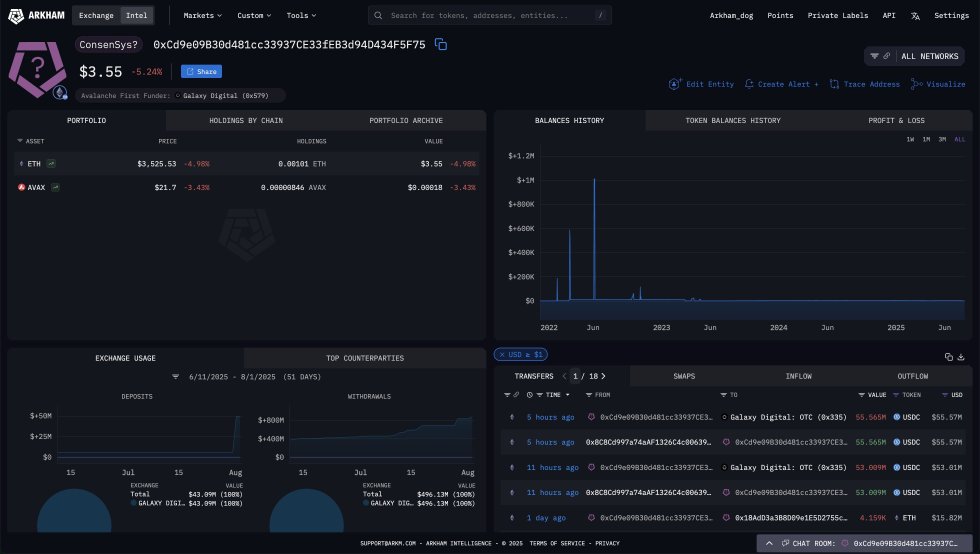

According to Arkham, an American company specializing in blockchain analytics, a SharpLink-associated account just deployed another $100 million to purchase Ethereum (ETH). The wallet address, 0xCd9e09B30d481cc33937CE33fEB3d94D434F5F75, has now accumulated approximately $800 million worth of ETH on behalf of SharpLink Gaming, making headlines for its aggressive ETH treasury strategy. Additionally, Arkham reports that this account just sent $108.6 million in USDC to Galaxy Digital’s OTC desk, indicating further imminent ETH purchases.

This continued buying spree has raised significant questions among analysts and investors: How long can SharpLink keep buying ETH? And what does this signal for other public companies?

SharpLink’s actions are fueling speculation about a new trend—Ethereum as a strategic treasury reserve asset. While Bitcoin has historically dominated corporate crypto holdings, SharpLink appears to be pioneering a shift toward ETH, likely due to its utility in decentralized finance (DeFi), real-world asset (RWA) tokenization, and smart contract infrastructure.

As Ethereum’s role in institutional finance grows, SharpLink’s accumulation could act as a blueprint for other firms, showcasing how public companies might integrate ETH into long-term capital strategies. The broader implication? Ethereum may soon take center stage alongside Bitcoin in corporate treasuries, reshaping the institutional crypto landscape.

ETH Price Action Details: Setting Fresh Lows

Ethereum (ETH) is currently trading at $3,406, continuing its downward movement after failing to break above the $3,860 resistance zone. The chart reveals a clear breakdown from the previous consolidation range, with ETH losing momentum after weeks of bullish price action. The price has now fallen below the 50-day ($3,730) and 100-day ($3,691) simple moving averages (SMA), signaling growing bearish pressure in the short term.

Volume has spiked during the recent decline, indicating active selling, but the current price sits near a key support region. The next significant level to watch is the 200-day SMA at $3,222, which could act as a critical defense line for bulls. If Ethereum fails to hold this zone, a retest of the $2,852 level is likely, which marks the previous breakout point from early July.

Despite the current bearish sentiment, many analysts consider this correction a healthy pullback within a broader uptrend, especially with strong accumulation trends on-chain. A reclaim of the $3,600-$3,700 range is necessary to regain bullish structure. For now, Ethereum remains in a vulnerable position, and the coming sessions will be crucial to determine whether bulls can defend key support and attempt another breakout.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link