For many investors, the thrill of engaging with fast-moving industries such as electric vehicles (EVs) is coupled with the caution exercised towards companies showing pre-profit financials. One notable example in this industry is the Chinese EV manufacturer, Nio (NYSE: NIO). Despite its enthusiastic embrace of innovation and aggressive market strategies, Nio has observed a loss of nearly $1.5 billion in the first half of this fiscal year alone, perpetuating its streak of non-profitability since inception.

This financial backdrop has undoubtedly contributed to the company’s stock plummeting over 80% in value within a span of three years, leaving many to question the viability and future of Nio in the competitive EV market. However, Nio’s recent second-quarter earnings report has infused a newfound optimism around the company’s trajectory, evidenced by a more than 40% surge in the value of its American depositary shares over the past month alone.

Now, Nio’s market capitalization hovers around the $11 billion mark, creating an interesting case study for potential investors. With $5.7 billion in cash and equivalents reported at the end of the quarter, the dialogue shifts towards dissecting Nio’s strategic maneuvers for the upcoming period and evaluating its potential for inclusion in a diversified investment portfolio.

A step toward profits

One pivotal achievement of Nio in its quest for profitably was the significant uplift in its vehicle profit margin during the second quarter. This metric, which assesses the profitability based on revenue versus the cost of sales for new vehicles, saw an increase to 12.2% from a mere 6.2% in the comparable period the previous year. This improvement was facilitated by a revenue uptick that nearly doubled on a year-over-year basis.

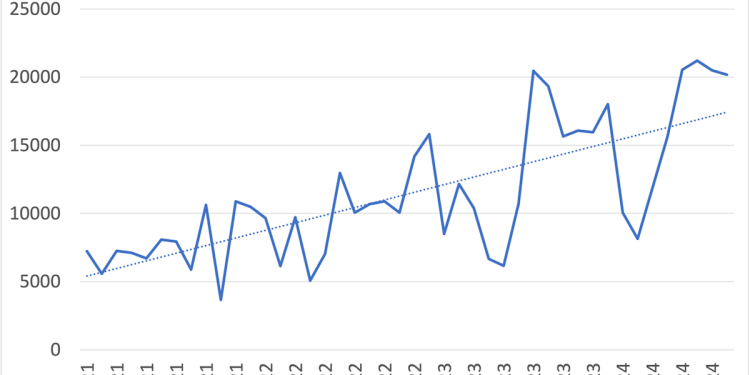

Nio’s journey has been characterized by periods of uncertainty and stagnation, but recent developments suggest a maturing company on the cusp of breaking into consistent production and sales growth. Such progress is timely, as the global EV landscape becomes more crowded and competitive. The company’s achievement of selling upwards of 20,000 EVs for four consecutive months for the first time is a testament to this strengthening position, helping Nio to secure a growing share of the market and improve its margins.

With a new quarterly record set at over 57,000 units shipped and a guidance for third-quarter deliveries ranging between 61,000 to 63,000 EVs, Nio’s traction in the market is palpable. The company’s CEO, William Li, noted that the second quarter’s sales volume has garnered Nio more than a 40% market share in the Chinese EV sector for vehicles priced above approximately $42,000. Nio’s strategy to maintain and expand its influence in the high-end market segment positions it as a formidable competitor against leaders like BYD, which dominates the more affordable segments of the Chinese EV market.

Addressing range anxiety

Nio has consistently led initiatives within China and internationally to mitigate range anxiety among EV users through the expansion of its battery charging infrastructure and its pioneering battery swapping technology. The company’s battery swap stations offer a unique value proposition, allowing EV buyers to opt for a lower upfront vehicle cost through a monthly Battery as a Service (BaaS) subscription. This innovative service enables drivers to exchange depleted batteries for fully charged ones in a matter of minutes.

In a strategic move to enhance its charging and battery swapping network across China, Nio recently unveiled its “Power Up Counties” plan aimed at expediting the construction of such facilities. With over 2,500 battery swap stations globally and more than 800 located on China’s expressways, the firm has facilitated more than 50 million battery swaps for its 577,000 plus vehicles on the road. This ambitious plan anticipates the availability of power swap stations in thousands of Chinese counties by the end-of-next year and includes the construction of a new factory dedicated to producing up to 1,000 power swap stations annually.

Mass market brand

Alongside its upscale offerings, Nio is broadening its market reach with the introduction of the Onvo brand, marking its foray into the mass market EV segment to rival competitors like Tesla’s Model Y. The mid-size SUV Onvo L60, priced at about $30,000, represents Nio’s strategic expansion and diversification. This move, coupled with the continued growth in charging technology and infrastructure, signals a potent phase of business acceleration for Nio that could tantalize aggressive investors to buy into the stock now, in anticipation of Onvo’s market penetration and success.

Should you invest $1,000 in Nio right now?

Before aligning your investment strategy with Nio’s prospects, it’s essential to conduct a thorough analysis and consider the broader market context. The Motley Fool Stock Advisor team has recently earmarked what they perceive as the 10 most promising stocks for investors at present, interestingly, Nio did not feature in this selection. The highlighted stocks are expected to deliver substantial returns, akin to Nvidia’s staggering growth witnessed since its recommendation in 2005, which if a $1,000 investment had been made then, would equate to a return of $722,320 today!

Stock Advisor aims to simplify investment decisions through step-by-step guides, insightful analysis from seasoned analysts, and by offering two new stock picks each month. Since 2002, this service has outperformed the S&P 500 by more than fourfold.

For more engaging and trending news articles like this, visit DeFi Daily News.

It’s clear that Nio is at a critical juncture in its evolution. With strategic initiatives in place to boost its operational and financial metrics, coupled with an ambitious expansion into the mass market segment, Nio’s narrative is more about a future potential than its past financial disappointments. Whether Nio’s next big move will catapult it into profitability and deliver substantial returns for its investors remains to be seen, but the company’s efforts to redefine its position in the global EV market paints an exciting picture of what might lie ahead.