We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Go to Alpha Reports

Bernstein analysts are closely monitoring seven key crypto stocks as former President Donald Trump prepares to address the Bitcoin Nashville conference on July 27. The research firm outlined its bullish outlook on the crypto sector in a note on Monday, forecasting significant upside potential for select companies amid an improving regulatory environment.

The Bernstein team—led by Gautam Chhugani—wrote that the market has not priced in a positive shift in the crypto regulatory environment if Trump wins reelection in November. Given that, the firm said it sees significant headroom from institutional investors allocating to crypto and crypto stocks.

Bitcoin markets have been buoyant again, with BTC up 13% last week, back above $67,000. Crypto stocks were even stronger, up 22% last week, the firm writes.

The report highlights seven stocks across three categories: Bitcoin mining consolidators (Riot Platforms, CleanSpark, Marathon Digital Holdings), hybrid Bitcoin/AI data centers (Core Scientific, Iris Energy), and crypto broking/exchange platform (Robinhood), as well as a Bitcoin corporate treasury (MicroStrategy).

For BTC mining consolidators, the analysts see significant growth potential.

“We view large Bitcoin mining consolidators as high-beta Bitcoin proxies, with price action being driven by underlying Bitcoin price and potential cashflows from operating leverage,” the report stated.

Specifically for Riot Platforms, the analysts noted, “RIOT holds more than $0.6 billion [worth of] Bitcoin on its balance sheet, and has raised $500 million in equity capital to build its 1Gw Corsicana site in Texas as the world’s largest Bitcoin facility.”

Highlighting CleanSpark’s rapid expansion, the report states the company has grown its hash rate aggressively from 10EH/s to 20.4EH/s YTD, with a potential pipeline to grow to 32EH/s by 2024 end.

Noting a strategic shift for Marathon Digital, the report stated it was earlier focused on a capital light model, working with hosting partners to mine BTC, but has now drastically shifted strategy to own and operate Bitcoin mining sites.

The hybrid Bitcoin mining and AI data center operators were praised for their unique market position.

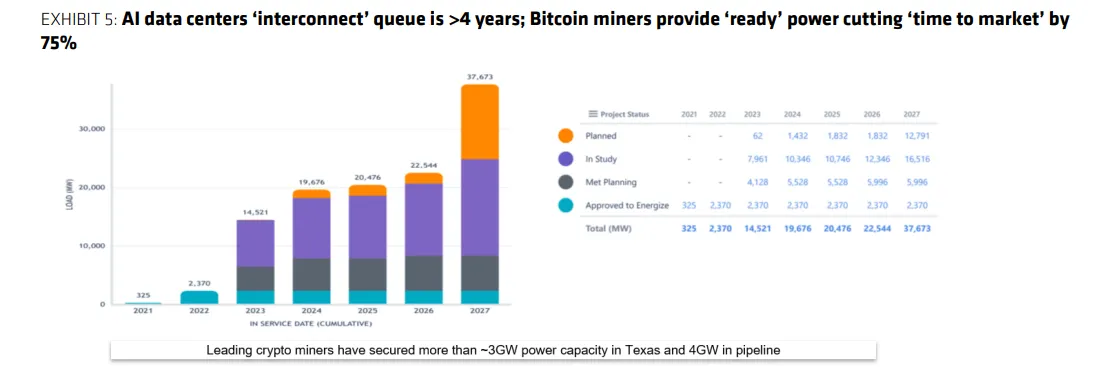

“Bitcoin miners find themselves in a unique position, led by their disproportionate ‘power access’ in a power constrained world,” the analysts wrote.

They detailed Core Scientific’s recent deal: “Recently, CORZ obtained a 12 year $4.7bn co-hosting contract with CoreWeave (leading AI GPU cloud provider and NVIDIA partner).”

For Iris Energy, they noted, “IREN has successfully executed a ~500 GPU AI cloud for Poolside.AI, a leading AI venture. IREN owns 1.4GW site with ready power interconnect in West Texas.”

Emphasizing Robinhood’s potential in the crypto market, the analysts noted that they expect HOOD revenues to double over the next 2 years, with more than 70% of the growth coming from crypto transaction revenues.

“By FY25E, we expect HOOD’s crypto revenues to be ~40% of total revenues vs 7% today,” the analysts added.

Lauding MicroStrategy’s BTC strategy, they stated that MSTR has demonstrated an active capital market strategy to become the largest corporate holder of BTC, owning 1.1% of the world’s Bitcoin supply.

“MSTR’s active strategy has delivered a higher Bitcoin per equity share – BTC/share has grown 67% since Bitcoin strategy adoption,” they added.

The Bernstein team’s bullish stance is underpinned by their ambitious BTC price target.

“We expect significant uptick in 2025E EBITDA, driven by a Bitcoin bull cycle, as we expect Bitcoin to cross $100K in 2025 with a cycle peak close to $200K, on the back of accelerated BTC institutional

Source link