rewrite this content using a minimum of 1200 words and keep HTML tags

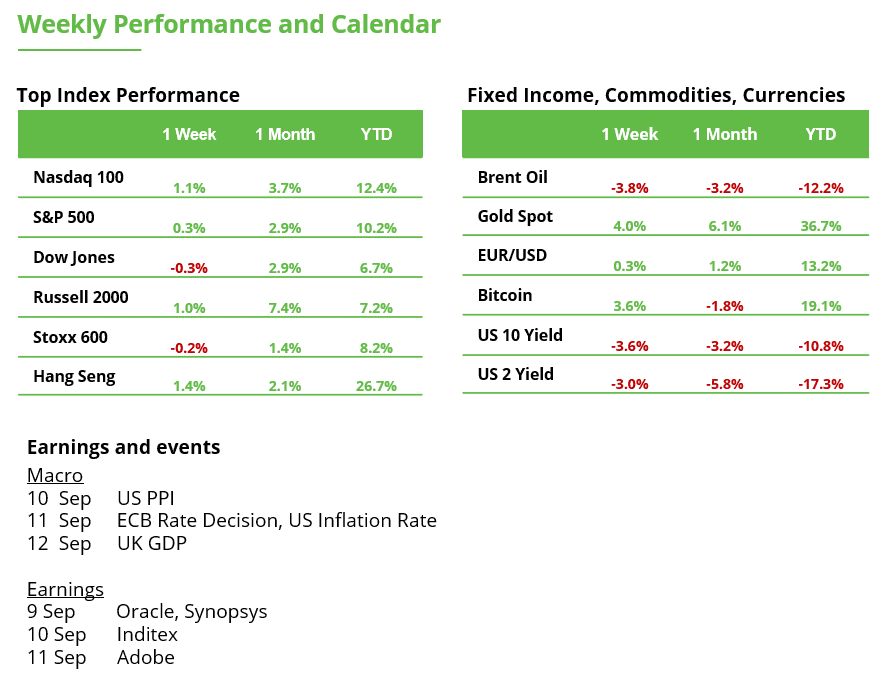

Analyst Weekly, September 8. 2025

Markets are juggling mixed signals. Payrolls disappointed, pushing the Fed closer to cuts. China’s recovery is narrow, with e-commerce and tourism winning but subsidies fading. Volatility risks are rising as funds crowd into short-vol bets. And with ECB and US inflation data ahead, policy clarity will be the week’s catalyst.

US Payrolls: Investment Takeaways

Payrolls flop: August US payrolls barely budged at +22K (June even revised negative). That’s basically stall speed.The report suggests the Fed will likely cut -25bp on Sep 17, with the possibility of a more aggressive -50bp or a series of steady cuts in Sep/Oct/Dec.

Who’s hiring? Healthcare, private education, and leisure & hospitality are still adding jobs. Cyclicals like manufacturing and goods-producing? In the red.

Cracks showing: Unemployment ticked up to 4.3%, underemployment is creeping higher, workweek hours are shrinking, and temp jobs are sliding. Consumers could feel the pinch.

Wages steady: Paychecks are growing around 3.7%-4% y/y, stable enough to support spending without triggering inflation, for now. That gives the Fed room to ease.

Investment Takeaway: 1. Rate-sensitive sectors (housing, REITs, growth tech) stand to benefit as the Fed exits restrictive policy. 2. Small caps could be big winners if rates fall. These companies tend to rely more on shorter-term debt, making them especially sensitive to borrowing costs. Encouragingly, over half of small-cap stocks have seen earnings estimates revised higher in recent months, a rare positive shift. For context, since the late 1990s, this figure has typically stayed below the 50% threshold. 3. The curve could steepen if cuts are gradual, supporting financials. 4. Healthcare demand looks resilient; defensive healthcare equities may outperform from here, as market positioning has not caught up yet.

China Consumption: Narrow Recovery Ahead

China’s consumer recovery in 2026 is expected to be uneven: digital platforms and select consumer brands benefit, but reliance on subsidies limits sustainable growth. Investors should favor e-commerce platforms with scale and brands positioned in services, sportswear, and cosmetics, while being cautious on appliances and capital-intensive delivery ventures.

Growth outlook is modest: China’s retail sales is heavily reliant on subsidies, which is leading to “subsidy fatigue,” particularly in categories like home appliances.

Tourism and spending shifts help brands: Government stimulus in the second half of 2025 could add 833 billion yuan in spending, though consensus expects up to 1.2 trillion yuan. A $42B boost is expected from more inbound tourism and less overseas spending by Chinese consumers. Beneficiaries include Anta, Midea, Shiseido, Laopu Gold, Pop Mart, and Xiaomi (EV & IOT Growth).

E-commerce stays dominant but pressures profits: Platforms like Alibaba,JD.com, Meituan, and Douyin are driving growth through promotions, online exclusives, and partnerships (e.g., with Xiaohongshu/RedNote and WeChat). However, competition and new ventures (cloud kitchens, satellite stores) weigh on margins.

Sector standouts:

Digital platforms and tourism plays look best positioned.

Home appliances, capital-heavy food delivery ventures, and subsidy-reliant sectors face more headwinds.

Sportswear & cosmetics could see stronger demand via online-exclusive launches.

Luxury, devices, and appliances face slower growth as subsidies lose effectiveness.

September Brings Volatility Risk

In both the S&P 500 (SPY) and Nasdaq 100 (QQQ), investors are paying much more for downside protection than for upside bets.

For one-month options, the gap between the cost of put options and call options is the widest it’s been in almost two years. Hedge funds are betting heavily that volatility will stay low, their biggest such bet since early 2021. If volatility suddenly jumps, those funds could be forced to cover their positions quickly, pushing prices higher.

After cutting stock exposure in April, funds that adjust positions based on volatility have now bought heavily back into equities. But because they’ve already done most of that buying, they have less room to add more support now.

Put simply, many of the forces that were helping the market earlier are now fading in September.

That said, options dealers’ positions (long gamma positioning in SPX) could help keep day-to-day market swings in check.

Super Thursday: ECB Decision and US Inflation Data

This week features two highlights on the economic calendar: the ECB rate decision and the US inflation data – both scheduled for Thursday, making it the most important trading day of the week. No change in interest rates is expected from the ECB at 2:15 p.m. The focus will instead be on Christine Lagarde’s press conference at 2:45 p.m., particularly her comments on the impact of tariffs and Europe’s weak economic growth.

In between, at 2:30 p.m., the US consumer price data for August will be released. It will be the last inflation check before the upcoming Fed meeting. A rate cut in September is already fully priced in, supported by last Friday’s weak US labor market report. Nevertheless, there are good reasons why investors should pay close attention to inflation developments right now. Tariffs often work with a delay and could still affect rate expectations for the remainder of the year. Moreover, core inflation remained elevated in July at 3.1% year-over-year.

Bond Market Tests Medium-Term Resistance

It has been some time since long-term bond prices (iShares 20+ Year Treasury Bond ETF, or TLT) marked a new low in the broader downtrend. The last low was in October 2023 at 82.30. Last week, the ETF closed 2.45% higher at 88.56, representing a rebound of more than 7% from the lows. With this move, the market has reached a Fair Value Gap between 88.36 and 90.22. This zone acts as medium-term resistance. A breakout above it could attract additional buyers. Investors should closely monitor price action around this area.

TLT on the weekly chart

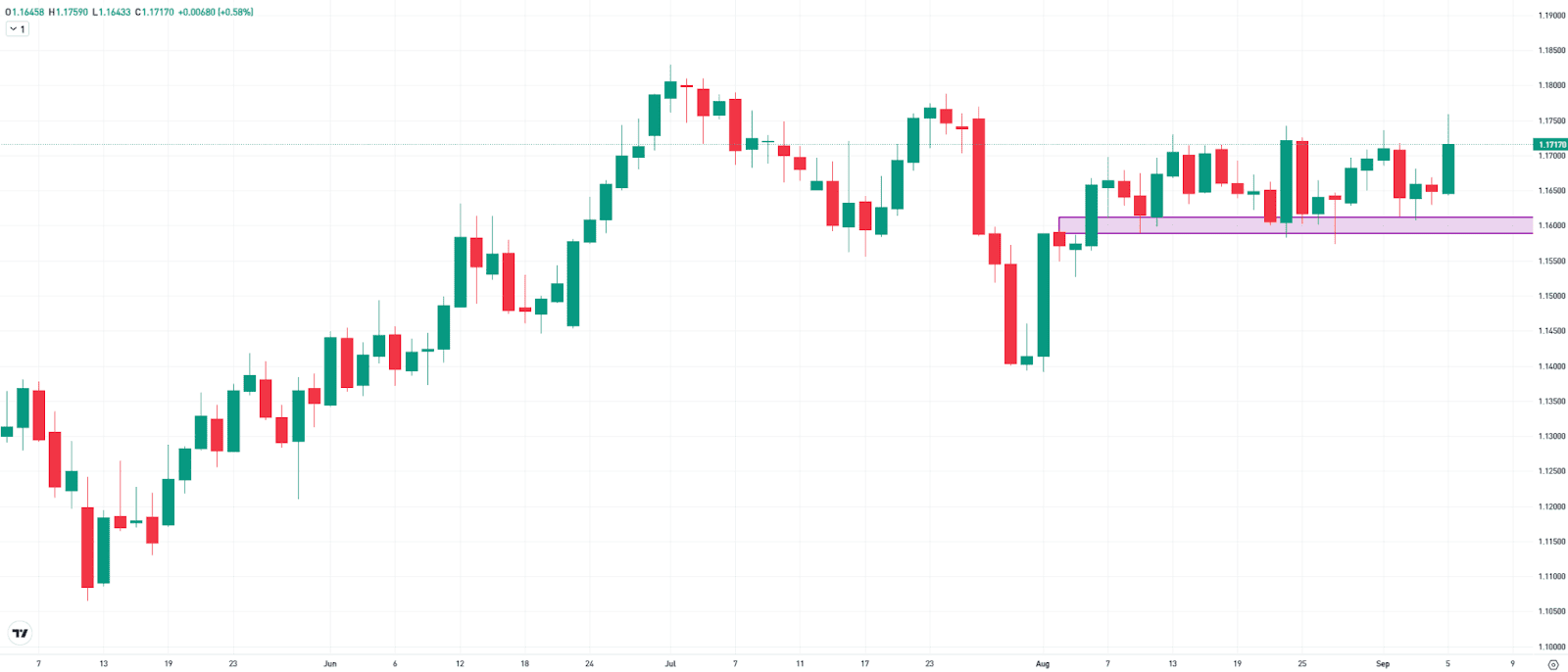

EURUSD: Sideways Phase Within an Uptrend

EURUSD is in an overall upward trend. However, the last high dates back a bit. On July 1, a peak was reached at 1.1829. Since then, the pair has been moving sideways for about a month and closed at 1.1717 on Friday. The area around 1.1730 has repeatedly capped stronger upward moves, most recently last Friday. The Fair Value Gap between 1.1587 and 1.1610, which was created by the rally at the beginning of August, serves as an important support level and was successfully defended twice last week. Only a breakout from this sideways range could re-establish a clearer short-term trend structure.

EURUSD on the daily chart

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link