rewrite this content using a minimum of 1000 words and keep HTML tags

Victoria d’Este

Published: December 02, 2024 at 5:31 am Updated: December 02, 2024 at 5:31 am

Edited and fact-checked:

December 02, 2024 at 5:31 am

In Brief

Bitcoin News & Macro

Bitcoin has delivered a headline-grabbing week, with sharp price moves and market shifts that demand attention. November’s $26,000 monthly price gain shattered records, pushing BTC within striking distance of the $100,000 mark.

BTC/USD 1-month chart. Source: Cointelegraph/TradingView

Year-to-date, Bitcoin has surged 129%, thanks to it tightening liquidity and strong adoption signals.

Bitcoin monthly performance 2011-2024. Source: ICO Analytics

Exchange reserves now hold less than 2.5 million BTC, according to CryptoQuant, amplifying the supply squeeze narrative. Long-term holders are dominating, with self-custody trends gaining ground. Fewer coins are available for trading, which is the reason prices go up.

Institutional players are making waves as well. Spot Bitcoin ETFs recorded over $3.1 billion in inflows last week alone, signaling deep-pocketed confidence in BTC’s trajectory.

Weekly total net inflows for spot Bitcoin ETFs. Source: SoSoValue

Futures markets have echoed this sentiment: Bitcoin CME futures briefly topped $100,000 for the second time, though the spot price lags just behind.

Bitcoin price hits $100,000 at CME futures. Source: Bitcoin Archive/X

Bitcoin’s dominance also hints at broader market moves. As BTC consolidates near all-time highs, attention is shifting to altcoins like Ethereum, which are eyeing their own breakout runs. With Bitcoin holding the spotlight, the ripple effect across crypto markets could spark an altseason sooner rather than later. For now, Bitcoin’s next test remains clear: breaking – and sustaining – the six-figure milestone.

BTC Price Analysis

Bitcoin spent the week consolidating below $98,000, stuck in a tight range as anticipation builds for a breakout toward $100,000.

BTC/USD 1D Chart, Coinbase. Source: TradingView

Multiple attempts to clear $98,000 resistance failed, marked by long wicks and weak closes, with sellers firmly holding the level. A mid-week dip below $96,500 tested $94,000, where buyers defended the 20-day EMA and preserved the bullish trend. While a late-week bounce showed little momentum, BTC remained close to resistance, poised for a decisive move.

BTC/USD 4H Chart, Coinbase. Source: TradingView

On the 4-hour chart, tightening price action underscores growing pressure. Lower highs have formed against solid support at $94,000, creating a classic setup for a breakout or breakdown. Attempts to reclaim the 50-EMA faltered, and RSI indicates fading bullish strength, yet the $94,000 level has held firm. Breaking $98,000 would likely trigger a surge toward $100,000, as this psychological level attracts fresh momentum. However, losing $94,000 could deepen the correction and stall the rally.

Ethereum News & Macro

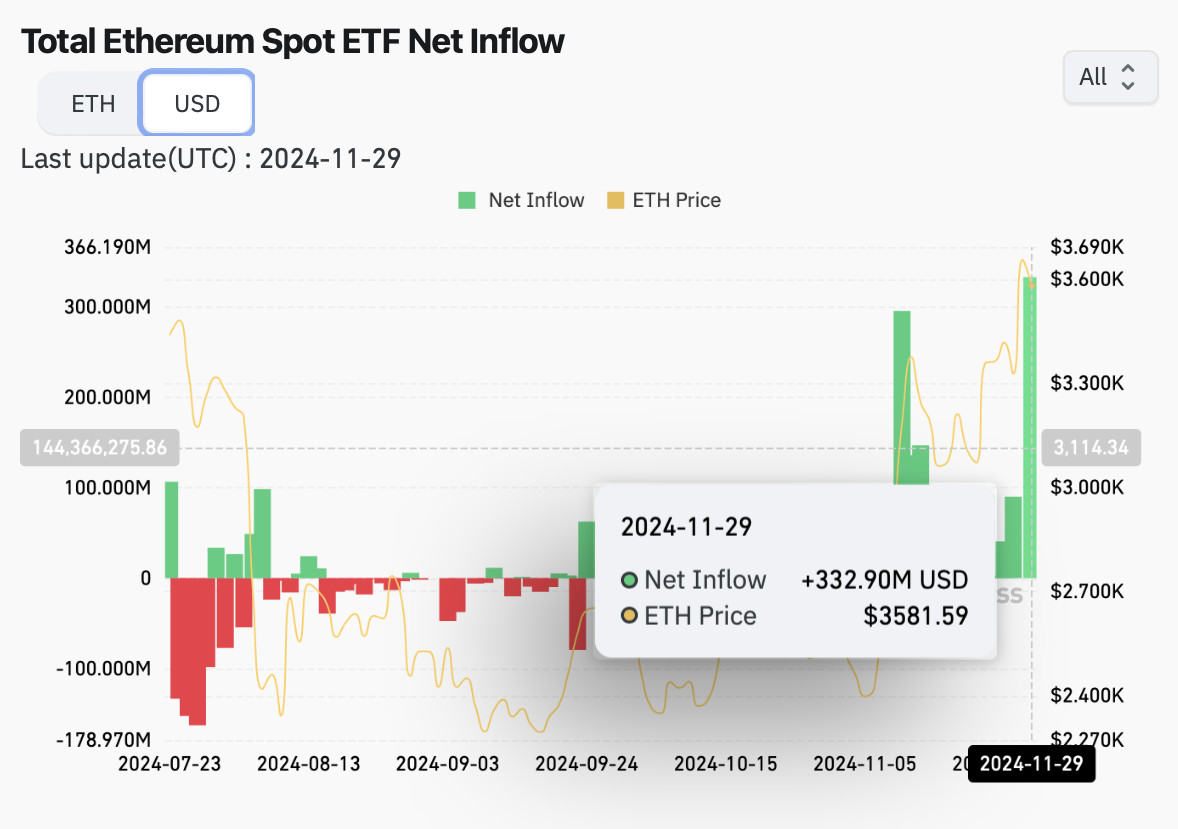

Ethereum has also had a standout week. Spot Ether ETFs have been leading the charge. U.S. markets saw record-breaking inflows into ETH-focused ETFs, outpacing Bitcoin by $12.9 million in a single day. This surge underscores the growing institutional appetite for Ethereum, particularly as Bitcoin’s momentum cools below the $100,000 mark.

Spot Ether ETFs saw $332.9 million in inflows on Nov. 29. Source: CoinGlass

Ether is also poised to crack $4,000 in the near term, driven by strong futures performance and a wave of ETF interest. Over 90% of ETH holders are currently in profit, further bolstering confidence. However, the $4,000 level remains a key psychological hurdle.

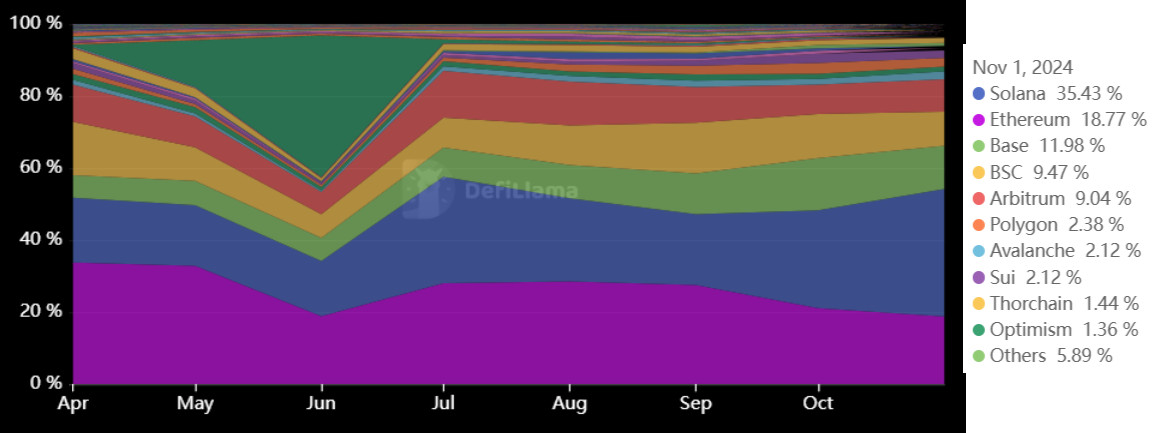

Ethereum’s layer-2 solutions are firing on all cylinders. A 70% spike in activity pushed total value locked (TVL) to a record $51 billion, making a 205% annual jump. While this scaling success is a major win for usability, some analysts caution it could siphon fee revenue from the main chain, potentially slowing ETH’s price growth.

Decentralized exchanges 30-day volumes, market share. Source: DefiLlama

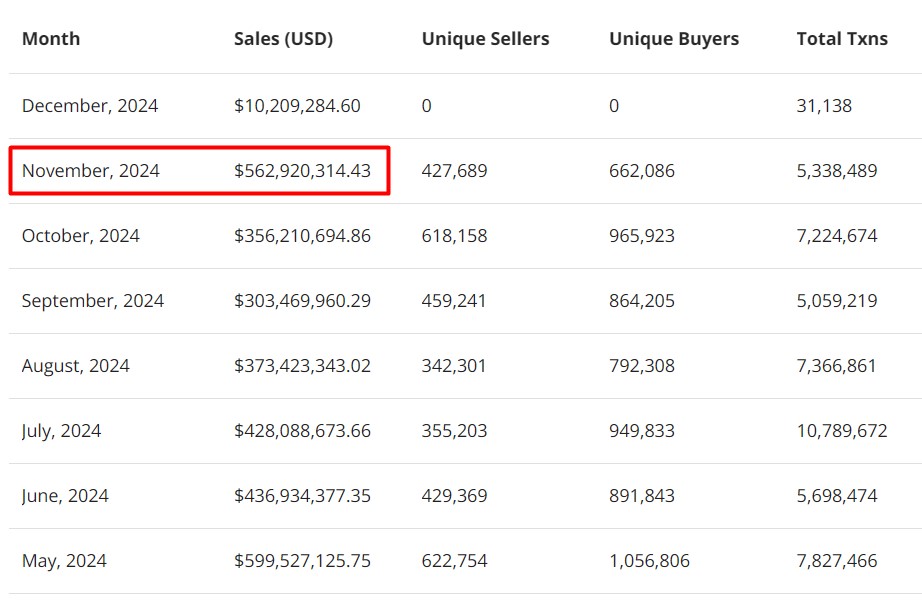

The NFT market has come roaring back, logging $562 million in sales for November — its best month in half a year.

NFT sales volume from May to December 2024. Source: CryptoSlam

In a win for Ethereum’s core network, it has reclaimed the top spot from Tron in USDT dominance after two years.

Decentralized exchanges 30-day volumes, market share. Source: DefiLlama

This milestone, combined with record trading volumes on DeFi platforms like Uniswap, highlights Ethereum’s ecosystem flexing its muscle as 2025 approaches.

ETH Price Analysis

The week began for ETH with a breakout above $3,500, flipping it into support after a successful retest of prior resistance.

ETH/USD 1D Chart, Coinbase. Source: TradingView

Momentum slowed midweek as ETH faced selling pressure at $3,750, a key resistance marked by previous highs. This prompted consolidation, with smaller candlesticks and a doji signaling indecision. A brief pullback to $3,600 tested the 20-EMA, but buyers defended the level, maintaining the bullish structure as long as price holds above $3,500.

ETH/USD 4H Chart, Coinbase. Source: TradingView

On the 4H chart, ETH rallied above $3,500 with strong momentum before consolidating in a bull flag below $3,750. A false breakout led to a sharp rejection, with price retracing toward $3,600, where it found support at the 50-EMA. The RSI reset from overbought, creating room for another move higher. $3,750 remains a key resistance, while $3,500 holds as a pivotal support. A breakout above $3,750 could target $3,850–$4,000, while losing $3,500 risks revisiting $3,350.

Toncoin News & Macro

And let’s not forget Toncoin, which also had a week full of strategic developments. For one, Fragment marketplace made a move to enforce mandatory KYC, coming on the heels of Telegram’s announcement to expand Toncoin’s footprint in the U.S. market.

While the rollout signals growing regulatory alignment, technical glitches prevented Russian phone numbers from completing verification — a fix is expected soon.

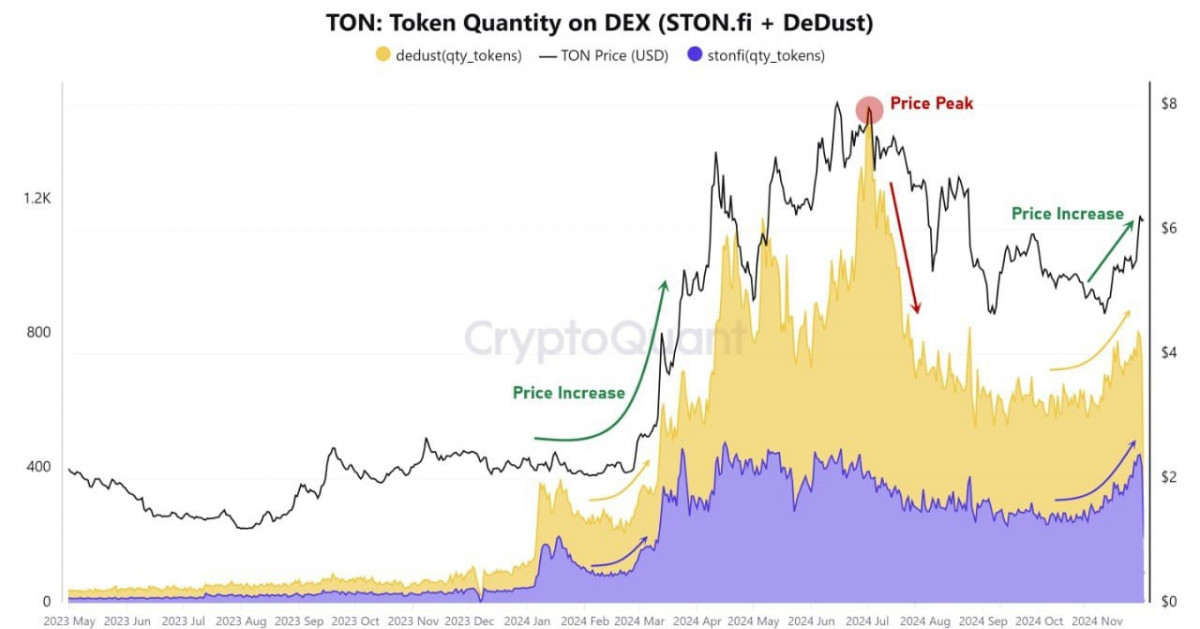

Source: CryptoQuant

Decentralized exchanges saw a sharp rise in TON trading activity, a pattern often linked to price surges.

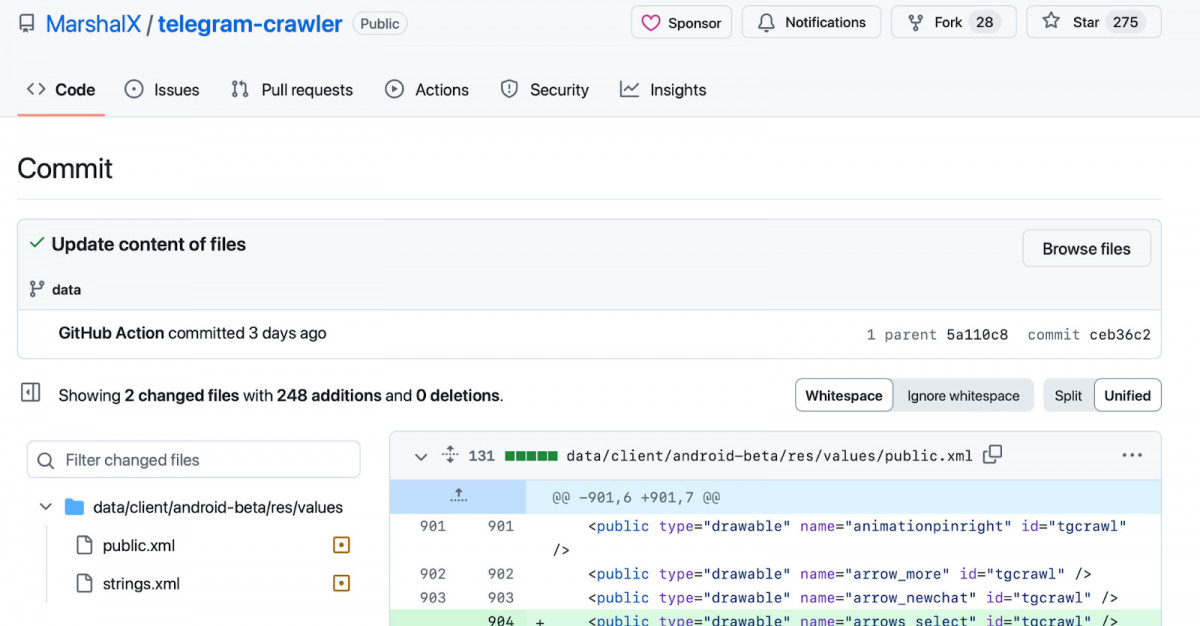

Source: MarshalX @GitHub

Telegram also announced a bot-focused partnership program, enabling channel owners to earn automated commissions in TON for referred users. This initiative adds utility to the token and could fuel further adoption. Meanwhile, the Neuton Protocol, built on TON, closed its IDO and listed its token on multiple exchanges.

All this news points to a lot of institutional momentum concentrated around the Toncoin ecosystem.

TON Price Analysis

With that in mind, let’s move over to the charts. Last week’s focus for TON was a sharp breakout above $6.50, which marked a pivotal shift from prior consolidation.

TON/USD 4H Chart. Source: TradingView

Buyers propelled the rally toward $7.10, smashing through resistance with a bold, high-volume green candle mid-week. However, the momentum tapered off as profit-taking kicked in near the psychological $7.00-$7.10 level, leaving a rejection wick and signaling hesitation. The $6.50 breakout zone has since been retested and held firm, flipping into support and setting the stage for accumulation in a tight range.

TON/USD 4H Chart. Source: TradingView

On the 4H chart, the rally followed a clean ascending channel, with the 50 EMA providing dynamic support during pullbacks. The RSI spiked into overbought territory as the breakout surged, cooling to neutral levels as the price consolidated between $6.80 and $7.00. Key levels are now crystal clear — $6.50 remains a must-hold for bulls, while a decisive break above $7.10 could ignite another leg higher. Until then, the market appears poised for a tug-of-war between consolidation and continuation.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria d’Este

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link