Since the groundbreaking launch of Bitcoin Exchange Traded Funds (ETFs) in early 2024, the cryptocurrency sector has witnessed Bitcoin shattering its previous all-time highs. This period has been marked by an exhilarating ride of double-digit gains in multiple months, instigating a renewed interest and excitement in the realm of digital currencies. Yet, as remarkable as Bitcoin’s performance has been during this era, there exists a methodology that can substantially elevate the potential for profit beyond simply holding Bitcoin — a technique centered around the strategic utilization of ETF data to inform one’s trading maneuvers.

The Ripple Effect of Bitcoin ETFs

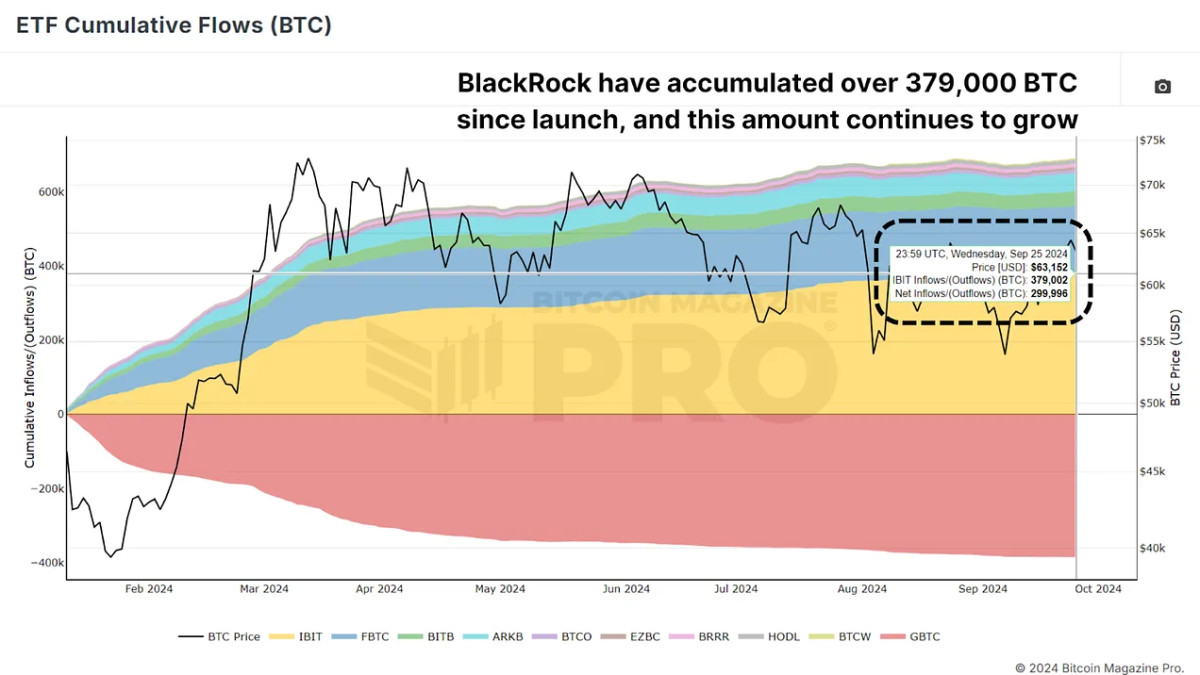

Shortly after their debut in January 2024, Bitcoin ETFs swiftly became the focal point for a tremendous aggregation of Bitcoin, magnetizing both institutional and retail investors towards the allure of exposure to Bitcoin without necessitating direct ownership. The amassed billions in USD worth of BTC by these ETFs and the necessity to monitor this cumulative flow has grown ever so critical. It provides a window into institutional behaviors within the Bitcoin market, shedding light on whether such entities are in the phase of accumulation or distribution.

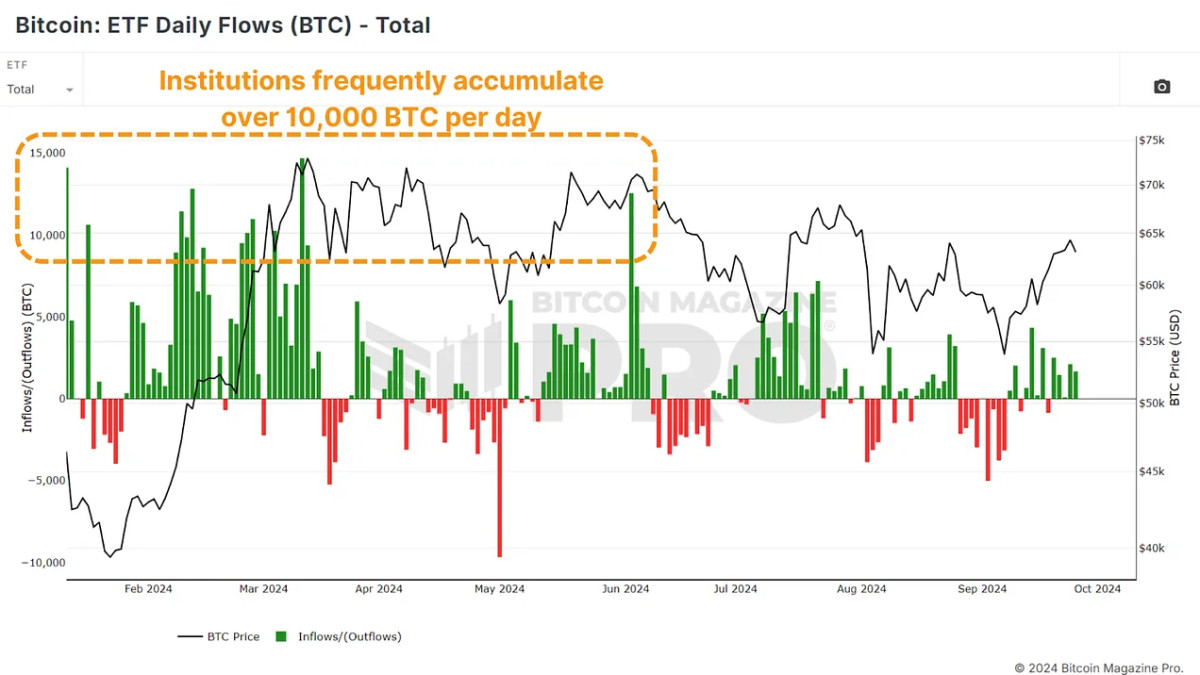

The daily inflows and outflows of ETFs, denominated in Bitcoin, offer pinpoint insights into the cycles of accumulation and selling off undertaken by heavyweight investors. Such movements grant savvy traders with the knowledge to smartly time their entry and exit points in the Bitcoin market, thereby capitalizing on opportunities to surpass the already sterling performance Bitcoin has shown in 2024.

A Crafty Approach Leveraging ETF Data

Imagine employing a straightforward tactic: purchasing Bitcoin upon witnessing positive inflows (depicted via green bars) and selling during the episodes of outflows (represented by red bars). This approach, seemingly elementary, has been linked to outpacing even the most bullish spells in Bitcoin’s timeline.

Employing this strategy has consistently led to outmatching the broader market returns by syncing trades with the price momentum and evading potential downtrends by aligning with the investment strategies of institutional backers.

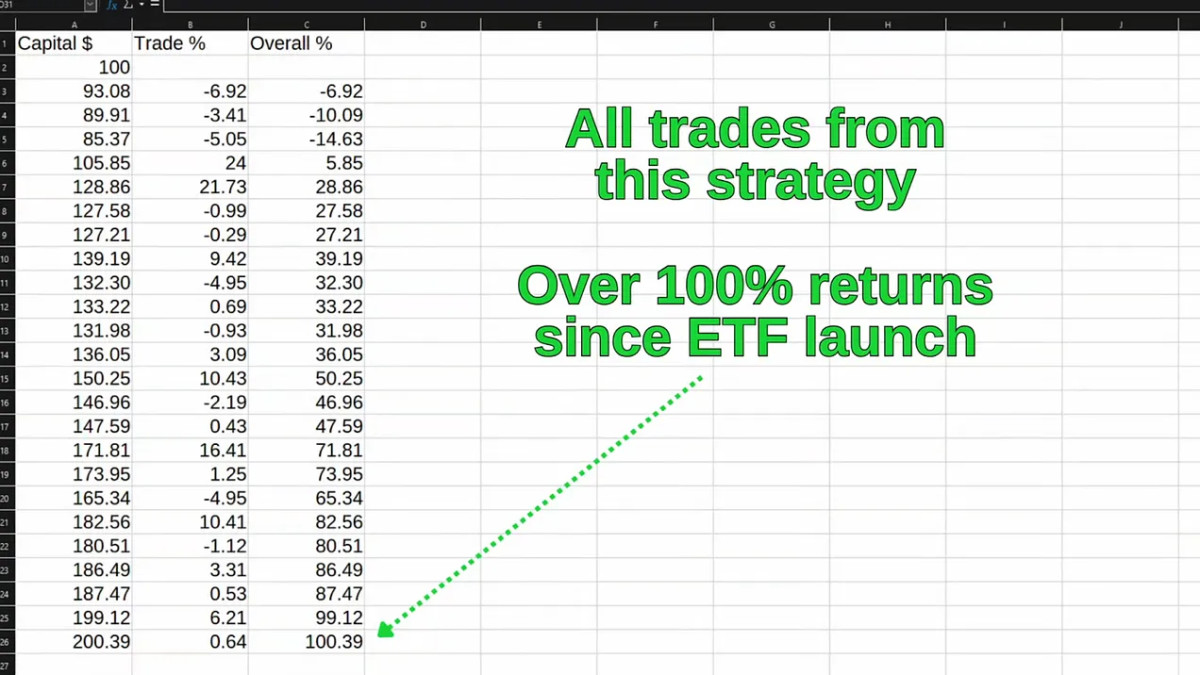

The true prowess of this method lies in the magic of compounding. Compounding one’s gains over stretches of time can dramatically amplify overall returns, even in phases characterized by either consolidation or slight volatility. Consider starting with an initial investment of $100. A 10% gain not only increases your capital to $110 but following another 10% gain escalates the total to $121. This essence of compounding, even through modest successes, can culminate in substantial profit margins, where the occasional setbacks are significantly dwarfed by the compounded victories.

Since these ETFs have graced the market, adopting this strategy has realized returns exceeding 100%, in stark contrast to merely holding BTC, which would have yielded about 37%, or even compared to timing one’s investment coinciding with the ETF’s debut and exiting at the pinnacle, which would stand at around 59%.

Beyond the stellar performance thus far, the landscape appears ripe for additional upside. A discernible trend of sustained positive ETF inflows signals that institutional appetite for Bitcoin remains robust, with days marked by significant acquisitions often leading up to price surges. Instances like BlackRock, with their IBIT ETF amassing over 379,000 BTC since its inception, underscore the potential ahead.

In Conclusion

While it’s unequivocal that market dynamics are perpetually in flux, laden with periods of unpredictability and turbulence, the historically proven correlation between ETF inflows and the ascendancy of Bitcoin prices posits a compelling narrative. This strategic prism offers an intriguing opportunity for those aiming to magnify their Bitcoin gains, transcending the conventional buy-and-hold mantra. For individuals inclined towards an active stance in augmenting returns by leveraging granular institutional data, the observation of Bitcoin ETF inflows and outflows could indeed be a monumental shift in strategy.

For those yearning to delve deeper into this fascinating domain or to stay abreast with the latest in digital finance news, a visit to DeFi Daily News is highly recommended, where an eclectic mix of trends and insights awaits.

Source link