rewrite this content using a minimum of 1000 words and keep HTML tags

The crypto market continued to decline on Thursday and today, October 17, following renewed global uncertainty after former U.S. President Donald Trump’s comments about imposing 100% tariffs on Chinese imports. The threat of trade disruption pushed investors toward defensive assets, weighing on both equities and digital currencies. With market sentiment sinking, traders are now questioning whether this correction could present the best crypto to buy opportunity before year-end.

Total crypto market capitalization fell 4.67% to $3.61 trillion, while the CMC20 Index dropped 5.4%. Bitcoin

2.95%

traded near $104,900, down 5.3% in 24 hours and 12.18% over the week. Ethereum

7.06%

slipped below $3,700, while Solana

4.92%

now at $176,

5.22%

, and Cardano

5.13%

each declined between 7% and 9%.

The Crypto Fear & Greed Index dropped to 28 (“Fear”), signaling weakened sentiment. The average crypto RSI of 35.88 also points to oversold conditions across major assets.

EXPLORE: Top 20 Crypto to Buy in 2025

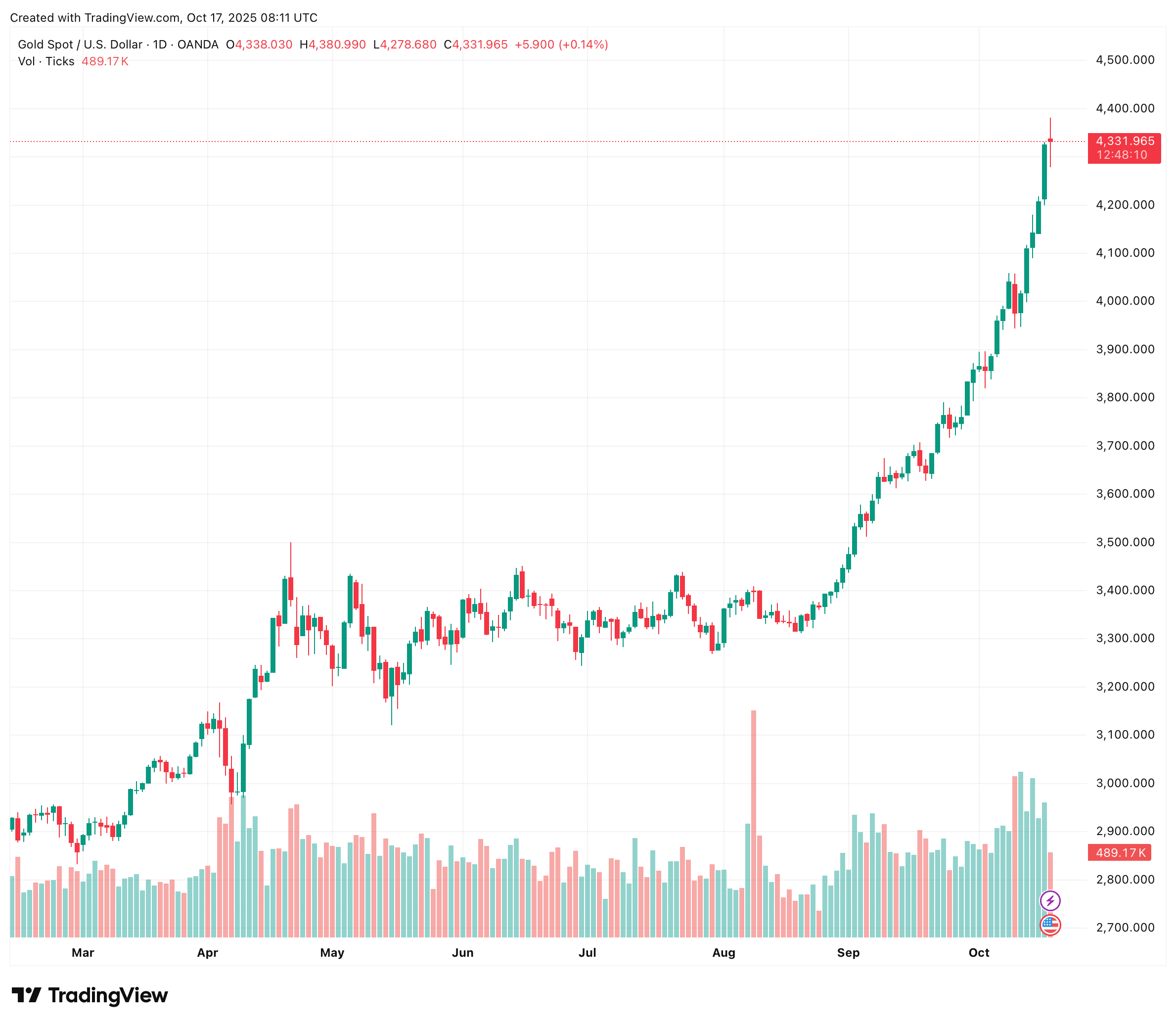

Gold Extends Record Rally as Investors Shift to Safe-Haven Assets

Gold prices continued their record-breaking climb for a fourth consecutive day on Thursday, October 16, as traders moved away from risk assets amid escalating U.S.–China trade tensions and growing fears of a U.S. government shutdown. Spot gold surged 3% to $4,380 per ounce.

(Source: TradingView)

Gold has now gained more than 60% in 2025, supported by geopolitical uncertainty, expectations of Federal Reserve rate cuts, strong central bank demand, and a continued move toward de-dollarisation. Analysts attribute much of the rally to renewed safe-haven buying, with investors increasingly diversifying away from volatile equities and crypto assets.

Meanwhile, Washington’s criticism of China’s rare-earth export restrictions and Trump’s plan for another summit with Russian President Vladimir Putin added to geopolitical uncertainty. The U.S. Federal Reserve is now widely expected to cut rates twice before year-end, with October and December probabilities at 98% and 95%, respectively.

Reflecting the broad move into precious metals, silver rose 1.8% to US$54.04 per ounce, setting a new record at US$54.15, while platinum advanced 3.2% to US$1,706.65, and palladium jumped 4.6% to US$1,606.00.

DISCOVER: Why Is Crypto Crashing? Did Robinhood Just Mark the End of the Cycle?

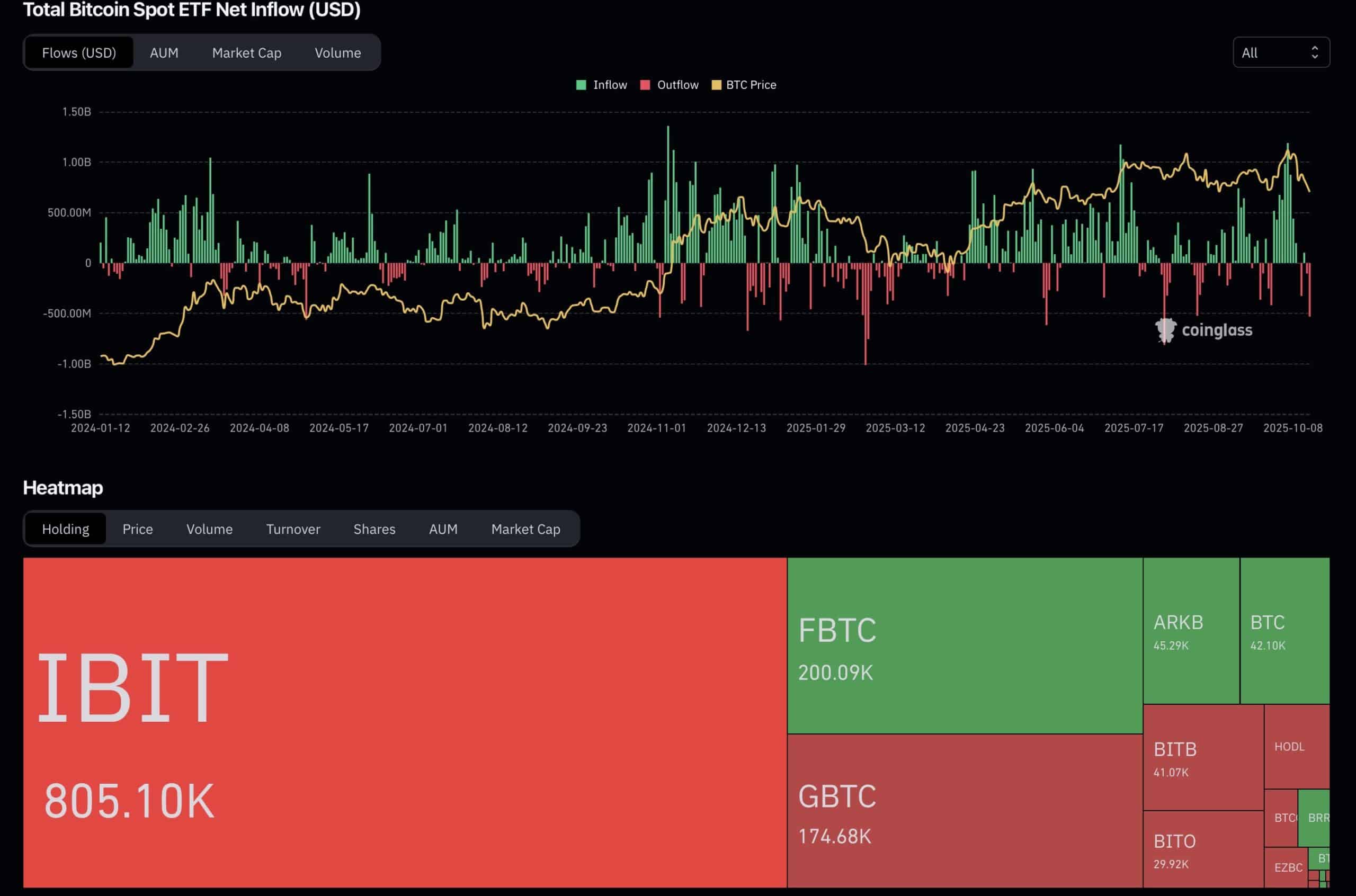

ETF Outflows Raise Caution, Traders Ask: What’s the Best Crypto to Buy Now?

On October 16, U.S. spot Bitcoin ETFs reported $536 million in net outflows, the largest single-day withdrawal since August. None of the twelve funds recorded inflows, while Grayscale’s GBTC and Fidelity’s FBTC led redemptions. Spot Ethereum ETFs saw $56.88 million in outflows, with BlackRock’s ETHA the only one to post a small inflow.

Bitcoin is now testing key support near $104,000, a level that previously triggered $2.1 billion in liquidations. The ongoing correction reflects a combination of trade-related anxiety, institutional withdrawals, and derivatives pressure.

While sentiment remains weak, analysts are watching whether ETF flows stabilize and if current prices could represent long-term accumulation zones.

For investors assessing opportunities amid fear, upcoming sessions may help identify the best crypto to buy as market volatility settles.

哈基米 (Hajimi) and GIGGLE Coin Are Last Hope of Traders: Best Memecoin To Buy?

In a market dominated by hype and short-lived trends, HAJIMI and GIGGLE stand out as two of the best memecoin to buy currently, with completely different approaches to the game.

HAJIMI is riding the wave of anime-inspired branding and community-driven storytelling. On the other hand, GIGGLE takes a more thoughtful approach. But, don’t get me wrong. It still thrives on humor and social buzz, but its core mission is charitable donations. A portion of every transaction made using GIGGLE supports the Giggle Academy (an education-focused nonprofit).

Read The Full Article Here

Bitcoin’s Rollercoaster: $103,500 Touchdown Signals Potential Bottom?

Bitcoin’s wild ride hit a nerve-wracking low of $103,500 today, October 17, 2025, before clawing back to $104,907. For the first time since July, BTC dipped below $106,000, erasing billions in leveraged longs amid a historic liquidation cascade. But is the pain finally easing?

A snapshot of exchange futures reveals the bearish heat:

Platforms like Binance (42.91% long vs. 57.09% short, $3.61B longs/$4.81B shorts) and Bybit (41.06% long/58.94% short) show overwhelming short dominance, fuelling the sub-$100K push.

KuCoin’s $73M longs pale against $107M shorts, underscoring the squeeze.

Whispers of doom linger: losing $104K could unleash a cascade to $98K, per analysts eyeing liquidity voids. Yet, fear may breed opportunity.

Crypto trader James Wynn, fresh off a brutal 10x PEPE long liquidation, flipped to a 10x PUMP short. But let’s be fair, his performance in the past few months… is disappointing. As Wynn flips bearish, could this signal that finally the bottom is in?

As James (@JamesWynnReal) got liquidated on his $PEPE (10x) long position, he opened a $PUMP short position with 10x leverage.

Classic call to go long on $PUMP? NFAhttps://t.co/1hAeECtml2 pic.twitter.com/Bd605dM9C0

— Onchain Lens (@OnchainLens) October 17, 2025

Binance Is Returning to Seoul: Will South Korea Crypto Greenlight Trigger New Binance Listings?

Binance has secured regulatory approval to take majority control of GOPAX, marking its official return to the South Korean crypto market after more than two years of scrutiny.

The Financial Intelligence Unit (FIU) confirmed the approval on Wednesday, ending a prolonged impasse that had delayed its reentry since its 2021 exit over tighter banking and AML regulations. Meanwhile, an all-new crypto market presale is set to explode if the bull market returns in Q4.

GOPAX said the board change was part of “enhancing management stability and meeting necessary regulatory requirements.” – GOPAX

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is Binance Taking Over The Crypto World Before Coinbase?

99Bitcoins analysts believe the approval is a regulatory milestone rather than a market disruptor. Upbit and Bithumb still dominate South Korea’s exchange landscape, commanding roughly 72% and 24% of the market share, respectively, according to Kaiko Research.

This signals reconciliation with regulators, but not a major disruption to Korea’s trading landscape,” one Seoul-based analyst told Decrypt.

Read The Full Article Here

Uniswap Adds Solana Support: Swap Solana Tokens Directly from the Web App

Starting today, Uniswap is rolling out native support for Solana, allowing users to connect their Solana wallets and swap Solana tokens directly from the Uniswap Web App. This integration adds Solana to Uniswap’s growing list of supported networks, which already includes Ethereum, Base, Unichain, and 13+ others.

The update addresses one of the community’s most-requested features. Solana has quickly become a major DeFi hub with over $11.4 billion in total value locked (TVL), but until now, Uniswap users had to switch apps to trade Solana assets.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link

![rewrite this title with good SEO [LIVE] Crypto News Today, October 17 – After Trump’s Speech, Crypto Market Crashes Further: Gold Price Hits ATH, Bitcoin Falls to $104K, ETH Below $3.7K — Is This the Best Crypto to Buy Opportunity? – 99Bitcoins rewrite this title with good SEO [LIVE] Crypto News Today, October 17 – After Trump’s Speech, Crypto Market Crashes Further: Gold Price Hits ATH, Bitcoin Falls to $104K, ETH Below $3.7K — Is This the Best Crypto to Buy Opportunity? – 99Bitcoins](https://i2.wp.com/99bitcoins.com/wp-content/uploads/2025/06/CryptoCrash.jpg?w=750&resize=750,375&ssl=1)