rewrite this content using a minimum of 1000 words and keep HTML tags

Chainlink’s partnership with Japanese SBI is all over the headlines Today. Investors are majorly excited as these two start working together, especially as this collaboration not only feeds into Chainlink’s use case but also spreads crypto awareness among non-crypto natives, opening up fresh liquidity. The LINK price chart is also looking very good from a technical analysis point of view.

🚨BREAKING🚨

Strategic partnership between Chainlink and SBI Group one of Japan’s largest financial conglomerates with the USD equivalent of over $200 billion in total assets. pic.twitter.com/H8MpF3eX2C

— Quinten | 048.eth (@QuintenFrancois) August 25, 2025

200 Billion USD! What does that mean? Is SBI buying 200 billion worth of LINK?

This is an institutional partnership. SBI Group is one of Japan’s most significant financial conglomerates and has been a dominant provider of internet-based financial services since the late 1990s.

Now, in light of recent successes surrounding the growth of corporate crypto reserves, it wants to grow its digital currency portfolio. To do that, it will use Chainlink’s technology.

What does the Chainlink technology do? It facilitates cross-chain tokenization of assets, cross-border payments, and compliance-focused transactions, lowering costs. It provides on-chain net asset value data to improve automation and efficiency. This ensures transparency and trust for regulated stablecoins in an institutional setting.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

I know this is a lot of information all at once. But I hope it gives a clear picture of how much Chainlink is actually doing and the strong fundamentals they’ve built to become the backbone of institutional adoption.

ChainLink Price Analysis: What Does the LINK Price Chart Say?

(LINKUSD)

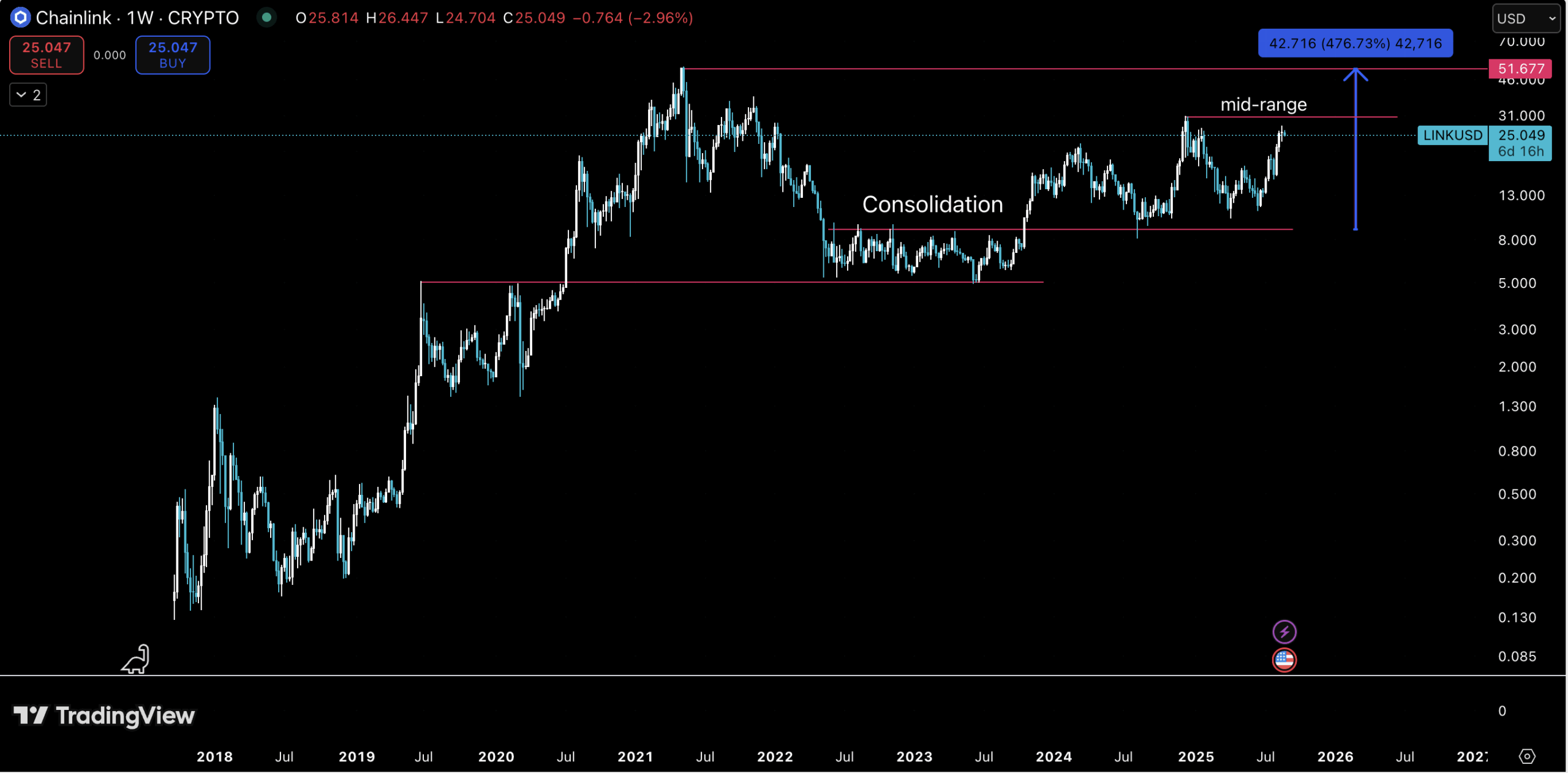

Let us begin with a higher timeframe, such as the 1W chart. Here we see the price history from the project’s inception. We see a clear consolidation from May 2022 until October 2023 that tested 2019’s highs.

Then, in late 2023, Chainlink’s price broke above the consolidation range into another one, below mid-range. The next break above should lead us to the previous ATH and soon after, above it.

DISCOVER: Top Solana Meme Coins to Buy in 2025

(LINKUSD)

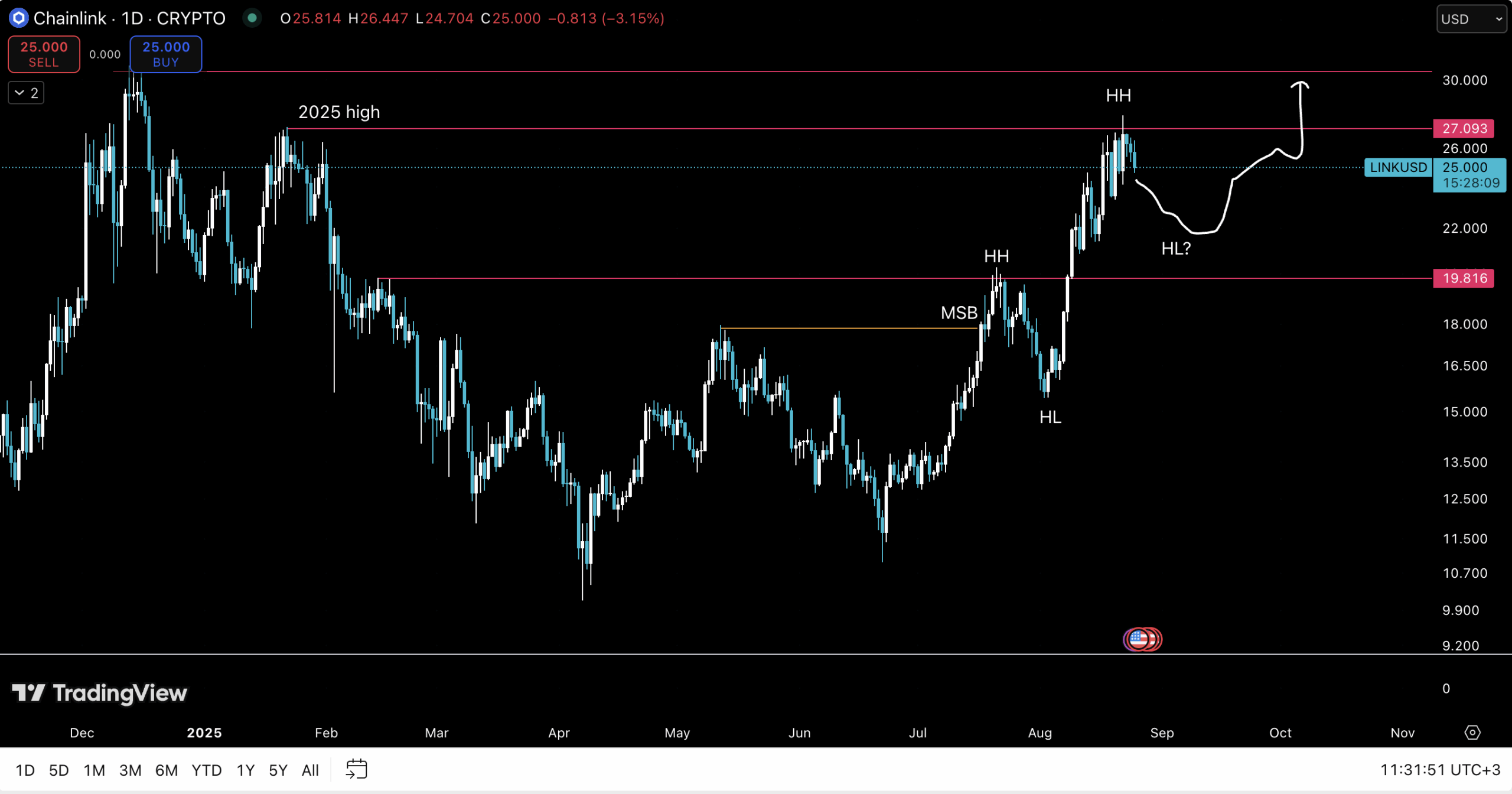

The next and final chart will be the 1D chart. It’s not good to get chopped up on lower timeframes during volatile periods. Yesterday was a great example of why it’s worth waiting and not going all in when the LINK price is between key levels.

From this chart, we see that our next level to overcome is the 2025 high. Last week, there was a clear rejection. There is a beautiful bullish trend that started in July. For long entries, I’d wait to see a higher low formed.

DISCOVER: Top 20 Crypto to Buy in 2025

Cancel out the noise and hype vibes. Protect your capital at all times. That’s the only way to stay and trade profitably in the long run.Happy trading!

Join The 99Bitcoins News Discord Here For The Latest Market Update

ChainLink Price Run Soon: Major Partnership With SBI Group

Weekly chart shows slow and steady advance towards ATH

Good consolidation periods – clearly defined

1D chart shows expected rejection at 2025 high, looking for lower high to form

Strong fundamentals of the project overall and institutional partnerships

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link