rewrite this content using a minimum of 1000 words and keep HTML tags

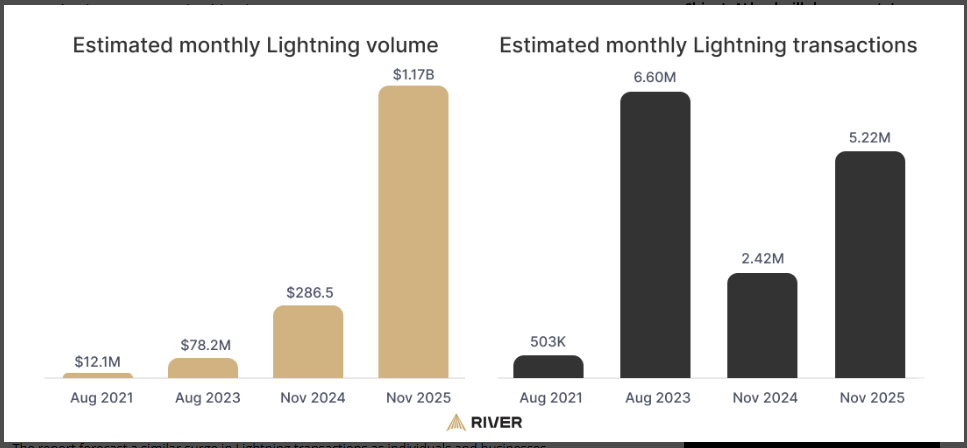

A clear sign of more than hobbyist use: monthly Lightning activity climbed past a big mark late last year. According to a report from River, November saw about $1.1 billion flow over the Bitcoin network.

That money, according to a report shared by River’s marketing chief Sam Wouters, moved through over 5 million transactions, which shows both volume and movement. It matters because money actually changed hands on Bitcoin’s second layer, not just price bets.

Adoption Driven By Bigger Players

Reports say many of the biggest gains were not from tiny tips or in-app experiments this time. Exchanges and merchant integrations are carrying a lot of the load.

Back in 2023, monthly transactions peaked at 6.6 million as apps tried out micropayments in gaming and chat. Now the shape of use looks different. Average payment sizes appear larger and the profile of users has shifted toward trading desks and businesses.

https://t.co/5Kmor1eA1n

— Sam Wouters (@SDWouters) February 19, 2026

Institutional Transfers Show Network Muscle

A striking example came when Secure Digital Markets routed a million-dollar Lightning Network transfer to Kraken. That move showed big sums can be shifted quickly without waiting for on-chain confirmation.

Network capacity, which measures BTC tied up to keep channels open, reached 5,606 BTC in December. That increased liquidity matters for larger deals because it lowers the chance a large payment will fail for lack of routed funds.

Estimated monthly Lightning transaction volume and number of transactions. Source: River

Bitcoin Price Action And Market Mood

Market conditions were mixed as the network grew. Bitcoin slid under key levels this week, and traders grew cautious as geopolitical headlines piled up.

Volume in spot markets has been muted at times, yet Lightning traffic rose despite that. Price swings still happen, and low trading days tend to amplify those moves, but the network’s payment activity did not simply mirror price spikes. In short, payments rose while BTC sometimes moved sideways.

Some of the companies that provide Bitcoin Lightning Network services. Source: River

Why Lightning Is Different

The Lightning Network moves payments off the main chain by opening channels between parties. Transactions inside a channel settle almost instantly and at a fraction of the cost of a typical on-chain transfer.

Only the channel’s net balance is posted to Bitcoin when it’s closed. That design makes small and frequent payments practical, and it removes the 10-minute wait that can ruin buying something at a store.

Reports say Lightning transactions could climb if AI systems begin making automatic micro-payments for data and computing, but that shift still needs better software and clearer business models.

For the time being, the network’s growth signals progress toward everyday Bitcoin payments, though broader exchange support, deeper liquidity, and stronger merchant use will decide whether it becomes a common payment rail or stays a niche tool.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link