rewrite this content using a minimum of 1200 words and keep HTML tags

Trading crypto is messy. One day you see a clear bullish trend, the next day charts look like spaghetti. The Ichimoku Cloud promises to clean that up. It’s a single technical indicator that gives you trend direction, support and resistance, and momentum at a glance. In this guide, you’ll see what it is, how it works, and how to actually use the Ichimoku Cloud for crypto trading without getting lost in lines.

What Is the Ichimoku Cloud?

The Ichimoku Cloud is a multi-line indicator. Unlike simple moving averages, it’s a full system with five lines that show trend, strength, and even future price movements.

Ichimoku Kinko Hyo, as it was originally named, means “one-look equilibrium chart” in Japanese. It was created by journalist Goichi Hosoda and officially published in 1969.

Here’s the key: the Ichimoku Cloud indicator doesn’t just describe what’s happening now. It projects forward, so you can see where support or resistance may form. That’s why so many crypto traders use it—you don’t just react to price action, you anticipate it.

Does the Ichimoku Cloud Work on Crypto?

Yes, it does. While it started in traditional markets, the Ichimoku is widely used in crypto trading today. It works on Bitcoin, Ethereum, and altcoins. Exchanges and charting platforms like TradingView or Binance include it by default.

It’s especially useful in volatile crypto markets. Most indicators look backward. The Ichimoku also looks forward—the cloud, called the kumo cloud, shifts into the future. That’s a huge advantage when you’re dealing with 24/7 trading and wild swings.

Why Crypto Traders Use the Ichimoku Cloud

So why use this system over a dozen other indicators?

It saves time. You can see market trends, momentum, and support and resistance levels in one glance.

It adapts. The cloud suggests where price may find a floor or ceiling, even before it gets there.

It confirms. The lagging span (Chikou) lets you compare current and past trends, filtering noise.

It gives trading signals. Crosses, twists, and breakouts help you spot when to enter or exit.

That’s why it’s considered a “multi-tool” for crypto traders.

Imagine you’re charting Bitcoin. Normally, you might combine a 50-day moving average, RSI, and MACD. That’s three indicators, each with separate rules. The Ichimoku Cloud indicator folds all of that into one visual. Instead of flipping between tools, you get a single snapshot that shows whether BTC is trending, where it might stall, and whether momentum is building.

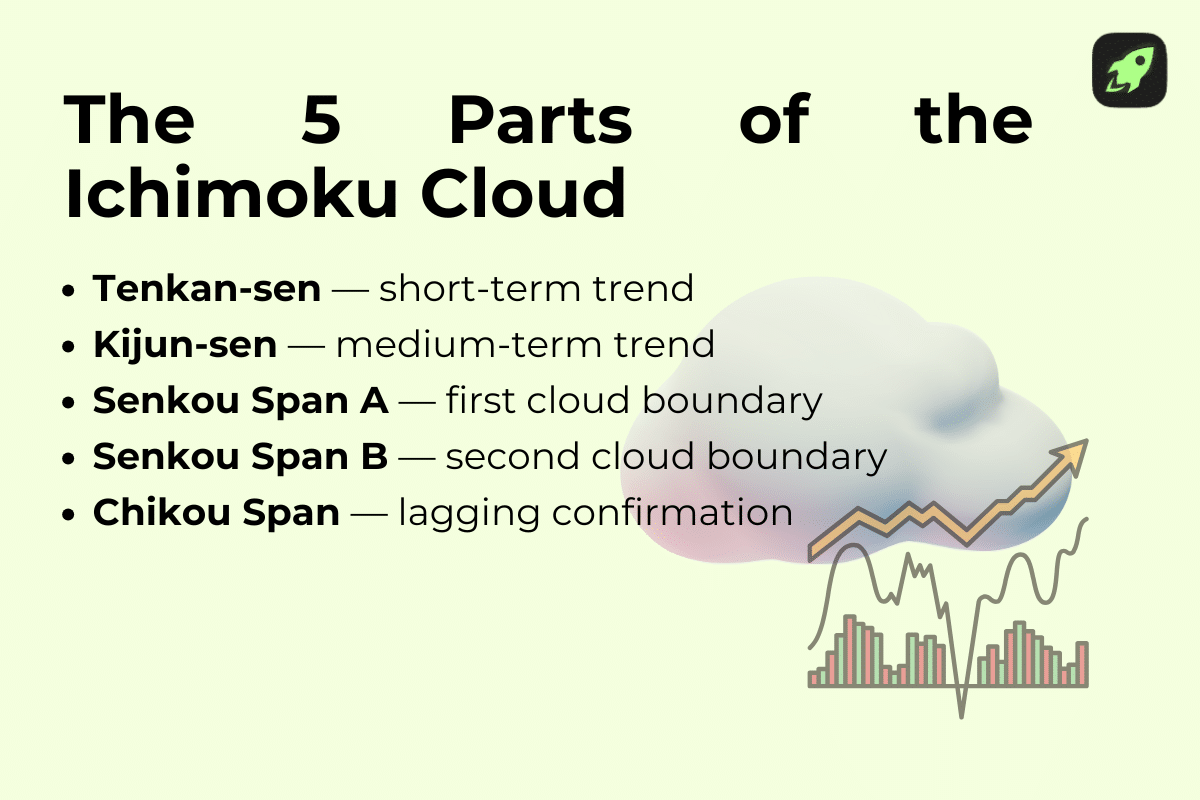

Ichimoku Cloud Components Explained

The system has five key components. Each has its role, and together they form a complete picture. Let’s break them down.

Tenkan-Sen (Conversion Line)

The Tenkan-sen, or conversion line, is the short-term line. It shows the midpoint of the highest high and lowest low over the last nine periods.

Formula: (9-period high + 9-period low) ÷ 2.

Think of it as a fast moving average, but instead of closing prices, it uses midpoints. If Bitcoin jumps from $40,000 to $42,000 over 9 hours, the Tenkan will sit right in the middle. That makes it quick to react, great for spotting short-term trend shifts.

Kijun-Sen (Base Line)

The Kijun-sen, or base line, is slower. It shows the midpoint of the past 26 periods.

Formula: (26-period high + 26-period low) ÷ 2.

It’s like a slower, steadier compass. If ETH trades between $2,000 and $2,600 in the last 26 hours, the Kijun-sen will sit at $2,300. Price above it means strength, price below it means weakness. Many traders wait for price to retest the Kijun—this is the Kijun Bounce.

Senkou Span A and B (The Cloud or Kumo)

Here’s the heart of the system: the kumo cloud. It’s made of two leading spans that project forward.

Senkou span A: (Tenkan + Kijun) ÷ 2, plotted 26 periods ahead.

Leading span B: (52-period high + 52-period low) ÷ 2, also shifted forward.

The space between these two creates the shaded cloud boundaries.

If span A is above span B, you get a green cloud (bullish bias).

If span A is below span B, you get a red cloud (bearish bias).

The cloud’s color makes bullish and bearish trends obvious. Its cloud thickness matters too: thick = stronger support and resistance, thin = weak zones vulnerable to reversals.

Chikou Span (Lagging Line)

Chikou is the lagging span. It plots today’s closing price 26 periods back. That sounds odd, but it gives context: is the current market stronger or weaker than it was 26 candles ago?

If Chikou is above the price, that’s bullish confirmation.

If it’s below, it signals bearish momentum.

This backward look is what traders call lagging span confirmation. It helps you avoid chasing weak moves.

How to Set Up the Ichimoku Cloud for Crypto Trading

On TradingView or Binance, just add the Ichimoku indicator. The default Ichimoku Cloud settings are 9-26-52. These come from Japanese trading weeks: 9 days (1.5 weeks), 26 days (month), 52 days (two months).

In crypto, some adapt to crypto-adjusted parameters like 10-30-60 because the market never sleeps. Still, most pros recommend learning the classic 9-26-52 first.

When you add it to a chart, hide extra moving averages so your screen doesn’t turn into rainbow soup. Save your layout as “Ichimoku Cloud chart” to reuse.

Timeframes That Work Best (1h, 4h, Daily)

The Ichimoku works on all timeframes, but it shines on higher ones.

Daily: Best for defining the main trend analysis.

4h: Great for swing trades that last days.

1h: Fine-tunes entries, especially after a breakout.

Combine them with multi-timeframe analysis. For example, only go long when the daily and 4h are bullish, then use the 1h to time the entry. This stacking helps you catch more reliable signals.

How to Read the Ichimoku Cloud

Here’s the step-by-step read:

Position relative to the cloud: above = a bullish trend, inside = chop, below = a bearish trend.

Check the Kijun-sen slope. Rising means bullish momentum, falling means bearish sentiment.

Look at the Chikou span: is it above or below past candlesticks? That tells you strength.

Note cloud boundaries and cloud thickness. A twist or thinning often hints at trend shifts.

Put together, this gives a complete view of market dynamics.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

How to Calculate Senkou Span A and Span B in Ichimoku Kinko Hyo?

Let’s be clear:

Leading span A = (Tenkan-sen + Kijun-sen) ÷ 2, plotted 26 periods ahead.

Leading span B = (52-period high + 52-period low) ÷ 2, also plotted 26 ahead.

These forward-projected lines build the future kumo. For example, if BTC trades between $85,000 and $95,000 in the past 52 candles, span B will sit at $90,000. That midpoint often acts as potential support or resistance.

Now, do you need to calculate these manually? The answer is no—every major trading platform (TradingView, Binance, Bybit, Kraken, etc.) already has the Ichimoku Cloud built in. When you apply it, the platform automatically calculates all five lines, including Senkou span A and B, and shifts them forward on your chart.

How to Identify Bullish and Bearish Signals with the Ichimoku Cloud Indicator?

Here’s how you read Ichimoku trading signals:

Bullish signal: Price breaks above the kumo cloud, Tenkan crosses above Kijun, and the lagging span clears past price.

Bearish signals: Price breaks below the cloud, Tenkan crosses below Kijun, and Chikou is under price.

Add strength filters: a buy signal is stronger if the breakout aligns on higher timeframes. A sell signal is stronger if the cloud suggests resistance overhead.

Ichimoku Cloud Trading Strategies for Crypto

You now know the parts. Let’s put them into Ichimoku Cloud trading strategy setups.

Kumo Breakout Strategy

Look for a bullish kumo breakout above a green cloud. Confirm with volume. Enter a long position on breakout or wait for a breakout retest at the cloud edge. Place a stop-loss order under the cloud. Set a take-profit order at prior highs.

Mirror rules apply for a bearish kumo breakout. This is a classic trading strategy for trend shifts.

Tenkan-Kijun Crossover Strategy

Watch Tenkan-sen and Kijun.

A Bullish Tenkan–Kijun Cross above the cloud is a strong entry.

A Bearish Tenkan–Kijun Cross below the cloud is a strong short setup.

This is a clear crossover method. Filter with trend bias from the higher timeframe.

Chikou Span Confirmation Strategy

Use the Chikou span as a filter. Only enter when it confirms the trend following signal. For example, if Tenkan crosses Kijun bullish, check if Chikou is above the price. That’s lagging span confirmation.

Kumo Twist Strategy

A Kumo Twist happens when span A crosses span B forward in time.

Red-to-green twist = possible bullish trend while forming.

Green-to-red twist = possible a bearish shift.

This is not a standalone entry. Combine it with a pullback or trend continuation setup to reduce false starts.

Pros and Cons of the Ichimoku Cloud

When the Ichimoku Cloud Doesn’t Work Well

The Ichimoku Cloud strategy isn’t perfect. It struggles in flat markets. A flat kumo means the market price is consolidating. In these zones, you’ll get false signals. The best move here is to wait for a clear breakout before acting.

Take any altcoin during its quiet periods. The cloud often flattens and flips color back and forth. A trader relying only on the cloud there would see constant buy signals and sell signals that quickly fail. Adding ATR or Volume filters helps—if there’s no real momentum behind the move, skip it. The cloud gives you context, but you need to confirm the trade has fuel.

Combine With Other Indicators (e.g. RSI, Volume)

You can strengthen Ichimoku analysis with other tools. Add RSI to gauge overbought/oversold. Use Average True Range for stop sizing in high Volatility. Track Volume to filter fake breakouts. But keep your charts clean—too many indicators kill clarity.

Risk Management Tips for Cloud-Based Trading

Never skip risk management. The Ichimoku can show a perfect buy or sell signal, but without control, one loss wipes gains.

Use position sizing and keep risk below 2% per trade.

Follow a set risk–reward ratio (like 1:2).

Exit if price closes back inside the kumo cloud.

Avoid heavy leverage against the trend.

One practical way to set stops is with the Average True Range (ATR), which measures volatility. Check the Average True Range (ATR) of your pair. If ATR on BTC is $600, set your stop at least 1× ATR below the cloud when going long. That way, normal noise won’t knock you out. This method respects the volatility of crypto markets while still giving room for your trade to breathe.

Tips for Using the Ichimoku Cloud in Crypto

Using the Ichimoku Cloud for crypto trading gets easier if you follow a structured approach. Here are practical tips:

Start with the basics.Focus first on the conversion line, base line, and the kumo cloud. These three show trend, support and resistance, and momentum. Add the chikou span later for lagging span confirmation once you’re comfortable.

Backtest your trading strategies.It’s recommended to run at least 100 backtesting trades using historical data. Test rules like a bullish kumo breakout or a Tenkan–Kijun crossover. Record outcomes to see which setups give the most reliable signals.

Keep a trading plan.Write down your preferred timeframes, valid Ichimoku trading signals, and exact risk management rules. A clear trading plan keeps you disciplined during volatile crypto markets.

Use the right order types.Place a market order if you need to catch a fast breakout. Use a limit order for pullbacks near the Kijun-sen. Always pair orders with a stop-loss to protect against sudden price movements.

Stay consistent.Don’t jump between systems. Stick with the Ichimoku Cloud strategy, refine it, and trust your data. Consistency turns technical analysis into actionable trades.

Final Thoughts

The Ichimoku Cloud looks complicated at first, but it’s just five lines working together. You get structure, bias, and forward-looking valuable insights in one tool. Start with the basics, keep risk tight, and add layers as you grow.

Used well, the Ichimoku Cloud chart helps you cut through noise and make sharper trading decisions in the crypto market.

FAQ

What is the difference between leading spans and lagging spans in Ichimoku analysis?

Leading span A and Leading span B project forward, building the future kumo. The lagging span plots backward and confirms with historical data. Together, they show both future price movements and past context.

What does a green cloud vs red cloud indicate in crypto price analysis?

A green cloud = bullish bias and potential support. A red cloud = bearish bias and overhead resistance. Many traders check the cloud’s color first before anything else.

Does the Ichimoku Cloud work better on Bitcoin, Ethereum, or altcoins?

It works on all digital assets. The cleaner reads come on BTC and ETH due to higher liquidity and volume. On small-cap alts, signals are noisier.

Why do crypto traders use the Lagging Span to confirm trade signals?

Because it filters weak moves. If the Chikou span is above past price, it confirms strength. If below, it warns of weakness. That’s why many wait for lagging span confirmation before pulling the trigger.

How do I know if the Ichimoku Cloud is right for my trading style?

If you like trend following and structured technical analysis, it fits. If you prefer scalping every tick, it may feel slow. Try it on higher timeframes and see if its pace matches you.

Do I need to learn every line in the Ichimoku Cloud, or can I start with just a few?

You can start with just the conversion line, base line, and kumo cloud. Add the Chikou once you’re comfortable. It’s better to learn step by step than drown in signals.

Are there certain market conditions where Ichimoku doesn’t work well?

Yes. In consolidation, especially with a flat kumo, the system gives choppy, unreliable signals. In those conditions, patience is your best strategy.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link