rewrite this content using a minimum of 1200 words and keep HTML tags

Cryptocurrency trading can feel overwhelming when you’re just starting out. But it doesn’t have to be. With the right tools, a solid plan, and a clear understanding of how crypto markets behave, you can start trading digital assets confidently, even as a beginner. This guide shows you how to trade crypto from scratch, covering everything from picking your first coin to avoiding costly mistakes. Whether you’re curious about day trading or just want to learn how to buy and sell safely, this is where you start.

What Is Crypto Trading?

Crypto trading means buying and selling cryptocurrencies to make a profit. You try to predict price movements by analyzing market trends—just like in stock or forex trading. The goal is simple: buy low, sell high.

Unlike traditional markets, crypto trades 24/7. Prices move fast, driven by news, supply and demand, investor sentiment, and broader economic events. Traders use tools like charts and indicators to spot patterns and time their moves.

Some trade daily, others hold long-term. Either way, you’re always reacting to how the market behaves.

Why Trade Cryptocurrency?

Trading cryptocurrencies offers opportunities that traditional markets often don’t. Here’s why many choose to trade digital assets:

24/7 market access. Unlike stock markets, cryptocurrency exchanges never close. You can trade anytime, including weekends and holidays.

Volatility creates opportunity. Crypto prices move quickly. This gives traders more chances to profit from short-term changes.

Low entry barriers. You don’t need a large sum to start. You can trade with as little as $10.

Diverse digital assets. Thousands of cryptocurrencies offer unique features and roles, giving traders a wider range of options.

Global market. Crypto trading is borderless. You’re not limited by country-specific exchanges or business hours.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

Crypto Trading vs. Stock Trading

Crypto trading and stock trading both involve speculating on price movements, but how they work under the hood is very different.

Cryptocurrency markets are decentralized, borderless, and run on blockchain networks. Trades settle in minutes and assets can be self-custodied. In contrast, stock markets are centralized, operate through brokers, and rely on third-party custodians. That means crypto gives you more control, but also more responsibility for things like security and risk management.

With stocks, you’re trading equity—ownership in a real-world company, backed by financials, leadership teams, and regulatory filings. In crypto, assets range from utility tokens, to governance rights, to pure speculation. The value behind each token varies widely, and you often have to do more due diligence yourself.

Regulation is another key difference. Stocks are heavily regulated by national authorities (like the SEC in the U.S.). Crypto regulation is still developing, varies by country, and in some cases, is nonexistent. This makes the crypto market more flexible—but also riskier and less predictable for new traders.

How to Start Trading Crypto

To start trading you need the right tools and a plan. Here’s a step-by-step guide that covers everything you need, from creating a crypto account to making your first trade.

Choose a Crypto Exchange

Start by choosing a cryptocurrency exchange. This is the platform where you’ll buy, sell, and trade digital assets. Look for one that offers low fees, strong security, and a user-friendly interface. It should support your local currency and preferred payment methods. Reputable exchanges like Coinbase, Binance, and Kraken are good starting points if you’re unsure.

Setting Up Your Account

Once you’ve picked an exchange, create an account using your email and a secure password. Most platforms will ask for identity verification through a KYC process. This usually involves uploading an official ID and a photo to confirm your identity. Some exchanges complete this in minutes, while others may take longer. After verification, you’ll have full access to trading features.

Fund Your Account

To start trading, deposit money into your account. Most exchanges support payments via bank transfer, card, or third-party services. Some also let you deposit cryptocurrencies if you already own some. Choose the funding method with the lowest fees and the fastest processing time. Once your balance is available, you’re ready to make your first trade.

Choose a Wallet

Storing your crypto safely is just as important as trading it. You can use the exchange’s built-in wallet, but it’s safer to store your assets in a wallet you control. You have a few options here. Hot wallets are connected to the internet and are more convenient for active traders. Meanwhile, cold wallets are offline and provide stronger protection for long-term holdings. Beginners often start with hot wallets and later switch to cold storage for better security.

Read more: Top Cryptocurrency Wallets

Buy, Sell, and Swap Crypto

To make your first trade, select a crypto trading pair like BTC/USD or ETH/USDT. You can place a market order if you want the trade to happen immediately at the current price. If you’re waiting for a specific price, use a limit order (link).

Swapping lets you exchange one cryptocurrency for another without using fiat currency, which is useful for portfolio adjustments.

Monitor Your Account and Trade History

After you make a trade, you’ll want to monitor your account activity. Most exchanges give you access to your trade history, open orders, and balance changes. Use this data to track your profits, losses, and trading fees. Reviewing your history regularly helps you improve your strategy and spot trends in your performance.

Withdraw Your Cryptocurrency into a Wallet

Once you’ve completed a trade, you can leave your crypto on the exchange or move it to a personal wallet. To withdraw, go to the withdrawal section, enter your wallet address, confirm the details, and complete the transaction. Transferring your crypto off the exchange lowers the risk of losing access if the platform faces technical issues, freezes, or there’s a security breach.

Types of Cryptocurrency Trading

There are two main ways to approach the crypto market: long-term and short-term trading. Don’t mistake these for long and short positions––this is a different concept.

Your strategy depends on how often you want to trade, how much time you can commit, and what kind of risk you’re comfortable with. Think of it like using a bank account: are you saving for years, or moving money around daily?

Long-Term Trading

Long-term trading means buying crypto assets and holding them for months or years. The goal is to wait for the value to increase significantly over time. Many beginners choose this method because it doesn’t require constant monitoring of the crypto platform. It’s similar to investing in stocks or real estate. You believe in the project behind the coin, such as Ethereum or Bitcoin, and you expect it to grow in value as adoption increases.

If you choose this strategy, you might trade Bitcoin once, then hold onto it while ignoring short-term price swings. That way, you’re less exposed to the day-to-day noise of the market, but you have to be patient and willing to see your investment dip in the short term. Security becomes more important here—you’ll want to store your assets in a private wallet rather than leave them on the exchange.

Read More: Best Long-Term Cryptocurrencies for 2025

Short-Term Trading

Short-term trading focuses on taking advantage of small price changes over hours or days. You make trades frequently and rely on fast decision-making. This approach suits people who are comfortable spending more time on a crypto platform, watching charts, and acting on short-term signals.

A short-term trader might buy a crypto asset in the morning and sell it that evening if the price goes up. Unlike a long-term holder, you’re not concerned with the coin’s future potential—just whether you can earn a profit from the current price movement. It’s more like flipping currency than saving in a bank account.

This strategy can generate quicker gains but comes with higher risk. Crypto prices move fast, and if you’re not paying attention, losses can happen just as quickly as profits. Beginners can still try this approach, but it’s essential to start small and treat it like a skill to develop over time.

Picking Your First Cryptocurrency for Trading

Choosing your first crypto to trade is one of the biggest hurdles beginners have to overcome. Choice paralysis is already rough when you’re just looking for your next Netflix show, and now there’s money involved!

It’s easy to chase headlines or jump on a coin that’s suddenly trending. But hype is not a strategy. What you need is a coin that behaves predictably in most conditions, with solid infrastructure and enough trading activity to let you buy or sell without issues. The best beginner-friendly coins are well-supported across major trading platforms, backed by active development teams, and tested by real-world use.

Popular Beginner-Friendly Coins

These cryptocurrencies are widely available, supported by most platforms, and actively used by day traders and investors alike.

Bitcoin (BTC). The most traded and well-known cryptocurrency. It has high liquidity and is often used as a reference for market trends.

Ethereum (ETH). Known for smart contracts and a massive developer base. Offers long-term potential and steady volume.

Litecoin (LTC). A lighter, faster version of Bitcoin. Often used for smaller transactions with lower transaction fees.

USD Coin (USDC). A stablecoin that doesn’t fluctuate much. Good for learning how trades work without heavy risk.

Solana (SOL). Popular among newer traders thanks to its fast transactions and growing ecosystem.

What Makes a Good First Investment?

Your first crypto trade should be simple to execute and easy to manage. That starts with liquidity. A coin that trades on two or three major platforms with consistent daily volume gives you the flexibility to enter and exit without delays or price slippage. If you’re relying on a tiny exchange or struggling to fill an order, you’re already adding risk you don’t need.

Equally important is clarity. If you can’t explain what the coin actually does in one sentence, you shouldn’t be trading it. That doesn’t mean memorizing the technical whitepaper, but you should understand the basics: what the project is for, who’s behind it, and how it works. If the last update was over a year ago, take that as a warning. Active projects leave a visible trail.

Trading volume can confirm whether price moves are real. High volume means stronger trends and fewer false signals. That gives you a more stable environment to practice entering and exiting trades with confidence. Market cap is also worth considering. Smaller-cap tokens often move faster, but not always for the right reasons. A single rumor can push the price up or down 20% in an hour. As a beginner, that kind of volatility can be fatal for your funds.

Remember: the goal with your first investment isn’t to find the next breakout. It’s to build comfort with the trading process.

How To Trade Crypto 101: The Basics You Need To Know

Before you place a trade, you need to understand how the market works. Crypto doesn’t move randomly—there are patterns, tools, and data that can help you make better decisions.

What Drives Crypto Prices?

Crypto prices change based on supply and demand, but the forces behind that demand are unique. News, regulations, and macro events (like inflation or interest rate changes) often trigger big moves. So does sentiment—fear and hype spread fast in crypto.

On-chain activity also matters. If more people are using a network (sending tokens, staking, or minting NFTs), that usually increases the price. Limited supply, token burns, or halving events (like Bitcoin’s) can reduce available coins and push prices higher.

Lastly, large traders (whales) can move markets with a single transaction. In a low-liquidity market, which happens quite often for cryptocurrencies, that matters more than you think.

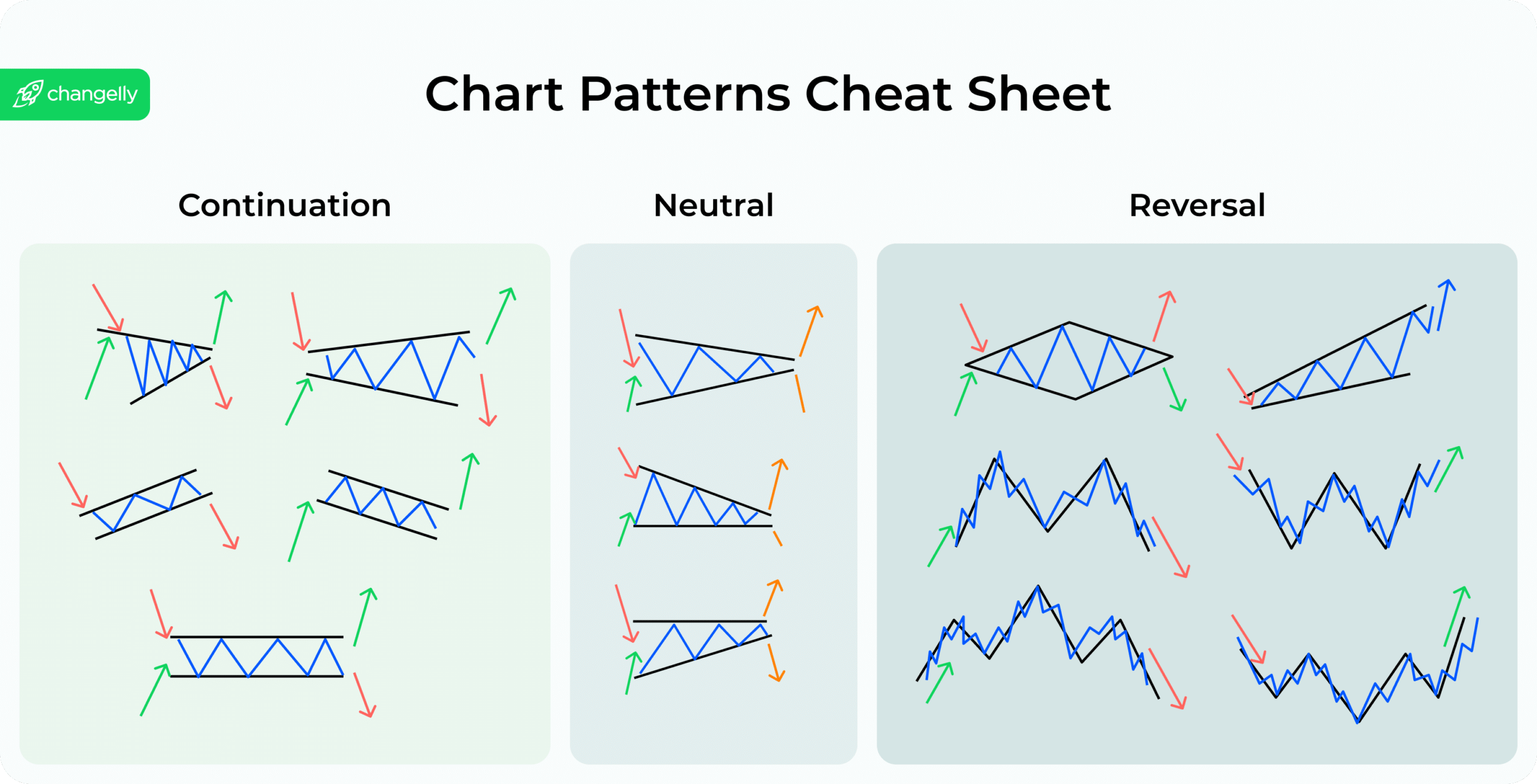

Basic Chart Reading

Charts help you see what the price has done, and what it might do next. You’ll mostly use candlestick charts, which show how prices move over time. Green candles mean the price went up during that time frame; red means it went down.

You’ll also see support and resistance levels—these are zones where the price tends to stall or reverse. Learning to spot them gives you an edge when deciding where to enter or exit.

Technical Analysis

Technical analysis means using chart patterns, volume, and indicators to find trading opportunities. It doesn’t predict the future, but it helps you make more informed decisions based on past price behavior. Popular tools include RSI, moving averages, MACD, and Fibonacci retracements. These can help you time trades and manage risk more effectively.

Order Types

Every crypto trade starts with an order, but not all orders are the same. The type of order you choose determines how and when your trade is executed.

Market orders are the simplest. You buy or sell at the current market price. It’s fast, but you might pay more (or get less) than expected in a volatile market.

Limit orders let you set a specific price. The trade only happens if the market hits that price. It gives you more control, but there’s a chance your order won’t be filled.

Stop-loss orders help protect your downside. If the price drops to a certain level, the stop order turns into a market order and sells your asset automatically.

Take-profit orders work the same way, but on the upside. Once the price hits your target, the asset sells and locks in any gains.

You can open a long position if you expect the price to rise: you’re buying low to sell high later. If you expect a drop, you can take a short position, which means borrowing an asset to sell it now and buying it back at a lower price. Shorting involves more risk and usually requires a margin account.

Using the right order type—and knowing when to go long or short—helps you trade smarter, manage risk, and avoid emotional decisions.

When To Sell

Knowing when to sell is just as important as knowing when to buy cryptocurrency. Selling too soon means you miss potential gains. Selling too late could wipe out your profits.

Set a clear target before you buy. Decide the price where you’ll take profit and stick to it. Emotional selling leads to bad trades.

You can use technical indicators to find exit signals. For example, if the price hits a strong resistance level or an indicator like RSI shows the asset is overbought, it may be time to sell.

Don’t ignore fundamentals. If a project’s leadership changes, development stalls, or bad news hits the market, selling can protect your capital.

Have a stop-loss plan. This automatically sells your position if the price falls below a certain point. It limits your losses and removes the pressure to make a split-second decision.

Tools for Crypto Research

You can use these tools to stay informed and spot strong trading setups:

CoinGecko / CoinMarketCap. Track price, volume, market cap, and project stats

TradingView. Charting platform with technical indicators and drawing tools

Glassnode / IntoTheBlock. On-chain analytics (wallet activity, flows, etc.)

Messari. Deep research reports on crypto projects

X (formerly Twitter). Real-time updates from traders, devs, and analysts

Discord/Telegram. Community discussions, but be cautious of hype

Popular Cryptocurrency Trading Strategies

There’s no single way to trade cryptocurrency. Your strategy depends on how much time you want to spend watching the market, how comfortable you are with risk, and what your trading goals are. Below are beginner-friendly strategies that help you find optimal entry points, manage your crypto account, and respond to changing market conditions.

HODLing (Long-Term Holding)

HODLing means buying a virtual currency and holding it for months or years, regardless of short-term price swings. You’re not trying to time the market—you believe in the long-term value of the asset and trust the network security and adoption of the project.

It’s a low-effort, low-stress strategy, best for people with a long time horizon and low trading frequency. Bitcoin and Ethereum are the most common coins held this way.

Day Trading

Day trading involves buying and selling crypto within a single day to profit from short-term price movements. You’ll need to stay active, watch the charts, and learn to recognize patterns that signal when to enter or exit trades.

This strategy requires discipline, fast decision-making, and a high risk tolerance. It’s not recommended unless you’re ready to spend time learning how the market reacts minute-by-minute.

Swing Trading

Swing traders hold positions for several days or weeks. The goal is to catch “swings” in price—buying after a dip and selling after a rise. You don’t need to monitor your crypto account constantly, but you do need to follow market conditions and use basic analysis tools.

This strategy strikes a balance between HODLing and day trading, and it’s a good entry point for beginners who want to be more hands-on.

Dollar-Cost Averaging (DCA)

DCA means investing a fixed amount into a cryptocurrency at regular intervals—no matter the price. For example, buying $50 worth of Bitcoin every week.

This strategy smooths out volatility. Instead of trying to time the market, you spread out your purchases and reduce the impact of sudden price changes. It’s a solid way to build exposure without making emotional decisions.

Trend Trading Strategy

Trend trading means identifying the direction of the market—up or down—and trading in that direction. If the price is rising, you look for a good entry and ride the trend. If it’s falling, you might short the asset or stay out entirely.

To use this strategy, you need to understand how to recognize patterns, follow news that affects virtual currencies, and confirm trends with technical indicators. It’s more advanced than DCA or HODLing but still accessible to committed beginners willing to learn.

How To Protect Your Crypto Assets

Trading cryptocurrency opens new opportunities, but it also puts your digital assets at risk if you don’t take security seriously. Here’s how to protect what you own, whether you’re day trading or holding for the long term:

Use non-custodial walletsCustody services are third parties that hold your crypto for you (like an exchange). Non-custodial wallets let you hold your own private keys, giving you full control and full responsibility.

Enable two-factor authentication (2FA)This adds a second layer of security beyond your password. Use apps like Google Authenticator or Authy, not SMS.

Write down your seed phraseStore it offline in multiple secure locations. Never save it in cloud storage or screenshots.

Watch for phishing scamsAlways double-check URLs, emails, and apps. Never click unknown links or approve wallet access from untrusted sources.

Use cold wallets for long-term storageThese offline wallets are immune to online attacks. Devices like Ledger or Trezor are good options.

Keep software updatedWhether it’s your wallet app or browser extension, updates patch critical security vulnerabilities.

Risk Management in Crypto

Risk management is what separates a lucky win from a consistent trading strategy. In crypto, value changes can happen fast, especially if you’re day trading or reacting to sudden news. Without a plan, it’s easy to lose more than you gain.

Start by defining how much you’re willing to risk on each trade. Many experienced traders never risk more than 1–2% of their total portfolio. This limits losses when the market moves against you. Whether you’re trading Bitcoin or swapping tokens for fiat currency, this rule helps preserve capital.

Next, understand the role of stop-loss and take-profit levels. These tools let you automate your decisions instead of reacting emotionally. If a coin drops below your risk threshold, you sell. If it hits your target, you lock in profits. It’s simple, and it works.

Don’t rely on borrowing or leverage until you understand how crypto behaves. Crypto is nothing like traditional currencies—it’s faster, more volatile, and less forgiving. Brokerage services may offer advanced features, but they won’t protect you from bad trades.

Even long-term holders need a risk plan. You’re still exposed to market cycles, regulation shifts, and tech risks. Diversify your assets, stay updated, and review your portfolio regularly. As new opportunities arise, you’ll be in a better position to buy and sell with confidence.

Common Mistakes Beginners Make When They Start Trading Crypto

New traders often repeat the same avoidable errors. Here are the most common mistakes:

Assuming day trading is easyMost beginners lose their money fast. Timing trades without experience is harder than it looks.

Trading too many coinsFocus on one or two assets at first, like Bitcoin, Ethereum, or Solana. Spreading your money thin leads to confusion and poor decisions.

Using tools you don’t understandIndicators won’t help if you don’t know how they work. Learn before you rely on them.

Trusting price over fundamentalsPrice spikes often mean hype, not quality. Look at the project, not just the chart.

Focusing on the charts too muchThere’s a phenomenon called analysis paralysis, a situation when traders get overwhelmed by all the charts and indicators, too afraid to make a mistake and thus not making any traders. Remember that while research is important, charts aren’t everything.

Treating crypto like gamblingRandom trades aren’t a strategy. Stick to established rules and review every move.

Neglecting security early onEven small amounts get stolen. Use strong passwords, wallets, and two-factor authentication from day one.

Final Thoughts

Trading cryptocurrency isn’t about luck—it’s about learning how markets move, protecting your digital assets, and building a strategy that works for you. Start simple. Focus on coins with real utility. Keep your risk low and your security tight. As your skills grow, so will your ability to spot opportunities and react with confidence. The crypto market moves fast, but with the right foundation, you don’t have to fall behind.

FAQ

Is cryptocurrency trading safe for beginners?

It can be if you start small and learn the basics. Crypto is highly volatile, so managing risk is essential from the start.

How much money do I need to start trading crypto?

You can trade cryptocurrency with as little as $10. Most platforms have low entry limits, making it easy to begin.

Can I lose all my money in crypto trading?

Yes, especially if you ignore risk or try day trading without a plan. Digital assets can drop sharply without warning.

What’s the difference between investing and trading crypto?

Investing means holding long-term based on a project’s potential. Trading focuses on short-term price moves to earn rewards more frequently.

How do I know which crypto is worth buying?

Start with assets that have high trading volume, are listed on major exchanges, and behave predictably—like Bitcoin or Ethereum. If you can’t explain what the coin does or who’s using it, don’t trade it.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link