In the evolving landscape of cryptocurrency investments, the introduction of spot Ethereum Exchange-Traded Funds (ETFs) marked a significant milestone, anticipated to bring about greater market stability, improved liquidity, and enhanced access for the institutional investor. Yet, the reality that has unfolded in the weeks following their launch paints a rather different picture, one that diverges from the initial wave of optimism that greeted these financial instruments.

Ethereum, the blockchain platform known for its role in enabling smart contracts and hosting a majority of decentralized finance (DeFi) applications, has seen its native cryptocurrency, ETH, become the second-largest by market capitalization. This prominence makes the performance of Ethereum-based ETFs a subject of keen interest among investors and market observers alike.

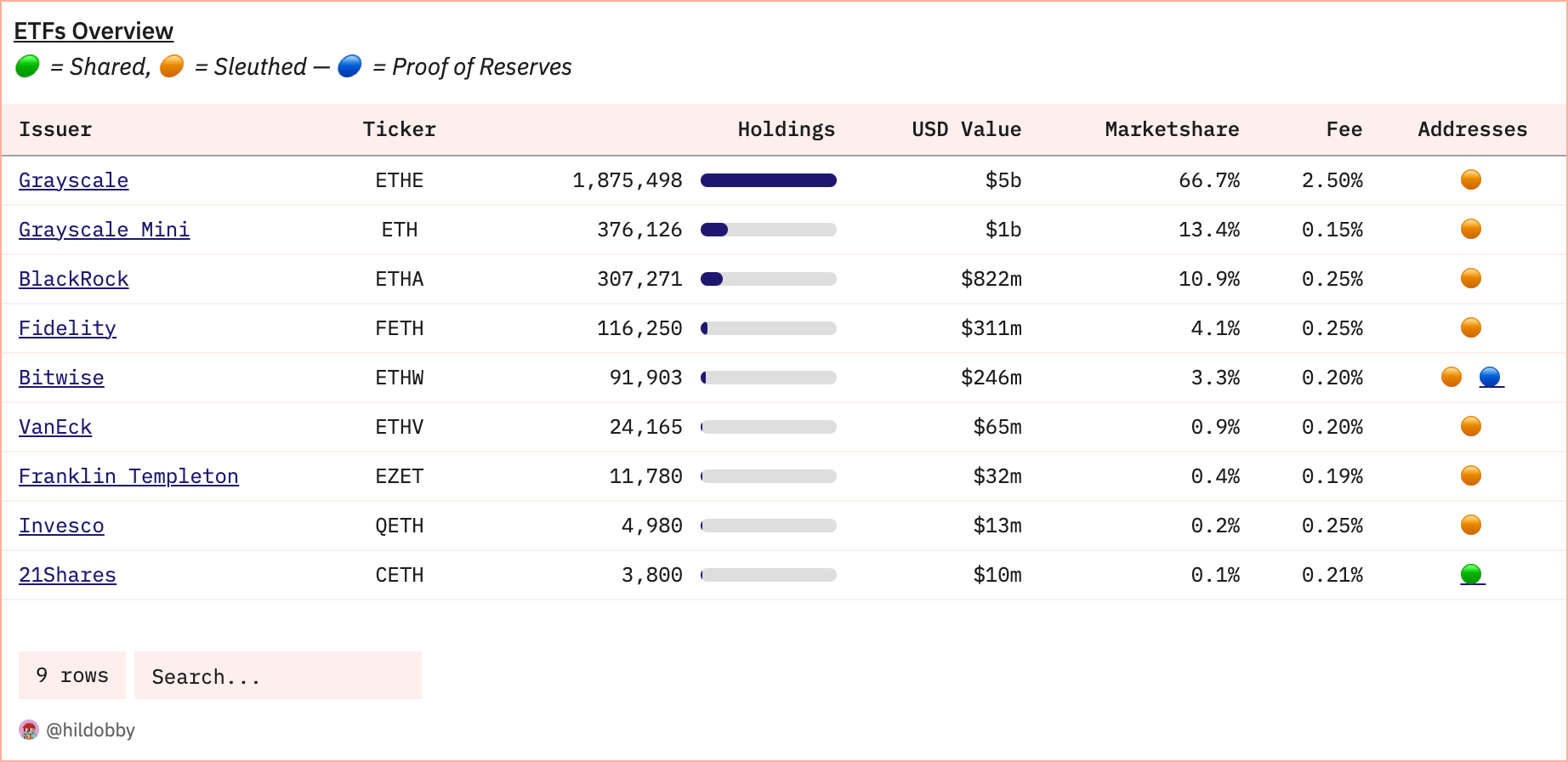

To date, the aggregate on-chain holdings of these ETFs are reported to be approximately 2.81 million ETH, establishing a valuation near $7.33 billion. This considerable sum represents about 2.3% of the total circulating supply of Ethereum, underscoring the significant stake these investment vehicles have in the broader Ethereum ecosystem.

However, despite the substantial holdings encapsulated within these ETFs, their journey has been marred by a net outflow of funds. Specifically, there has been a withdrawal of 136,700 ETH since their inception. This trend of capital extraction accentuates the challenges these ETFs face in garnering sustained investor confidence.

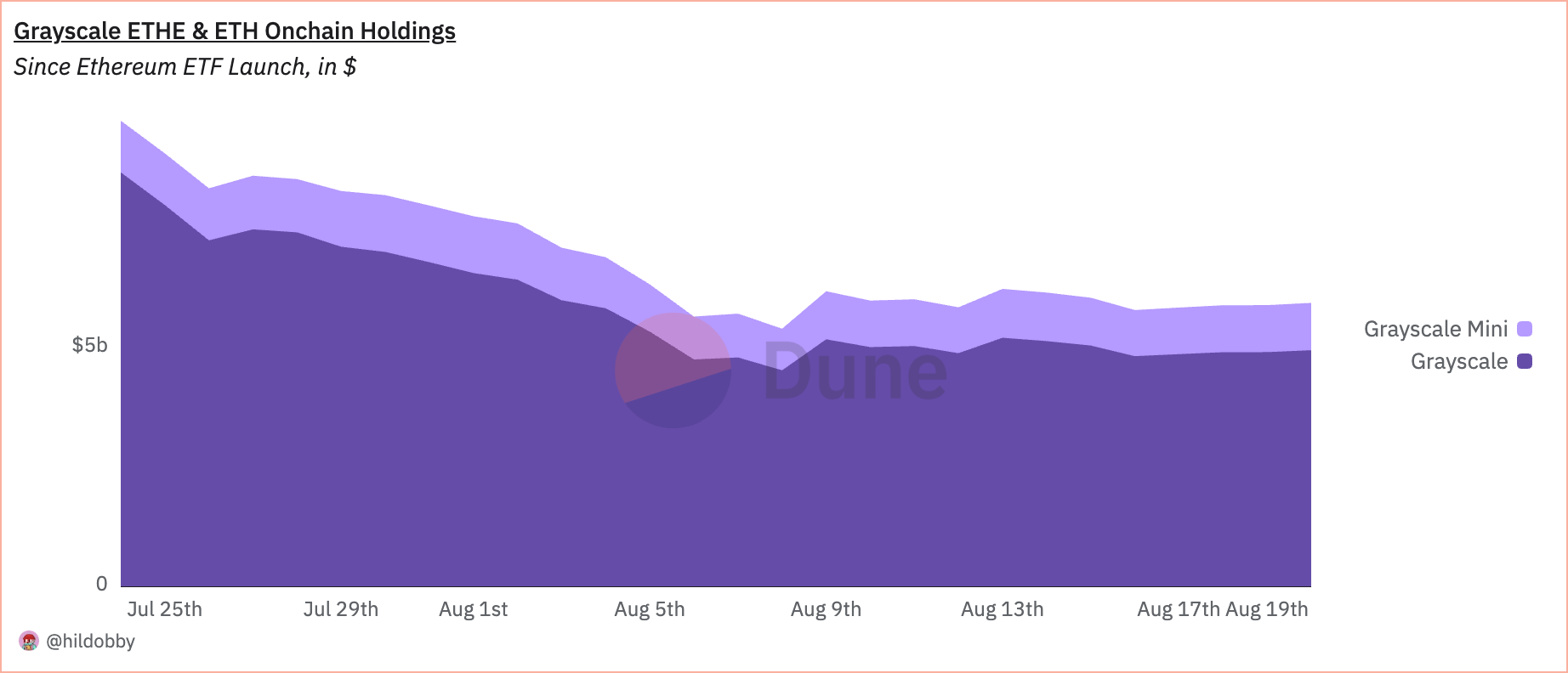

The outflows can be significantly attributed to Grayscale’s Ethereum Trust (ETHE), which experienced a staggering withdrawal of $487.88 million on its inaugural trading day. Although there have been consistent inflows into other Ethereum ETFs, these have not sufficed to counterbalance the considerable outflow from ETHE.

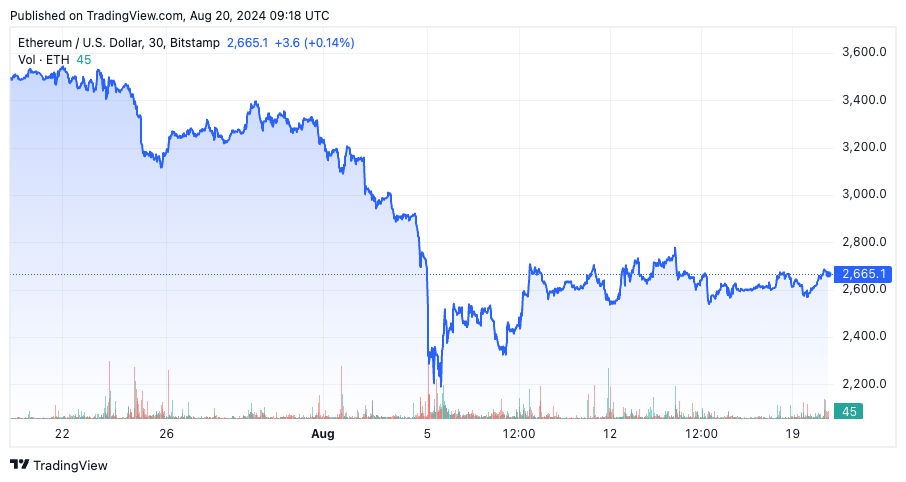

This outflow phenomenon has not gone unnoticed in the wider cryptocurrency market, with Ethereum’s price trajectory reflecting the impact. Following an initial surge in value, buoyed by the heightened anticipation surrounding the ETF launches, Ethereum’s price experienced a sharp decline. It plummeted to a low of $2,338 by August 7, showcasing the vulnerability of its market valuation to shifts in investor sentiment and capital flow.

In the aftermath, while there has been a modest recovery with prices oscillating around $2,600, the overarching mood remains one of caution. The cryptosphere’s macroeconomic downturn has only served to compound these uncertainties, casting shadows over Ethereum’s immediate price outlook.

The trading dynamics within the Ethereum futures market have equally mirrored this heightened state of flux. A noticeable uptick in leverage ratios points to a community of traders who are increasingly willing to engage in risk-laden positions, betting on short-term price directionalities. This leveraged trading activity hints at the market’s undercurrent of volatility, implying that any adverse developments could trigger magnified price movements, further destabilizing Ethereum’s valuation.

Despite these immediate financial turbulences, the institutional allure towards Ethereum and its derivative products remains undeterred. Noteworthy is the example of BlackRock’s iShares Ethereum Trust (ETHA), which continues to draw substantial inflows, indicating a latent institutional belief in Ethereum’s enduring value proposition.

The market for Ethereum ETFs has also glimpsed moments of optimism, with sporadic episodes of net inflows somewhat mitigating the specter of outflows, particularly from products like ETHE. This suggests that investor sentiment may be stabilizing, laying the groundwork for potential recovery in both the ETF market and Ethereum’s broader valuation.

Navigating through the complexities and tumultuous nature of the cryptocurrency markets, Ethereum ETFs continue to search for equilibrium amidst broad market volatility and specific adversities stemming from Grayscale’s ETHE withdrawals.

While the comparison with spot Bitcoin ETFs may cast these early days of Ethereum ETFs in a less favorable light, the deceleration in outflows from ETHE, coupled with sustained institutional interest, provides a glimmer of hope. It hints that, over the medium to long term, optimism may well be justified.

However, as the dust begins to settle, it’s evident that Ethereum and its associated ETFs occupy a precarious juncture. Their trajectory ahead will not only be shaped by the broader market dynamics but also by the strategic maneuvers of heavyweight institutional entities.

In a realm as unpredictable and vibrant as cryptocurrency, enthusiasts and investors alike eagerly watch these developments unfold, balancing on the knife-edge of innovation and uncertainty. For more enthralling insights into the DeFi space and to stay abreast of trending news, visit DeFi Daily News.

The nuanced ballet of market forces, investment trends, and technological advancements continues, and within this intricate dance lies the potential for both unprecedented success and notable challenges. As the narrative around Ethereum ETFs progresses, it promises to be a specter of fascination, debate, and, most importantly, learning for the entire cryptosphere.

The quest for stability, growth, and recognition within the conventional financial ecosystem is both a challenge and an opportunity for Ethereum and its burgeoning market of ETFs. How this journey unfolds will undeniably contribute a riveting chapter to the annals of digital finance history.